Dear President von der Leyen: President Biden Can’t Fix European Competitiveness

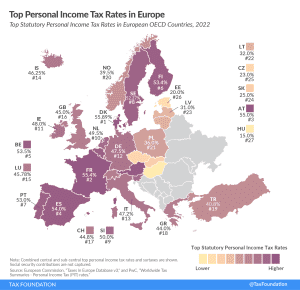

Focusing on the “threat” to European industry caused by the Inflation Reduction Act rather than internal tax system flaws puts the EU at risk of slower economic growth and possibly losing some of its important industrial base. It is also contrary to the EU’s geopolitical goals.

4 min read