All Related Articles

Introducing the Tax Foundation’s Tax Reform Calculator

The Tax Foundation’s 2018 tax reform calculator shows you how the Tax Cuts and Jobs Act will impact take-home incomes, taxes owed, and more.

2 min read

Tax Reform Moves to the States: State Revenue Implications and Reform Opportunities Following Federal Tax Reform

Federal tax reform gives states an opportunity to improve their own tax codes. This study surveys the federal provisions to which states conform, what each state can expect from federal tax changes, and what options are available to them.

58 min read

New York Taxpayers Must Pay for Ill-Advised Lawsuit Seeking Tax Cuts for Wealthiest Residents

New York, New Jersey, and Connecticut are pursuing a questionable legal strategy to overturn the cap on a federal tax deduction that benefits the wealthy.

5 min read

More States Considering Dubious SALT Charitable Contribution Workaround

California’s plan to circumvent the new state and local tax deduction cap is dubious, but now Illinois, Nebraska, Virginia, and Washington are considering similar plans.

3 min read

A Look Ahead at Expiring Tax Provisions

5 min read

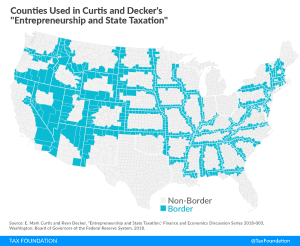

New Federal Reserve Paper: State Corporate Taxes Hurt Entrepreneurship

For every 1 percentage point increase in a state’s corporate tax rate, employment in start-up firms declines 3.7 percent, according to a recent Federal Reserve study.

2 min read

Supreme Court Agrees to take South Dakota v. Wayfair Online Sales Tax Case

The U.S. Supreme Court has agreed to take South Dakota v. Wayfair Inc., which could result in a ruling that settles the years-long debate over how to apply sales taxes to online retail activity.

1 min read

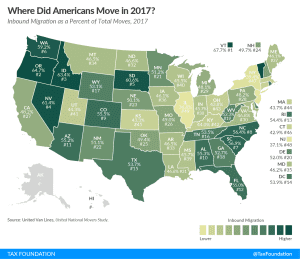

Where Did Americans Move in 2017?

There are many ways that states can compete with one another for residents, and tax rates and structures should certainly be part of the conversation for states looking to attract new residents.

2 min read

Mississippi Lawmakers Consider Creation of State Lottery

As Mississippi policymakers contemplate a lottery, it may be tempting to think of it as free money—new revenue raised without having to adopt a new tax. A better way of thinking about the issue, however, would recognize the lottery for what it is: a regressive form of high implicit taxation.

3 min read