All Related Articles

Post-Versailles Declaration: Tax Policy in the Future of European Energy Security

The unified EU signing of the “Versailles Declaration” is a historic break from the past. Russia’s war against Ukraine has made energy (and related tax policies) an even more urgent focus for the EU.

6 min read

Iowa Enacts Sweeping Tax Reform

Even if 2022 sees many tax reforms, the scope of Iowa’s tax relief measures is likely to stand out. With the most recent reform package, Iowa lawmakers have made a significant investment in a more competitive tax climate for an increasingly competitive era.

6 min read

Florida Gas Tax Holiday Has Negligible Benefits—But Other States Seem Ready to Follow

A gas tax holiday may be good politics, but it’s unlikely to achieve its aims. There are far better ways to provide tax relief—short- or long-term—than an inefficient gas tax suspension.

4 min read

Tax Reform Framework Would Improve Nebraska’s Competitiveness

If Nebraska is to create a competitive environment and attract in-state investment, comprehensive tax modernization must be a priority.

9 min read

Georgia Income Tax Reform Would Improve Standing Among Neighbors, Country

In a time of increased mobility and tax competition, a lower rate and simpler tax structure would help Georgia stand out among states. Lawmakers would be wise to consider reforming the state’s income tax to improve the state’s competitiveness.

3 min read

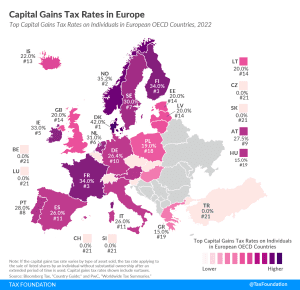

Capital Gains Tax Rates in Europe, 2022

In many countries, investment income, such as dividends and capital gains, is taxed at a different rate than wage income. Denmark levies the highest top capital gains tax among European OECD countries, followed by Norway, Finland, and France.

4 min read

A Gas Tax Holiday

The cost of gas is going up. To address this, policymakers have proposed suspending the gas tax. But could this actually make matters worse? We discuss why suspending the gas tax might be a mistake and what lawmakers could do to help with the rising costs of gas.

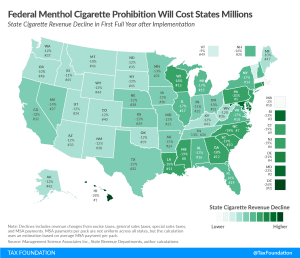

Federal Menthol Cigarette Ban May Cost Governments $6.6 Billion

The FDA’s expected announcement of a national ban on menthol-flavored cigarettes and cigars with a characterizing flavor would carry significant revenue implications for both the federal government and state governments, with likely limited benefits in smoking cessation.

6 min read

Federal Gas Tax Holiday? Suspending the Gas Tax Is a Mistake

If policymakers are looking to change the tax code to help fight inflation, they should pump the brakes on the federal gas tax holiday and instead consider structural reforms to raise the economy’s productive capacity in the long term.

4 min read

10 Tax Reforms for Growth and Opportunity

By reducing the tax code’s current barriers to investment and saving and simplifying its complex rules, lawmakers would greatly enhance the ability of Americans to pursue new ideas, create more opportunities, and build financial security for themselves and their families.

40 min read

The Child Tax Credit Score

The expanded Child Tax Credit from the American Rescue Plan was touted as a once-in-a-lifetime achievement toward reducing child poverty. But it was passed as a temporary tax measure. Temporary tax policy makes tax filing confusing, and the IRS has shown that it isn’t able to keep pace with being a social administrator and a tax collector. We discuss what taxpayers need to know about the ever-changing Child Tax Credit and how it may impact taxpayers this spring.

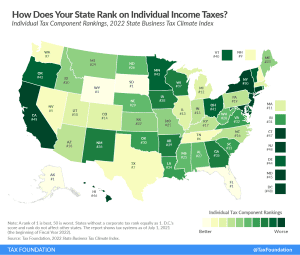

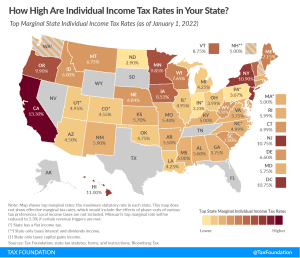

State Individual Income Tax Rates and Brackets, 2022

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections:

28 min read

Sources of U.S. Tax Revenue by Tax Type, 2022

Compared to other industrialized countries, the United States relies more on individual income taxes and property taxes and less on consumption taxes.

4 min read

Alabama Should Pursue Permanent, Not Piecemeal, Solutions to Federal Deductibility Issues

Alabama lawmakers are acting to ensure that federal relief from the American Rescue Plan Act does not increase tax liabilities in the state.

4 min read