Windfall Profit Taxes in Europe, 2023

13 min readBy:While energy prices are dropping, European countries continue to rely on windfall profit taxes—a one-time taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. levied on a company or industry when economic conditions result in large, unexpected profits—to fund relief measures for consumers. As early as March 8, 2022, the European Commission recommended in its REPowerEU communication that Member States temporarily impose windfall taxes on all energy providers. The Commission suggested such measures be technologically neutral, not retroactive, and designed in a way that doesn’t affect wholesale electricity prices and long-term price trends.

Later, on 30 September 2022, the Council of the European Union agreed to impose an EU-wide windfall profits taxA windfall profits tax is a one-time surtax levied on a company or industry when economic conditions result in large and unexpected profits. Inheritance taxes and taxes levied on lottery winnings can also be considered windfall taxes on individual profits. (the “solidarity contribution” in EU terms) on fossil fuel companies. At the same time, a cap was set on market revenues for electricity generators that use infra-marginal technologies to produce electricity, such as renewables, nuclear, and lignite. The EU anticipates the policy would raise about €140 billion. The revenue could be used to partially offset households’ high energy bills “in a non-selective and transparent measure supporting all final consumers.”

Countries like Romania and Spain were the first to implement a temporary mechanism in 2021 to cut excess revenues of energy companies that benefit from higher energy and gas wholesale prices.

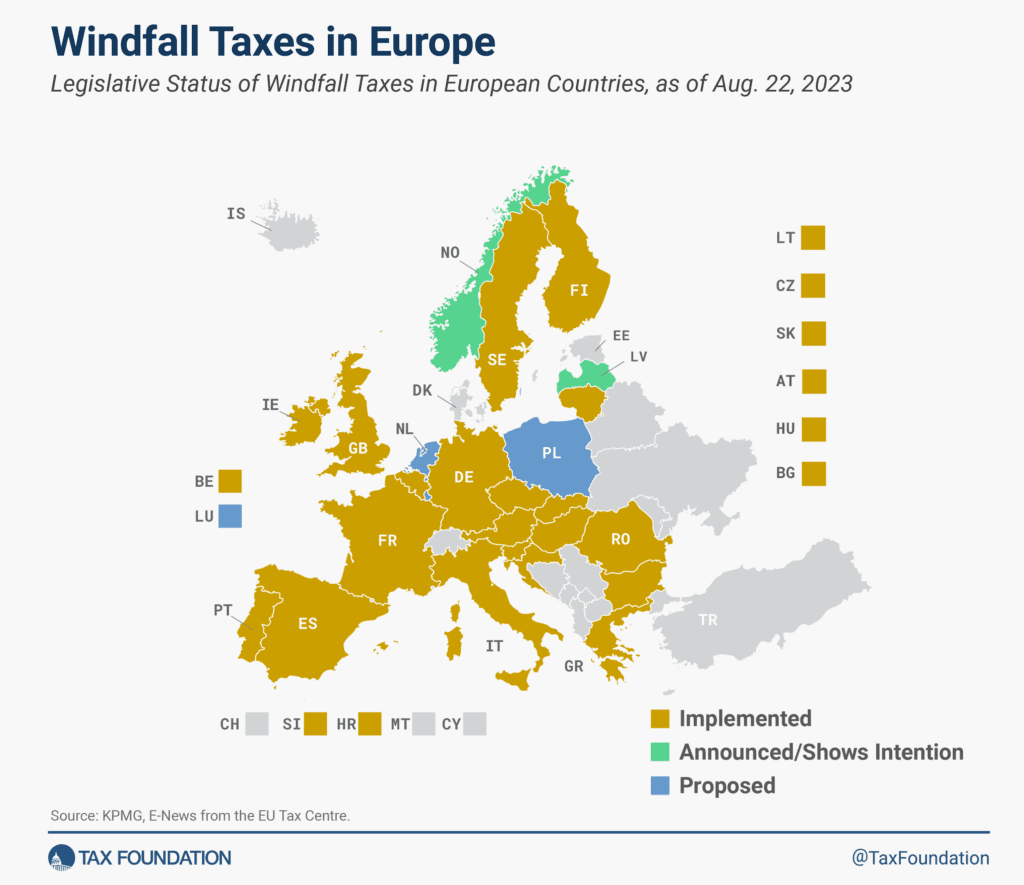

Nine months after the EU Council approved the EU-wide windfall tax, 25 European countries announced, proposed, or implemented the EU-wide windfall tax or some variation of it. Twenty have already implemented a windfall tax while Luxembourg, the Netherlands, and Poland have published proposals to enact one. Latvia and Norway have either officially announced or shown intentions to implement a windfall tax. Additionally, the Czech Republic, Hungary, Slovakia, Spain, and the United Kingdom plan to extend the application of windfall taxes beyond 2023.

The proposed and implemented windfall taxes differ significantly in their tax rates (ranging from 25 percent in the United Kingdom to 70 percent in Slovakia and 75 percent in Ireland) and their structures.

Additionally, many of the proposed and enacted measures are not proper windfall profit taxes—they go beyond merely taxing windfall profits. For oil and gas companies, European countries, following the EU recommendation, defined the windfall tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. as the difference between the current profits and the profits generated over a baseline period. Nevertheless, these incremental profits are not necessarily excess or supernormal returns and a windfall tax could translate into double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income. of regular profits.

Some countries didn’t limit the scope of the windfall tax to energy producers or oil and gas companies. Hungary, the Czech Republic, Lithuania, and Spain extended the scope to cover the banking sector, while Latvia and Italy are considering doing the same. Portugal applied the windfall tax to food distribution companies while Croatia extended the windfall tax to all companies exceeding a certain revenue threshold.

Additionally, in most countries with windfall taxes, the tax base is not designed in a way that exclusively captures the windfall profits generated by the spikes in energy and oil prices. A tax on electricity sold over an arbitrarily determined price—as the EU recommended and most European countries implemented—or on total sales like in Spain, resembles more of an excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. .

The flawed design of these windfall profit taxes has already created problems in countries that implemented them. An EU Commission report finds that the “diverging implementation strategies across Member States have reportedly led to significant investor uncertainty,” and, therefore, the Commission will not propose prolonging these crisis measures. Furthermore, European Parliament research also finds that historically, windfall taxes have affected investment. In Spain, after the approval of the EU-wide windfall tax, the country’s government vowed to adjust the two windfall taxes, heavily criticized by the targeted sectors, to the EU design. Nevertheless, no amendments were introduced. Norway has recently delayed plans for an onshore wind tax as companies warned that this measure could “bankrupt projects and drive investors away.”

It’s unlikely these implemented and proposed windfall taxes will achieve their goals of raising additional revenues without distorting the market. Instead, they would penalize domestic production and punitively target certain industries without a sound tax base. Although the EU-wide windfall tax tackled some of the problems that previously posed windfall taxes generated, its implementation has generated uncertainty for investors. And since energy prices have dropped, the windfall tax would collect little to no revenue. Countries should consider repealing windfall taxes altogether.

| Country | Tax Rate | Scope | Base | Status |

|---|---|---|---|---|

| Austria (AT) | 90% for electricity producers; up to 40% for oil and gas companies | Electricity producers and oil and gas companies. | For electricity producers, the revenue that exceeds €140 (€120 after June 2023) per MWh. For oil and gas companies, taxable profits that are at least 20% above the average profits of the previous four years. | Implemented (For electricity producers, applicable from December 1, 2022, to December 31, 2023. For oil and gas companies, applicable for the period from July 1, 2022, to December 31, 2023.) |

| Belgium (BE) | 100% | Electricity producers. | The market revenue that exceeds €130 (€180 for biomass, biogas, and waste) per MWh. | Implemented (For the tax period between August 1, 2022, and June 30, 2023. An extension may be adopted in the event of a prolongation of Council Regulation [EU] 2022/1845.) |

| Bulgaria (BG) | 90% for electricity producers; 33% for the rest | Electricity producers, energy companies, and refining industries. | For electricity producers, revenue exceeding prescribed rates per MWh. Rates vary depending on the nature of the production. For other companies, profit margin exceeding 120% of the average profit of 2018, 2019, 2020, and 2021. | Implemented (For the tax period between December 1, 2022, and June 30, 2023. In March 2023, the finance minister announced a new one-off solidarity contribution for all sectors and for the tax period between July 1, 2023, and December 31, 2023. Nevertheless, this proposal was dropped.) |

| Croatia (HR) | 90% for electricity producers; 33% for the rest | Electricity producers and all companies with total income exceeding €40 million (HRK 300 million) in 2022. | For electricity producers, the revenue that exceeds €180 per MWh. For other companies, profit margin exceeding 120% of the average profit of 2018, 2019, 2020, and 2021. | Implemented (Approved on December 16, 2022, for one tax period beginning on or after January 1, 2022.) |

| Czech Republic (CZ) | 90% for electricity producers; 60% for the rest | Electricity producers and companies in the energy and fossil fuel sectors with a total annual turnover in 2021 of at least CZK 2 billion and a current total annual net turnover of at least CZK 50 million. Banks with a current net interest income of at least CZK 50 million and a net interest income in 2021 of at least CZK 6 billion. | For electricity producers, the revenue exceeding prescribed rates per MWh. Rates vary depending on the nature of the production from €70 for nuclear energy, up to €240 for biogas. For other companies, profit margin exceeding 120% of the average profit of 2018, 2019, 2020, and 2021. | Implemented (For electricity producers, applicable from December 1, 2022, to December 31, 2023. For other companies to be applied for three years: 2023, 2024 and 2025.) |

| Finland (FI) | 30% (33% for fossil fuel) | Electric, gas, and oil companies. | Profit margin exceeding 120% of the average profit of 2018, 2019, 2020, and 2021. | Implemented (Introduced on March 24, 2023; applicable for 2023.) |

| France (FR) | 90% for electricity producers; 33% for the rest | Electricity producers and extraction, mining, refining of petroleum, or manufacturing of coke oven products. | For electricity producers, the revenue exceeding prescribed rates per MWh. Rates vary depending on the nature of the production from €90 for nuclear energy, up to €175 for biogas) For other companies, profit margin exceeding 120% of the average profit of 2018, 2019, 2020, and 2021. | Implemented (For electricity producers, applicable from July 1, 2022, to December 31, 2023. For other companies, for the tax period between January 1, 2023, and December 31, 2023.) |

| Germany (DE) | 90% | Electricity producers. | Revenue exceeding prescribed rates per MWh. Rates vary depending on the nature of the production. | Implemented (For electricity generated after November 30, 2022, and before July 1, 2023. |

| Greece (GR) | 60% (90% until December 2022) | Certain energy producers. | The difference between the profit generated in a given month of the tax period and the profit for the corresponding month of the previous year (monthly basis). | Implemented (Introduced on May 2022; applies retroactively for the tax period between October 1, 2021, and June 30, 2022. On November 16, a new windfall tax was introduced for the period between August 1, 2022, and July 31, 2023.) |

| Hungary (HU) | A variety of rates depending on the sector | Producers of petroleum products, renewable energy, pharmaceutical distributors, mining royalties, airline companies, credit, financial institutions, etc. | Varies by industry. The base for the banking tax was lowered from 100% to 50% of last year’s pretax earnings, but the tax rate was increased from 8% to 13%. | Implemented (Introduced on July 1, 2022; applicable to the 2021 and 2022 fiscal years, collected in 2022 and 2023. Plans to keep windfall taxes in “some form” in 2024.) |

| Ireland (IE) | 75% | Electricity producers. | Profit margin exceeding 120% of the average profit of 2018, 2019, 2020, and 2021. | Implemented (On July 25, 2023, a temporary solidarity contribution was introduced on energy companies with at least 75% of their income coming from fossil fuels.) |

| Italy (IT) | 50% for the energy sector; 40% for the banking sector | Production, importation, and sale of electricity, natural gas, and oil products (in the case of oil products, distributors are also subject to the tax). Banking sector. | Profit margin exceeding 110% of the average profit of 2018, 2019, 2020, and 2021. The tax base for the banking tax is the larger of two amounts: the difference in the net interest margin—a measure of income defined as the difference between lending and deposit rates—between 2022 and 2021, above a 5% increase, or the difference in net interest margin between 2023 and 2021, above a 10% increase. |

Implemented (Introduced on December 29, 2022, applicable to the fiscal year 2023. It replaces the previous extraordinary tax applied in 2022 of 25% on the Incremental Added-Value—the difference between the added value for the period from October 1, 2021, to April 30, 2022, and the added value for the period from October 1, 2020, to April 30, 2021.) Announced (On 7 August, the Italian government announced a new windfall profits tax on the banking sector. The bill needs to receive Parliamentary approval within 60 days of the announcement to become law. If approved, the levy will be in place for the 2023 fiscal year, to be collected by 30 June 2024.) |

| Latvia (LV) | Banks and energy companies. | Announced/Shows Intention (On March 20, 2023, the Finance Minister is working on a proposal for the introduction of windfall gains tax on banks and energy companies. In early August 2023, the finance minister announced that a bank tax will be part of next year’s budget.) | ||

| Lithuania (LT) | 60% | Domestic banks and branches of foreign banks licensed in EU Member States and the European Economic Area. | The net interest income that exceed a four-year moving average by 50%. | Implemented (Introduced on May 1, 2023, and in place for two years.) |

| Luxembourg (LU) | 90% | Electricity producers. | Income that exceeds prescribed caps, per MWh. The revenue caps are: €100 per MWh for hydroelectric power; €130 for wind energy, solar energy, combustion of municipal and industrial waste, and gas from water treatment plants; and €180 for fuels from solid biomass or scrap wood, and biogas. | Proposed (On March 15, the Parliament accepted for consideration a bill to introduce a temporary windfall tax on the excess income of specific electricity producers. It would apply retroactively, from December 1, 2022, to December 31, 2023.) |

| Netherlands (NL) | 90% | Electricity producers. | Income that exceeds prescribed caps. | Proposed (On January 27, 2023, the Ministry of Finance published the draft bill. The tax is proposed to apply retroactively from December 1, 2022, to June 30, 2023.) |

| Norway (NO) | 40% | Wind farms. | Announced/Shows Intention (Norway is delaying plans for an onshore wind tax. The 2022 September proposal was rejected by the industry. A revised bill will be presented in the second half of 2023. | |

| Poland (PL) | 33% | Coal and mining companies. | Profit margin exceeding 120% of the average profit of the previous four years. | Proposed (On July 10, 2023, the Polish Council of Ministers approved a draft bill to require coal companies to pay solidarity contributions on excess profits.) |

| Portugal (PT) | 33% | Oil, natural gas, coal, and refining companies, and food distribution establishments. | Profit margin exceeding 120% of the average profit of 2018, 2019, 2020, and 2021. | Implemented (Introduced on December 22, 2022. To be applied for two years: 2022 and 2023.) |

| Romania (RO) | RON 350 ($78.53) per ton of refined crude | Oil, natural gas, coal, and refining companies. | Tons of refined crude. | Implemented (Introduced on December 28, 2022. To be applied for two years: 2022 and 2023. It replaces a previous 60% tax on excess profits for oil, gas, and coal refining companies. Additionally, at the end of March 2023, a windfall tax on energy producers and suppliers applied an 80 percent tax on the selling price of electricity that exceeded RON 450 (€91) per MWh expired.) |

| Slovakia (SK) | 90% for electricity producers; 70% for the rest | Electricity producers and also oil, natural gas, coal, and refining companies. | For electricity producers, revenue exceeding prescribed rates per kilowatt hour. Rates vary depending on the nature of the production. For other companies, the corporate tax base. | Implemented (For electricity producers, applicable from December 1, 2022, to December 31, 2024. For other companies to be applied for two years: 2022 and 2023.) |

| Slovenia (SI) | 90% for electricity producers; 33% for the rest | Electricity producers and also oil, natural gas, coal, and refining companies. | For electricity producers, the revenue that exceeds €180 per MWh. For oil and gas companies, taxable profits that are at least 20 percent above the average profits of the previous four years. | Implemented (For electricity producers, applicable from December 1, 2022, to December 31, 2023. For oil and gas companies applicable for two years: 2022 and 2023.) |

| Spain (ES) | 1.2% for energy companies and 4.8% for banks | Energy companies (gas, oil, and electricity) and banks | Sales of domestic power utilities (companies with an annual turnover exceeding €1 billion in 2019). Bank’s net interest income and net fees if the net income from these sources exceeded €800 million in 2019. | Implemented (In December 2022, two windfall taxes on the banking sector and energy companies were approved. Applicable for two years: 2023 and 2024. Previously, in September 2021, Spain approved a temporal mechanism that was in force until December 31, 2022. The mechanism consisted of a temporary reduction in the remuneration of electricity production activities to reduce windfall profits earned due to higher gas and carbon prices. The tax applied to facilities with a capacity of more than 10 MW and power plants not benefiting from public subsidies. The tax was payable if the gas price was higher than €20/MWh. The rate of the tax depended on the energy produced, the gas price, and the price of the energy produced by gas-powered plants. However, later on, a series of exclusions were approved and many energy providers were left outside the scope of the mechanism.) |

| Sweden (SE) | 90% | Electricity producers. | The taxable market revenue of electricity producers that exceeds SEK 1,957 ($181) per MWh of electricity. | Implemented (Applicable for the period from March 1, 2023, to June 30, 2023.) |

| United Kingdom (GB) | 25% | Oil and gas companies operating in the UK and the UK Continental Shelf. | On the same profits that are already subject to the UK’s oil and gas 40% headline tax, generating an effective tax rate of 65%. However, the “investment allowance” together with other reliefs already available, enables taxpayers to obtain relief of up to 91.25 pence in the pound when they reinvest profits in the UK oil and gas sector. | Implemented (Approved on July 11, 2022, applicable to profits generated on or after May 26, 2022, up to December 31, 2025. On September 8, 2022, the new Prime Minister announced that there will be no extension of the application of this previously introduced windfall profit tax. In June 2023, the UK Treasury announced a plan to ease a windfall tax on the profits of UK oil and gas companies.) |

| Sources: KPMG, E-News from the EU Tax Centre. | ||||

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribePrevious Versions

-

Windfall Profit Taxes in Europe, 2022

9 min read