Key Findings

- Individual income taxes are a major source of state government revenue, accounting for 40 percent of state tax collections in fiscal year 2020, the latest year for which data are available.

- Forty-three states and the District of Columbia levy individual income taxes. Forty-one taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. wage and salary income. New Hampshire exclusively taxes dividend and interest income while Washington only taxes capital gains income. Seven states levy no individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. at all.

- Of those states taxing wages, 11 have single-rate tax structures, with one rate applying to all taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. . Conversely, 30 states and the District of Columbia levy graduated-rate income taxes, with the number of brackets varying widely by state. Hawaii has 12 brackets, the most in the country.

- States’ approaches to income taxes vary in other details as well. Some states double their single-filer bracket widths for married filers to avoid a “marriage penalty.” Some states index tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. , exemptions, and deductions for inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. ; many others do not. Some states tie their standard deductions and personal exemptions to the federal tax code, while others set their own or offer none at all.

Individual income taxes are a major source of state government revenue, accounting for 40 percent of state tax collections. Their prominence in public policy considerations is further enhanced by individuals being actively responsible for filing their income taxes, in contrast to the indirect payment of sales and excise taxes.

Forty-three states levy individual income taxes. Forty-one tax wage and salary income. New Hampshire exclusively taxes dividend and interest income while Washington only taxes capital gains income. Seven states levy no individual income tax at all.

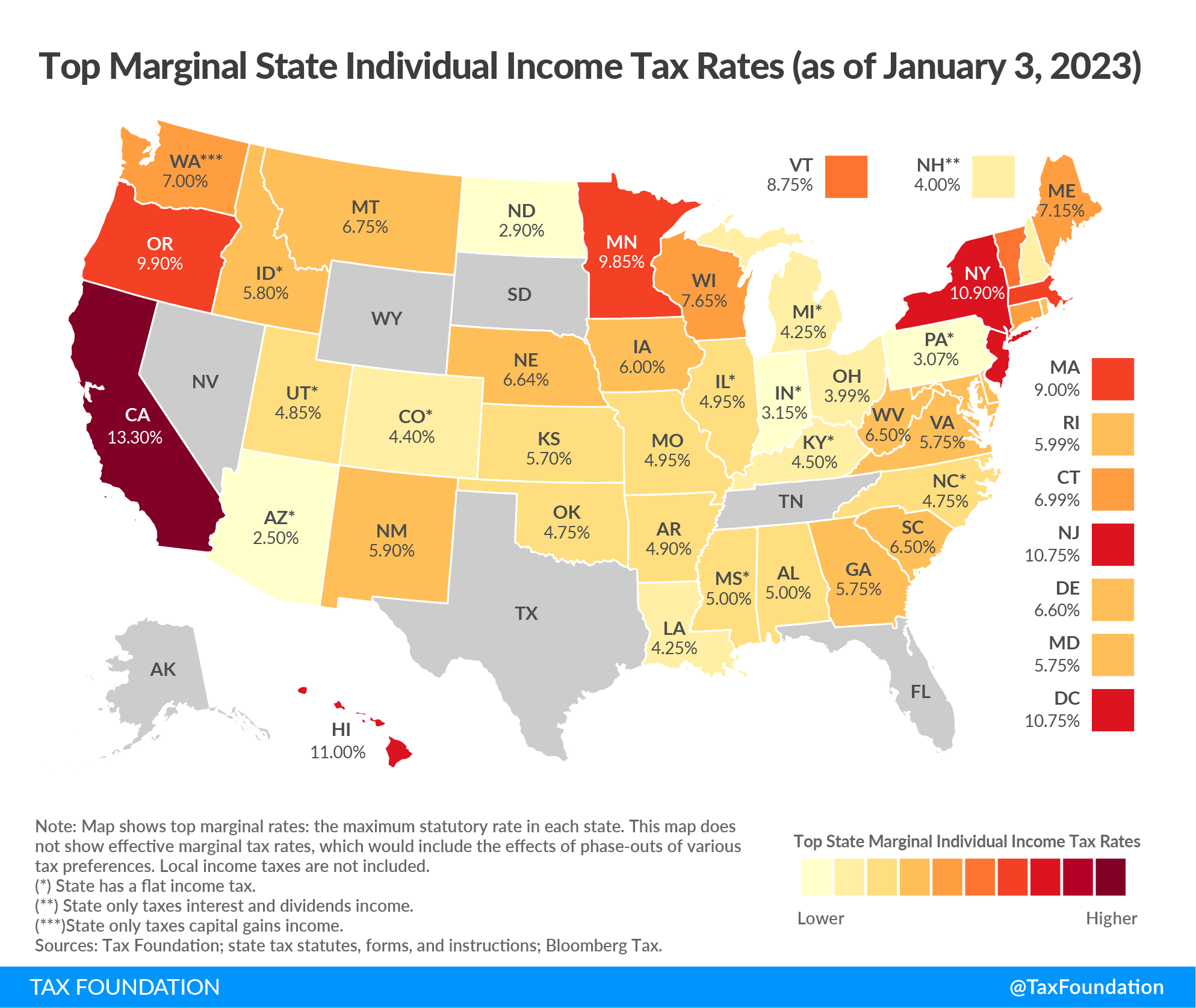

Of those states taxing wages, eleven have single-rate tax structures, with one rate applying to all taxable income. Conversely, 30 states and the District of Columbia levy graduated-rate income taxes, with the number of brackets varying widely by state. Kansas, for example, is one of several states imposing a three-bracket income tax system. At the other end of the spectrum, Hawaii has 12 brackets. Top marginal rates range from Arizona’s 2.5 percent to California’s 13.3 percent.

In some states, a large number of brackets are clustered within a narrow income band. For example, Georgia’s taxpayers reach the state’s sixth and highest bracket at $7,000 in taxable income. In other states, the top rate kicks in at a much higher level of marginal income. For example, the top rate kicks in at or above $1 million in California (when the “millionaire’s tax” surcharge is included), Massachusetts, New Jersey, New York, and the District of Columbia.

Table 1 shows how each state’s individual income tax is structured.

Income Tax Structures by State

2024 State Individual Income Tax Structures

| States with No Income Tax | States with a Flat Income Tax | States with a Graduated-rate Income Tax |

|---|---|---|

| Alaska | Arizona | Alabama |

| Florida | Colorado | Arkansas |

| Nevada | Idaho | California |

| South Dakota | Illinois | Connecticut |

| Tennessee | Indiana | Delaware |

| Texas | Kentucky | Georgia |

| Wyoming | Michigan | Hawaii |

| Mississippi | Iowa | |

| New Hampshire* | Kansas | |

| North Carolina | Louisiana | |

| Pennsylvania | Maine | |

| Utah | Maryland | |

| Washington** | Massachusetts | |

| Minnesota | ||

| Missouri | ||

| Montana | ||

| Nebraska | ||

| New Jersey | ||

| New Mexico | ||

| New York | ||

| North Dakota | ||

| Ohio | ||

| Oklahoma | ||

| Oregon | ||

| Rhode Island | ||

| South Carolina | ||

| Vermont | ||

| Virginia | ||

| West Virginia | ||

| Wisconsin | ||

| Washington DC |

Sources: Tax Foundation; state tax statutes, forms, and instructions; Bloomberg BNA.

States’ approaches to income taxes vary in other details as well. Some states double their single-filer bracket widths for married filers to avoid imposing a “marriage penaltyA marriage penalty is when a household’s overall tax bill increases due to a couple marrying and filing taxes jointly. A marriage penalty typically occurs when two individuals with similar incomes marry; this is true for both high- and low-income couples. .” Some states index tax brackets, exemptions, and deductions for inflation, while many others do not. Some states tie their standard deductions and personal exemptions to the federal tax code, while others set their own or offer none at all.

The federal Tax Cuts and Jobs Act of 2017 (TCJA) increased the standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers not to itemize deductions when filing their federal income taxes. (set at $13,850 for single filers and $27,700 for joint filers in 2023) while suspending the personal exemption by reducing it to $0 through 2025. Because many states use the federal tax code as the starting point for their own standard deduction and personal exemption calculations, some states that previously linked to these provisions in the federal tax code have updated their conformity statutes in recent years to either adopt federal changes, retain their previous deduction and exemption amounts, or retain their own separate system but increase the state-provided deduction or exemption amounts.

In the following tables, we have compiled the most up-to-date data available on state individual income tax rates, brackets, standard deductions, and personal exemptions for both single and joint filers. After the tables, we document notable individual income tax changes implemented in 2022.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe2023 State Income Tax Rates and Brackets

State Individual Income Tax Rates and Brackets, as of January 1, 2023

| State | Single Filer Rates | Single Filer Brackets | Married Filing Jointly Rates | Married Filing Jointly Brackets | Standard Deduction (Single) | Standard Deduction (Couple) | Personal Exemption (Single) | Personal Exemption (Couple) | Personal Exemption (Dependent) | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Alabama (a, b, c) | 2.00% | > | $0 | 2.00% | > | $0 | $3,000 | $8,500 | $1,500 | $3,000 | $1,000 |

| Alabama | 4.00% | > | $500 | 4.00% | > | $1,000 | |||||

| Alabama | 5.00% | > | $3,000 | 5.00% | > | $6,000 | |||||

| Alaska | none | none | n.a. | n.a. | n.a. | n.a. | n.a. | ||||

| Arizona (f, g, w) | 2.50% | > | $0 | 2.50% | > | $0 | $13,850 | $27,700 | n.a. | n.a. | $100 credit |

| Arkansas (d, h, i, o, oo) | 2.00% | > | $0 | 2.00% | > | $0 | $2,270 | $4,540 | $29 credit | $58 credit | $29 credit |

| Arkansas | 4.00% | > | $4,300 | 4.00% | > | $4,300 | |||||

| Arkansas | 4.90% | > | $8,500 | 4.90% | > | $8,500 | |||||

| California (a, i, k, l, m, n, o, rr) | 1.00% | > | $0 | 1.00% | > | $0 | $5,202 | $10,404 | $140 credit | $280 credit | $433 credit |

| California | 2.00% | > | $10,099 | 2.00% | > | $20,198 | |||||

| California | 4.00% | > | $23,942 | 4.00% | > | $47,884 | |||||

| California | 6.00% | > | $37,788 | 6.00% | > | $75,576 | |||||

| California | 8.00% | > | $52,455 | 8.00% | > | $104,910 | |||||

| California | 9.30% | > | $66,295 | 9.30% | > | $132,590 | |||||

| California | 10.30% | > | $338,639 | 10.30% | > | $677,278 | |||||

| California | 11.30% | > | $406,364 | 11.30% | > | $812,728 | |||||

| California | 12.30% | > | $677,275 | 12.30% | > | $1,000,000 | |||||

| California | 13.30% | > | $1,000,000 | 13.30% | > | $1,354,550 | |||||

| Colorado (a, p) | 4.40% | > | $0 | 4.40% | > | $0 | $13,850 | $27,700 | n.a. | n.a. | n.a. |

| Connecticut (j, q, r, s) | 3.00% | > | $0 | 3.00% | > | $0 | n.a. | n.a. | $15,000 | $24,000 | $0 |

| Connecticut | 5.00% | > | $10,000 | 5.00% | > | $20,000 | |||||

| Connecticut | 5.50% | > | $50,000 | 5.50% | > | $100,000 | |||||

| Connecticut | 6.00% | > | $100,000 | 6.00% | > | $200,000 | |||||

| Connecticut | 6.50% | > | $200,000 | 6.50% | > | $400,000 | |||||

| Connecticut | 6.90% | > | $250,000 | 6.90% | > | $500,000 | |||||

| Connecticut | 6.99% | > | $500,000 | 6.99% | > | $1,000,000 | |||||

| Delaware (a, i, n, t) | 2.20% | > | $2,000 | 2.20% | > | $2,000 | $3,250 | $6,500 | $110 credit | $220 credit | $110 credit |

| Delaware | 3.90% | > | $5,000 | 3.90% | > | $5,000 | |||||

| Delaware | 4.80% | > | $10,000 | 4.80% | > | $10,000 | |||||

| Delaware | 5.20% | > | $20,000 | 5.20% | > | $20,000 | |||||

| Delaware | 5.55% | > | $25,000 | 5.55% | > | $25,000 | |||||

| Delaware | 6.60% | > | $60,000 | 6.60% | > | $60,000 | |||||

| Florida | none | none | n.a. | n.a. | n.a. | n.a. | n.a. | ||||

| Georgia | 1.00% | > | $0 | 1.00% | > | $0 | $5,400 | $7,100 | $2,700 | $7,400 | $3,000 |

| Georgia | 2.00% | > | $750 | 2.00% | > | $1,000 | |||||

| Georgia | 3.00% | > | $2,250 | 3.00% | > | $3,000 | |||||

| Georgia | 4.00% | > | $3,750 | 4.00% | > | $5,000 | |||||

| Georgia | 5.00% | > | $5,250 | 5.00% | > | $7,000 | |||||

| Georgia | 5.75% | > | $7,000 | 5.75% | > | $10,000 | |||||

| Hawaii (n,v) | 1.40% | > | $0 | 1.40% | > | $0 | $2,200 | $4,400 | $1,144 | $2,288 | $1,144 |

| Hawaii | 3.20% | > | $2,400 | 3.20% | > | $4,800 | |||||

| Hawaii | 5.50% | > | $4,800 | 5.50% | > | $9,600 | |||||

| Hawaii | 6.40% | > | $9,600 | 6.40% | > | $19,200 | |||||

| Hawaii | 6.80% | > | $14,400 | 6.80% | > | $28,800 | |||||

| Hawaii | 7.20% | > | $19,200 | 7.20% | > | $38,400 | |||||

| Hawaii | 7.60% | > | $24,000 | 7.60% | > | $48,000 | |||||

| Hawaii | 7.90% | > | $36,000 | 7.90% | > | $72,000 | |||||

| Hawaii | 8.25% | > | $48,000 | 8.25% | > | $96,000 | |||||

| Hawaii | 9.00% | > | $150,000 | 9.00% | > | $300,000 | |||||

| Hawaii | 10.00% | > | $175,000 | 10.00% | > | $350,000 | |||||

| Hawaii | 11.00% | > | $200,000 | 11.00% | > | $400,000 | |||||

| Idaho (n, w) | 5.8% | > | $0 | 5.8% | > | $0 | $13,850 | $27,700 | n.a. | n.a. | n.a. |

| Illinois (n, o, x) | 4.95% | > | $0 | 4.95% | > | $0 | n.a. | n.a. | $2,425 | $2,850 | $2,425 |

| Indiana (a, n, y) | 3.15% | > | $0 | 3.15% | > | $0 | n.a. | n.a. | $1,000 | $2,000 | $1,000 |

| Iowa (a, e, i) | 4.40% | > | $0 | 4.40% | > | $0 | n.a. | n.a. | $40 credit | $80 credit | $40 credit |

| Iowa | 4.82% | > | $6,000 | 4.82% | > | $12,000 | |||||

| Iowa | 5.70% | > | $30,000 | 5.70% | > | $60,000 | |||||

| Iowa | 6.00% | > | $75,000 | 6.00% | > | $150,000 | |||||

| Kansas (a, n) | 3.10% | > | $0 | 3.10% | > | $0 | $3,500 | $8,000 | $2,250 | $4,500 | $2,250 |

| Kansas | 5.25% | > | $15,000 | 5.25% | > | $30,000 | |||||

| Kansas | 5.70% | > | $30,000 | 5.70% | > | $60,000 | |||||

| Kentucky (a, e) | 4.50% | > | $0 | 4.50% | > | $0 | $2,770 | $5,540 | n.a. | n.a. | n.a. |

| Kentucky | |||||||||||

| Louisiana (z) | 1.85% | > | $0 | 1.85% | > | $0 | n.a. | n.a. | $4,500 | $9,000 | $1,000 |

| Louisiana | 3.50% | > | $12,500 | 3.50% | > | $25,000 | |||||

| Louisiana | 4.25% | > | $50,000 | 4.25% | > | $100,000 | |||||

| Maine (w, aa, dd) | 5.80% | > | $0 | 5.80% | > | $0 | $13,850 | $27,700 | $4,700 | $9,400 | $300 credit |

| Maine | 6.75% | > | $24,500 | 6.75% | > | $49,050 | |||||

| Maine | 7.15% | > | $58,050 | 7.15% | > | $116,100 | |||||

| Maryland (a, n, o, bb, cc) | 2.00% | > | $0 | 2.00% | > | $0 | $2,400 | $4,850 | $3,200 | $6,400 | $3,200 |

| Maryland | 3.00% | > | $1,000 | 3.00% | > | $1,000 | |||||

| Maryland | 4.00% | > | $2,000 | 4.00% | > | $2,000 | |||||

| Maryland | 4.75% | > | $3,000 | 4.75% | > | $3,000 | |||||

| Maryland | 5.00% | > | $100,000 | 5.00% | > | $150,000 | |||||

| Maryland | 5.25% | > | $125,000 | 5.25% | > | $175,000 | |||||

| Maryland | 5.50% | > | $150,000 | 5.50% | > | $225,000 | |||||

| Maryland | 5.75% | > | $250,000 | 5.75% | > | $300,000 | |||||

| Massachusetts | 5.00% | > | $0 | 5.00% | > | $0 | n.a. | n.a. | $4,400 | $8,800 | $1,000 |

| Massachusetts | 9.00% | > | $1,000,000 | 9.00% | > | $1,000,000 | |||||

| Michigan (a, n, o) | 4.25% | > | $0 | 4.25% | > | $0 | n.a. | n.a. | $5,000 | $10,000 | $5,000 |

| Minnesota (e, dd, ee) | 5.35% | > | $0 | 5.35% | > | $0 | $13,825 | $27,650 | n.a. | n.a. | $4,800 |

| Minnesota | 6.80% | > | $30,070 | 6.80% | > | $43,950 | |||||

| Minnesota | 7.85% | > | $98,760 | 7.85% | > | $174,610 | |||||

| Minnesota | 9.85% | > | $183,340 | 9.85% | > | $304,970 | |||||

| Mississippi | 5.00% | > | $10,000 | 5.00% | > | $10,000 | $2,300 | $4,600 | $6,000 | $12,000 | $1,500 |

| Missouri (a, b, k, n, w) | 2.00% | > | $1,121 | 2.00% | > | $1,121 | $13,850 | $27,700 | n.a | n.a | n.a |

| Missouri | 2.50% | > | $2,242 | 2.50% | > | $2,242 | |||||

| Missouri | 3.00% | > | $3,363 | 3.00% | > | $3,363 | |||||

| Missouri | 3.50% | > | $4,484 | 3.50% | > | $4,484 | |||||

| Missouri | 4.00% | > | $5,605 | 4.00% | > | $5,605 | |||||

| Missouri | 4.50% | > | $6,726 | 4.50% | > | $6,726 | |||||

| Missouri | 4.95% | > | $7,847 | 4.95% | > | $7,847 | |||||

| Montana (b, e, dd, ff) | 1.00% | > | $0 | 1.00% | > | $0 | $5,540 | $11,080 | $2,960 | $5,920 | $2,960 |

| Montana | 2.00% | > | $3,600 | 2.00% | > | $3,600 | |||||

| Montana | 3.00% | > | $6,300 | 3.00% | > | $6,300 | |||||

| Montana | 4.00% | > | $9,700 | 4.00% | > | $9,700 | |||||

| Montana | 5.00% | > | $13,000 | 5.00% | > | $13,000 | |||||

| Montana | 6.00% | > | $16,800 | 6.00% | > | $16,800 | |||||

| Montana | 6.75% | > | $21,600 | 6.75% | > | $21,600 | |||||

| Nebraska (e, i, n, dd) | 2.46% | > | $0 | 2.46% | > | $0 | $7,900 | $15,800 | $157 credit | $314 credit | $157 credit |

| Nebraska | 3.51% | > | $3,700 | 3.51% | > | $7,390 | |||||

| Nebraska | 5.01% | > | $22,170 | 5.01% | > | $44,350 | |||||

| Nebraska | 6.64% | > | $35,730 | 6.64% | > | $71,460 | |||||

| Nevada | none | none | n.a. | n.a. | n.a. | n.a. | n.a. | ||||

| New Hampshire (gg) | 4% on interest and dividends only | 4% on interest and dividends only | n.a | n.a | $2,400 | $4,800 | n.a. | ||||

| New Jersey (a) | 1.400% | > | $0 | 1.400% | > | $0 | n.a. | n.a. | $1,000 | $2,000 | $1,500 |

| New Jersey | 1.750% | > | $20,000 | 1.750% | > | $20,000 | |||||

| New Jersey | 3.500% | > | $35,000 | 2.450% | > | $50,000 | |||||

| New Jersey | 5.525% | > | $40,000 | 3.500% | > | $70,000 | |||||

| New Jersey | 6.370% | > | $75,000 | 5.525% | > | $80,000 | |||||

| New Jersey | 8.970% | > | $500,000 | 6.370% | > | $150,000 | |||||

| New Jersey | 10.750% | > | $1,000,000 | 8.970% | > | $500,000 | |||||

| New Jersey | 10.750% | > | $1,000,000 | ||||||||

| New Mexico (n, w, nn) | 1.70% | > | $0 | 1.70% | > | $0 | $13,850 | $27,700 | n.a. | n.a. | $4,000 |

| New Mexico | 3.20% | > | $5,500 | 3.20% | > | $8,000 | |||||

| New Mexico | 4.70% | > | $11,000 | 4.70% | > | $16,000 | |||||

| New Mexico | 4.90% | > | $16,000 | 4.90% | > | $24,000 | |||||

| New Mexico | 5.90% | > | $210,000 | 5.90% | > | $315,000 | |||||

| New York (a, j) | 4.00% | > | $0 | 4.00% | > | $0 | $8,000 | $16,050 | n.a. | n.a. | $1,000 |

| New York | 4.50% | > | $8,500 | 4.50% | > | $17,150 | |||||

| New York | 5.25% | > | $11,700 | 5.25% | > | $23,600 | |||||

| New York | 5.50% | > | $13,900 | 5.50% | > | $27,900 | |||||

| New York | 6.00% | > | $80,650 | 6.00% | > | $161,550 | |||||

| New York | 6.85% | > | $215,400 | 6.85% | > | $323,200 | |||||

| New York | 9.65% | > | $1,077,550 | 9.65% | > | $2,155,350 | |||||

| New York | 10.30% | > | $5,000,000 | 10.30% | > | $5,000,000 | |||||

| New York | 10.90% | > | $25,000,000 | 10.90% | > | $25,000,000 | |||||

| North Carolina | 4.75% | > | $0 | 4.75% | > | $0 | $12,750 | $25,500 | n.a. | n.a. | n.a. |

| North Dakota (k, p, w) | 1.10% | > | $0 | 1.10% | > | $0 | $13,850 | $27,700 | n.a. | n.a. | n.a. |

| North Dakota | 2.04% | > | $41,775 | 2.04% | > | $69,700 | |||||

| North Dakota | 2.27% | > | $101,050 | 2.27% | > | $168,450 | |||||

| North Dakota | 2.64% | > | $210,825 | 2.64% | > | $256,650 | |||||

| North Dakota | 2.90% | > | $458,350 | 2.90% | > | $458,350 | |||||

| Ohio (a, k, o, hh) | 2.765% | > | $26,050 | 2.765% | > | $26,050 | n.a. | n.a. | $2,400 | $4,800 | $2,400 |

| Ohio | 3.226% | > | $46,100 | 3.226% | > | $46,100 | |||||

| Ohio | 3.688% | > | $92,150 | 3.688% | > | $92,150 | |||||

| Ohio | 3.990% | > | $115,300 | 3.990% | > | $115,300 | |||||

| Oklahoma (n) | 0.25% | > | $0 | 0.25% | > | $0 | $6,350 | $12,700 | $1,000 | $2,000 | $1,000 |

| Oklahoma | 0.75% | > | $1,000 | 0.75% | > | $2,000 | |||||

| Oklahoma | 1.75% | > | $2,500 | 1.75% | > | $5,000 | |||||

| Oklahoma | 2.75% | > | $3,750 | 2.75% | > | $7,500 | |||||

| Oklahoma | 3.75% | > | $4,900 | 3.75% | > | $9,800 | |||||

| Oklahoma | 4.75% | > | $7,200 | 4.75% | > | $12,200 | |||||

| Oregon (a, b, e, i, n, dd, ii, rr) | 4.75% | > | $0 | 4.75% | > | $0 | $2,605 | $5,210 | $236 credit | $472 credit | $236 credit |

| Oregon | 6.75% | > | $4,050 | 6.75% | > | $8,100 | |||||

| Oregon | 8.75% | > | $10,200 | 8.75% | > | $20,400 | |||||

| Oregon | 9.90% | > | $125,000 | 9.90% | > | $250,000 | |||||

| Pennsylvania (a) | 3.07% | > | $0 | 3.07% | > | $0 | n.a. | n.a. | n.a. | n.a. | n.a. |

| Rhode Island (e, dd, jj) | 3.75% | > | $0 | 3.75% | > | $0 | $10,000 | $20,050 | $4,700 | $9,400 | $4,700 |

| Rhode Island | 4.75% | > | $68,200 | 4.75% | > | $68,200 | |||||

| Rhode Island | 5.99% | > | $155,050 | 5.99% | > | $155,050 | |||||

| South Carolina (d, p) | 0.00% | > | $0 | 0.00% | > | $0 | $13,850 (w) | $27,700 (w) | n.a. | n.a. | $4,430 (o) |

| South Carolina | 3.00% | > | $3,200 | 3.00% | > | $3,200 | |||||

| South Carolina | 6.50% | > | $16,040 | 6.50% | > | $16,040 | |||||

| South Dakota | none | none | n.a. | n.a. | n.a. | n.a. | n.a. | ||||

| Tennessee | none | none | n.a. | n.a. | n.a. | n.a. | n.a. | ||||

| Texas | none | none | n.a. | n.a. | n.a. | n.a. | n.a. | ||||

| Utah (i, kk) | 4.85% | > | $0 | 4.85% | > | $0 | $831 credit (e) | $1,662 credit (e) | n.a. | n.a. | $1,802 credit (o) |

| Vermont (k, o, ll, qq) | 3.35% | > | $0 | 3.35% | > | $0 | $6,500 | $13,050 | $4,500 | $9,000 | $4,500 |

| Vermont | 6.60% | > | $42,150 | 6.60% | > | $70,450 | |||||

| Vermont | 7.60% | > | $102,200 | 7.60% | > | $170,300 | |||||

| Vermont | 8.75% | > | $213,150 | 8.75% | > | $259,500 | |||||

| Virginia (n) | 2.00% | > | $0 | 2.00% | > | $0 | $8,000 | $16,000 | $930 | $1,860 | $930 |

| Virginia | 3.00% | > | $3,000 | 3.00% | > | $3,000 | |||||

| Virginia | 5.00% | > | $5,000 | 5.00% | > | $5,000 | |||||

| Virginia | 5.75% | > | $17,000 | 5.75% | > | $17,000 | |||||

| Washingon | 7.0% on capital gains income only | 7.0% on capital gains income only | $250,000 | $250,000 | n.a. | n.a. | n.a. | ||||

| West Virginia (a, n) | 3.00% | > | $0 | 3.00% | > | $0 | n.a. | n.a. | $2,000 | $4,000 | $2,000 |

| West Virginia | 4.00% | > | $10,000 | 4.00% | > | $10,000 | |||||

| West Virginia | 4.50% | > | $25,000 | 4.50% | > | $25,000 | |||||

| West Virginia | 6.00% | > | $40,000 | 6.00% | > | $40,000 | |||||

| West Virginia | 6.50% | > | $60,000 | 6.50% | > | $60,000 | |||||

| Wisconsin (e, n, dd, mm) | 3.54% | > | $0 | 3.54% | > | $0 | $12,760 | $23,620 | $700 | $1,400 | $700 |

| Wisconsin | 4.65% | > | $13,810 | 4.65% | > | $18,420 | |||||

| Wisconsin | 5.30% | > | $27,630 | 5.30% | > | $36,840 | |||||

| Wisconsin | 7.65% | > | $304,170 | 7.65% | > | $405,550 | |||||

| Wyoming | none | none | n.a. | n.a. | n.a. | n.a. | n.a. | ||||

| Washington, DC (w) | 4.00% | > | $0 | 4.00% | > | $0 | $13,850 | $27,700 | n.a. | n.a. | n.a. |

| Washington, DC | 6.00% | > | $10,000 | 6.00% | > | $10,000 | |||||

| Washington, DC | 6.50% | > | $40,000 | 6.50% | > | $40,000 | |||||

| Washington, DC | 8.50% | > | $60,000 | 8.50% | > | $60,000 | |||||

| Washington, DC | 9.25% | > | $250,000 | 9.25% | > | $250,000 | |||||

| Washington, DC | 9.75% | > | $500,000 | 9.75% | > | $500,000 | |||||

| Washington, DC | 10.75% | > | $1,000,000 | 10.75% | > | $1,000,000 |

(b) These states allow some or all of federal income tax paid to be deducted from state taxable income.

(c) For single taxpayers with AGI below $25,500, the standard deduction is $3,000. This standard deduction amount is reduced by $25 for every additional $500 of AGI, not to fall below $2,500. For Married Filing Joint (MFJ) taxpayers with AGI below $25,500, the standard deduction is $8,500. This standard deduction amount is reduced by $175 for every additional $500 of AGI, not to fall below $5,000. For all taxpayers with AGI of $20,000 or less and claiming a dependent, the dependent exemption is $1,000. This amount is reduced to $500 per dependent for taxpayers with AGI above $20,000 and equal to or less than $100,000. For taxpayers with more than $100,000 in AGI, the dependent exemption is $300 per dependent.

(d) Statutory rates and brackets for 2023 are shown. Brackets are adjusted annually for inflation, but 2023 inflation adjustments were not available as of publication.

(e) Standard deduction and/or personal exemption is adjusted annually for inflation. Inflation-adjusted amounts for tax year 2023 are shown.

(f) Arizona's standard deduction can be adjusted upward by an amount equal to 27 percent of the amount the taxpayer would have claimed in charitable deductions if the taxpayer had claimed itemized deductions.

(g) In lieu of a dependent exemption, Arizona offers a dependent tax credit of $100 per dependent under the age of 17 and $25 per dependent age 17 and older. The credit begins to phase out for taxpayers with federal adjusted gross income (FAGI) above $200,000 (single filers) or $400,000 (MFJ).

(h) Rates apply to individuals earning more than $84,500. A separate tax tables exist for individuals earning $84,500 or less, with rates of 2 percent on income greater than or equal to $5,000; 3 percent on income greater than or equal to $10,000; 3.4 percent on income greater than or equal to $14,300; and 4.9 percent on income greater than $23,600 but less than or equal to $84,500.

(i) Standard deduction or personal exemption is structured as a tax credit.

(j) Connecticut and New York have "tax benefit recapture," by which many high-income taxpayers pay their top tax rate on all income, not just on amounts above the benefit threshold.

(k) Bracket levels adjusted for inflation each year. Inflation-adjusted bracket widths for 2023 were not available as of publication, so table reflects 2022 inflation-adjusted bracket widths.

(l) Exemption credits phase out for single taxpayers by $6 for each $2,500 of federal AGI above $229,908 and for MFJ filers by $12 for each $2,500 of federal AGI above $459,821. The credit cannot be reduced to below zero.

(m) Rates include the additional mental health services tax at the rate of 1 percent on taxable income in excess of $1 million.

(n) State provides a state-defined personal exemption amount for each exemption available and/or deductible under the Internal Revenue Code. Under the Tax Cuts and Jobs Act, the personal exemption is set at $0 until 2026 but not eliminated. Because it is still available, these state-defined personal exemptions remain available in some states but are set to $0 in other states.

(o) Standard deduction and/or personal exemption adjusted annually for inflation, but the 2023 inflation adjustment was not available at time of publication, so table reflects actual 2022 amount(s).

(p) Colorado, North Dakota, and South Carolina include the federal standard deduction in their income starting point.

(q) Connecticut has a complex set of phaseout provisions. For each single taxpayer whose Connecticut AGI exceeds $56,500, the amount of the taxpayer's Connecticut taxable income to which the 3 percent tax rate applies shall be reduced by $1,000 for each $5,000, or fraction thereof, by which the taxpayer's Connecticut AGI exceeds said amount. Any such amount will have a tax rate of 5 percent instead of 3 percent. Additionally, each single taxpayer whose Connecticut AGI exceeds $200,000 shall pay an amount equal to $90 for each $5,000, or fraction thereof, by which the taxpayer's Connecticut AGI exceeds $200,000 but is less than $500,000, and by an additional $50 for each $5,000, or fraction thereof, by which the taxpayer’s AGI exceeds $500,000, up to a maximum payment of $3,150. For each MFJ taxpayer whose Connecticut AGI exceeds $100,500, the amount of the taxpayer's Connecticut taxable income to which the 3 percent tax rate applies shall be reduced by $2,000 for each $5,000, or fraction thereof, by which the taxpayer's Connecticut AGI exceeds said amount. Any such amount of Connecticut taxable income to which, as provided in the preceding sentence, the 3 percent tax rate does not apply shall be an amount to which the 5 percent tax rate shall apply. Each MFJ taxpayer whose Connecticut AGI exceeds $400,000 shall pay, in addition to the amount above, an amount equal to $180 for each $10,000, or fraction thereof, by which the taxpayer's Connecticut AGI exceeds $400,000, up to a maximum of $5,400, and a further $100 for each $10,000, or fraction thereof, by which Connecticut AGI exceeds $1 million, up to a combined maximum payment of $6,300.

(r) Connecticut taxpayers are also given personal tax credits (1-75%) based upon adjusted gross income.

(s) Connecticut's personal exemption phases out by $1,000 for each $1,000, or fraction thereof, by which a single filer's Connecticut AGI exceeds $30,000 and a MFJ filer's Connecticut AGI exceeds $48,000.

(t) In addition to the personal income tax rates, Delaware imposes a tax on lump-sum distributions.

(v) Additionally, Hawaii allows any taxpayer, other than a corporation, acting as a business entity in more than one state and required by law to file a return, to report and pay a tax of 0.5 percent of its annual gross sales (1) where the taxpayer's only activities in Hawaii consist of sales, (2) when the taxpayer does not own or rent real estate or tangible personal property, and (3) when the taxpayer’s annual gross sales in or into Hawaii do not exceed $100,000. Haw. Rev. Stat. § 235-51 (2015).

(w) Deduction and/or exemption tied to federal tax system. Federal deductions and exemptions are indexed for inflation, and where applicable, the tax year 2023 inflation-adjusted amounts are shown.

(x) As of June 1, 2017, taxpayers cannot claim the personal exemption if their adjusted gross income exceeds $250,000 (single filers) or $500,000 (MFJ).

(y) $1,000 is a base exemption. If dependents meet certain conditions, filers can take an additional $1,500 exemption for each.

(z) Standard deduction and personal exemptions are combined: $4,500 for single and married filing separately; $9,000 MFJ and head of household.

(aa) Maine's personal exemption begins to phase out for taxpayers with income exceeding $286,200 (single filers) or $343,400 (MFJ) (2022 inflation adjustments). The dependent personal exemption is structured as a tax credit and begins to phase out for taxpayers with income exceeding $200,000 (head of household) or $400,000 (married filing jointly).

(bb) The standard deduction is 15 percent of income with a minimum of $1,600 and a cap of $2,400 for single filers and married filing separately filers. The standard deduction is a minimum of $3,200 and capped at $4,850 for MFJ filers, head of household filers, and qualifying widows/ widowers. The minimum and maximum standard deduction amounts are adjusted annually for inflation. 2023 inflation-adjusted amounts were not announced as of publication, so 2022 inflation-adjusted amounts are shown.

(cc) The exemption amount has the following phaseout schedule: If AGI is above $100,000 for single filers and above $150,000 for married filers, the $3,200 exemption begins to be phased out. If AGI is above $150,000 for single filers and above $200,000 for married filers, the exemption is phased out entirely.

(dd) Bracket levels adjusted for inflation each year. Inflation-adjusted bracket levels for 2023 are shown.

(ee) For taxpayers whose AGI exceeds $103,025 (married filing separately) or $206,050 (all other filers), Minnesota’s standard deduction is reduced by the lesser of 3 percent of the excess of the taxpayer’s federal AGI over the applicable amount or 80 percent of the standard deduction otherwise allowable.

(ff) Montana filers' standard deduction is 20 percent of AGI. For single taxpayers, the deduction must be between $2,460 and $5,540. For joint taxpayers, the deduction must be between $4,920 and $11,080.

(gg) Applies to interest and dividend income only.

(hh) Ohio's personal and dependent exemptions are $2,400 for an AGI of $40,000 or less, $2,150 if AGI is more than $40,000 but less than or equal to $80,000, and $1,900 if AGI is greater than $80,000.

(ii) The personal exemption credit is not allowed if federal AGI exceeds $100,000 for single filers or $200,000 for MFJ.

(jj) The phaseout range for the standard deduction, personal exemption, and dependency exemption is $233,750 to $260,550. For taxpayers with modified Federal AGI exceeding $260,550, no standard deduction, personal exemption, or dependency exemption is available.

(kk) The standard deduction is taken in the form of a nonrefundable credit of 6 percent of the federal standard or itemized deduction amount, excluding the deduction for state or local income tax. This credit phases out at 1.3 cents per dollar of AGI above $15,548 ($31,096 for married couples).

(ll) For taxpayers with federal AGI that exceeds $150,000, the taxpayer will pay the greater of state income tax or 3 percent of federal AGI.

(mm) The standard deduction begins to phase out at $18,400 in income for single filers and $26,550 in income for joint filers. The standard deduction phases out to zero at $124,733 for single filers and $145,976 for joint filers.

(nn) In lieu of the suspended personal exemption, New Mexico offers a deduction of $4,000 for all but one of a taxpayer’s dependents.

(oo) Taxpayers with net income greater than or equal to $84,501 but not greater than $89,100 shall reduce the amount of tax due by deducting a bracket adjustment amount. The bracket adjustment amount starts at $460 for individuals with net income of $84,501 and decreases by $10 for every $100 in additional net income.

(qq) Taxpayers also receive an additional deduction of $1,050 for each standard deduction box checked on federal Form 1040.

(rr) California and Oregon do not fully index their top brackets.

Notable 2023 State Individual Income Tax Changes

Last year continued the historic pace of income tax rate reductions. In 2022, 12 states enacted individual income tax rate reductions, a continuation from 2021 when 13 states enacted or implemented individual income tax rate reductions. Nearly all of the 2022 rate reductions were effective starting January 1, 2023. Georgia’s rate reduction will occur in 2024 along with additional reductions in Iowa, Mississippi, and Nebraska. Some of the scheduled future rate reductions rely on tax triggers, where rate reductions will occur once certain revenue benchmarks are met. Other rate reductions are set to occur on specific future dates, with rates phasing down incrementally over time. Massachusetts was the only jurisdiction to enact an individual income tax rate increase in 2022. Notable changes to major individual income tax provisions include the following:

Arizona

Arizona joined the growing list of states with a flat individual income tax structure, one year earlier than originally anticipated. Under S.B. 1828, tax triggers were established that set the state on a course to a 2.5 percent flat rate subject to reaching specified revenue targets. Since Arizona reached the final revenue target sooner than anticipated, the rate schedule converted directly from a two-bracket structure with rates of 2.55 and 2.98 percent to a flat rate of 2.5 percent, without the need for another year of a two-rate structure.

Arkansas

In August 2022, Arkansas legislators passed H.B. 1002, a bill to accelerate previously planned individual and corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate reductions. The reduction in the top marginal individual income tax rate from 5.5 to 4.9 percent was retroactive to January 1, 2022.

Idaho

In September 2022, Idaho legislators enacted H.B. 1 to convert the individual income tax structure to a flat rate of 5.8 percent, down from a top marginal rate of 6 percent. As this law was designed in part to supersede a tax increase proposal that was approved for the ballot but later withdrawn, the law technically took effect January 3, 2023, but its provisions apply retroactively to January 1, 2023.

Indiana

Under H.B. 1002, enacted in March 2022, Indiana’s flat individual income tax rate was reduced from 3.23 to 3.15 percent effective for 2023 and 2024. Additional triggers are in place that could reduce the rate to 2.9 percent by 2029 if specified conditions are met.

Iowa

Iowa enacted comprehensive tax reforms in 2018, 2021, and 2022, and many of these reforms will continue phasing in over the coming years. Effective January 1, Iowa’s nine individual income tax rates were consolidated into four, and the top rate was decreased from 8.53 to 6 percent. Iowa’s graduated-rate tax structure is scheduled to shift to a flat taxAn income tax is referred to as a “flat tax” when all taxable income is subject to the same tax rate, regardless of income level or assets. at a rate of 3.9 percent in 2026.

Additionally, effective tax year 2023, the standard deduction and state deduction for federal taxes paid are repealed, broadening the base to help pay for reductions to the rate.

Kentucky

In April 2022, H.B. 8 was enacted, reducing individual income tax rates. Many of the law’s provisions took effect on January 1, 2023, including the initial reduction in the individual income tax rate from 5 to 4.5 percent.

The law also established tax triggers that, contingent upon revenue meeting certain benchmarks, could phase down the individual income tax rate to zero over many years, starting with a likely further reduction from 4.5 to 4 percent in 2024.

Massachusetts

The narrow passage of Massachusetts Question 1, a legislatively referred constitutional amendment, in November 2022 modified the state’s constitution to add a 4 percent surtax to the current 5 percent individual income tax rate for annual income above $1 million. Massachusetts had a flat-rate individual income tax since 1917.

Mississippi

Mississippi moved to a flat individual income tax structure as a result of H.B. 531, enacted in April 2022. Effective January 1, 2023, the 4 percent tax on taxable income between $5,000 and $10,000 was eliminated, leaving a single rate of 5 percent on income exceeding $10,000. The flat rate is scheduled to phase down to 4.7 percent in 2024, 4.4 percent in 2025, and 4 percent in 2026.

Missouri

In October 2022, Missouri legislators passed S.B. 3, a bill to expedite planned individual income tax rate reductions and replace existing tax triggers with triggers that reduce the top marginal rate further and faster than planned in previous legislation enacted in 2014 and 2021. Effective January 1, Missouri’s top marginal individual income tax rate was reduced from 5.3 to 4.95 percent, and the amount of income exempt from Missouri’s individual income tax rates increased from $100 to $1,000. Additional triggers seek to eventually reduce the top rate to 4.5 percent.

Nebraska

Under L.B. 873, enacted in April 2022, Nebraska plans to reduce its top marginal individual income tax rate to 5.84 percent by 2027. The tax will be reduced by 0.2 percentage points per year. The initial reduction from 6.84 to 6.64 percent occurred on January 1, 2023.

New Hampshire

New Hampshire began phasing out its income tax on interest and dividend income in 2023, bringing the rate down from 5 to 4 percent. This is the result of H.B. 2, enacted in June 2021. The rate is scheduled to phase down by one percentage point per year until the tax is phased out entirely in 2027.

New York

New York’s budget for fiscal year 2023, enacted in April 2022, accelerated income tax rate reductions originally passed in 2016 for middle-income earners. Under S. 8009, rate reductions originally scheduled for 2025 took effect two years earlier than planned, bringing the rate on income between $13,900 and $80,650 (single filers) and between $27,900 and $161,550 (joint filers) to 5.5 percent and bringing the rate on income between $80,650 and $215,400 (single filers) and between $161,500 and $323,200 (joint filers) to 6 percent. For tax year 2022, the tax rates on those levels of income were 5.85 and 6.25 percent, respectively.

North Carolina

North Carolina’s flat individual income tax rate decreased from 4.99 to 4.75 percent for 2023 as a result of SB 105, the 2021 Appropriations Act, which was enacted in November 2021. Future scheduled reductions enacted under this same law will ultimately bring the rate to 3.99 percent by 2027.