An individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S.

How Does the Individual Income Tax Work?

In the United States, individual income taxes are levied at the federal level as well as in most states. Many countries around the world also levy individual income taxes.

The U.S. income tax is progressive, which means that tax rates (the percentage of your income that you pay in taxes) increase as taxpayer income increases. The U.S. levies income tax rates ranging from 10 percent to 37 percent that kick in at the specific income thresholds outlined below. The income ranges for which these rates apply are called tax brackets. All income that falls within each bracket is taxed at the corresponding rate.

| Tax Rate | For Single Filers | For Married Individuals Filing Joint Returns | For Heads of Households |

|---|---|---|---|

| 10% | $0 to $11,600 | $0 to $23,200 | $0 to $16,550 |

| 12% | $11,600 to $47,150 | $23,200 to $94,300 | $16,550 to $63,100 |

| 22% | $47,150 to $100,525 | $94,300 to $201,050 | $63,100 to $100,500 |

| 24% | $100,525 to $191,950 | $201,050 to $383,900 | $100,500 to $191,950 |

| 32% | $191,950 to $243,725 | $383,900 to $487,450 | $191,950 to $243,700 |

| 35% | $243,725 to $609,350 | $487,450 to $731,200 | $243,700 to $609,350 |

| 37% | $609,350 or more | $731,200 or more | $609,350 or more |

| Source: Internal Revenue Service | |||

A graduated-rate structure like the one above, where every dollar of income above each threshold is taxed at a higher rate, results in marginal tax rates, the amount of additional tax paid for every additional dollar earned as income.

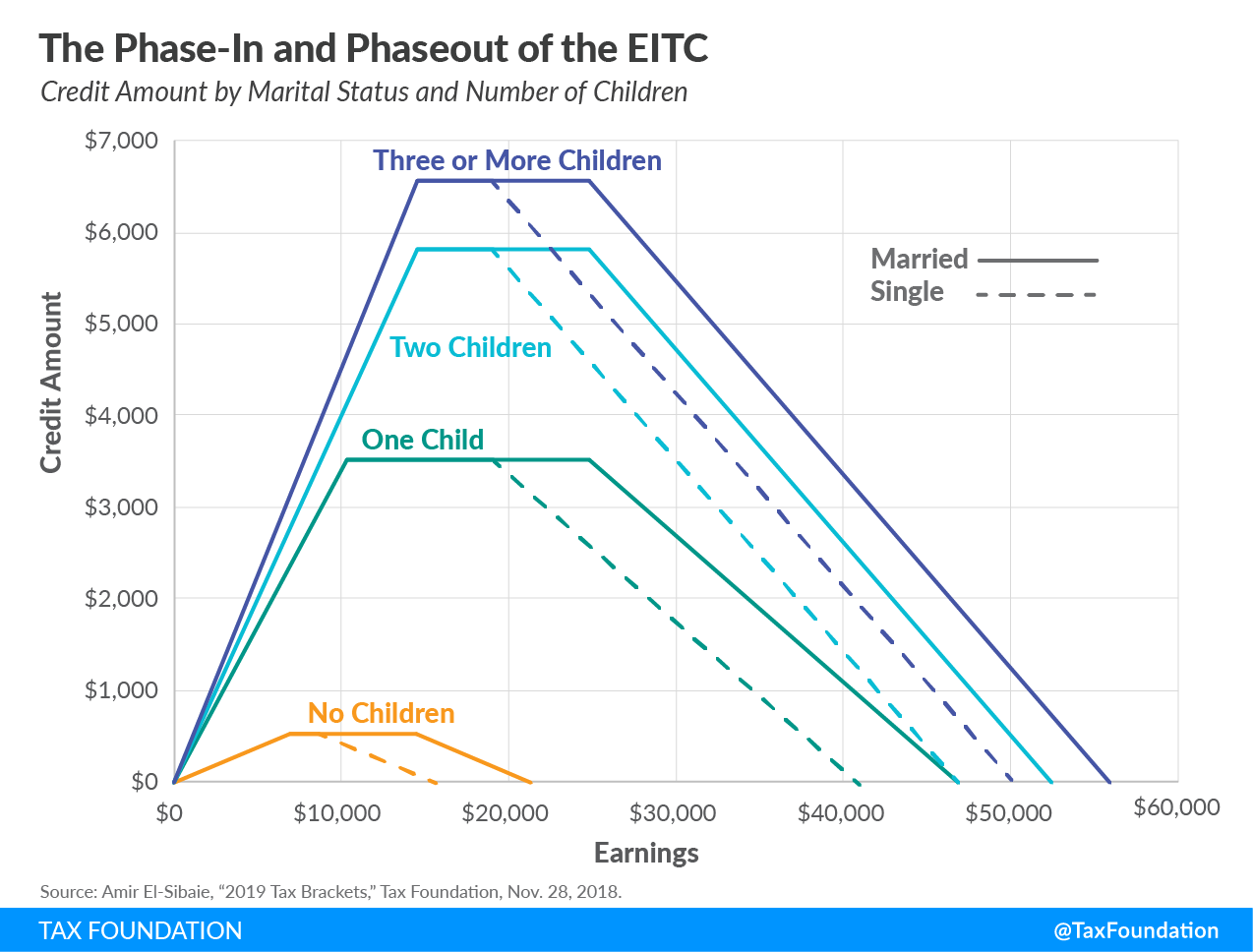

Due to various deductions, such as the standard deduction and itemized deductions, and credits, such as the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC), most taxpayers do not pay federal income taxes on all of their income. Many state tax codes also offer similar credits and deductions.

Who Pays the Federal Income Tax?

The progressive design of the U.S. income tax code leads to higher-income individuals paying a larger share of income taxes than lower-income individuals.

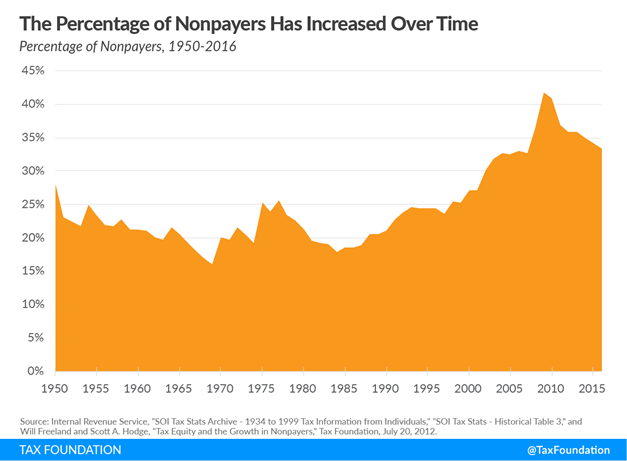

Between 1950 and 2016, an increasing number of U.S. taxpayers owed zero income taxes after credits and deductions. Despite occasional dips, the trend has been an increase in the percentage of nonpayers, from 28 percent in 1950 to 33.4 percent in 2016. During this period, the minimum percentage of nonpayers was 16 percent in 1969, and the maximum was 41.7 percent in 2009.

A Primary Source of Government Revenue

Compared to the OECD average, the United States relies significantly more on individual income taxes than other developed countries. While OECD countries on average raised 23.9 percent of total tax revenue from individual income taxes in 2021, in the U.S., individual income taxes (federal, state, and local) were the primary source of tax revenue at 42.1 percent, a difference of over 18 percentage points.

State and localities rely heavily on the individual income tax, which comprised 22.8% percent of total U.S. state and local tax collections in fiscal year 2020, the latest year of data available. The level of reliance on income taxes varies significantly by state.

Which States Levy These Taxes?

As of 2024, 43 states levy individual income taxes. Forty-one tax wage and salary income. New Hampshire exclusively taxes dividend and interest income while Washington only taxes capital gains income. Seven states levy no individual income tax at all.

Of those states taxing wages, 12 have single-rate tax structures, often called a “flat tax,” with one rate applying to all taxable income. Conversely, 29 states and the District of Columbia levy graduated-rate, progressive income taxes, with the number of brackets varying widely by state. Hawaii has 12 brackets, the most in the country.

States’ approaches to income taxes vary in other details as well. Some states double their single-bracket widths for married filers to avoid a “marriage penalty.” Some states index tax brackets, exemptions, and deductions for inflation; many others do not. Some states tie their standard deductions and personal exemptions to the federal tax code, while others set their own or offer none at all.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe