All Related Articles

Tax Reform 2.0 Takes Shape

Recently, Congress released a series of bills which have been dubbed “Tax Reform 2.0.” These bills modify and build upon the Tax Cuts and Jobs Act, whose individual provisions are currently set to expire at the end of 2025. We outline the details of each bill, including changes to tax rates, the standard deduction, and the child tax credit.

3 min read

Testimony: The Positive Economic Growth Effects of the Tax Cuts and Jobs Act

Tax Foundation President, Scott Hodge, provides written testimony before the United States Joint Economic Committee on the economic growth effects of TCJA.

Pennsylvania: A 21st Century Tax Code for the Commonwealth

Policymakers from across the spectrum recognize that Pennsylvania’s tax code has not kept up with a 21st century economy. Here are comprehensive solutions for how Pennsylvania can achieve a more competitive tax code.

13 min read

Post-Wayfair Options for States

What is included in the “Wayfair checklist,” what policy choices do legislators have to make their state compliant, and, ultimately, how prepared is each state to start requiring that online retailers collect sales tax?

42 min read

Prioritizing Tax Reform in Arkansas

1 min read

What to Expect from IRS Guidance on SALT Deduction Cap Workarounds

While a few are hoping for a different outcome, most observers expect the IRS to disallow these new, intentional SALT workarounds that have been adopted by New York and a handful of other states.

7 min read

Reviewing Different Methods of Calculating Tax Compliance Costs

Tax compliance creates real costs, which can be calculated. Each method provides unique illustrations of the cost of complying with U.S. tax code.

11 min read

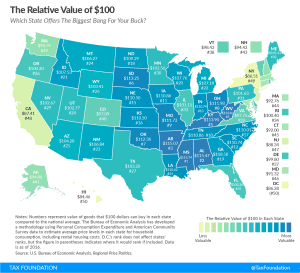

Real Value of $100 by State, 2018

4 min read

State Tax Implications of Federal Tax Reform in Virginia

Virginia has an opportunity to improve its tax competitiveness following the Tax Cuts and Jobs Act. Inaction will result in higher taxes.

14 min read

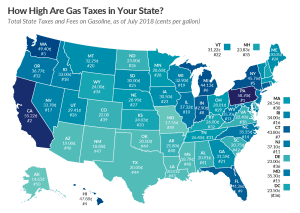

Gas Tax Rates by State, 2018

2 min read

The Tax Cuts and Jobs Act Simplified the Tax Filing Process for Millions of Households

The newly expanded standard deduction will reduce the time taxpayers spend working on Form 1040 by 4 to 7 percent, translating into $3.1 to $5.4 billion saved annually.

15 min read

Online Sales Tax Revenue Presents Opportunity for Permanent, Comprehensive Reform in Wisconsin

Wisconsin’s tax system needs to be more competitive. New revenue from online sales taxes will make it easier to accomplish comprehensive reforms that benefit all Wisconsinites.

13 min read