All Related Articles

Clearing up Carbon Taxes

Amidst bipartisan climate negotiations on Capitol Hill, there have been renewed calls for a carbon tax. Carbon taxes have long been magnets for political controversy. But from an economic standpoint, they deserve to be taken seriously. Here’s why.

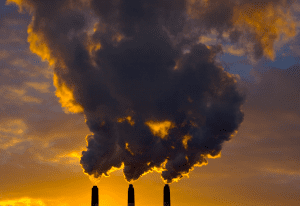

Ranking Property Taxes on the 2022 State Business Tax Climate Index

Which states have the highest property taxes in 2022? See how your state compares in property taxes across the United States

5 min read

Evaluating Wyoming’s Business Tax Competitiveness

Wyoming’s low taxes are highly attractive, but policymakers are still hard at work helping the state achieve broader economic development goals.

13 min read

State Sales Tax Breadth and Reliance, Fiscal Year 2021

The sales tax is too important a part of states’ revenue toolkits to be permitted further erosion, making sales tax modernization a vital project of the 2020s.

17 min read

The Aftermath of Arizona’s Proposition 208 and the Potential for a Flat Tax

Arizona now joins a growing cohort of states that are moving toward a flat income tax. Pending revenue triggers, the income tax rate will be reduced to 2.5 percent giving Arizona one of the lowest individual income tax rates in the country.

7 min read

FDA Menthol Ban Would Boost Smuggling, Reduce Revenues, with Few Health Benefits

Learn more about the FDA’s proposal to ban the sale of menthol cigarettes and flavored cigars. Including its effect on revenue & public health measures.

4 min read

States’ Taxes Go Flat

In more than 100 years of state income taxes, only four states have ever moved from a graduated-rate income tax to a flat tax. Another four may adopt flat tax legislation just this year. We discuss what flat taxes are, what they mean for taxpayers, and why so many states are making a push for them this year.

Tax Filing Season: Options for Improvement

Efforts to improve the taxpayer experience should focus on the IRS’s operations and include structural improvements to the tax code.

4 min read

The Three Basic Tax Types

The better you understand taxes, the better equipped you are to make decisions about them. All taxes can be divided into three basic types: taxes on what you buy, taxes on what you earn, and taxes on what you own.

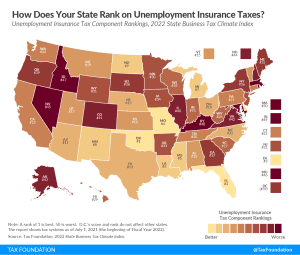

Ranking Unemployment Insurance Taxes on Our 2022 State Business Tax Climate Index

Ranking unemployment insurance tax codes on the 2022 State Business Tax Climate Index. Learn more about state unemployment insurance tax code and systems.

4 min read

Remembering Senator Orrin Hatch’s Historic Tax Legacy

Among the many achievements in the illustrious career of former Sen. Orrin Hatch (R-UT) was his commitment to bipartisan tax reform.

3 min read

Kansas Policymakers Should Improve Food Credit, Not Exempt Groceries

This legislative session, the sales tax on food has garnered a great deal of attention in Kansas, with policymakers on both sides of the aisle proposing the removal of groceries from the sales tax base.

7 min read

Missouri Tax Reform Could Give State Competitive Edge

Tax reform has become a major focus for state legislatures this session, and Missouri lawmakers are tuned in to the action: after adjusting individual income tax triggers in 2021, the legislature is exploring further tax reform options.

6 min read

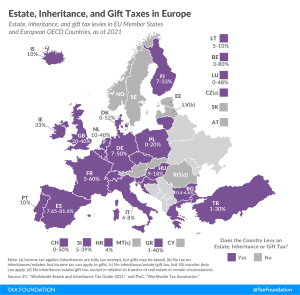

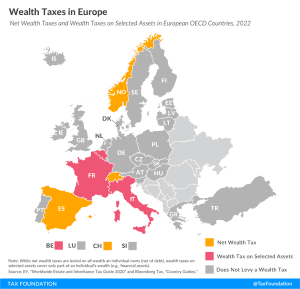

Wealth Taxes in Europe, 2022

Only three European OECD countries levy a net wealth tax, namely Norway, Spain, and Switzerland.

3 min read

Chaotic IRS Filing Season Shows the Perils of Running Social Policy Through the Tax Code

As the deadline for tax filing nears, the IRS faces scrutiny for its backlog of returns, inaccessible taxpayer service, and delays in issuing certain refunds.

5 min read

History of Taxes

Learn where and when taxes originated and how they resemble taxes we have today. Understand how the American tax code developed from the beginning of the colonies. Learn about some of the weirder taxes throughout history, designed not just to raise revenue, but influence behavior too.

Federal Corporate Tax Revenue and All Federal Tax Collections Headed for Another Record High

Total tax collections are currently running 25 percent higher than last year, and if that pattern holds, total federal tax collections will reach over $5 trillion in FY 2022—a new all-time high.

3 min read

Personal Income Tax Adjusts for Inflation, But It Could Do Better

In times of inflation, a review of the tax code shows that some provisions are automatically indexed, or adjusted, to match inflation, while others are not. And that creates unfair burdens for taxpayers. But it’s not always as simple as just “adjusting for inflation.”

4 min read

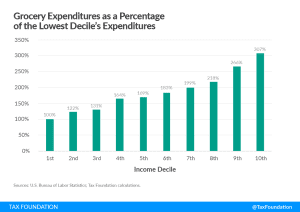

The Surprising Regressivity of Grocery Tax Exemptions

Exempting groceries from the sales tax base reduces economic efficiency without achieving its objective of enhancing tax progressivity.

19 min read