All Related Articles

Testimony: Reviewing Recent Federal Tax Policies and Considering Pro-Growth Reforms

Lawmakers should focus on simplifying the federal tax code, creating stability, and broadly improving economic incentives. There are incremental steps that can be made on the path to fundamental tax reform.

The Wayfair Sales Tax Ruling, Five Years Later

It’s the 5th anniversary of the groundbreaking Wayfair Supreme Court decision–a ruling that marked a new era of sales tax collection and changed how we think about taxation in the digital age.

How Would the American Families and Jobs Act Change Opportunity Zones?

House Republicans are proposing to expand the Opportunity Zone program and alter its reporting requirements as part of a new suite of tax bills packaged as the American Families and Jobs Act.

4 min read

North Carolina’s Budget Should Prioritize Pro-Growth Structural Reforms

As fiscal year 2023 draws to a close, North Carolina’s House and Senate have each passed their own versions of the biennial budget for fiscal years 2024-25. While legislative leaders have generally agreed to overall spending levels, negotiations remain ongoing to resolve different approaches to tax policy.

7 min read

Texas Lawmakers Should Deliver Principled Property Tax Relief

Texas’s robust surpluses create an opportunity to use state funds to lower local property taxes. However, it remains important for legislators to pursue a principled approach to rate compression, rather than enacting a plan that will simply shift the tax burden in nonneutral ways.

3 min read

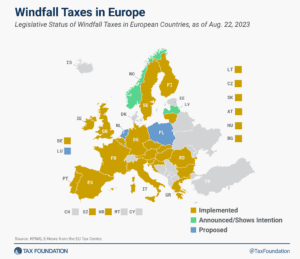

Windfall Profit Taxes in Europe, 2023

It’s unlikely these implemented and proposed windfall taxes will achieve their goals of raising additional revenues without distorting the market. Instead, they would penalize domestic production and punitively target certain industries without a sound tax base.

13 min read

What Would a Carbon Tariff Achieve?

Sens. Kevin Cramer (R-ND) and Christopher Coons (D-DE) have recently introduced a bill laying the groundwork for a possible solution to the problem: a tax on the carbon content of imports. But it falls short of the optimal approach in several ways.

4 min read

Republican Study Committee’s Tax Plan Simplifies the Tax Code and Offers Pro-Growth Ideas

By extending bonus depreciation and introducing neutral cost recovery, the RSC budget would significantly improve the treatment of investment leading to increased growth, expanded employment, and higher wages.

3 min read

The Real Problem with the IRS

What both parties ignore: The IRS does not need more money for enforcement; it needs fewer things to enforce.

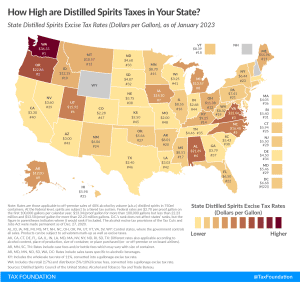

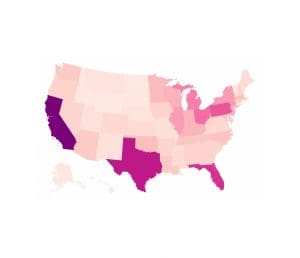

Distilled Spirits Taxes by State, 2023

Of all alcoholic beverages subject to taxation, stiff drinks—and all distilled spirits—face the stiffest tax rates. Like many excise taxes, the treatment of distilled spirits varies widely across the states.

4 min read

Repealing Inflation Reduction Act’s Energy Credits Would Raise $663 Billion, JCT Projects

The price tag of the Inflation Reduction Act’s green energy tax credits is much higher than originally thought. Among other things, the updated analysis indicates the Inflation Reduction Act does not reduce deficits after all.

6 min read

Oklahoma Adopts Franchise Tax Repeal, Eliminates Marriage Penalty

In the closing days of the 2023 legislative session, Oklahoma lawmakers repealed the state’s corporate franchise tax and eliminated the marriage penalty in its individual income tax. Both tax changes represent a positive step forward for the state.

4 min read

Why Congress Is More to Blame than IRS for $26 Billion in Refundable Tax Credit Overpayments

Lawmakers should avoid delivering social and economic benefits through the tax code whenever possible and work to simplify or repeal the tax expenditures already in the tax code.

7 min read

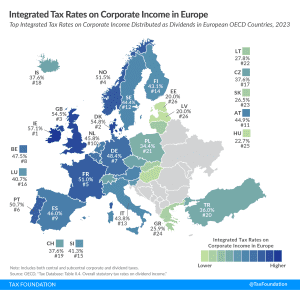

Integrated Tax Rates on Corporate Income in Europe, 2023

In most European OECD countries, corporate income is taxed twice, once at the entity level and once at the shareholder level.

4 min read

Debt Ceiling Deal Reduces Deficits in the Short Term but Delays a More Comprehensive Budget Reckoning

To address the more challenging parts of the budget, especially the unsustainable growth in mandatory spending, lawmakers should follow up on this debt ceiling agreement with a focus on long-term fiscal sustainability.

6 min read

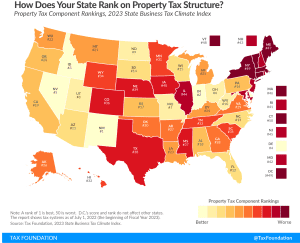

Ranking Property Taxes on the 2023 State Business Tax Climate Index

States are in a better position to attract business investment when they maintain competitive real property tax rates and avoid harmful taxes on tangible personal property, intangible property, wealth, and asset transfers.

5 min read

Tax Ideas for the EU Green Transition

The past few years have brought a renewed push from countries across the globe to combat climate change. In the European Union, policymakers have put a timeline on their climate agenda. By 2050, the EU wants to achieve a net-zero economy. Sean Bray, director of European policy, breaks down how much it would cost to achieve this goal.

Compare Tobacco Tax Data in Your State

Tobacco is the most highly taxed consumer product in the United States. The tools on this page allow you to explore state tax rates and the effects tax policy and tobacco regulations can have on state revenues, smuggling, and effective tax rates for different income groups.

2 min read