A C corporation or C corp (named for being in subchapter “C” of the Internal Revenue code) is an independent legal entity owned by its shareholders. A C corporation’s profit is taxed twice—as business income at the entity level and the shareholder level when distributed as dividends or realized as capital gains.

Why Do C Corporations Exist?

In short, C corporations exist to shield owners from certain liabilities. Due to the various risks inherent in offering a good or service in the marketplace, the tax code provides business owners the option to incorporate their business enterprise—including its earnings and liabilities—into a separate legal entity (a corporation) rather than taking the risk themselves. For example, imagine a business owner wanted to start a taxi service in an urban area, but did not want to be liable for any damages caused by the taxi drivers or be personally responsible for the losses if the taxi business failed. In this case, the owner would want to incorporate the taxi service to mitigate her risk.

C corporations may be distinguished from other types of business organizations like S corporations and sole proprietorships. While a corporation is legally separate from its owner(s), a sole proprietorship is a business composed of and legally synonymous with the single individual who owns it.

How Are C Corporations Taxed?

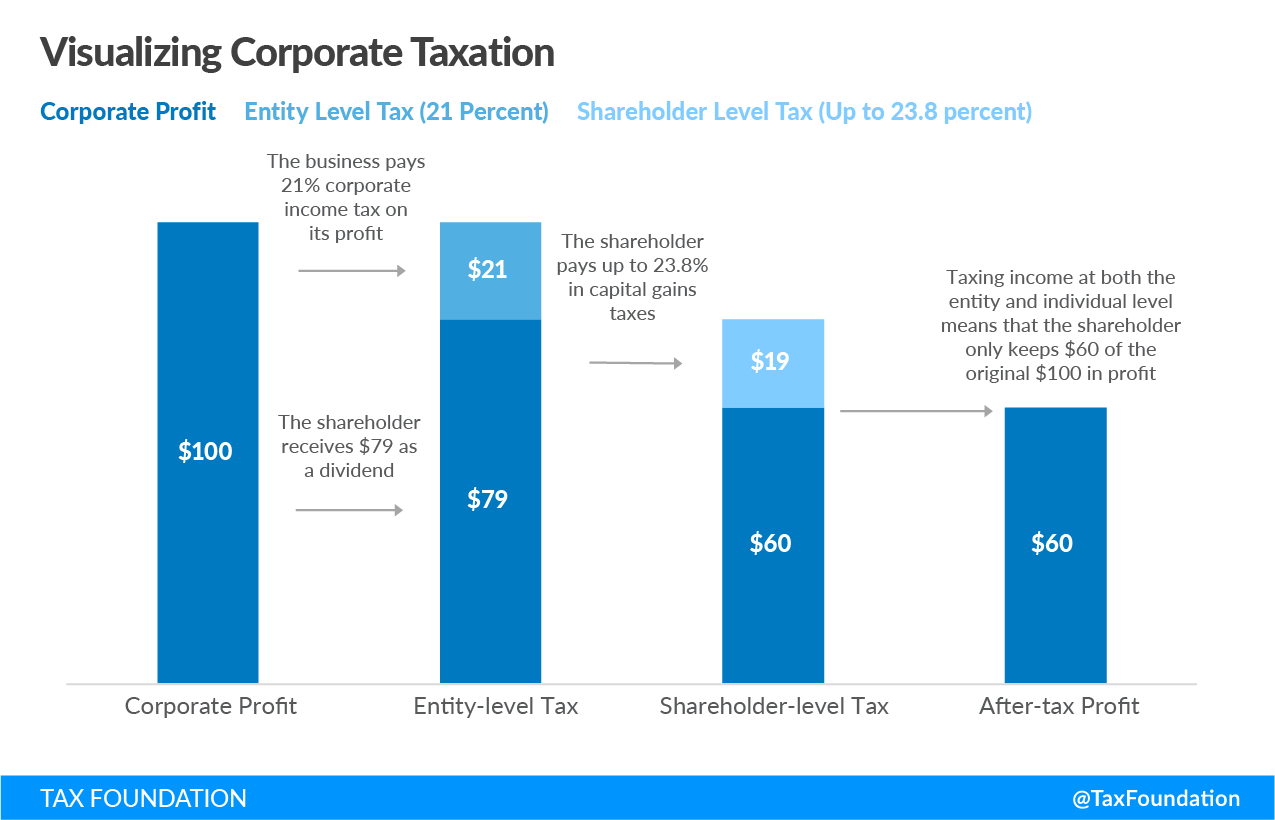

In the tax code, corporation profits are taxed at both the entity level by the corporate income tax and again at the shareholder level by the individual income tax when profits are distributed as dividends or realized as capital gains. Unlike a sole proprietorship, where all business income is accounted (or “passed through”) to the individual owner and only taxed once, C corporations must pay taxes as though they and their shareholders are two separate legal entities or “persons” subject to tax.

To visualize this, suppose a corporation makes a profit of $100 in a year. Under the corporate income tax (21 percent), corporations would first pay $21 at the entity level, reducing their income to $79. If that $79 was paid as a dividend to shareholders, the shareholders would be required to pay tax under the individual income tax at rates of 0 percent, 15 percent, or 20 percent and potentially face the Net Investment Income Tax (NIIT) of 3.8 percent. Depending on the shareholders’ income level, the $79 dividend could be taxed at a rate of up to 23.8 percent ($18.80). Thus, of the original $100 profit, the after-tax income comes out to $60.20. Note that state and local taxes may apply at both levels too.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe