State Individual Income Tax Rates and Brackets, 2025

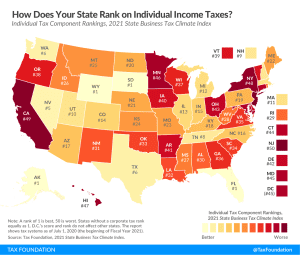

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

12 min readProviding journalists, taxpayers and policymakers with basic data on taxes and spending is a cornerstone of the Tax Foundation’s educational mission. We’ve found that one of the best, most engaging ways to do that is by visualizing tax data in the form of maps.

How does your state collect revenue? Every week, we release a new tax map that illustrates one important measure of state tax rates, collections, burdens and more. If you enjoy our weekly tax maps, help us continue this work and more by making a small contribution here.

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

12 min read

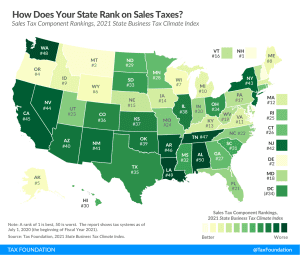

Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 24 percent of combined state and local tax collections.

15 min read

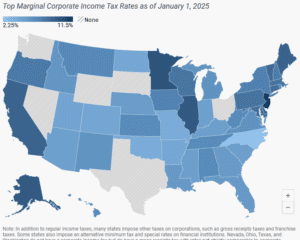

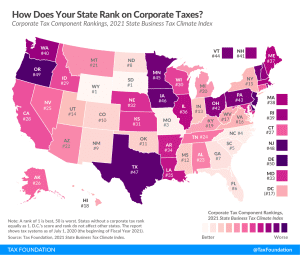

Forty-four states levy a corporate income tax, with top rates ranging from a 2.25 percent flat rate in North Carolina to a 11.5 percent top marginal rate in New Jersey.

7 min read

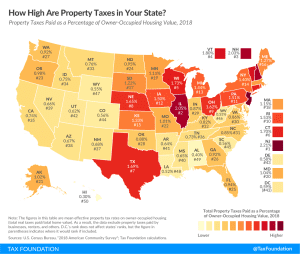

Property taxes are the primary tool for financing local governments. While no taxpayers in high-tax jurisdictions will be celebrating their yearly payments, property taxes are largely rooted in the benefit principle of taxation: the people paying the property tax bills are most often the ones benefiting from the services.

9 min read

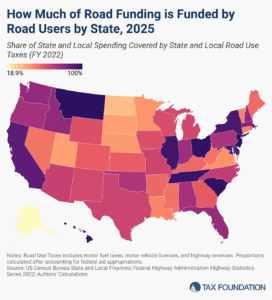

The amount of revenue states raise through roadway-related revenues varies significantly across the US. Only three states raise enough revenue to fully cover their highway spending.

5 min read

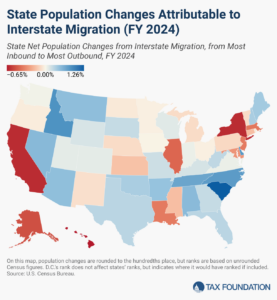

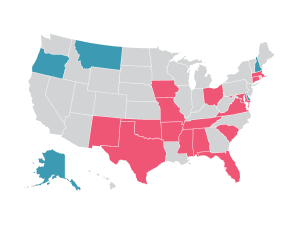

Americans were on the move in 2024, and many chose low-tax states over high-tax ones.

6 min read

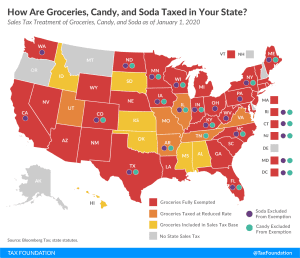

An ideal sales tax applies to a broad base of final consumer goods and services, with few exemptions, and is levied at a low rate. Broad-based, low-rate tax structures minimize tax-induced economic distortions that can occur when people change their purchasing behavior because of tax differences.

3 min read

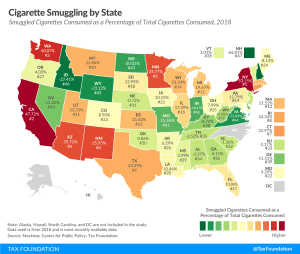

Excessive tax rates on cigarettes in some states induce substantial black and gray market movement of tobacco products into high-tax states from low-tax states or foreign sources. New York has the highest inbound smuggling activity, with an estimated 53.2 percent of cigarettes consumed in the state deriving from smuggled sources.

13 min read

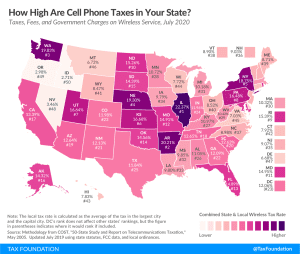

A typical American household with four phones on a “family share” wireless plan can expect to pay about $270 per year (or 22 percent of their cell phone bill) in taxes, fees, and surcharges.

36 min read

The corporate tax component of our Index measures each state’s principal tax on business activities. Most states levy a corporate income tax on a company’s profits (receipts minus most business expenses, including compensation and the cost of goods sold), while some states levy gross receipts taxes, which allow few or no deductions for a company’s expenses.

2 min read

Even in 2020, jack-o’-lanterns and fake skeletons have popped up in neighborhoods as they do every October, although Halloween may look and play out differently this time around.

4 min read

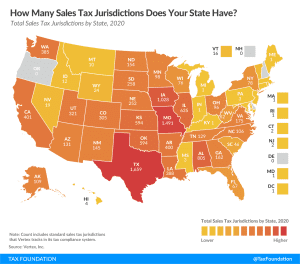

Following the Wayfair decision, states’ move to tax online sales has increased the importance of simplicity in sales tax systems, as sellers now have to deal with differing regulations in multiple states. There are over 11,000 standard sales tax jurisdictions in the United States in 2020

2 min read

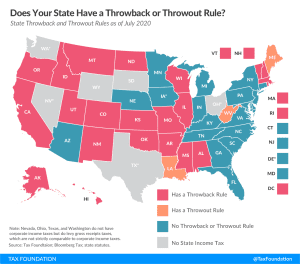

State throwback and throwout rules may not be widely understood, but they have a notable impact on business location and investment decisions and reduce economic efficiency for the states which impose such rules.

3 min read

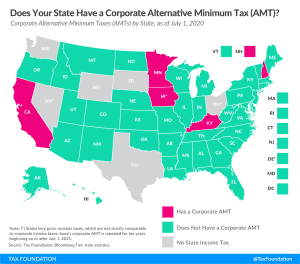

Five states currently collect corporate AMTs: California, Iowa, Kentucky, Minnesota, and New Hampshire. This is a significant drop from the eight states that levied AMTs in tax year 2017.

2 min read

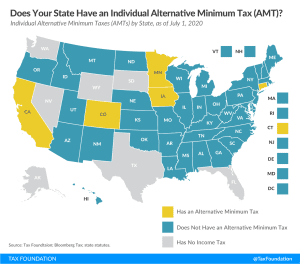

Under an individual AMT, many taxpayers are required to calculate their income tax liability under two different systems and pay the higher amount.

2 min read

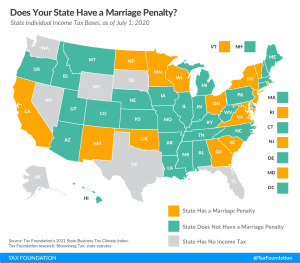

A marriage penalty exists when a state’s income brackets for married taxpayers filing jointly are less than double the bracket widths that apply to single filers.

2 min read

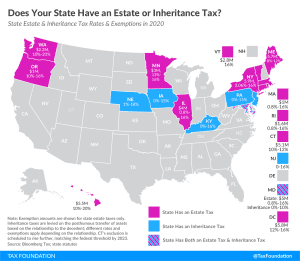

In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax.

3 min read

New Jersey has the highest effective rate on owner-occupied property at 2.21 percent, followed closely by Illinois (2.05 percent) and New Hampshire (2.03 percent).

2 min read

The five counties with the highest median property tax payments are all located near New York City and have bills exceeding $10,000.

3 min read

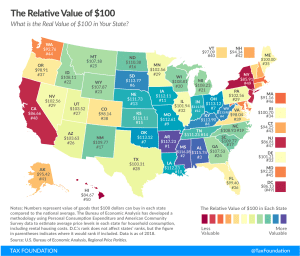

California is home to 7 of the 10 most expensive metro areas in America. See what’s the real value of $100 in your metro area with our new purchasing power map.

4 min read

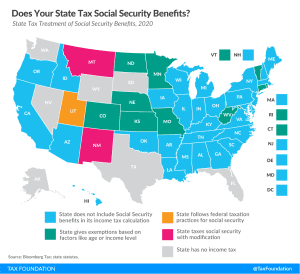

The question, “Does my state tax Social Security benefits?” may be simple enough, but the answer includes a lot of nuance. Many states have unique and specific provisions regarding the taxation of Social Security benefits, which can be broken into a few broad categories.

3 min read

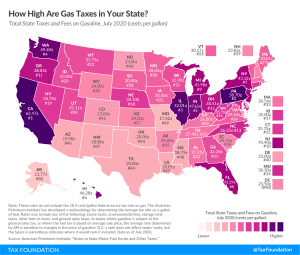

California pumps out the highest tax rate of 62.47 cents per gallon, followed by Pennsylvania (58.7 cpg), Illinois (52.01 cpg), and Washington (49.4 cpg).

2 min read

In the midst of the coronavirus crisis, some states are hoping that a sales tax holiday might help restart struggling industries by stimulating the economy. However, sales tax holidays can mislead consumers about savings and distract from genuine, permanent tax relief.

41 min read