All Related Articles

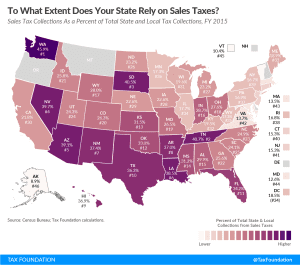

To What Extent Does Your State Rely on Sales Taxes?

Sales taxes represent a major source of state and local revenue. Click to see how much your state relies on sales taxes and for a state-by-state comparison.

3 min read

Supreme Court Decides Wayfair Online Sales Tax Case

The U.S. Supreme Court handed down its decision in South Dakota v. Wayfair. Thirty-one states that currently tax internet sales will be impacted.

3 min read

Are Sugar-Sweetened Beverage Taxes Regressive? Evidence from Household Retail Purchases

Soda taxes are proposed with the promise to improve public health outcomes, but they come with equity concerns because of their regressive nature.

23 min read

The Impact of the Tax Cuts and Jobs Act by Congressional District

A look at the data & methodology behind the Tax Foundation’s Mapping 2018 Tax Reform project which compares average 2018 tax cuts by congressional district.

3 min read

Taxing Patreon Contributions

4 min read

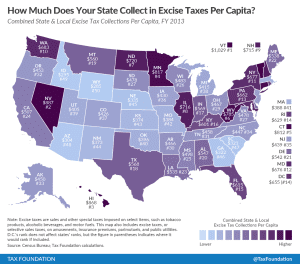

How Much Does Your State Collect in Excise Taxes?

Excise taxes make up a relatively small portion of state and local tax collections—about 11 percent—but per capita collections vary widely from state to state.

3 min read