A soda tax is an excise tax on sugary drinks. Most soda taxes apply a flat rate per ounce of a sugar-sweetened beverage.

Are Soda Taxes Sound Tax Policy?

Lawmakers often promote soda taxes as a way to both decrease sugar consumption and raise revenue, often for important and popular initiatives like education or health care. However, these taxes must either be focused on raising revenue or decreasing soda consumption; it cannot do both.

Soda taxes are an unstable source of revenue because if the tax is successful at deterring consumption, the decline in consumption will result in a shrinking revenue stream for the programs it is meant to fund. This effect is coupled with soft drink consumption already declining over the past two decades.

Ideally, public services should be funded by taxes with a broad tax base and a low tax rate. Soda taxes are the opposite, subjecting a narrow tax base to very high tax rates. Additionally, such taxes are regressive in two ways. Not only would low-income people pay a larger percentage of their income in soda taxes, but they would pay more in real dollars as well, in part because low-income people drink more soda than higher-income earners.

It remains unclear if soda taxes improve health public outcomes. Most consumers keep consuming soda, simply handing over more of their own money to do so. But for the consumers who do buy less soda, their substitutes are not necessarily healthier. A 2022 study documented a significant increase in beer purchases following the implementation of Seattle’s soda tax.

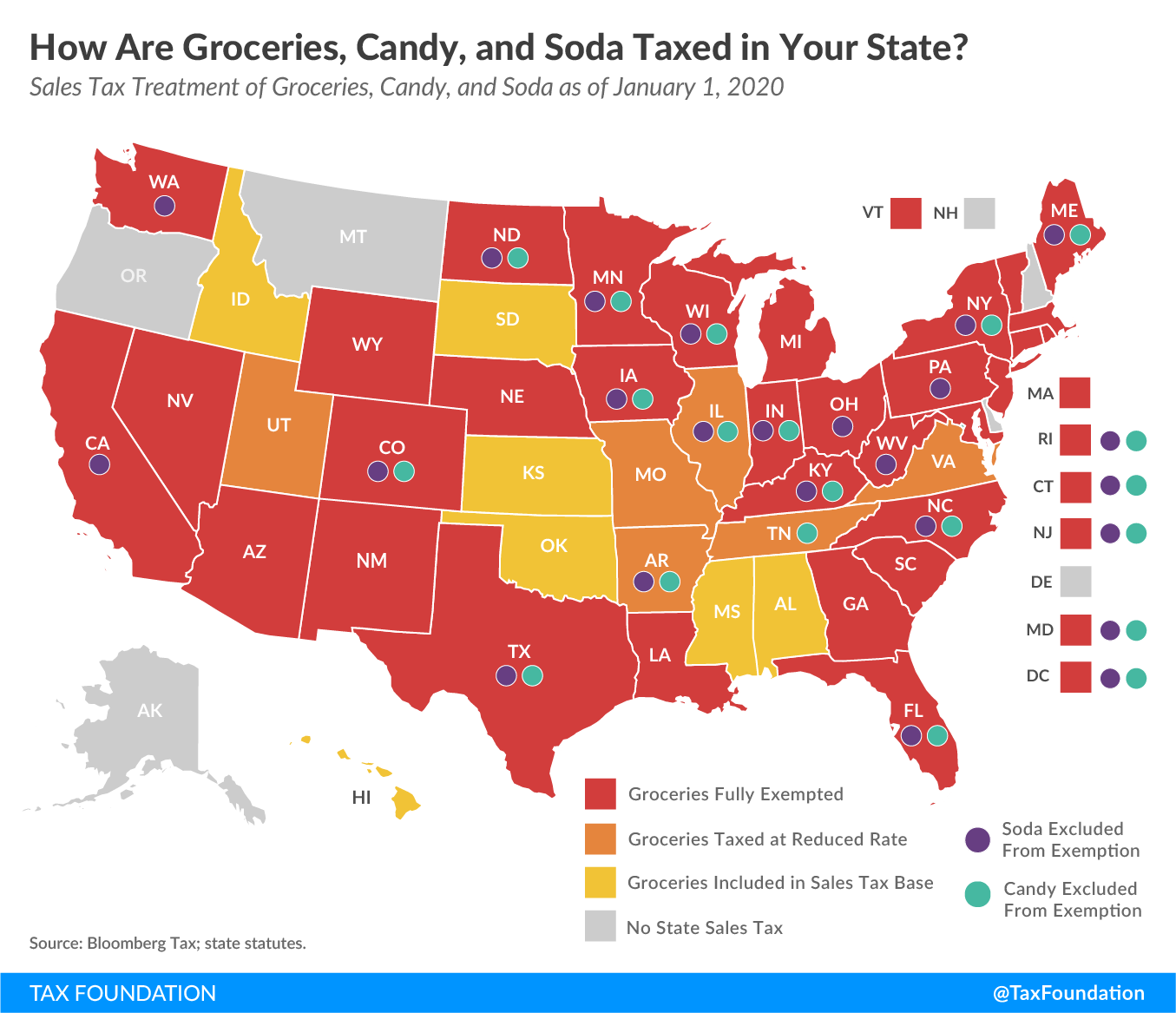

Finally, soda taxes complicate state and local tax collections. When special tax rates are applied to specific goods like candy and soda, retailers face a steep compliance burden as they work to collect and remit all the appropriate sales taxes at the correct rates without accidentally charging sales taxes on exempt items.

How Popular Are These Taxes?

The push to promote health has led to several cities and countries worldwide implementing some version of a soda tax. While a recent trend, Finland first taxed soda in 1940.

Soda taxes exist in multiple European countries, in Central and South America, and in a few U.S. cities.

In the U.S., no state currently has a statewide soda tax, though Washington state implemented an unpopular $0.02 per ounce soda tax in 2010. Several cities including Philadelphia, Washington, D.C., and Seattle levy local taxes on soft drinks.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

SubscribeShare this article