All Related Articles

State and Local Sales Tax Rates, Midyear 2019

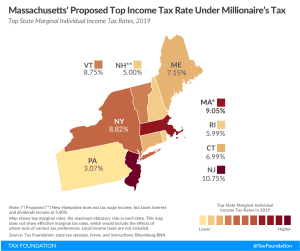

The role of competition in setting sales tax rates is often overlooked. One study shows that per capita sales in border counties in sales tax-free New Hampshire have tripled since the late 1950s, while per capita sales in border counties in Vermont have remained stagnant.

13 min read

Senator Van Hollen Introduces Proposal to Raise Taxes on High-Income Households

Van Hollen’s proposals add to the long list of Democratic Party tax proposals that attempt to both raise additional revenue from corporations and high-income households and make the tax code more progressive and “equitable.”

3 min read

The Regressivity of Deductions

3 min read

Vaping Taxes by State, 2019

3 min read

Testimony before the House Ways and Means Select Revenue Measures Subcommittee

Watch Nicole Kaeding, Vice President of Federal and Special Projects at the Tax Foundation, testify before the House Ways and Means Select Revenue Measures Subcomittee on the impact of limiting the SALT deduction.

Distilled Spirits Taxes by State, 2019

3 min read

The “Cadillac” Tax and the Income Tax Exclusion for Employer-Sponsored Insurance

The Cadillac tax offers one way that policymakers can work to rein in our tax code’s subsidization of the health-care industry, which has increased the price of health-care services.

18 min read