Double taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income.

Examples of Double Taxation

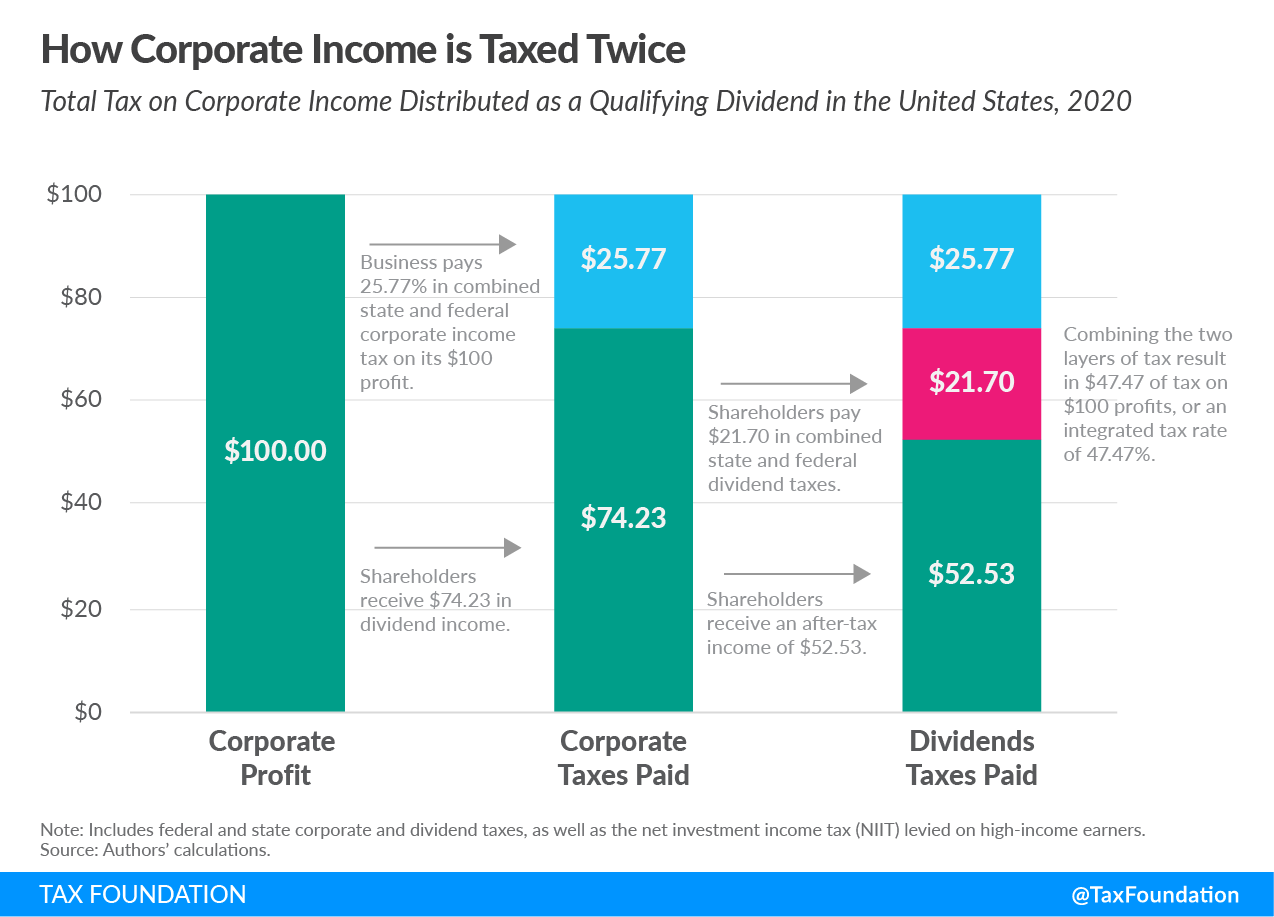

The United States’ tax code places a double-tax on corporate income with one tax at the corporate level through the corporate income tax and a second tax at the individual level through the individual income tax on dividends and capital gains. For example, when capital gains accrue from stock holdings, they represent a second layer of tax, as corporate earnings are already subject to corporate income taxes.

Additionally, the estate tax creates a double tax on an individual’s income and the transfer of that income to heirs upon death.

Corporate integration and the removal of the estate tax would address these instances of double taxation.

Businesses and individuals that reside in one country but earn income in other countries could also face double taxation if more than one country taxes their earnings. Credits for foreign taxes, territorial taxation, and tax treaties can minimize the likelihood of double taxation of foreign income.

How Does Double Taxation Occur?

Generally, the income tax attempts to tax the creation of new income once, as it happens. Take the example of a business that produces a good and sells it to a customer, who buys that good with after-tax income. The business then pays tax on the income generated from that sale.

We do not consider the taxation of that business income to be a double-tax of the customer’s income simply because the customer paid taxes on their wages. Rather, this transaction is due to the generation of new income attributable to the business, from a new good or service. This new income should be taxed.

However, a transaction that is the result of a new good or service is distinct from transactions in which no good or service is produced. Money changes hands in the economy all the time without the creation of a new good or service. Alimony is a good example of this. Under current law, the receipt of an alimony payment is considered taxable. However, alimony does not result in new income, because it is simply the transfer of money from one person to another. So, to prevent double taxation, the payer of alimony can deduct it from their taxable income. Transfers like these are generally exempt from additional taxation, in order not to tax the same income twice. The tax code makes a similar adjustment—allowing deduction for payment, but taxing receipt of income—for several other transfers between parties: business interest expenses, payroll expenses, costs of goods sold, and home mortgage interest, to name a few.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe