Bets on Legal Sports Markets Pay Off Big for States, Sportsbooks, and Consumers

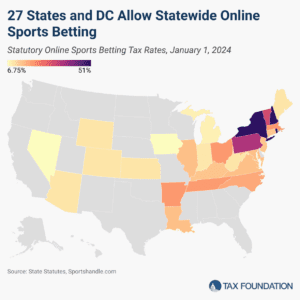

Consumers legally wagered more than $100 billion on sporting contests in 2023, creating more than $1.8 billion in state revenue. Sports betting is now legal in 38 states and DC, and the landscape is rapidly evolving.

18 min read