All Related Articles

State and Local Sales Tax Rates, 2020

While many factors influence business location and investment decisions, sales taxes are something within lawmakers’ control that can have immediate impacts.

12 min read

Proposal to Increase New York Beer Tax

3 min read

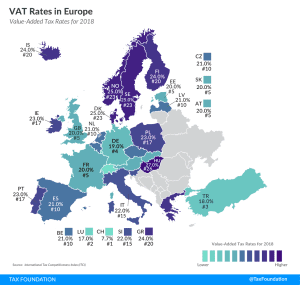

VAT Rates in Europe, 2020

4 min read

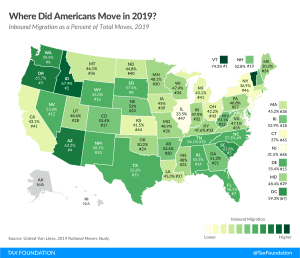

Where Did Americans Move in 2019?

2 min read

Reviewing the Tax Changes in Senator Bennet’s Real Deal

The “Real Deal” would increase the tax burden on saving, investing, and working in the United States, and reduce the global competitiveness of the U.S. economy.

3 min read

Tax Trends at the Dawn of 2020

From remote sales tax collection to taxes on marijuana and vaping products, we recap the top state tax trends from 2019 and break down which ones you should watch for in 2020.

38 min read

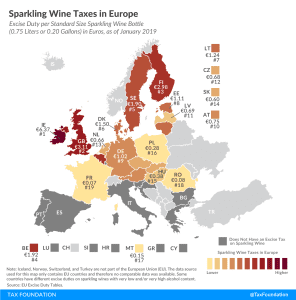

Sparkling Wine Taxes in Europe

1 min read

Virginia Governor Looks to Excise Taxes

The proposed budget reflects a growing trend as policymakers across the country look to excise taxes as long-term solutions to budget woes. While excise taxes can be a part of the revenue picture, they are not a sustainable revenue source due to their narrow base, which is easily affected by changes in consumer behavior or market conditions.

2 min read

State Tax Changes as of January 1, 2020

This year was a significant one for state tax policy, and the wide range of changes taking effect January 1, 2020, reflects the scope and intensity of that activity. With states continuing to grapple with issues like the taxation of international income and collections obligations for remote sellers and marketplace facilitators, the coming year is unlikely to be any quieter.

23 min read

GILTI and Other Conformity Issues Still Loom for States in 2020

Even two years after enactment of the federal Tax Cuts and Jobs Act (TCJA), many states have yet to issue guidance explaining how they conform to key provisions of the law, particularly those pertaining to international income.

27 min read