A sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding.

Sales Tax Rates in the United States

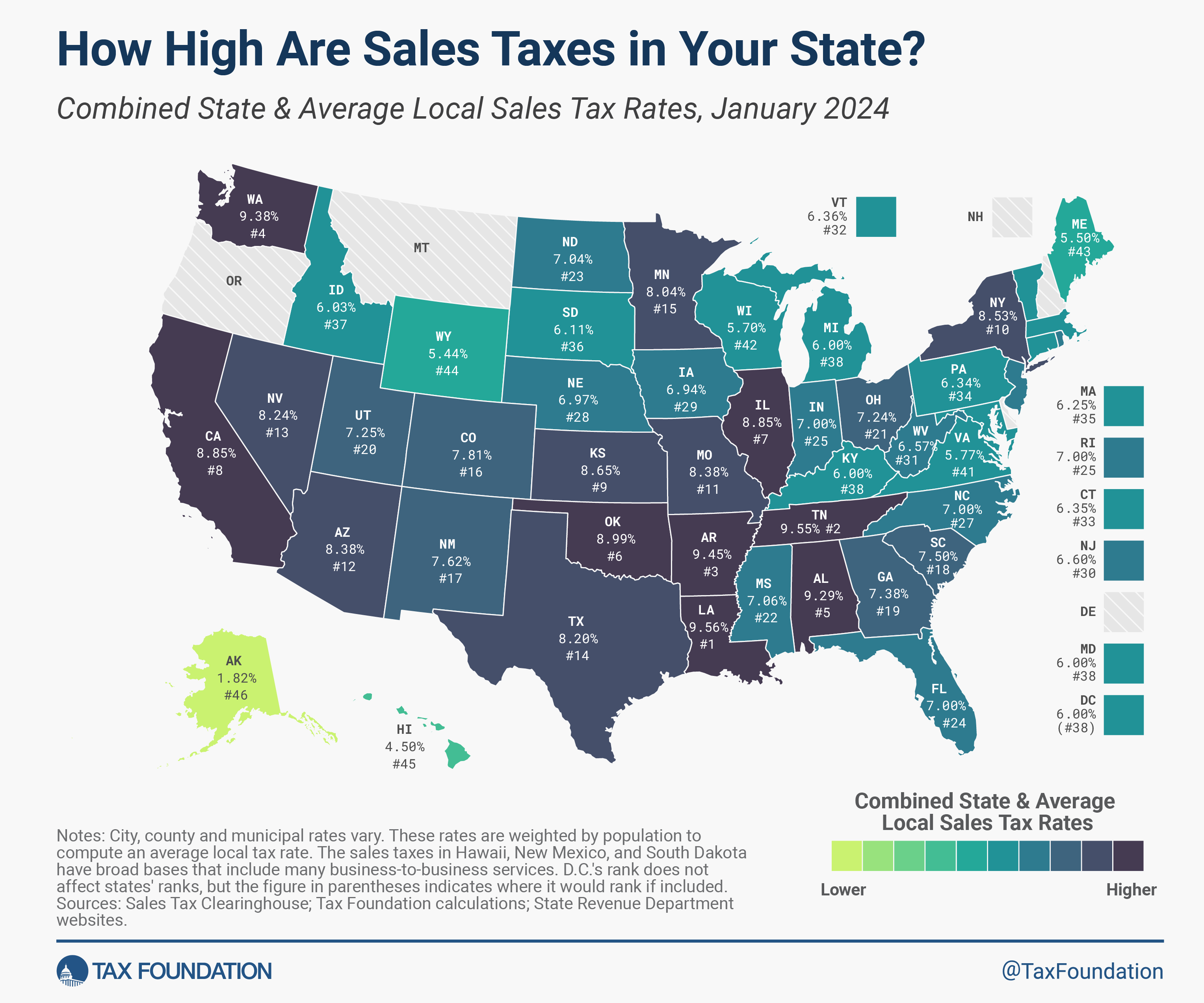

In the United States, retail sales taxes are a significant source of revenue at the state and local level. All U.S. states other than Alaska, Delaware, Montana, New Hampshire, and Oregon collect statewide sales taxes. Of these, Alaska allows localities to charge local sales taxes.

As of 2024, local sales taxes were collected in 38 states. In some cases, local sales tax rates can rival or even exceed state rates.

Sales tax rates can have a significant impact on consumer and business decisions. Sales tax avoidance is most likely to occur in areas with significant rate difference between jurisdictions. Research indicates that consumers can and do leave high-tax areas to make major purchases in low-tax areas, such as from cities to suburbs.

Likewise, businesses sometimes locate just outside the borders of high sales-tax jurisdictions. A stark example of this occurs in New England, where even though I-91 runs up the Vermont side of the Connecticut River, many more retail establishments choose to locate on the New Hampshire side, where there is no sales tax.

Sales Tax Bases: The Other Half of the Equation

Sales tax rates aren’t the only factor that matters. The tax base—what is and isn’t taxable—can have a significant impact on the competitiveness of different sales tax regimes and the efficiency with which they raise revenue.

U.S. state sales tax bases can vary greatly. For instance, most states exempt groceries from the sales tax base, others tax groceries at a limited rate, and still others tax groceries at the same rate as all other products.

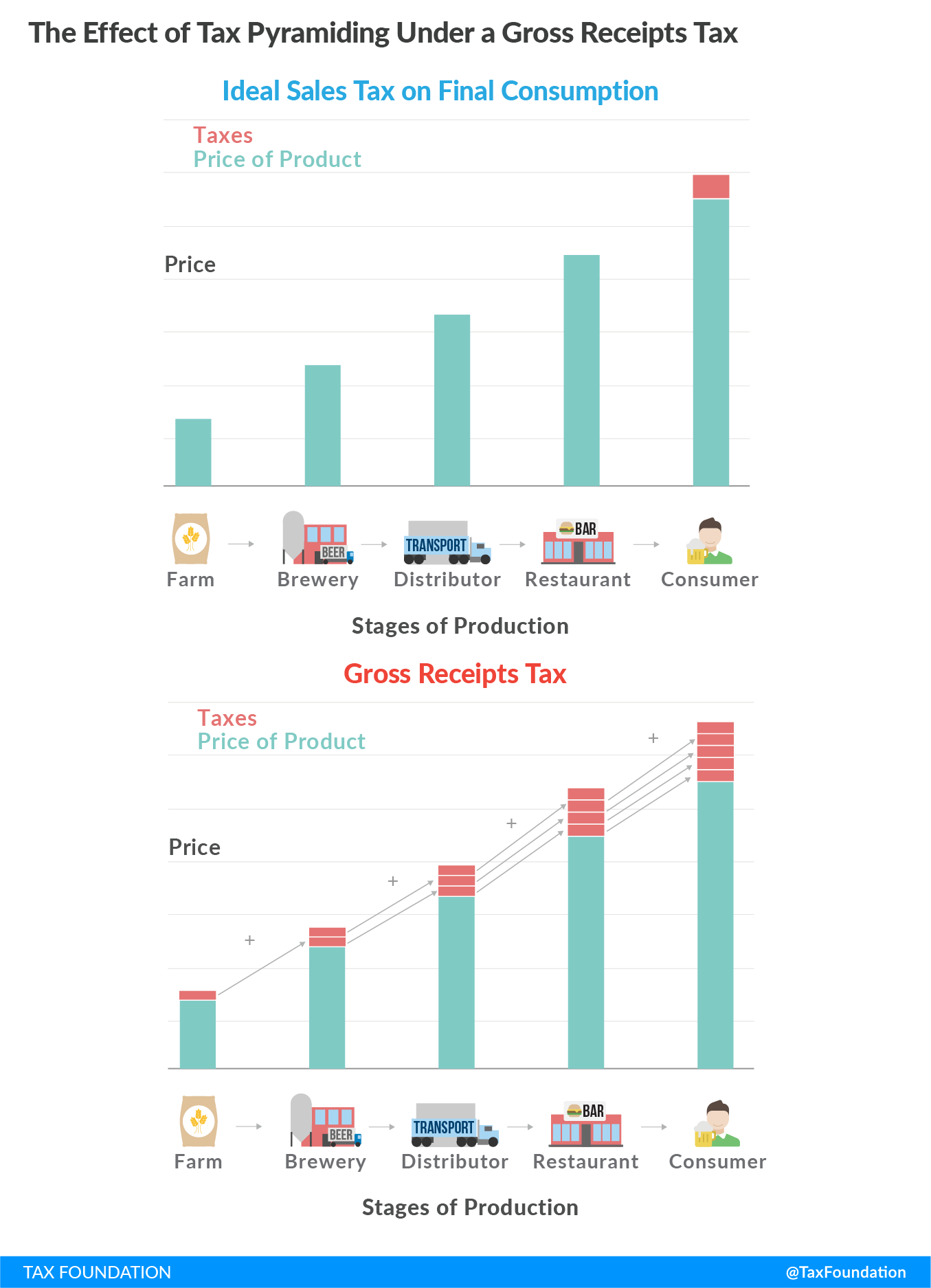

Tax experts generally recommend that sales taxes apply to all final retail sales of goods and services but not intermediate business-to-business transactions in the production chain.

Taxing business-to-business transactions results in what’s called “tax pyramiding,” an economically harmful phenomenon where the tax burden stacks up throughout the production chain, as in the case of gross receipts taxes.

Excise Taxes

Excise taxes are a unique form of retail sales tax imposed on a specific good or activity. They are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and make up a relatively small and volatile portion of state and local tax collections.

Value-Added Taxes

The United States is one of the few industrialized countries that still relies on traditional retail sales taxes. The most common form of consumption tax in the Organisation of Economic Co-operation and Development (OECD) is the value-added tax (VAT).

A Value-Added Tax (VAT) is a consumption tax assessed on the value added in each production stage of a good or service. Every business along the value chain receives a tax credit for the VAT already paid. The end consumer does not, making it a tax on final consumption.

This avoids the possibility of tax pyramiding, which exists when retail sales taxes are applied to business inputs.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe