Table of Contents

- Key Points

- Introduction

- A Short History of Excise Taxes

- — Pigouvian Taxes

- All Tax Policy is About Trade-offs

- General Design Considerations

- — Tax Base

- — Tax Rate

- — When to Levy

- — Revenue Allocation

- — Regressivity

- — Principles for Excise Tax Design

- Traditional Excise Tax Categories

- — Tobacco

- — Alcohol

- — Motor Fuel

- Excise Tax Trends

- — Recreational Marijuana

- — Sports Betting

- — Vaping

- — Sugar-Sweetened Beverages

- — Ride and Car Sharing

- — Single-Use Plastics

- Best Practice

- Conclusion

- Appendix

Key Points:

- In 2019, excise taxes accounted for less than 3 percent of total federal taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. collections while state excise taxes on tobacco, alcohol, and motor fuel accounted for about 7 percent of total state tax revenue

- Taxes levied on a transaction or good that creates a negative externalityAn externality, in economics terms, is a side effect or consequence of an activity that is not reflected in the cost of that activity, and not primarily borne by those directly involved in said activity. Externalities can be caused by either production or consumption of a good or service and can be positive or negative. or additional costs are known as Pigouvian taxes and, when designed to discourage an activity, are often colloquially called sin taxes. Examples include tobacco taxes, sugar taxes, and carbon taxes.

- For most excise taxes, the best choice of tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. is the externality-causing agent, as that provides the best proxy for costs. Because of their narrow base, revenue from excise taxes tend to be unstable, and some sources of revenue (like taxes on tobacco) are in long-term decline.

- Excise taxes should ideally be levied early in the value chain. Limiting the number of taxpayers lowers the cost of enforcement and enhances compliance, which makes tax implementation cheaper and more efficient.

- Excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. rates should be related to the costs an excise tax is internalizing—and revenue should be allocated to cover the same: health costs related to smoking, infrastructure cost associated with driving, and enforcement costs related to alcohol, for instance. Excise taxes should not be levied to raise general fund revenue because the tax bases are typically narrow and unstable.

- Levying new taxes on emerging products may be enticing to lawmakers. If growth projections hold, the value of recreational marijuana sales may be three times bigger than McDonald’s sales revenue by 2023.

Introduction

Excise taxes are a well-established part of governments’ taxation of consumption both in the United States and globally.[1] Excise taxes, which are levied on specific goods or services, are commonly levied on tobacco, alcohol, and motor fuel. Perhaps contrary to their reputation, excise taxes contribute a relatively small portion of total taxes paid in the U.S. Until the early twentieth century, excise taxes made up a large proportion of the total federal taxes paid, but today they contribute only 2.9 percent of federal tax revenues.[2]

The Internal Revenue Service defines an excise tax as a tax “imposed on the sale of specific goods or services, or on certain uses.”[3] By definition, these taxes are distinguished from broad-based consumption taxes by being selective in nature. That narrow base must be justified by unique costs or considerations related to the taxed activity; otherwise, these would just be arbitrary taxes.

While states have fared better during the COVID-19 pandemic than originally feared, both state governments and the federal government must decide how best to maintain tax revenues and fund growing expenses while not adding new burdens to a suffering economy.[4] As a potential solution, excise taxes may be an alluring proposition to some lawmakers, because excise taxes could be an avenue for governments to raise new revenue.[5] Since they are often levied narrowly (on one ingredient in a product or one specific type of transaction) and on products that may be considered harmful, excise tax hikes may be a politically attractive source of additional revenue.

Furthermore, as excise taxes often target a specific product, they pose a smaller risk to the general economy than increases to general taxes like the income tax or the general sales tax. However, lawmakers should exercise caution. Because these taxes are very narrow, excise tax hikes can be detrimental to specific industries and certain types of consumers. Their design also makes them poor sustainable revenue tools, as revenue tends to be volatile and the tax burden tends to be regressive.

In Samuel Johnson’s 1755 Dictionary of the English Language, the word excise was defined as “a hateful tax levied upon commodities and adjudged not by the common judges of property but wretches hired by those to whom excise is paid.”[6] Today, some people would probably still find that description to be accurate, but there are ways to design excise taxes to be both legitimate and efficient in raising tax revenue.

This paper aims to outline a principled approach to the legitimate application of excise taxes. The first section is a discussion of excise tax design, revenue allocation, and policy trade-offs. The second section is an analysis and discussion of traditional excise taxes as well as emerging excise tax trends at the federal and state level.

A Short History of Excise Taxes

The history of excise taxes goes back at least 5,000 years. The first documented tax was in ancient Egypt around 3000 B.C., where, among other things, an excise tax was levied on oil and beer.[7]

Thousands of years later, in his famous book An Inquiry into the Nature and Causes of the Wealth of Nations, Adam Smith gave favorable mention to excise taxation: “Sugar, rum, and tobacco are commodities which are nowhere necessaries of life, which [have]become objects of almost universal consumption, and which are therefore extremely proper subjects of taxation.”[8]

This quote may read like a suggestion to utilize excise taxes to generate general revenue, and Adam Smith is often invoked to argue that exact point, but it is not that simple. The book was written at a time when countability and measurability were crucial—a quality these products shared with other tax bases. The British Empire relied on land taxes, stamp duties, customs duties, and excise taxes—not income taxes, general sales taxes, or many of the other taxes we are familiar with today. Furthermore, Smith emphasizes that these products are ideal for taxation because they are of almost universal consumption. Not only are sugar, rum, and tobacco not universally consumed today, but we also have more appropriate taxes that target universal consumption: namely, the general sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. .

The first excise tax levied in the U.S. was on the manufacture of whiskey in 1791. The tax was unpopular, famously sparking insurrectionary activities among Western Pennsylvania farmers, and only survived until 1802. In the early years of the Republic, excise taxes served as a revenue tool related to wars and economic downturns. As late as 1934, during the Great Depression, excise tax revenues made up almost half of the federal government’s total tax revenue and generated three times more than the individual income tax. Today, there are federal excise taxes on motor fuel, tobacco, and alcohol, among other goods, services, and activities, in addition to a wide range of state excise taxes, though their contribution to overall federal revenue is much attenuated.

As is evident above, excise taxes have generally been levied to raise general fund revenue. This is because the taxed products were easy to count, which made tax administration simple and cheap. In more recent history, however, excise taxes are often used to try to deter (or even to completely eliminate) consumption of certain goods. For instance, this strategy is employed with taxes on nicotine-containing products. Although it would be difficult and potentially illegal to tax a product into nonexistence (a tax may not accomplish a prohibition which could not otherwise be imposed by law), there is no doubt that taxes influence behavior. The laws of supply and demand dictate that as prices go up, consumption goes down, even if this is a simplification.

In modern times, excise taxes have also been employed as user fees. This is best understood with the example of the motor fuel tax, where gasoline purchases serve as a proxy for a driver’s contributions to traffic congestion, road wear-and-tear, and emissions, in effect setting a price on the use of public roads.[9]

Finally, application of excise taxes can be viewed through the lens of British economist Arthur C. Pigou who, in his book The Economics of Welfare (1920), argued that taxes on certain externality-causing goods or activities could be a vehicle to internalize those negative externalities, meaning that their price would be borne by those responsible for them.[10]

Pigouvian Taxes

A Pigouvian taxA Pigouvian tax, named after 1920 British economist Arthur C. Pigou, is a tax on a market transaction that creates a negative externality, or an additional cost, borne by individuals not directly involved in the transaction. Examples include tobacco taxes, sugar taxes, and carbon taxes. , named after Pigou, is a tax on a market transaction that creates a negative externality or an additional cost. Examples include tobacco taxes, sugar taxes, and carbon taxes. This kind of tax is also sometimes referred to as a “sin tax,” though this language is typically reserved for activities deemed undesirable (e.g., smoking) and not simply those which, while perhaps desirable in their own right, create negative externalities (e.g., driving). An externality, in economics terms, is a side effect, societal cost, or consequence of an economic transaction or activity that is not reflected in the cost of said transaction or activity and not primarily borne by those directly involved in the transaction or activity.

For instance, smoking in a public restaurant creates a negative externality because secondhand smoke can affect nonsmokers and worsen their long-term health outcomes. More directly, smoking also increases public health costs generated by the smokers themselves. Levying an excise tax in these situations can serve to recoup some of the cost of these externalities and “internalize” the cost of the externality to the purchase of the product.[11]

The Pigouvian concept of internalizing externalities to correct inefficient market outcomes suggests that the size of the excise tax should be equal to the cost of the negative externality. However, there are several challenges to imposing excise taxes in response to negative externalities and there is usually no way to accurately measure the societal cost or externality.

A newer example of this Pigouvian way of thinking is the carbon taxA carbon tax is levied on the carbon content of fossil fuels. The term can also refer to taxing other types of greenhouse gas emissions, such as methane. A carbon tax puts a price on those emissions to encourage consumers, businesses, and governments to produce less of them. . When individuals purchase goods created through a carbon-intensive production process, they create a negative externality because excess carbon emissions are environmentally harmful. This negative externality imposes an indirect cost upon those who were not part of the initial transaction of production and purchase. Proponents of a carbon tax argue that such a tax internalizes these external costs on the environment by adding them to the price of the good. Revenue raised by such a tax could go toward carbon offsets or other mitigation efforts, but just “pricing” carbon emissions on its own has an impact, because it establishes a market mechanism by which manufacturers are incentivized to reduce emissions.

All Tax Policy is About Trade-offs

While governments do rely on revenue from excise taxes, the reliance has decreased significantly over the past nine decades. In 1934 (first year of available data), excise tax revenue made up 46 percent of the total tax revenue raised by the federal government. In 2019, excise taxes made up only 2.9 percent.[12] Across states, the revenue figures are somewhat higher relative to federal levels. In 2019, states collected 7 percent of their total tax revenue from excise taxes levied on tobacco, alcohol, and motor fuel.[13] States levy other excise taxes as well, but most excise tax revenue comes from these three sources.

As anyone involved in tax policy—or any policy field—can attest, tax policy is all about trade-offs and it is up to lawmakers to make design choices that facilitate principled application of taxes so that they may raise sufficient revenue with as few unintended consequences as possible. (Taxes intended to address externalities can, in many cases, generate their own.) For excise taxes, this can be particularly complicated as they often have a dual purpose: lowering demand and raising revenue.

Both can be achieved to a certain degree, but lawmakers should remember that they cannot simultaneously maximize for revenue and behavioral adjustment, as the two are in tension with each other. It is obvious that there would be no or very little revenue if lawmakers successfully design an excise tax to eliminate smoking or one prompting everyone to stop purchasing gasoline.

In fact, there is a point, the revenue-maximizing tax rate, where any additional increases to the tax rate would actually decrease revenue. This happens because, at this inflection point, the negative effect on consumption is greater than the positive effect on tax payments. That is not to say that the revenue-maximizing rate is the ideal tax rate; such a rate may be punitively high and lack policy justification. For most excise categories, a more efficient rate is likely lower as consumers are affected differently by high taxes.

When excise taxes are employed to deter consumption, the effect is greatest on the occasional user, as heavy consumers tend to have relatively inelastic demand. That means their behavior does not change as much because of price changes. When you add the addictive qualities of products including alcohol and nicotine to the equation, heavy users might seek to satisfy their addiction with alternatives—legal and illegal—rather than quitting.

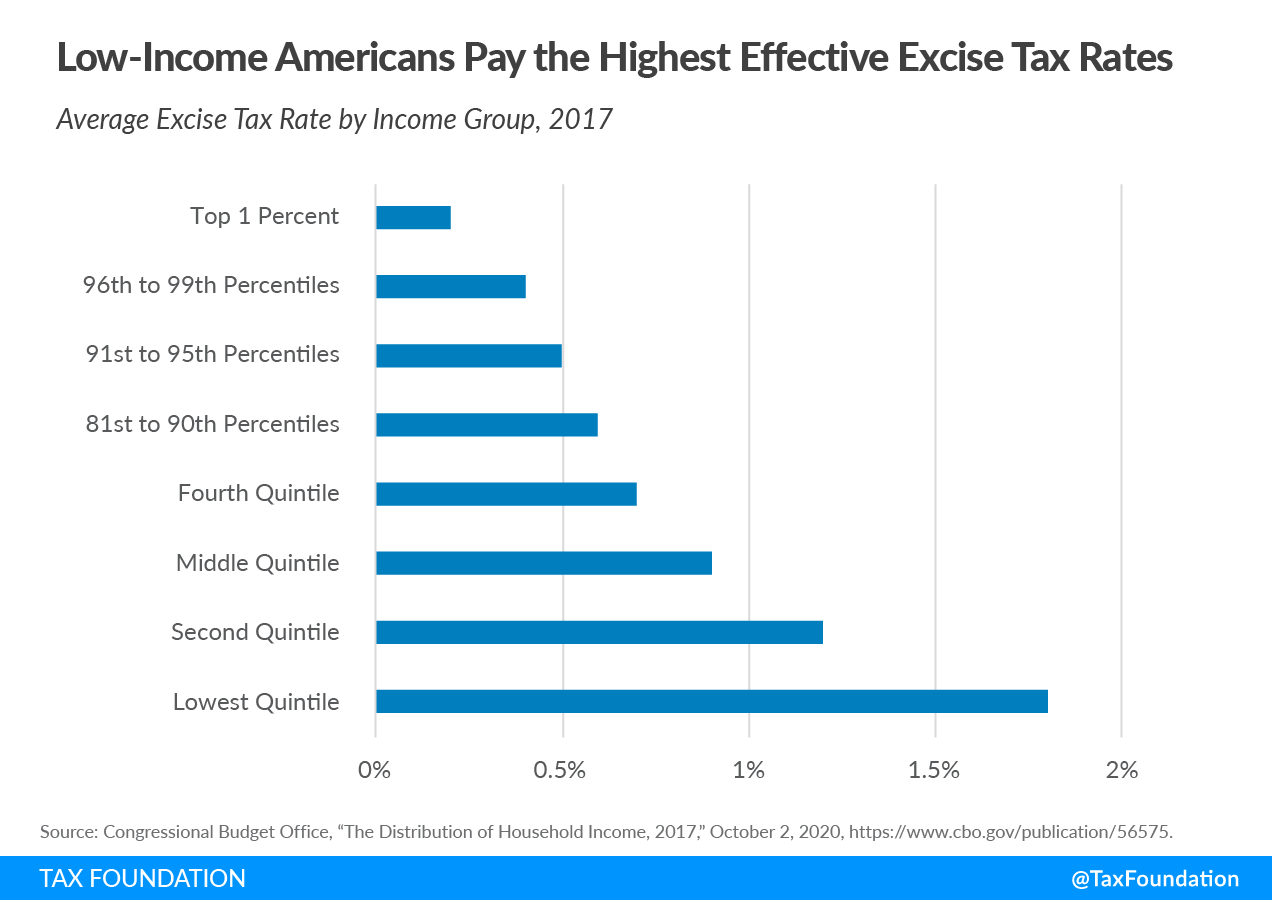

Another important aspect of excise tax is that they often affect people differently according to their income. In 2017, the top 1 percent on average paid an effective rate of 0.2 percent in federal excise taxes. The lowest quintile faced an average effective rate of 1.8 percent in federal excise taxes. While higher earners spend more and as a result also pay more in excise taxes in real terms, excise taxes as a percentage of their spending are significantly lower compared to low-income Americans.

A better choice for raising general revenue in a neutral manner is to employ broad-based taxes at low rates. While there are still important trade-offs to consider with broad-based taxes, they are less exposed to disruption and significantly more neutral.

General Excise Tax Design Considerations

This section discusses the elements of excise tax design and the policy trade-off impacted by various design choices. While some may consider a well-designed excise tax an oxymoron, excise taxes can be an effective tax tool. The goal of all tax policy, at least to a certain extent, is revenue generation, but a guiding principle is that excise taxes should only be levied when appropriate to capture some externality or to create a “user pays” system—not as a general revenue measure. Due to their narrow base, they are not a sustainable source of revenue for general spending priorities.

As a result, governments should limit the application of excise taxes to products or transactions for which a relevant externality can be identified. While consumption taxes can play a role in raising general tax revenue, general revenues should come from broad-based consumption taxes like the general sales tax. On a positive note, states do rely on the general sales tax revenues to a much larger degree than on revenue from excise taxes.

Excise Tax Base

When designing an excise tax, the first question that needs to be answered is what the excise tax base will be. Tax bases should be broad to achieve the greatest level of neutrality and to be most efficient in raising revenue—at the lowest possible rates.

For most excise taxes, the base should be the harm or cost-causing element because that best internalizes a negative externality. As examples, the amount of tobacco plant intended for smoking, alcohol content, and sports bets’ monetary value. In other cases, where the tax is employed as a user feeA user fee is a charge imposed by the government for the primary purpose of covering the cost of providing a service, directly raising funds from the people who benefit from the particular public good or service being provided. A user fee is not a tax, though some taxes may be labeled as user fees or closely resemble them. , the tax base should be the best available proxy for use. For instance, consumption of motor fuel acts as a proxy for drivers use of public roads.[14] From this follows that substitute goods (consumption alternatives) that do not result in negative externalities should not be included in the tax base. If a tax is levied on sugar-sweetened beverages, for instance, non-sugar beverages should not be taxed. Including substitute goods in the tax base can discourage desirable substitutions from more harmful goods to less harmful ones. An example of this issue, discussed in more detail later, is with taxes on vapor products. Despite their significantly lower harm profile, these products are too often taxed as tobacco products. To encourage harm-reducing behavior, tax burdens should reflect differences in harm.

An added benefit to taxing the externality-causing element is tax fairness. To illustrate that point, France used to apply one excise tax rate of grain-based alcohol products like gin and whiskey and another, and lower, rate on grape-based alcohol products like cognac. This practice, which favored domestically produced products over imports, was stopped by the European Court of Justice, and is a good example of inequitable tax treatment. Had France levied a tax on volume by alcohol content, the rates would have been similar on cognac and gin.

An important factor when considering tax bases is tax definitions. In tax writing, the base must be defined clearly because poorly written definitions can lead to disproportionate treatment of similar products. In a recent example from Minnesota, an excise tax on vapor products is levied differently when the nicotine solution is mixed in-state versus when products are imported in their final consumable form.[16] In Wisconsin, a “vapor product” was defined as a “a noncombustible product that produces vapor or aerosol for inhalation from the application of a heating element to a liquid or other substance that is depleted as the product is used, regardless of whether the liquid or other substance contains nicotine.” Lawmakers in the state applied a tax where the tax rate was determined by milliliter of liquid, but the definition of a vapor product clearly referred to vaping equipment. As a result, a tax is only levied on products where vapor liquid is sold in bundles (equipment and liquid sold together).[17]

Another element of excise tax design is whether to levy the tax on the value of the product (ad valorem) or on the quantity (specific). When excise taxes are levied as a vehicle for internalizing externalities or as a proxy for use of resources, it makes sense to levy the tax by quantity. The amount of tobacco or alcohol consumed has a much clearer connection to any harm caused by this consumption than the price paid for the products. Furthermore, if the tax is levied on price, consumers get a chance to downtrade (move from premium to discounted products) to limit their tax liability. Ad valorem taxes also incentivize manufacturers to invest less in product development as increased prices are punished by the tax design. However, buying a cheaper beer does not limit the externalities associated with consumption.

The same argument applies when considering motor fuel taxes, which are used as a proxy for road use. It is not the dollar amount spent but rather the gallons of gas used which serve as a proxy for road usage. Fortunately, specific excise taxes are also the most common.

Specific taxation has additional benefits as it is often simpler to calculate the tax based on weight, volume, or amount instead of the value. This is especially true as products often flow between different layers of a vertically integrated company (for instance a beer brewer that also operates as a wholesaler) and as such does not have a market value to tax. If a tax is levied on value, the taxpayer or taxing entity must compute an artificial value to tax if the tax is not levied at retail level (which few federal excise taxes are due to the number of taxpayers this would involve). Although rules exist for making this computation, it can create problems or perverse incentives—some of which are known as transfer pricing.[18]

Of course, there are instances where ad valorem taxes can be more appropriate. For sports betting, for instance, the potential harm of betting is best expressed by the size of the bet. A combination of the two can also be levied. This is often done when lawmakers seek to capture both the externality and the economic activity related to certain consumption. For instance, several states levy marijuana taxes that are both specific and ad valorem.

Excise Tax Rate

When a suitable base has been established, the next element is the tax rate. The rate should be determined by a number of factors, but the most important is the negative externalities or costs the tax is serving to internalize or recoup. This is obviously difficult, as it is almost impossible to determine the exact cost associated with drinking a glass of wine or driving a mile on a public highway. Fully efficient taxes that endeavor to recover external social costs may vary by location and person, which means that a theoretically correct tax would need to vary according to these distinctions. Trying to account for this difference would make the tax system exceedingly complex, and simplicity is almost certainly a preferable outcome. Thus, some average estimates must be made to get an idea of the cost in a similar fashion to how an insurance company prices out the cost of their coverage.

With some excise categories it is easier: the average cost of a mile driven by an average car on an average road, to cite one example. With other excise categories, it is much harder. For instance, society is very unlikely to incur costs from a person drinking a glass of wine a week. Not until that person becomes a heavy user does he or she impose costs on society as a whole, and yet the excise rate is the same for the first glass as it is for the tenth.

If a tax rate is at an appropriate level that captures externalities, lawmakers can include automatic inflation-adjusting mechanisms that guarantees that the tax rate retains its real value over time.

Since excise taxes should not serve as tools for general revenue, lawmakers should avoid the temptation to overtax products to raise additional revenue for general spending purposes. This can be difficult due to the inelastic nature of demand of many excised products.

Other considerations that should go into establishing a rate are market conditions, available economic substitutes, and general tax burden. Market conditions play a role for products that compete with the illicit market. For example, recreational marijuana retailers not only compete with each other but also with illegal operators. The same is true for both sports betting services and tobacco retailers. Economic substitutes are important because they may result in a pointless tax. Consider a tax on soda so high that people stopped consuming soda but were able to substitute sugar intake with an equally bad sugary habit like candy bars. This tax would have achieved no public health goal and no revenue would have been raised.

Finally, as lawmakers decide on tax rates, they should consider the general tax burden, as these taxes are typically imposed in addition to general sales taxes, individual and corporate income taxes, property taxes, and other taxes on the activity in question. Even where an excise tax is legitimate, excessive taxes on businesses can impair economic growth, job creation, and wages.

When to Levy

Excise taxes should ideally be levied early in the value chain because this generally results in a smaller number of taxpayers. Limiting the number of taxpayers lowers the cost of enforcement, which makes the tax design efficient and cheaper.

This is easier for excise taxes that are levied at a specific rate as the tax bill can be determined by quantity. If a tax is levied with an ad valorem rate, it can be simpler to levy it at retail level where a true market value is established. Levying a retail level excise tax does, however, multiply the number of taxpayers significantly, which can increase the cost of tax enforcement. This is likely the reason that the federal government does not levy excise taxes at retail level. Despite simpler valuation at retail level, even ad valorem taxes should be levied early to limit the number of taxpayers.

In international taxation, excise taxes should not be levied on products for export but on imported products at the same rates as domestically manufactured goods.

Excise Tax Revenue Allocation

Revenue from excise taxes should be allocated to cover societal costs related to consumption. This means, to cite a few examples, health costs related to smoking, infrastructure costs associated with driving, and costs related to enforcing bans of driving under the influence and regulating the sale of alcohol.

Allocating revenue to cover the cost associated with consumption of excised goods increases the taxpayers’ understanding of the tax and can effectively turn the tax into a sort of user fee. Unfortunately, too often lawmakers designate revenue from excise taxes to unrelated recurring spending priorities. As an example, 25 states divert a significant amount of revenue raised from motor fuel taxes to unrelated spending programs like education (Kansas and Texas), tourism (Utah), or wildlife conservation (Florida).[19] In addition, according to Campaign for Tobacco-Free Kids, states underfund tobacco cessation programs (measured against federal best practices) despite raising significant revenue from tobacco excise taxes.[20]

In addition to limiting use of excise taxes to raise general revenue, governments should also remain cautious when forecasting excise revenue. A well-established excise tax levied on quantity is generally a stable revenue generator—even in recessions. However, newer categories of excise taxes or categories with new tax rates tend to be more volatile. Revenue generation may also be impacted by changes in technology, consumer preference, or total tax burden. The impact of the tax burden is most visible in the cigarette market, where a substantial black market offers untaxed or low-tax products—primarily in areas with high taxes. Some markets, moreover, are in long-term decline, with cigarette smoking an obvious example.

Four Principles for Excise Tax Design

Sound tax policy should be guided by the principles of simplicity, transparency, neutrality, and stability. Tax policy that adheres to these principles is easier to understand for taxpayers and governments—clearly defined, more neutral in application, producing stable revenue.

Excise taxes are almost by definition not neutral. Many are designed specifically to impact decisions made by consumers to increase cost and lower consumption. However, excise tax design should strive to be as neutral as possible within the taxed category. This neutrality is achieved by levying the tax on the best available proxy for the externality or cost. Doing this ensures that, for instance, two beers with similar qualities and in similar quantities will have the same tax burden and that motor fuel with the same qualities and in similar quantities will have the same tax burden. By designing the tax to capture the externality, lawmakers guarantee that irrelevant product design qualities will not affect tax levels.

Transparency is important to taxation because transparent taxes are easier to understand for businesses and consumers. Excise taxes are generally less transparent as they are levied early in the value chain and built into the price when the good moves through the chain. Specific taxes are superior as the taxpayer more easily can identify the tax burden after a purchase is made. What is true for a transparent tax is also true for a simple tax. They are easier to comply with for taxpayers but also for tax administrators.

The last principle is designing for stability. Given their narrow bases, revenue from excise taxes lack long-term stability. An example can be observed with revenue from tobacco taxes. Tobacco consumption has been declining for decades and lawmakers have responded by increasing the rates. These factors combined have resulted in revenue instability.[21]

Motor fuel tax revenues may be the next most unstable revenue source as well as an example of how technological developments can erode a tax base. Motor fuel taxes are becoming much less efficient raising revenue from drivers because vehicles drive further on each gallon of gas and due to the growth of electrical vehicles sales.[22]

Regressivity

Federal excise taxes are regressive (see Figure 1), and the same is true for state excise taxes. However, not all excise taxes are created equal: for some excise taxes, the regressivity is exacerbated by disproportionate consumption patterns, and not just that low-income households consume more of their income overall. For instance, smoking incidence grows as income declines, which means that tobacco excise taxes are excessively regressive. For other excise taxes such as those on air travel, regressivity is limited as consumption increases as income increases.

As Table 1 shows, excise tax burden on highways, air travel,[23] and alcohol generally follows the income distribution by income group. This is truer for taxes on air travel and less so for highway and alcohol taxes. Tobacco taxes, however, stand out. Although the nominal tax burden does increase with income, it is much flatter than the other categories, and thus more regressive as a percentage of income.

| Highway | Air Travel | Alcohol | Tobacco | Income distribution | ||

|---|---|---|---|---|---|---|

| Lowest quintile | 4.2% | 4.5% | 3.5% | 15.9% | 3.1% | |

| Second quintile | 10.5% | 7.0% | 8.6% | 18.3% | 8.3% | |

| Middle quintile | 17.1% | 14.1% | 17.2% | 18.1% | 14.1% | |

| Fourth quintile | 23.4% | 21.6% | 23.9% | 20.1% | 22.7% | |

| Top quintile | 44.4% | 52.4% | 46.7% | 27.3% | 51.9% | |

| Total | 100% | 100% | 100% | 100% | 100% | |

|

Note: aggregates may not equal 100% due to rounding. Sources: Urban Brookings Tax Policy Center, “Who bears the burden of federal excise taxes?” https://www.taxpolicycenter.org/briefing-book/who-bears-burden-federal-excise-taxes; and U.S. Census Bureau, “Income and Poverty in the United States: 2019,” https://www.census.gov/library/publications/2020/demo/p60-270.html. |

||||||

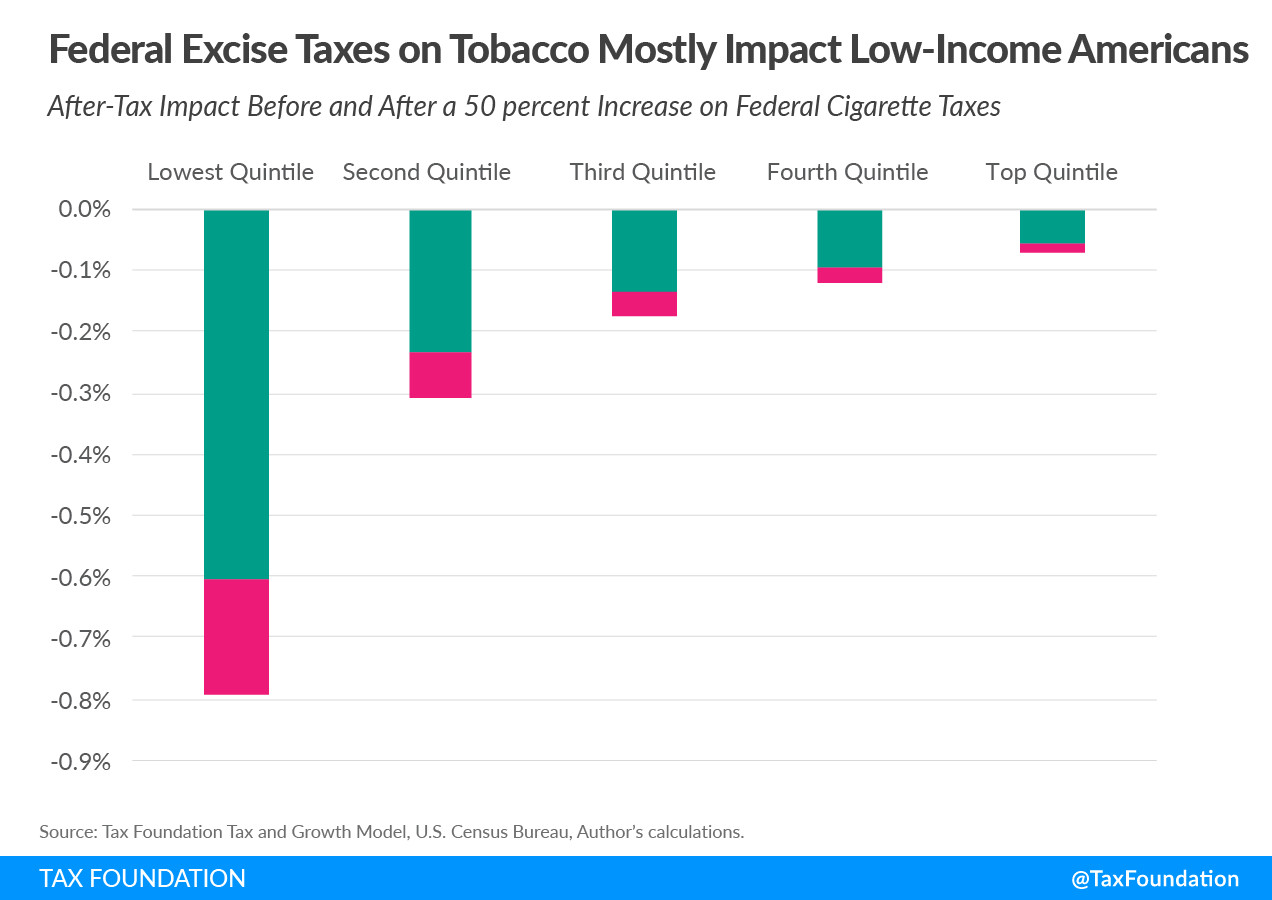

This distribution impacts how excise tax increases affect taxpayers. As an example, a federal tax increase of 50 percent on tobacco products would negatively impact the lowest quintile’s after-tax income by 0.2 percent whereas the top quintile would only see a 0.02 percent decline—one-tenth of the impact.

Another way to show this regressive effect is in actual tax burden. The Tax Foundation’s General Equilibrium Model estimates that a 50 percent increase in tobacco taxes would raise approximately $33.6 billion in federal revenue over 10 years.[24] If that additional burden is distributed similar to the existing burden, the lowest quintile would pay $5.3 billion more in taxes on tobacco and the top quintile would pay $9.2 billion more in taxes on tobacco. While the top quintile pays more actual tax, they also earn 51.9 percent of total income. Comparatively, Americans in the lowest quintile earn 3.1 percent of total income. Additional taxes paid by the lowest quintile are 58 percent of the additional taxes paid by the top quintile, but income is only 6 percent of the top quintile’s.

| Income distribution | Impact on after tax income | Additional tax burden | |

|---|---|---|---|

| Lowest quintile | 3.1% | -0.2% | $5.3 billion |

| Top quintile | 51.9% | -0.02% | $9.2 billion |

|

Sources: Tax Foundation Tax and Growth Model, October 2019; U.S. Census Bureau, author’s calculations. |

|||

The figure below illustrates after-tax impact on the five quintiles before and after a federal tax increase and mean income in the five quintiles.

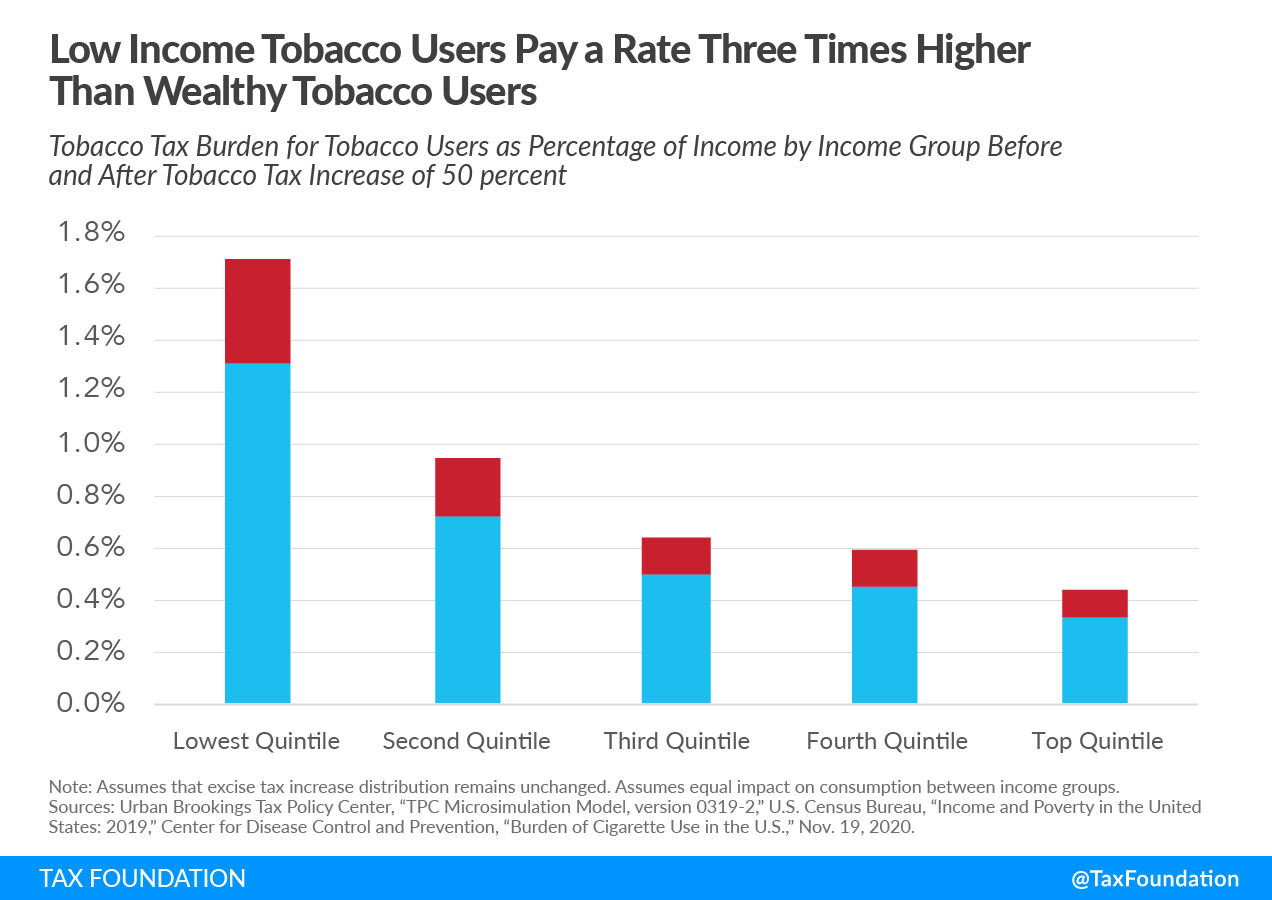

Using the figures in the different quintiles makes it possible to illustrate the difference in tax burden for taxpayers. Before a tax increase, a taxpayer making around $15,000 would pay $90 annually in cigarette taxes. A taxpayer making $254,000 would pay $127 annually. After a federal increase, those numbers rise to $120 and $167, respectively. It is worth noting, however, that not everyone in those groups consumes tobacco products—in fact, most do not.

Thus, for the individual tobacco consumer, the tax increase may be significantly larger. Adjusted for tobacco use incidence levels in the different income groups, the tax burden as a percentage of income for a taxpayer in the lowest quintile grows from 1.3 percent of income at the current tax level to 1.7 percent after a 50 percent increase in tobacco taxes. For the top quintile, the growth is only from 0.3 percent to 0.4 percent.

While the tobacco tax is the most regressive federal excise tax, a similar (though smaller) effect can be observed with excise increases on both alcohol and motor fuel taxes.

By itself, the fact that some excise taxes have regressive effects is no argument against levying them—a user-pays system or the internalization of meaningful externalities can be good policy—but the effect does illustrate the importance of not relying on regressive excise taxes for general fund revenue. It also underscores that trying to maximize revenue generation from excise taxes can carry adverse effects.

Some may argue regressive effects of tax increases on such products as tobacco are less problematic because price increases also have the largest deterrent effect on those who earn the least. While elasticity effects can be higher for low-income groups, it is important to note that Americans in the lowest quintile already pay a much higher effective tax rate yet remain the group with most tobacco users.[25]

Furthermore, excise tax increases are likely to have a greater effect on occasional users. Heavy users, who already pay most of the taxes, are less likely to change behavior. For alcohol, one study found that 82.7 percent of an increased tax burden from additional federal alcohol taxes would be paid by heavy drinkers.[26]

If the goal of an excise tax truly is to regulate behavior, it is often much more appropriate to use regulation. Limiting smoking, vaping, and heavy drinking in public places, for instance, is much better achieved by regulation than taxation.

Principles for Excise Tax Design

The discussion above can be summed in a few bullet points that serve as general rules of thumb for excise tax design. These are neither exhaustive nor always appropriate. They are, however, a good principled starting point for anyone in the business of developing principled excise taxes.

- Economic substitutes which lack the qualities justifying the excise tax or feature them in a dramatically attenuated form (e.g., non-sugary beverages, vapor products, plastic alternatives) should not be included in excise tax bases.

- An excise tax should target the negative externality or cost, which means the tax base should be the best available proxy for those externalities or cost.

- Specific taxes are superior to ad valorem taxes in most cases because quantity is associated with negative externalities or cost while a product’s price often shares no association.

- An efficient tax rate is not the same as a revenue-maximizing rate.

- Appropriately leveled tax rates can be indexed to inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. to retain real value of tax level.

Traditional Excise Tax Categories

Excise taxes on tobacco, alcohol, and motor fuel have been levied in the U.S. for more than a century. The following section is an introduction to the tax design of these large traditional excise tax categories.

Tobacco

Tobacco products are taxed at the federal level and, except for large cigars, all are taxed at specific rates. Tobacco may be an especially alluring product to tax as it has addictive qualities. This limits elasticity, which means that even high taxes have a limited impact on consumption.

| Category | Rate |

|---|---|

| Cigarettes (per 1,000) | $50.33 |

| Large cigarettes (per 1,000) | $105.69 |

| Small cigars (per 1,000) | $50.33 |

| Large cigars (per 1,000) | 52.75% of sales price but not to exceed $402.60 per 1,000 |

| Pipe tobacco (per pound) | $2.8311 |

| Chewing tobacco (per pound) | $0.5033 |

| Snuff (per pound) | $1.51 |

| Roll-your-own tobacco (per pound) | $24.78 |

|

Source: Alcohol and Tobacco Trade and Tax Bureau, “Tax Rates.” |

|

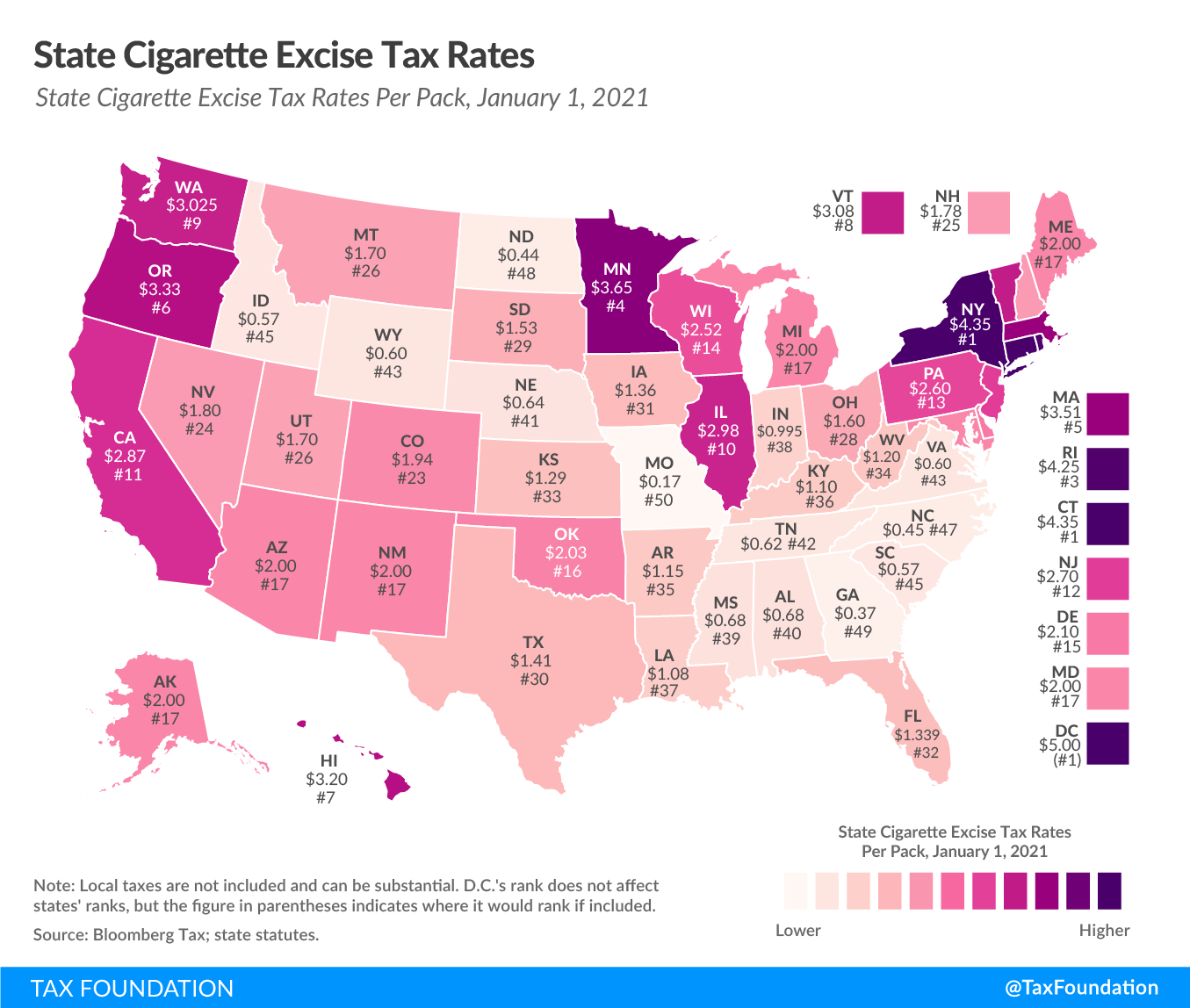

On average, states tax a pack of 20 cigarettes at a rate of $1.88, not including local taxes and general sales taxes (all states with a general sales tax except Oklahoma levy that tax on retail sales).[27] Cigars and other tobacco products (roll-your-own tobacco, pipe tobacco, smokeless tobacco) are taxed at various levels and with various bases. Some states appropriately use weight or quantity tax base for most categories, but others rely on the more inequitable ad valorem design.

As mentioned, tobacco is taxed at both the federal and state and sometimes even local levels. These layers of taxes often result in very high levels of taxation—the highest of any consumer item. The retail price of cigarettes, for instance, is more than 40 percent taxes on average. In some states, like Minnesota and New York, more than 50 percent of the price paid by consumers is made up of taxes.[28]

These layers of taxation also means that it is relevant to state governments what the federal government decides in terms of tax burden and vice versa. Because consumption is impacted by retail price, a federal tax hike, which would translate to increased retail prices and a decline in consumption, can impact the revenue generated by state governments. If, for instance, the federal government were to increase taxes by $1 per pack of 20 cigarettes, and this increase were passed on to consumers, state governments in aggregate would raise roughly $720 million less in revenue from excise taxes on cigarettes.[29] In addition, when taxpayers pay more in tobacco taxes, they pay less in other taxes like income and payroll taxes. This effect is known as the Income and Payroll Offset. Generally, additional revenue generated by increased excise taxes is reduced by around 25 percent as a result of this offset.[30]

| Example of Impact of Federal Excise Tax Increase on State Excise Revenue in Florida and New York, 2019 Data | ||||||

|---|---|---|---|---|---|---|

| State | Current Cigarette Tax Revenue | Current Price | Federal Tax Increase | New Price | Simulated Revenue after Increase | Difference |

| Florida | $1,011,677,240 | $6.26 | $1 | $7.32 | $960,285,329 | $51,391,911 |

| New York | $952,893,630 | $10.53 | $1 | $11.57 | $924,659,745 | $28,233,885 |

|

Note: Elasticity assumed at -0.3, tax increase assumed to be passed to consumer. Price effect of increased general sales tax included but local taxes and Income and Payroll Offset are excluded. Sources: U.S. Census Bureau, “State Government Tax Tables”; William Orzechowski and Robert Walker, “The Tax Burden on Tobacco,” Historical Compilation 54 (February 2020); author’s calculations. |

||||||

Because the excise tax base is already very narrow, certain policy decisions unrelated to tax policy can have an enormous impact on revenue generation. In the last few years, some lawmakers have entertained the idea of banning flavored tobacco products including menthol cigarettes, which make up a significant part of the cigarette market (36 percent at the national level).[31] Such a ban narrows the tax base even more and may result in much lower revenue from the cigarette tax by driving consumers to procure their cigarettes illegally or from jurisdictions without bans.[32]

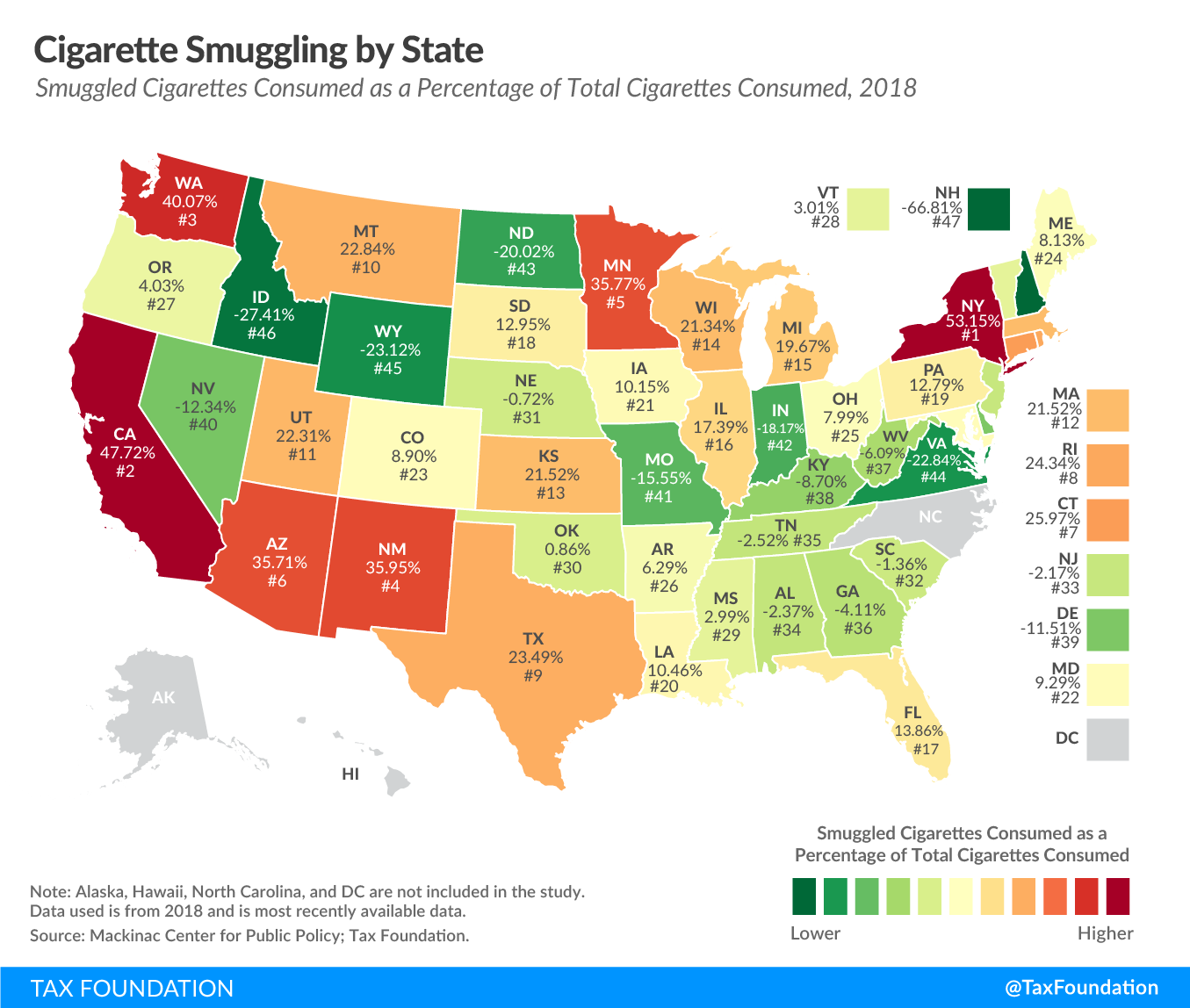

At the state level, high taxes can have a similar effect by driving consumers to purchase out-of-state tobacco products to avoid the tax. In 2018, New York was the highest net importer of smuggled cigarettes, totaling 53.2 percent of total cigarette consumption in the state. New York also has one of the highest state cigarette taxes ($4.35 per pack), not counting the additional local New York City cigarette tax ($1.50 per pack).[33]

Excise taxes revenue from tobacco products are allocated to a large number of different spending priorities—mainly health-related. However, a portion is also used for general spending priorities. This is problematic as all states, according to Center for Disease Control (CDC) recommendations, underfund relevant spending programs like cessation and youth prevention campaigns.[34] In fact, states only spend 2.4 percent of the revenue on tobacco prevention, which means that more resources could be dedicated to these programs without needing to further increase taxes.[35]

Alcohol

Excise taxes on alcoholic beverages are some of the oldest taxes in America. In fact, a tax on beer was levied by Dutch settlers in New Amsterdam (New York today) in the 17th century.[36] Taxation of spirits also goes back to the early days of the republic, when a tax was imposed on whiskey during George Washington’s administration to pay back war debts. Alcohol excise taxes would routinely be levied to pay down similar war debts until Prohibition. After the Great Depression, President Franklin Roosevelt supported ending Prohibition partially to open a new revenue source for governments.[37]

Today, an alcohol excise tax is imposed in all 50 states, in the District of Columbia, and by the federal government. State and federal taxes on alcohol vary among beer, wine, and spirits. For example, federal taxes on spirits and wine are based on separate functions of alcohol content. Because the tax base is the alcohol content (within a category of alcoholic beverage), an inexpensive brand and a costly brand incur the same federal tax if they have the same concentration of alcohol. This is appropriate, as it is not the job of the excise tax to tax progressively. The excise tax is levied to target alcohol consumption—regardless of price. Notably, however, federal excise taxes do have a progressive component, taxing large producers more than smaller ones.

The Tax Cuts and Jobs Act, passed in 2017, made the first reforms to the federal alcohol excise taxes since 1990, lowering the rates for all three commodities (beer, wine, and spirits).[38] The lower rates, which were originally temporary, were made permanent in 2020.[39]

At the federal level, smaller importers and brewers of beer pay a tax of $3.50 to $16 per barrel, and large producers pay $16 on the first six million barrels and $18 on every barrel after that (see Table 1 in the Appendix for details). On wine, producers pay four different rates depending on the number of gallons produced. The first 30,000 gallons are credited $1 of the rate, a $0.90 credit is applied on the next 100,000 gallons, and a $0.535 credit on the next 620,000 gallons. This effectively means wine faces a graduated excise tax schedule (see Table 2 in the Appendix for details). Spirits are taxed in a similar fashion. The first 100,000 gallons are taxed at $2.70 per gallon, the next 22,130,000 gallons at $13.34 per gallon, and everything above at $13.50 per gallon (see Table 3 in the Appendix for details).

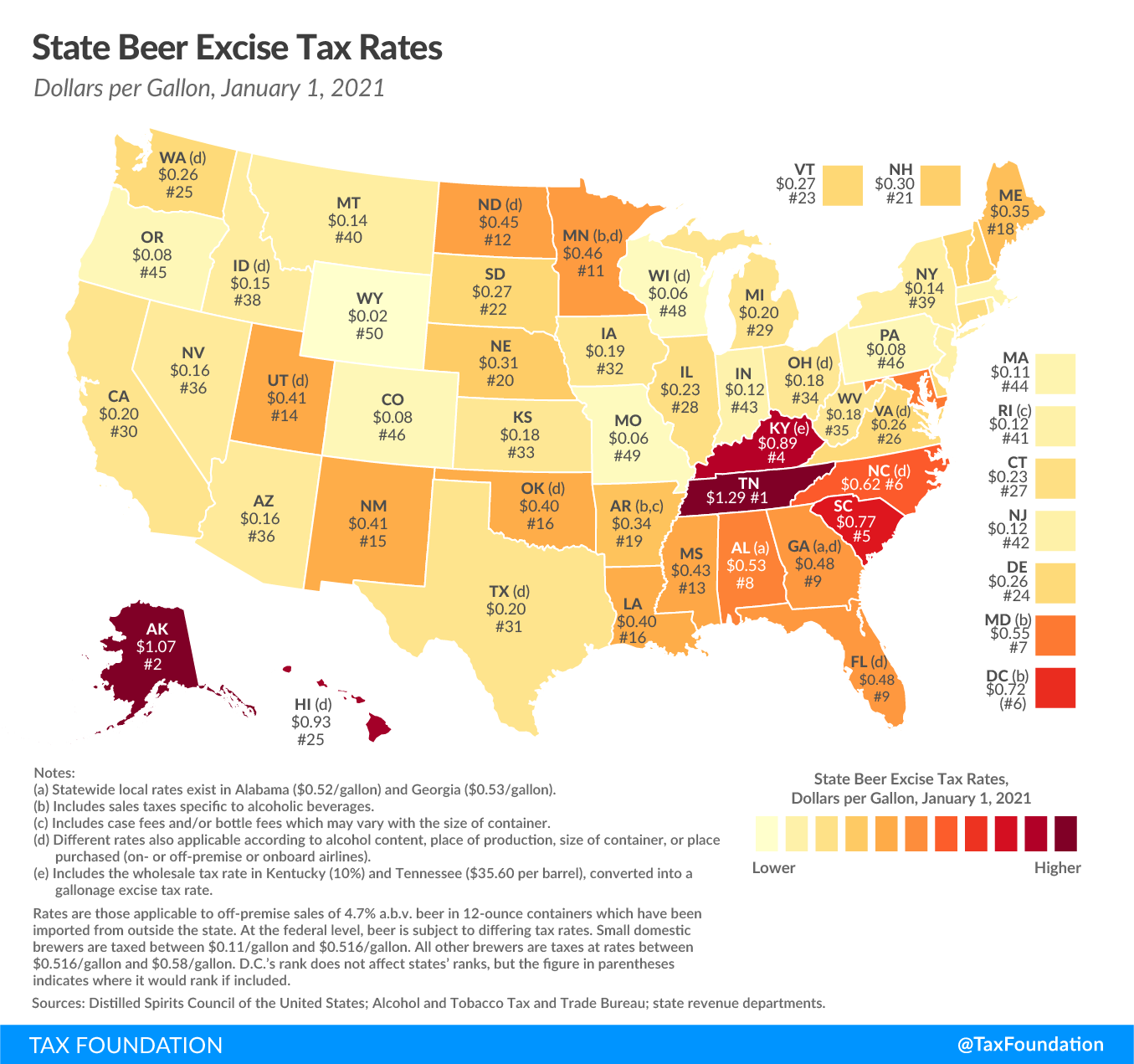

At the state level, rates on beer vary widely, from as low as $0.02 per gallon in Wyoming and as high as $1.29 per gallon in Tennessee.

According to the CDC, excessive alcohol consumption is one of the leading causes of preventable deaths in the U.S. The agency also estimates that costs associated with excessive alcohol consumption far outpace the revenue generated by excise taxes on alcohol.[40] However, it is not straightforward to use alcohol taxes to internalize the negative externalities because harm associated with consumption is exponential. Moderate drinkers are highly unlikely to inflict costs on society, while the top 10 percent of drinkers, who are responsible for well over 50 percent of all alcohol consumption, are considerably more likely to do so.[41] Thus, the question becomes whether it is equitable to ask moderate drinkers to pay significantly more in excise taxes on their weekly glass of wine to cover the costs of abusive drinkers, and whether that would even work.

In general, economists find that the consumption of alcohol is relatively inelastic, which means consumption does not change as much as the price changes. The reason consumption of alcohol does not change as price or income shifts is that individuals can simply change the mixture of alcohol consumed rather than scaling up or down the total alcohol consumed.

In addition, research indicates that when higher prices do decrease consumption, it tends to be light and moderate drinkers that are affected. Heavy drinkers are not deterred by the tax.[43] The moderate consumers are unlikely to cause any externalities, which would make excise tax increases as a means to deter consumption (and decrease societal costs associated with drinking) inefficient policy. As mentioned in the section on regressivity, one study found that 82.7 percent of an increased tax burden from additional federal alcohol taxes would be paid by heavy drinkers.[44]

Alcohol tax revenue is often allocated for general revenue spending. This is natural as these taxes have traditionally been imposed for general revenue. However, lawmakers should consider allocating revenue to fund societal cost associated with alcohol consumption.

Motor Fuel

President Ronald Reagan once observed that “[o]ur country’s outstanding highway system was built on the user fee principle—that those who benefit from a use should share in its cost.”[45]

The federal motor fuel excise tax has been levied since 1932. The first levy was 1 cent per gallon and was originally a deficit-reduction measure following the Great Depression. In 1941 the rate was increased to 1.5 cents to help fund World War II, and increased again, to 2 cents, during the Korean War. In 1956, the rate was increased to 3 cents and the Highway Trust Fund was established to fund the new Interstate Highway System. Since then, the rate has increased five times to today’s 18.4 cents (including 0.1 cent reserved for the Leaking Underground Storage Tank Fund).

Some states have levied motor fuel taxes since 1919, and all states (including the then territories Alaska and Hawaii) and the District of Columbia had implemented a motor fuel tax by 1946.[46] The average state excise tax rate in 2021 is 25.7 cents, but gasoline is taxed at an average rate of 36.8 cents per gallon when other taxes are included.[47]

Diesel fuel is taxed at 24.3 cents per gallon at the federal level and at a combined (all state and local taxes) rate of 37.8 cents at the state level. The rate is slightly higher to reflect the fact that diesel-powered vehicles are often larger and thus responsible for more road damage than gasoline-powered vehicles.[48]

The motor fuel tax is relatively well-designed and seeks to capture the negative externalities caused by driving petroleum-powered vehicles, internalizing the costs of contributions of road wear-and-tear, traffic congestion, and pollution. From the Pigouvian perspective, the motor fuel tax is one of the best policy options to mitigate the externalities associated with automotive transportation.[49]

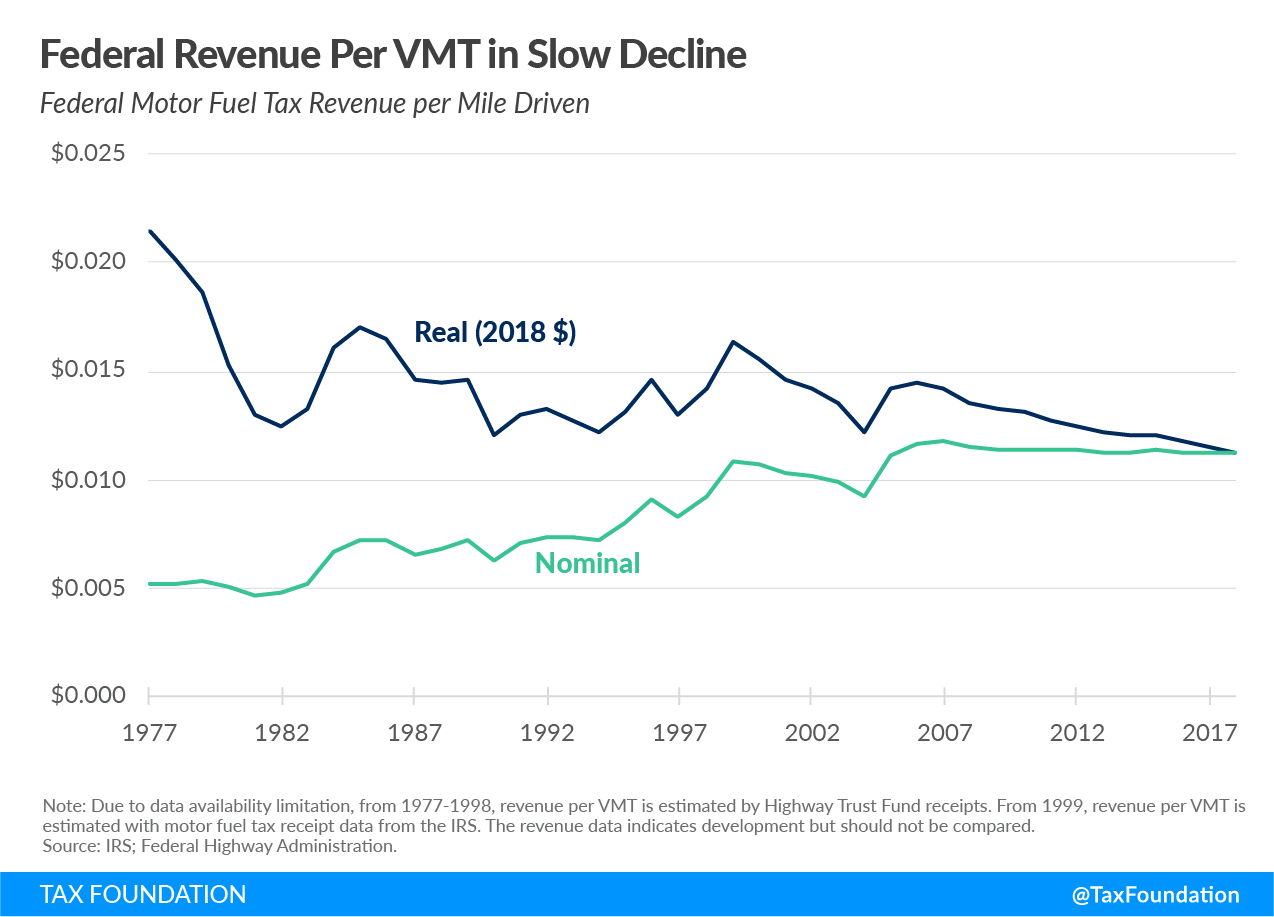

Motor fuel as a tax base has been, and to a certain extent still is, well-chosen, but also does highlight two concerns with excise taxes. First, the specific rate of the federal tax has not been indexed to inflation, which means it has lost real value over time. The federal tax rate should have been roughly 33 cents in 2020 to correspond to its value in 1993. Fortunately, motor fuel tax rates have been adjusted by many states (36 have increased rates over the last decade, with many now indexing them automatically).[50]

The second issue is a narrow tax base. The improvement in vehicles’ fuel economy along with growth in sales of electric vehicles result in a tax base that no longer captures the externalities as well. Electric vehicles do not consume motor fuel and vehicles that drive far on each gallon of gas pay less in taxes per vehicle miles traveled (VMT), even though it is the actual act of driving on roads, not the burning of fuel, that generates most of the externalities addressed by the tax. As these issues grow, the difference between revenue from the tax and infrastructure spending will widen for both federal and state governments.

Motor fuel as a proxy for road use may be well on its way to becoming obsolete. Federal gas tax collections in 2018 totaled $26.7 billion. Adjusted for inflation, that would be approximately $17.7 billion in 1994 (the first year after the last gas taxA gas tax is commonly used to describe the variety of taxes levied on gasoline at both the federal and state levels, to provide funds for highway repair and maintenance, as well as for other government infrastructure projects. These taxes are levied in a few ways, including per-gallon excise taxes, excise taxes imposed on wholesalers, and general sales taxes that apply to the purchase of gasoline. increase). The federal government actually collected $19.8 billion that year, which is almost 12 percent more. Combined with the fact that expenditures have not decreased, these numbers indicate that the system no longer lives up to the user-fee principle.

At the federal level, the revenue from motor fuel taxes has not been sufficient to cover transportation expenditures since 2008. The federal government has had to supplement motor fuel tax revenue with general fund revenue to keep up with outlays, but the current funding program, the Fixing America’s Surface Transportation Act (FAST Act), expires this year. Congress must decide how to pay for the Highway Trust Fund in the years to come because revenue from the federal motor fuel tax will not cover projected spending at the current tax rate. The only options for lawmakers are to either appropriate more general fund money or to increase taxes.[51]

Increasing taxes may only be a short-term solution as erosion of the tax base is likely to continue, driven by technological advances and regulations like the Corporate Average Fuel Economy (CAFE) standards. The CAFE standards result in better MPG and may encourage a switch to alternative fuel vehicles, which means using the motor fuel tax as a user fee will become more challenging in the future.[52] The U.S. Energy Information Administration estimates that gas consumption will decline 19 percent through 2050 even though road usage will increase.[53]

At the state and local levels, the amount of road spending covered by gas taxes, tolls, user fees, and user taxes varies. In order to truly live up to the benefit principle and user fee ideal, the taxes collected on transportation would be sufficient to cover transportation expenditures. This is, however, not the case, as shown in Table 4 in the Appendix. Almost every state spends more on highways than they collect in dedicated revenue from federal, state, and local sources. The only exceptions are Hawaii, Idaho, and Tennessee. That means the rest of the expenditures are covered by non-transportation-related tax revenues (Appendix Table 4) collected from people who may not use the roads, or activity not related to road use. To make matters worse, 25 states divert revenue raised from motor fuel taxes to unrelated spending programs.[54]

With these issues threatening the sustainability of the established motor fuel taxes, it may be time for lawmakers at both the state and federal levels to consider other options for transportation revenue. One such option is a vehicle miles traveled (VMT) tax. Instead of using fuel as a proxy for road usage, taxing actual road usage would better respect the benefit principle and guarantee that the tax acts as a user fee. On both a federal and a state level, imposing a VMT tax does require lawmakers to make some hard decisions on trade-offs. Significant concerns regarding privacy must be addressed and balanced against a desire for a targeted, equitable, and efficient tax.[55]

Excise Tax Trends

Over the last few years, several new categories of excise taxation have emerged—some, like sports betting and marijuana, due to legislative changes, and others, like ride-sharing and vapor, due to technological developments. Finally, proposed or implemented taxes on plastics and sugar are indicative of changes in public opinion.

Most of these categories are still developing, so tax law and policy should remain agile enough to track the maturation of new markets. The following section introduces and analyzes these developing excise tax categories.

Recreational Marijuana

Establishing legal access to recreational marijuana[56] is a still relatively new trend (15 states have done so),[57] but reports of growing marijuana sales and expanding popular support make it likely that more states, and maybe even the federal government, will consider allowing licensed sales of, and taxing, marijuana.[58]

In 2021, several additional states may look at excise taxes on recreational marijuana. Lawmakers in 15 states have expressed interest in revenue from recreational marijuana or passed legislation to establish a legal market. In addition, Senate Majority Leader Chuck Schumer (D-NY) has indicated interest in considering marijuana reform at the federal level.[59]

While meaningful revenue may be available (eventually), lawmakers should remain cautious as revenue will not materialize for a number of years and could be volatile. See Table 5 in the Appendix for revenue potential by state calculated based on actual revenue collections in states with legal recreational marijuana markets operating for three or more years.

That being said, there are examples of legal markets working. Facilitating affordable accessible marijuana seems to have worked in Colorado, Oregon, and Washington, where legal sales have successfully outcompeted the illicit market—at least to a certain degree. At the same time, these states have raised the revenue required to cover the cost of the system.

The marijuana market still has potential to grow as more states enter the fray. Estimates suggest that the legal market was worth between $11.0 billion and $13.7 billion in 2019, and may be worth up to $30 billion by 2023.[60] If these projections materialize, the value of marijuana sales will grow to two times that of firearms and ammunition, and three times that of McDonald’s sales revenue in the U.S (2018 data).[61] In 2019, recreational marijuana was estimated to make up about 60 percent of the market, but is expected to grow to closer to 75 percent by 2023.[62] In the recreational market, the product split is fairly even between flower-based products and infused products/concentrates.

A profitable new industry to tax is understandably enticing to many lawmakers, but an excise tax on recreational marijuana should be based on the following principles:

- Tax rates should be low enough to allow legal markets to undercut, or at least gain price parity with, the illicit market;

- Taxes should be designed to offer stable revenue in the short term regardless of potential price declines; and

- Taxes should raise enough revenue to fund marijuana-related spending priorities and cover societal cost related to consumption.

Taxes that capture general consumption, profit generation, and property value exist outside the excise tax space. Lawmakers should rely on these broad-based taxes rather than develop gross receipts taxes or ad valorem taxes to this new tax economic activity.

In order to tax marijuana efficiently, the tax should be levied at a rate that corresponds to the externalities associated with the product. This is difficult as the actual externalities are hard to estimate for any product, and no study on the subject exists for marijuana.[63] Not only is it hard to estimate cost related to marijuana use, but external cost is also impacted by substitution. For instance, the external cost of marijuana use is smaller if consumption of marijuana is substituted for alcohol, painkillers, or tobacco consumption and vice versa. Nonetheless, these principles can be helpful to tax writers.

For this and perhaps other reasons, most states have implemented price-based (ad valorem) taxes on recreational marijuana levied at the retail level. Levying the tax on retail sales allows for simplicity because there is a taxable event with a transaction, allowing for simple valuation. However, if an ad valorem tax is applied at the wholesale level, it is difficult for vertically integrated businesses to calculate the taxable value, as there is no transaction. To offset that, Colorado and Nevada levy their ad valorem tax based on a fixed rate (adjusted at different intervals) and weight. Although structured as an ad valorem tax, applying a fixed price essentially converts these taxes to a weight-based tax.

Although ad valorem taxation is simple, it is neither neutral nor equitable. Furthermore, such a design harms consumer choice and product quality as it incentivizes manufacturers and retailers to reduce prices to limit tax liability. It also incentivizes downtrading, which is when consumers shift from premium products to cheaper alternatives. Downtrading effects do not reduce harm and have no relation to any externality the tax is seeking to capture.

In addition, like any tax in an immature market, ad valorem systems run the risk of being too high in the beginning, when supply is low, and too high after a few years, when prices might drop significantly. When supply is low, the tax rate may add significant cost to an already scarce expensive product. As the market develops, prices may fall, which would subsequently reduce tax revenue. This effect is not yet widely noticed as states have been expanding the market, with growth in sales masking this effect. Nonetheless, the longevity of an ad valorem system remains uncertain as, according to a report from the Congressional Research Service, the price per ounce may fall as low as $5-$18.[64]

Rather than levying the tax on price, lawmakers should use a specific tax base: weight and potency (THC-based). [65] By taxing this way, highly potent products would be more expensive and yield more revenue, reflecting higher societal cost associated with more potent products. By including the weight component, the levy would also respect the different harm profiles of smoking a little versus a lot of marijuana. A specific, separate category should be created for edibles and concentrates as they are easier to test. Neither weight nor potency are perfect, but both are substantially better proxies than price for internalizing the externalities.

| Product | Design |

|---|---|

| Smokable Plant Material |

Specific per ounce |

| Edibles and Concentrates |

Specific by milligrams of THC content |

|

Note: Testing for THC in plant material may still need time. Thus, a tax could be established purely on weight for now. Source: Author’s definitions. |

|

Using THC as a tax base assumes that THC content is the best proxy for potency and therefore the best measure of externalities related to marijuana consumption. This, however, is an area that should be studied further. There are hundreds of cannabinoids in marijuana and the understanding of the “formula for potency” is nowhere near complete. Even with a THC focus, there may be a need to levy one rate on edibles and another of concentrates to account for different and more potent absorption mechanisms. For instance, New York State has recently proposed a tax system where edibles are taxed four times higher than concentrate.[66]

Furthermore, one of the great challenges with tax design for marijuana is the amount of product types available on the market, from pre-rolled joints to sparkling water, and the yet unknown products to come. Any tax system should either be nimble enough or be updated frequently enough to capture new products as they enter the market.

State taxes should be levied at the wholesale level to avoid tax pyramiding. If interstate commerce becomes legal, marijuana risks double taxation if the origin state taxes cultivation and the destination state taxes sales. To avoid this problem, states should not levy taxes on products that are not consumed in the state. Avoiding tax pyramidingTax pyramiding occurs when the same final good or service is taxed multiple times along the production process. This yields vastly different effective tax rates depending on the length of the supply chain and disproportionately harms low-margin firms. Gross receipts taxes are a prime example of tax pyramiding in action. would guarantee that the excise tax is a tax on consumption rather than on cultivation or production.

Excise tax revenue should be appropriated to relevant spending priorities related to the consumption of marijuana. Examples include public safety, cessation programs, marijuana research, and youth drug use education.[67]

Sports Betting

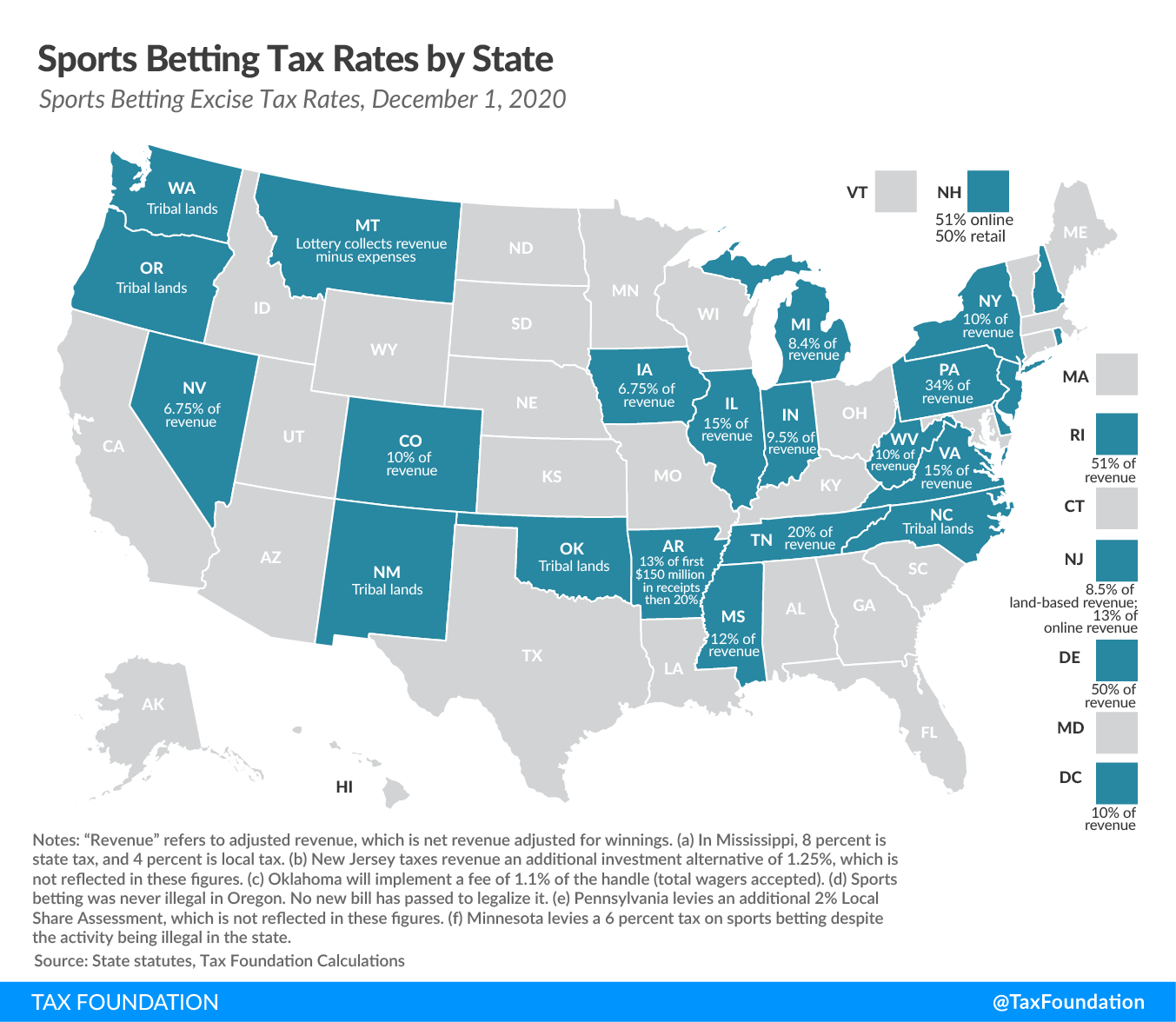

Since the Supreme Court’s 2018 decision in Murphy v. National Collegiate Athletic Association overturned the federal ban on sports betting, 23 states and the District of Columbia have legalized betting (several more are in the process), and most have also introduced excise taxes on the revenues. Most states that have legalized sports betting have allowed operators to offer both in-person and online betting. There are a few states that only allow in-person or only allow betting on tribal lands.

The market share of online betting has grown quickly since the beginning of the coronavirus pandemic in 2020. With many professional sporting events taking place without spectators, online betting has become more popular than ever. Since many states still mandate social distancing, brick and mortar casinos and physical sportsbooks are not able to compete with online sports betting. Out of the 23 states that allow wagering, this is an issue for seven, because they do not allow online betting. Those seven are Arkansas, Mississippi, New Mexico, New York, North Carolina, Oklahoma, and Washington. Those states, along with states that have not legalized, are more likely to have residents utilizing illegal bookies. If states choose to legalize, they should give the new industry the best possible chance to succeed and the new consumers a variety of options. Allowing online betting and several operators to service consumers is the best way to support the new industry and consumers.

Sports betting taxes are almost always levied as a percentage of the value of the adjusted revenue (revenue minus winnings), which is effectively an ad valorem tax on each bet. Sports betting is one of the few products where an ad valorem tax is appropriate. The best proxy for any harm caused by betting is certainly the amount of money spent on betting. Tax rates vary significantly among states, where some levy single digit taxes and others impose taxes worth fully half of industry revenue.

It is important to remember when setting tax rates on wagering that sports betting facilities will be competing with illicit markets in a way that is analogous to how legal marijuana competes with illegal product. Setting gambling tax rates too high could keep bettors in untaxed markets. According to the American Gaming Association, Americans spend close to $150 billion on illegal bets each year.[68] States, localities, and professional sports leagues all want a piece of that pie.

Just like states want to raise revenue from sports betting, so do professional sports leagues. The rise of in-game betting intensifies the importance of the integrity of in-game data, at least theoretically. That has been the crux of arguments advanced by professional sports leagues—particularly Major League Baseball (MLB) and the National Basketball Association (NBA)—for so-called “integrity fees,” in which as much as 1 percent of the “handle” (the total amount of bets taken) would be remitted to the league to offset the costs of maintaining the data on which bets are based, and in compensation for generating the product (the games themselves) which makes betting possible. Many policymakers have questioned the justifications for these integrity fees and only three states (Illinois, Michigan, and Tennessee) have adopted them.

Despite the pandemic, 2020 was a good year for the sports betting industry. Americans spent more than $20 billion on legal sports betting throughout the year with New Jersey, Nevada, and Pennsylvania as the largest markets. This activity generated over $200 million in tax revenue in the states.[69]

In the long run, sports betting represents a real opportunity for new revenue for states—especially if they develop an appropriate regulatory and tax framework, one which allows the industry to grow. However, it is very unlikely that revenue from sports betting will have any meaningful impact on budget shortfalls.[70] Revenue should be allocated to relevant spending priorities associated with the issues that can arise from gambling, such as addiction, which tends to escalate, and may eventually lead to, crime. Too often, lawmakers appropriate the funds to tangential spending programs, as in Colorado, where tax revenue from sports betting is used for water projects.

Vaping

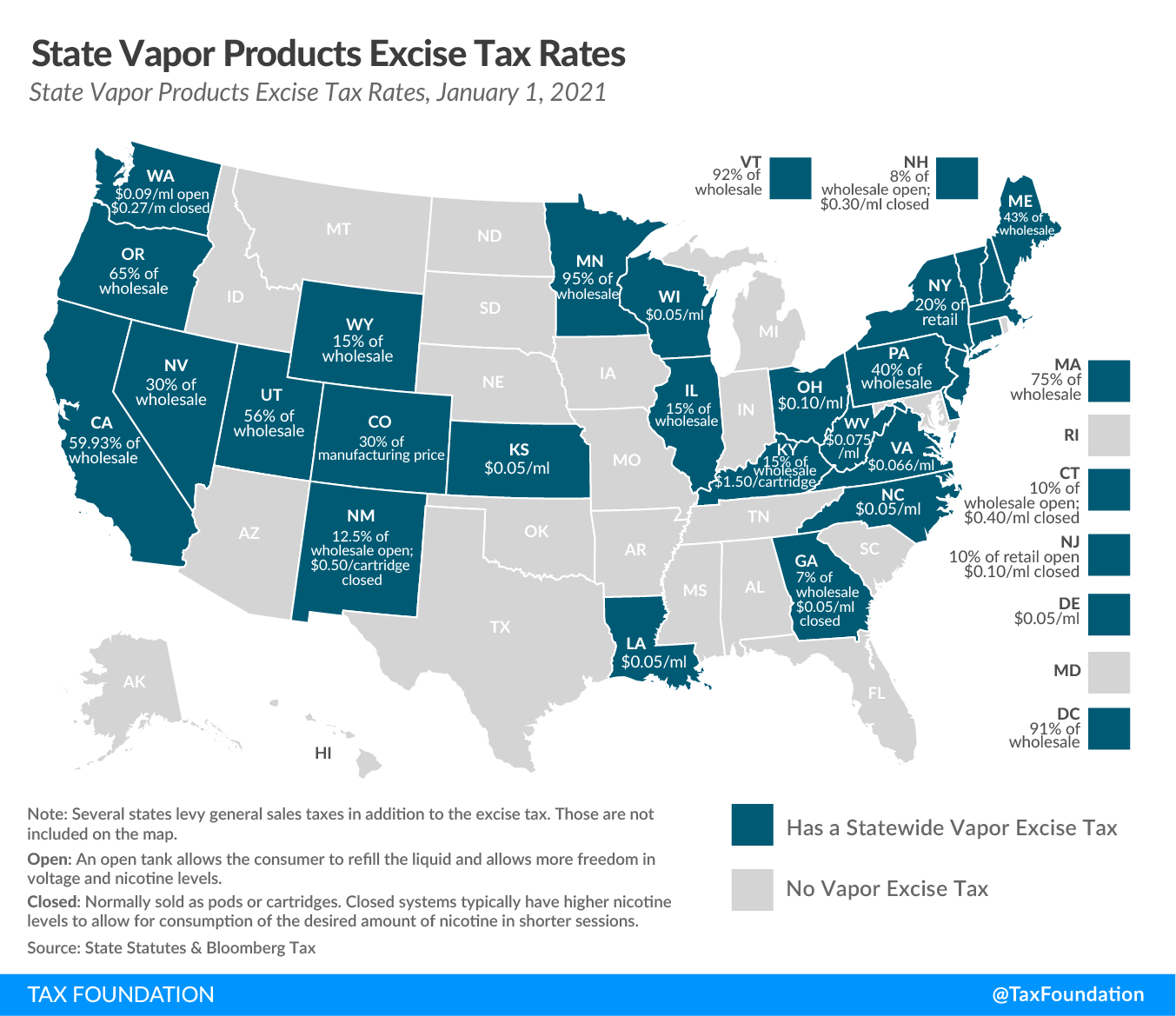

The nicotine market in America has changed dramatically over the last decade. Since vaping entered the market in the mid-2000s, it has grown into a well-established product category and viable alternative to smokers. So far, 28 states and the District of Columbia impose an excise tax on vaping products. In addition, the federal government is likely to impose a tax on vaping products in the near future.

From a pure public health standpoint, the rationale for taxing all nicotine products, and not just traditional tobacco products, is not very strong. It is generally believed beneficial for society every time a smoker becomes a vaper. While more research relating to the potential harm-reduction qualities of vapor products is needed, for now, the consensus is that vapor products are less harmful than traditional combustible tobacco products. Public Health England, an agency of the English Ministry for Health, concludes that vapor products are 95 percent less harmful than cigarettes.[71]

Before discussing the trade-offs in nicotine tax policy design, it is important to introduce the concept of harm reduction. This is the notion that it is more practical to reduce harm associated with use of certain goods rather than attempting to eliminate it completely through bans or punitive levels of taxation. This concept is relevant because vapor products are less harmful than combustible tobacco products. Combine that with the fact that about 70 percent of America’s 34 million smokers are interested in quitting, but only have a success rate of about 7 percent (10 percent among younger smokers[72]), and vapor products—even if unhealthy in their own right—are highly attractive as an alternative to smoking. The main reason for the low success rate in smoking cessation is the addictive nature of nicotine. To put it simply: it is very difficult to quit.

Consequently, vapor products could be a key tool in the fight against tobacco-related morbidity and mortality. Protecting access to harm-reducing vapor products is connected to excise tax design as nicotine-containing products are substitute goods.[73] By looking at cessation behaviors in the context of a tax increase on vapor products, a recent publication found that 32,400 smokers in Minnesota were deterred from quitting cigarettes after the state implemented a 95 percent excise tax on vapor products.[74] The substitution effect is also evident looking at the smoking rates in the U.S. There is some correlation, and perhaps causality, between recent growth in the vapor market and the pace at which the cigarette market is declining. While vaping has been growing in many states, the decline in smoking has accelerated—especially among teens and young adults.

Rather than protecting public health, high-rate excise taxes on vapor products risk harming public health by pushing vapers back to smoking combustible products. If the policy goal of taxing cigarettes is to encourage cessation, vapor taxation must be considered a part of that policy design.

Lawmakers can make sure that the least harmful products are cheaper than the most harmful products by adhering to excise tax principles and levying a tax rate based on the negative externalities and associated costs. That strategy is utilized in a couple of states, which have introduced provisions in their tax code cutting tax rates in half if the FDA classifies a product with a modified risk tobacco product (MPTP) order. These provisions should be encouraged.

As a revenue tool rather than a public health tool, the vapor products tax might be tempting. Some of the decline in revenue from traditional tobacco can be made up by taxing other nicotine consumers more. However, assuming the rationale for taxing tobacco involved considerations beyond mere revenue (and it should), the harm-reduction potential of vapor products may advise against this, and this rationale still leaves questions around the justification for targeting a single product and group of consumers for revenue.

To the extent that legislators do choose to tax nicotine products, they should design a principled excise regime. For a new category like vapor product, the first step is clear definitions. Currently the states define vapor products in different ways, which affects how the tax is imposed. (Examples of failed definitions can be found in the Tax Base section.) For vaping, it might be advisable to use the FDA’s definition of Electronic Nicotine Delivery Systems, which regards it as an umbrella term for “noncombustible tobacco products containing an e-liquid that, when heated, creates aerosol that a user inhales.”[75] Another example is Virginia, which has updated its tax code to reflect the nicotine products market more accurately.[76] Good uniform definitions ensure that state taxes and potential federal taxes treat the products similarly.

In terms of base, a specific excise tax based on volume (e.g., a certain amount per ml) at a low rate is the most efficient way to design a tax on nicotine products as it is the most neutral. It is not as simple as it may seem given that vapor products are not all similar. Closed systems typically have higher nicotine content than open systems.[77] Thus, legislators could consider establishing a tiered system, where open refillable systems are taxed at a lower rate than closed systems, with different rates designed to equalize taxation and keep it neutral, not introduce unnecessary disparities.

Another option for establishing the base is to tax the potency of the product, but a strength-based nicotine tax has a significant flaw. Such an excise system for vapor products results in high nicotine-liquids becoming relatively more expensive compared to low nicotine-liquids. The logical outcome would be that consumers switch to low-nicotine liquids and customizable devices. Research has shown that the use of low nicotine-liquids may be associated with “compensatory behavior” as users’ drags change to be deeper, more frequent, and longer to achieve the nicotine level that reduces their desire to smoke. This contrasts with a policy goal of limiting users’ exposure to vapor by encouraging behavior opposite of the desired goal.[78] Furthermore, nicotine is not the harm-creating agent.[79]

Of course, vapor products are not the only disruptive product on the nicotine market. Nicotine pouches, small non-tobacco-containing pouches that consumers place in their mouth; heated tobacco products, tobacco products without combustion; and snus, pasteurized oral tobacco, have all grown market share over the last few years. Taxation of these products should follow the same principles as the taxation of vapor products. If they are proven to reduce risk associated with nicotine consumption, they should be taxed at lower rates. Below is a quick guide to appropriate tax base choices.

| Product | Design |

|---|---|

| Vapor Products | Specific per milliliter (potentially bifurcated) |

| Snus | Specific per ounce |

| Nicotine Pouches | Specific per ounce |

| Heated tobacco | Specific by weight or quantity |

|

Source: Author’s analysis. |

|

One argument that proponents of high taxes on vapor products often articulate is the need to keep vapor products out of the hands of young people. While this is a laudable goal, regulation is a far better tool than taxation. For instance, raising the smoking and vaping age to 21—meaning that no high schoolers have access to the product legally—appears to have yielded immediate results. According to results from the National Youth Tobacco Survey, almost two million fewer middle and high schoolers used vapor products in 2020 than in 2019.[80]

While taking the issue of youth nicotine addiction seriously, policymakers would do well to consider the potential of these products in combating smoking of combustible tobacco products before supporting punitive taxes or even bans.[81]

Sugar-Sweetened Beverages

Obesity is a major driver of preventable disease and health-care costs in the United States, and prevention is a worthy goal. Excise taxes on sugar-sweetened beverages (SSB) has been proposed as one way to help tackle the issues surrounding obesity, but it is doubtful whether such a tax is appropriate to the task.

Sugar-sweetened beverage taxes are generally implemented to curb consumption and as a tool to raise revenue for prioritized spending programs. Regardless of whether such an excise tax is designed as a revenue tool or as a health initiative, it carries inherent flaws. First, the tax base is exceedingly narrow and is thus likely to result in volatile revenue. Second, it is highly regressive, resulting in low-income Americans paying a disproportionate share of their disposable income in excise taxes on SSBs.

So far, no state has implemented an SSB tax, but 10 localities have. Nine out of these 10 levy the tax on liquid by volume. These localities exempt 100 percent fruit juice, unsweetened milk products, dietary aids, and infant formula from the base. However, both Philadelphia and the District of Columbia include diet beverages in their tax base.

Philadelphia implemented a tax of 1.5 cents per ounce on SSBs in 2017. The city has collected $193.8 million in its first three fiscal years. While the stated goal of the tax was to raise money for education programs, the revenue in the first year was about 15 percent lower than projected.[82]

Revenue has since picked up and some reports have even found that the tax has, in fact, lowered SSB consumption. Other reports point to insignificant changes.[83] Although the Philadelphia experience could be portrayed as a success based on the revenue collection, the tax has driven consumers to purchase SSBs outside the jurisdiction of the tax.[84] In other words, by taxing SSBs within city limits, it has encouraged economic activity to move out of the city.

While SSB taxes may decrease consumption, there are some indications that the taxes are not effective in decreasing caloric intake. National Health and Nutrition Examination Survey data suggests that when individuals reduce soda consumption due to soda tax increases, they fully offset the calories they would have consumed from soda with calories consumed elsewhere, rendering soda taxes ineffective in terms of caloric reduction.[85]