Tennessee Should Build on Success and Improve Corporate Taxes

While Tennessee now boasts no individual income tax, there is still more work to be done for businesses—Tennessee is in a good position to get the job done.

7 min read

While Tennessee now boasts no individual income tax, there is still more work to be done for businesses—Tennessee is in a good position to get the job done.

7 min read

Tax relief can take many different forms, but not all tax cuts have the same effects. Ultimately, maintaining broad tax bases while reducing tax rates is a more neutral and less complex approach than further narrowing an already-narrow sales tax base.

Before declaring victory, it is imperative to get the details right. The latest proposal is a drastic improvement over the last one, but there is still more work to be done if the Magnolia State is to sustain the intended transformation.

7 min read

Consumer prices rose by 7 percent in 2021, the highest annual rate of inflation since 1982. Where did this inflation come from and what might its impacts be? Tax and fiscal policy offer important clues.

5 min read

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

41 min read

The 2022 tax filing season is about to begin. With expected delays, pandemic-related troubles, and a backlog of over 8 million unprocessed returns from the 2021 tax filing season, Garrett Watson joins Jesse Solis to discuss what all these troubles will mean for taxpayers in what is shaping up to be a chaotic spring.

Recent discussions of a proposed wealth tax for the United States have included little information about trends in wealth taxation among other developed nations. However, those trends and the current state of wealth taxes in OECD countries can provide context for U.S. proposals.

3 min read

The National Taxpayer Advocate argued the IRS telephone service “was the worst it has ever been” in 2021, with an answer rate of about 11 percent.

4 min read

Lawmakers in Washington need not revisit their vapor tax. The current tax is levied at an appropriate level and it has the right tax base.

3 min read

Twenty-one states and D.C. had significant tax changes take effect on January 1, including five states that cut individual income taxes and four states that saw corporate income tax rates decrease.

17 min read

A proposal to introduce a wholesale tax on vapor products in Alaska could make switching from combustible tobacco products very expensive for smokers.

4 min read

Practically doubling state taxes—even if the burden is partially offset through state-provided health coverage—could send taxpayers racing for the exits.

6 min read

States are unprepared for the ongoing shift to remote and flexible work arrangements, or for the industries and activities of today, to say nothing of tomorrow. In some states, moreover, existing tax provisions exacerbate the impact of high inflation and contribute to the supply chain crisis.

40 min read

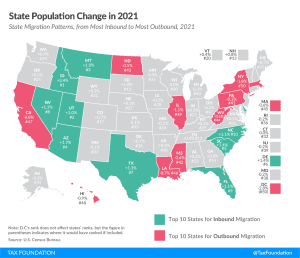

The pandemic has accelerated changes in the way we live and work, making it far easier for people to move—and they have. As states work to maintain their competitive advantage, they should pay attention to where people are moving, and try to understand why.

6 min read

As the U.S. grapples with rising price inflation, a large and growing national debt, as well as a possible economic slowdown due to Omicron, the decision to provide additional fiscal support will prove to be a difficult one. Policymakers can debate how much stimulus is appropriate, but what is clear is that the U.S. fiscal support so far during the pandemic outranks nearly every industrialized country.

3 min read

Tax extenders this year can be split into three rough groups: expiring parts of the Tax Cuts and Jobs Act (TCJA), expiring parts of various COVID-19 economic relief packages, and the Island of Misfit Extenders.

8 min read

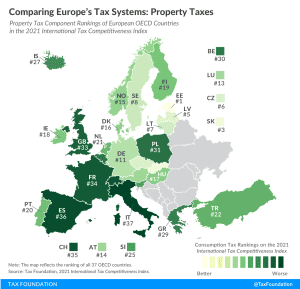

According to the 2021 International Tax Competitiveness Index, Switzerland has the best-structured consumption tax among OECD countries while Poland has the worst-structured consumption tax code.

2 min read

While there are many ways to show how much is collected in taxes by state governments, our State Business Tax Climate Index is designed to show how well states structure their tax systems and provides a road map for improvement.

169 min read

Policymakers and taxpayers should understand the scope of tax changes necessary to fully pay for the large-scale social spending programs that would be initiated under the Build Back Better Act.

6 min read