Note: Each year we review and improve the methodology of the Index. For that reason, prior editions are not comparable to the results in this 2021 edition. All data and methodological notes are accessible in our GitHub repository. Below is a preview of the 2021 Index. To access the full report, click the download button above.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeIntroduction

The structure of a country’s taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. code is a determining factor of its economic performance. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities. In contrast, poorly structured tax systems can be costly, distort economic decision-making, and harm domestic economies.

Many countries have recognized this and have reformed their tax codes. Over the past few decades, marginal tax rates on corporate and individual income have declined significantly across the Organisation for Economic Co-operation and Development (OECD). Now, most OECD nations raise a significant amount of revenue from broad-based taxes such as payroll taxes and value-added taxes (VAT).[1]

Not all recent changes in tax policy among OECD countries have improved the structure of tax systems; some have made a negative impact. Though some countries like the United States and France have reduced their corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rates by several percentage points, others, like Turkey, have increased them. Corporate tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. improvements have occurred in Chile and the United Kingdom, while the corporate tax base has been made less competitive in Belgium.

The COVID-19 pandemic has led many countries to adopt temporary changes to their tax systems. Faced with revenue shortfalls from the downturn, countries will need to consider how to best structure their tax systems to foster both an economic recovery and raise revenue.

The variety of approaches to taxation among OECD countries creates a need to evaluate these systems relative to each other. For that purpose, we have developed the International Tax Competitiveness Index—a relative comparison of OECD countries’ tax systems with respect to competitiveness and neutrality.

The International Tax Competitiveness Index

The International Tax Competitiveness Index (ITCI) seeks to measure the extent to which a country’s tax system adheres to two important aspects of tax policy: competitiveness and neutrality.

A competitive tax code is one that keeps marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. s low. In today’s globalized world, capital is highly mobile. Businesses can choose to invest in any number of countries throughout the world to find the highest rate of return. This means that businesses will look for countries with lower tax rates on investment to maximize their after-tax rate of return. If a country’s tax rate is too high, it will drive investment elsewhere, leading to slower economic growth. In addition, high marginal tax rates can impede domestic investment and lead to tax avoidance.

According to research from the OECD, corporate taxes are most harmful for economic growth, with personal income taxes and consumption taxes being less harmful. Taxes on immovable property have the smallest impact on growth.[2]

Separately, a neutral tax code is simply one that seeks to raise the most revenue with the fewest economic distortions. This means that it doesn’t favor consumption over saving, as happens with investment taxes and wealth taxA wealth tax is imposed on an individual’s net wealth, or the market value of their total owned assets minus liabilities. A wealth tax can be narrowly or widely defined, and depending on the definition of wealth, the base for a wealth tax can vary. es. It also means few or no targeted tax breaks for specific activities carried out by businesses or individuals.

As tax laws become more complex, they also become less neutral. If, in theory, the same taxes apply to all businesses and individuals, but the rules are such that large businesses or wealthy individuals can change their behavior to gain a tax advantage, this undermines the neutrality of a tax system.

A tax code that is competitive and neutral promotes sustainable economic growth and investment while raising sufficient revenue for government priorities.

There are many factors unrelated to taxes which affect a country’s economic performance. Nevertheless, taxes play an important role in the health of a country’s economy.

To measure whether a country’s tax system is neutral and competitive, the ITCI looks at more than 40 tax policy variables. These variables measure not only the level of tax rates, but also how taxes are structured. The Index looks at a country’s corporate taxes, individual income taxes, consumption taxes, property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. es, and the treatment of profits earned overseas. The ITCI gives a comprehensive overview of how developed countries’ tax codes compare, explains why certain tax codes stand out as good or bad models for reform, and provides important insight into how to think about tax policy.

Due to some data limitations, recent tax changes in some countries may not be reflected in this year’s version of the International Tax Competitiveness Index.[3]

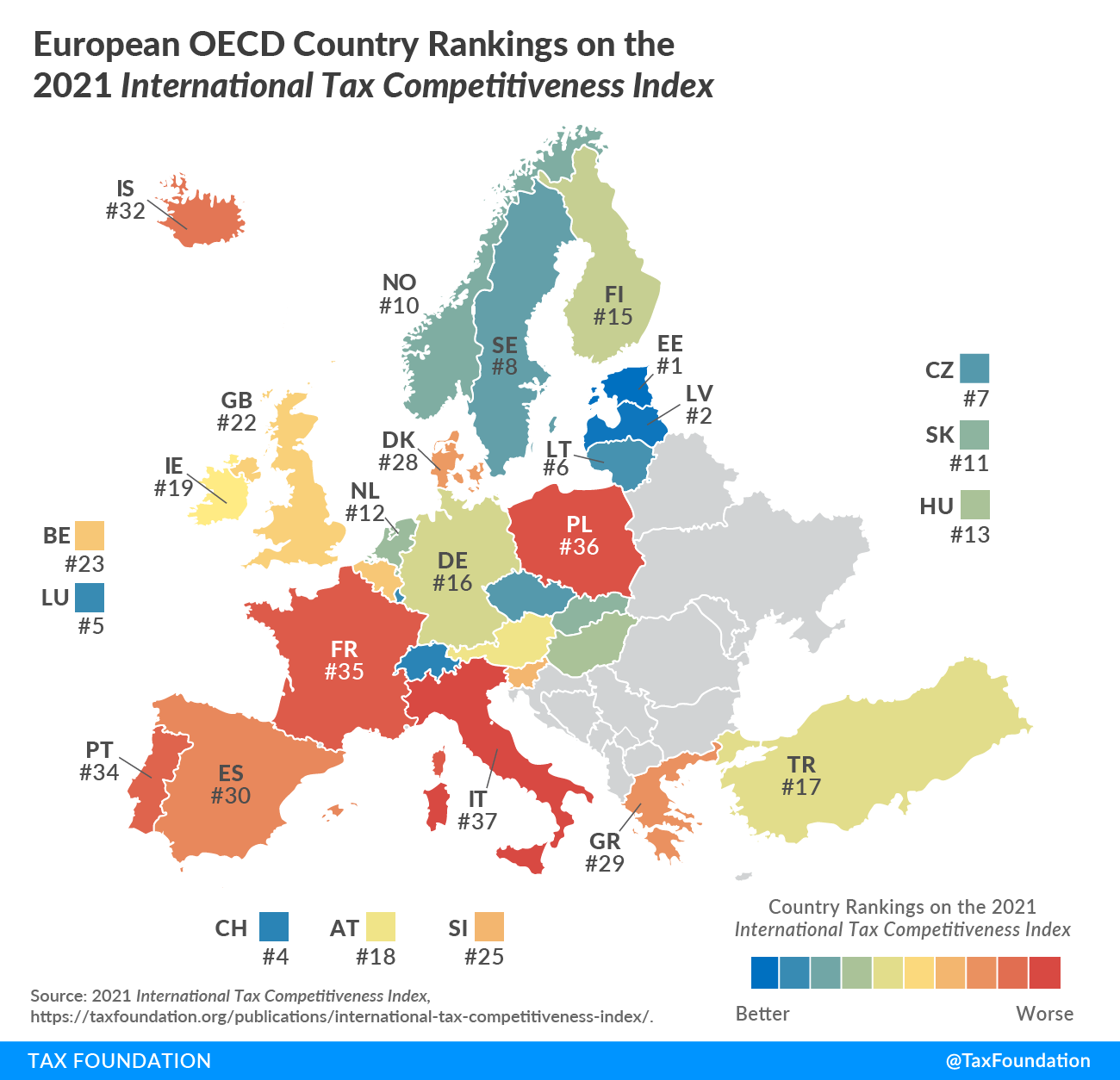

2021 International Tax Competitiveness Index Rankings

For the eighth year in a row, Estonia has the best tax code in the OECD. Its top score is driven by four positive features of its tax system. First, it has a 20 percent tax rate on corporate income that is only applied to distributed profits. Second, it has a flat 20 percent tax on individual income that does not apply to personal dividend income. Third, its property tax applies only to the value of land, rather than to the value of real property or capital. Finally, it has a territorial tax systemA territorial tax system for corporations, as opposed to a worldwide tax system, excludes profits multinational companies earn in foreign countries from their domestic tax base. As part of the 2017 Tax Cuts and Jobs Act (TCJA), the United States shifted from worldwide taxation towards territorial taxation. that exempts 100 percent of foreign profits earned by domestic corporations from domestic taxation, with few restrictions.

| Country | Overall Rank | Overall Score | Corporate Tax Rank | Individual Taxes Rank | Consumption Taxes Rank | Property Taxes Rank | Cross-Border Tax Rules Rank |

|---|---|---|---|---|---|---|---|

| Estonia | 1 | 100.0 | 3 | 1 | 9 | 1 | 15 |

| Latvia | 2 | 85.1 | 2 | 5 | 27 | 5 | 9 |

| New Zealand | 3 | 81.3 | 28 | 6 | 6 | 2 | 22 |

| Switzerland | 4 | 78.4 | 10 | 15 | 1 | 35 | 2 |

| Luxembourg | 5 | 76.5 | 25 | 20 | 4 | 13 | 5 |

| Lithuania | 6 | 76.5 | 4 | 7 | 24 | 7 | 23 |

| Czech Republic | 7 | 75.5 | 8 | 4 | 35 | 6 | 12 |

| Sweden | 8 | 72.9 | 9 | 18 | 16 | 8 | 14 |

| Australia | 9 | 71.3 | 29 | 17 | 7 | 4 | 24 |

| Norway | 10 | 70.6 | 11 | 13 | 18 | 15 | 11 |

| Slovak Republic | 11 | 69.3 | 19 | 3 | 34 | 3 | 34 |

| Netherlands | 12 | 69.2 | 24 | 22 | 14 | 21 | 3 |

| Hungary | 13 | 69.0 | 6 | 9 | 36 | 17 | 4 |

| Israel | 14 | 67.6 | 17 | 29 | 12 | 10 | 10 |

| Finland | 15 | 67.4 | 7 | 25 | 15 | 19 | 21 |

| Germany | 16 | 67.2 | 27 | 28 | 11 | 11 | 6 |

| Turkey | 17 | 66.7 | 26 | 8 | 23 | 22 | 8 |

| Austria | 18 | 65.7 | 21 | 32 | 13 | 14 | 7 |

| Ireland | 19 | 64.7 | 5 | 30 | 25 | 18 | 19 |

| Canada | 20 | 64.6 | 23 | 27 | 8 | 24 | 16 |

| United States | 21 | 62.4 | 20 | 26 | 5 | 28 | 32 |

| United Kingdom | 22 | 61.8 | 18 | 23 | 22 | 33 | 1 |

| Belgium | 23 | 61.6 | 15 | 11 | 30 | 30 | 18 |

| Japan | 24 | 61.5 | 36 | 21 | 3 | 26 | 27 |

| Slovenia | 25 | 61.3 | 12 | 14 | 31 | 25 | 20 |

| Korea | 26 | 60.6 | 33 | 24 | 2 | 32 | 33 |

| Chile | 27 | 58.2 | 1 | 35 | 29 | 12 | 37 |

| Denmark | 28 | 57.9 | 16 | 34 | 17 | 16 | 30 |

| Greece | 29 | 57.5 | 22 | 10 | 32 | 29 | 25 |

| Spain | 30 | 57.1 | 32 | 19 | 10 | 36 | 17 |

| Colombia | 31 | 55.0 | 37 | 2 | 20 | 23 | 35 |

| Iceland | 32 | 53.7 | 13 | 36 | 19 | 27 | 31 |

| Mexico | 33 | 52.5 | 31 | 16 | 26 | 9 | 36 |

| Portugal | 34 | 49.0 | 35 | 31 | 33 | 20 | 28 |

| France | 35 | 48.7 | 34 | 37 | 21 | 34 | 13 |

| Poland | 36 | 45.7 | 14 | 12 | 37 | 31 | 29 |

| Italy | 37 | 44.6 | 30 | 33 | 28 | 37 | 26 |

While Estonia’s tax system is the most competitive in the OECD, the other top countries’ tax systems receive high scores due to excellence in one or more of the major tax categories. Latvia, which recently adopted the Estonian system for corporate taxation, also has a relatively efficient system for taxing labor income. New Zealand has a relatively flat, low-rate individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. that also largely exempts capital gains (with a combined top rate of 33 percent), a well-structured property tax, and a broad-based value-added tax. Switzerland has a relatively low corporate tax rate (19.7 percent), a low, broad-based consumption taxA consumption tax is typically levied on the purchase of goods or services and is paid directly or indirectly by the consumer in the form of retail sales taxes, excise taxes, tariffs, value-added taxes (VAT), or an income tax where all savings is tax-deductible. , and an individual income tax that partially exempts capital gains from taxation. Luxembourg has a broad-based consumption tax and a competitive international tax system.

Italy has the least competitive tax system in the OECD. It has a wealth tax on financial assets and real estate held abroad, a financial transaction tax, and an inheritance taxAn inheritance tax is levied upon an individual’s estate at death or upon the assets transferred from the decedent’s estate to their heirs. Unlike estate taxes, inheritance tax exemptions apply to the size of the gift rather than the size of the estate. . Italy also has a high compliance burden associated with its individual tax system. It takes businesses an estimated 169 hours to comply with the individual income tax. The Italian value-added tax covers less than 40 percent of final consumption, revealing both policy and enforcement gaps.

Countries that rank poorly on the ITCI often levy relatively high marginal tax rates on corporate income. The five countries at the bottom of the rankings all have higher than average corporate tax rates, except for Poland, at 19 percent. In addition, all five countries have high consumption tax rates, with rates of 20 percent or higher, except for Mexico, at 16 percent.

Notable Changes from Last Year[4]

Austria

Austria implemented accelerated depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. schedules for machinery and buildings and introduced stricter thin capitalization rules from 2021 onwards. Austria’s ranking fell from 16th to 18th.

Belgium

Belgium made its capital allowanceA capital allowance is the amount of capital investment costs, or money directed towards a company’s long-term growth, a business can deduct each year from its revenue via depreciation. These are also sometimes referred to as depreciation allowances. provisions for machinery, buildings, and intangibles less generous and reintroduced a wealth tax on securities accounts. Belgium’s ranking fell from 19th to 23rd.

Chile

As a response to the COVID-19 pandemic, Chile introduced temporary full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. of fixed assets—such as buildings and machinery—and 100 percent amortization of intangibles from 2020 until the end of 2022. At the same time, the corporate income tax was temporarily reduced to 10 percent for the majority of businesses. The top statutory personal income tax rate and the tax rate on capital gains were both increased from 35 percent to 40 percent. Chile’s ranking improved from 32nd to 27th.

Colombia

Colombia reduced its corporate income tax rate from 32 percent in 2020 to 31 percent in 2021, with a further scheduled reduction to 30 percent from 2022 onwards. R&D tax subsidies were expanded for small businesses. Colombia’s ranking remained unchanged at 31.

Czech Republic

The Czech Republic introduced a permanent 2-year carryback provision for net operating losses, allowing businesses to be taxed on their average profitability. The Czech Republic’s ranking remained unchanged at 7.

Denmark

Denmark introduced R&D tax subsidies. Its ranking remained unchanged at 28.

Finland

Finland doubled its declining-balance depreciation rate for machinery from 25 percent to 50 percent for the years 2020 to 2023. Finland’s ranking improved from 17th to 15th.

France

France is in the process of reducing its corporate income tax rate over several years, concluding in 2022. As part of this scheduled reduction, France reduced its combined corporate rate (including a surtaxA surtax is an additional tax levied on top of an already existing business or individual tax and can have a flat or progressive rate structure. Surtaxes are typically enacted to fund a specific program or initiative, whereas revenue from broader-based taxes, like the individual income tax, typically cover a multitude of programs and services. ) from 32.02 percent in 2020 to 28.41 percent in 2021. Its Index rank remained unchanged at 35.

Germany

Germany implemented accelerated depreciation schedules for machinery for the years 2020 and 2021 and introduced R&D tax subsidies. Its ranking dropped from 15th to 16th.

Greece

Greece reduced its corporate income tax rate from 24 percent in 2020 to 22 percent in 2021, expanded its R&D tax subsidies, and slightly reduced its top statutory personal income tax rate. Greece’s ranking remained unchanged at 29.

Iceland

Iceland expanded its R&D tax subsidies. Its ranking fell from 30th to 32nd.

Israel

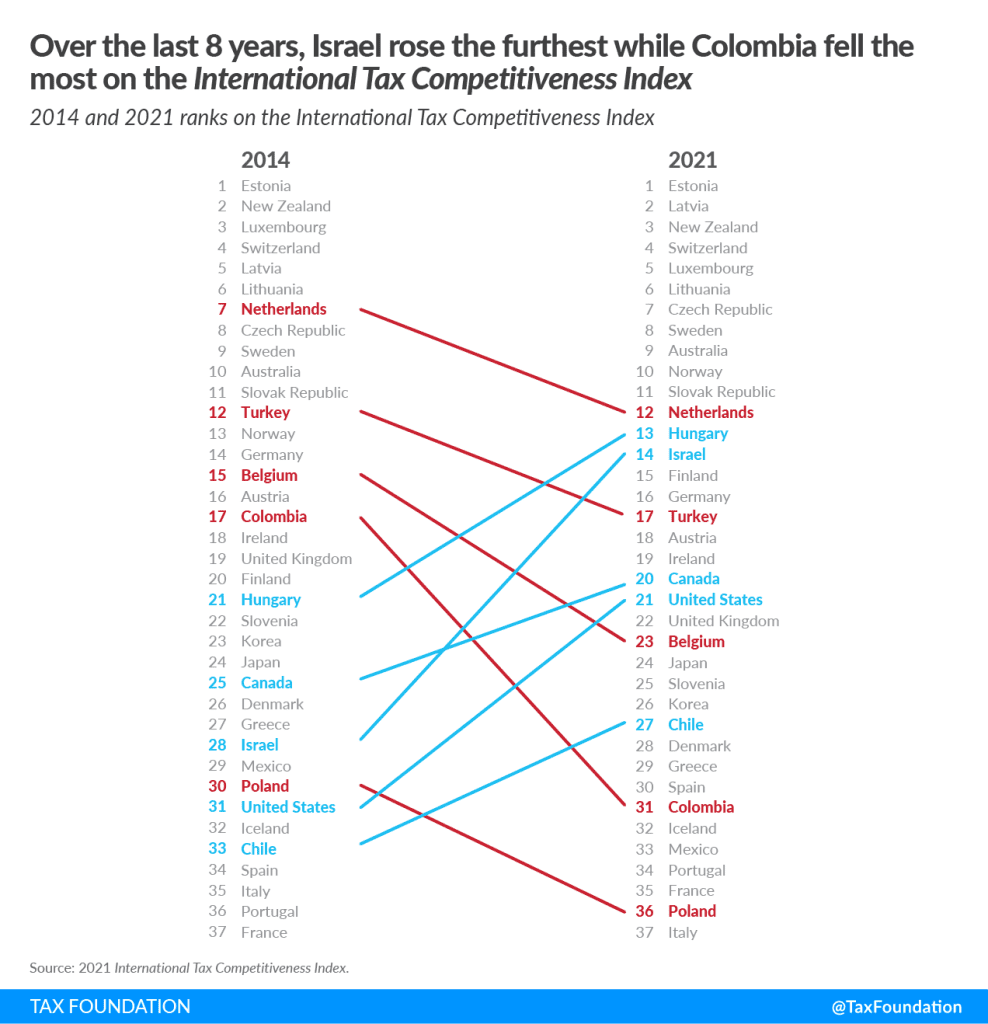

Israel’s ranking rose from 27th to 14th due to a significant reduction in tax complexity as measured by the PwC’s “Paying Taxes” data. Labor tax payments fell from 12 to one, other tax payments fell from 14 to three, and the time it takes businesses to file consumption taxes also decreased. Israel recorded this year’s largest improvement in rank.

Korea

Korea reduced the average time it takes a business to file corporate and consumption taxes. In addition, the top personal dividends tax rate was increased from 40.28 percent in 2020 to 43.95 percent in 2021. Korea’s ranking fell from 25th to 26th.

Lithuania

Lithuania increased its top statutory personal income tax rate from 27 percent to 32 percent and slightly reduced the amount of time it takes businesses to file consumption taxes. Lithuania’s ranking remained unchanged at 6.

Netherlands

The Netherlands increased its tax rate on deemed returns from 30 percent to 31 percent, slightly increased its top personal dividends tax rate, and reduced its top statutory personal income tax rate by approximately two percentage-points to 49.5 percent. Its ranking remained unchanged at 12.

New Zealand

New Zealand implemented a 1-year loss carryback provision as part of its COVID-19 response, permanently reintroduced depreciation for commercial and industrial buildings with an estimated useful life of 50 years or more, and increased its top personal dividends tax rate from 6.94 percent to 15.28 percent. New Zealand’s ranking remained unchanged at 3.

Norway

As part of its COVID-19 response, Norway increased its declining-balance depreciation rate from 20 to 30 percent for machinery acquired or improved between July and December of 2020. Norway’s ranking improved from 11th to 10th.

Slovak Republic

Slovakia expanded its R&D tax subsidies and repealed its bank levy as of January 2021. Its rank improved from 14th to 11th.

Spain

Spain introduced a digital services tax (DST) and a financial transactions tax (FTT), increased both its capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. rate and its dividends tax rate from 23 percent in 2020 to 26 percent in 2021, slightly reduced the amount of time it takes a business to file consumption taxes, and reduced the participation exemption for foreign-earned dividends and capital gains from 100 percent to 95 percent. Spain’s ranking fell from 26th to 30th.

Sweden

Sweden reduced its corporate income tax rate from 21.4 percent in 2020 to 20.6 percent in 2021, expanded its R&D tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly. , and reduced the top statutory personal income tax rate by about five percentage points to 52.28 percent. Sweden’s ranking remained unchanged at 8.

Switzerland

Switzerland reduced its top combined corporate income tax rate from 21.1 percent in 2020 to 19.7 percent in 2021. Switzerland’s ranking remained unchanged at 4.

Turkey

Turkey increased its corporate income tax rate from 22 percent in 2020 to 25 percent in 2021 and increased its top statutory personal income tax rate by five percentage points to 40.76 percent. Turkey’s rank fell from 10th to 17th.

United Kingdom

The UK permanently reintroduced depreciation for industrial buildings at 2 percent in 2019 and expanded it to 3 percent in 2020. Although not reflected in this edition of the Index due to a 1-year lag in the depreciation data, it is important to note that the UK introduced a 130 percent super-deductionA super-deduction is a tax deduction that permits businesses to deduct more than 100 percent of their eligible expenses from their taxable income. As such, the super-deduction is effectively a subsidy for certain costs. This policy sometimes applies to capital costs or research and development (R&D) spending. for plant and equipment for the next two years, followed by an increase in the corporate income tax rate from 19 percent to 25 percent in 2023. It has also become slightly more complex for UK businesses to file labor taxes. The UK’s ranking remained unchanged at 22.

| Country | 2019 Rank | 2019 Score | 2020 Rank | 2020 Score | 2021 Rank | 2021 Score | Change in Rank from 2020 to 2021 | Change in Score from 2020 to 2021 |

|---|---|---|---|---|---|---|---|---|

| Australia | 9 | 71.8 | 9 | 71.9 | 9 | 71.3 | 0 | -0.6 |

| Austria | 13 | 68.4 | 16 | 66.8 | 18 | 65.7 | -2 | -1.2 |

| Belgium | 23 | 61.8 | 19 | 65 | 23 | 61.6 | -4 | -3.4 |

| Canada | 18 | 65.1 | 18 | 65.4 | 20 | 64.6 | -2 | -0.8 |

| Chile | 35 | 46.9 | 32 | 52.6 | 27 | 58.2 | 5 | 5.6 |

| Colombia | 30 | 54.4 | 31 | 55.3 | 31 | 55 | 0 | -0.3 |

| Czech Republic | 8 | 71.9 | 7 | 75.3 | 7 | 75.5 | 0 | 0.2 |

| Denmark | 28 | 58.7 | 28 | 58.3 | 28 | 57.9 | 0 | -0.3 |

| Estonia | 1 | 100 | 1 | 100 | 1 | 100 | 0 | 0 |

| Finland | 17 | 67.2 | 17 | 66.8 | 15 | 67.4 | 2 | 0.6 |

| France | 37 | 44.3 | 35 | 46.2 | 35 | 48.7 | 0 | 2.5 |

| Germany | 16 | 67.5 | 15 | 67.5 | 16 | 67.2 | -1 | -0.3 |

| Greece | 31 | 54.3 | 29 | 57.2 | 29 | 57.5 | 0 | 0.3 |

| Hungary | 15 | 67.6 | 13 | 68.7 | 13 | 69 | 0 | 0.3 |

| Iceland | 29 | 56.1 | 30 | 55.3 | 32 | 53.7 | -2 | -1.6 |

| Ireland | 19 | 64.9 | 20 | 64.6 | 19 | 64.7 | 1 | 0.1 |

| Israel | 27 | 59.2 | 27 | 60 | 14 | 67.6 | 13 | 7.7 |

| Italy | 36 | 46.8 | 37 | 44.8 | 37 | 44.6 | 0 | -0.1 |

| Japan | 20 | 64.6 | 23 | 61.6 | 24 | 61.5 | -1 | 0 |

| Korea | 24 | 61.3 | 25 | 60.5 | 26 | 60.6 | -1 | 0.1 |

| Latvia | 3 | 83.1 | 2 | 84.2 | 2 | 85.1 | 0 | 0.9 |

| Lithuania | 6 | 76.9 | 6 | 76 | 6 | 76.5 | 0 | 0.5 |

| Luxembourg | 5 | 77.2 | 5 | 77.5 | 5 | 76.5 | 0 | -1 |

| Mexico | 32 | 53.2 | 33 | 52.5 | 33 | 52.5 | 0 | -0.1 |

| Netherlands | 10 | 70.3 | 12 | 69 | 12 | 69.2 | 0 | 0.2 |

| New Zealand | 2 | 83.6 | 3 | 83.2 | 3 | 81.3 | 0 | -1.8 |

| Norway | 11 | 69.8 | 11 | 69.9 | 10 | 70.6 | 1 | 0.7 |

| Poland | 33 | 51.3 | 36 | 45.3 | 36 | 45.7 | 0 | 0.4 |

| Portugal | 34 | 47.3 | 34 | 49 | 34 | 49 | 0 | 0 |

| Slovak Republic | 14 | 67.9 | 14 | 67.9 | 11 | 69.3 | 3 | 1.3 |

| Slovenia | 25 | 60.8 | 24 | 61.5 | 25 | 61.3 | -1 | -0.2 |

| Spain | 26 | 60 | 26 | 60.3 | 30 | 57.1 | -4 | -3.2 |

| Sweden | 7 | 72.3 | 8 | 72 | 8 | 72.9 | 0 | 0.9 |

| Switzerland | 4 | 79.2 | 4 | 78.1 | 4 | 78.4 | 0 | 0.4 |

| Turkey | 12 | 69.7 | 10 | 70.3 | 17 | 66.7 | -7 | -3.6 |

| United Kingdom | 21 | 63.3 | 22 | 62.1 | 22 | 61.8 | 0 | -0.3 |

| United States | 22 | 62.7 | 21 | 62.8 | 21 | 62.4 | 0 | -0.4 |

Methodological Changes

Each year we review the data and methodology of the Index for ways that could improve how it measures both competitiveness and neutrality. This year we have incorporated several changes to the way the Index treats corporate taxes, individual taxes, property taxes, and cross-border tax rules. No changes were made to the consumption tax category other than routine updates to incorporate the most recent data.

We have applied each change to prior years to allow consistent comparison across years. Data for all years using the current methodology is accessible in the GitHub repository for the Index,[5] and a description of how the Index is calculated is provided in the Appendix of this report. Prior editions of the Index, however, are not comparable to the results in this 2021 edition due to these methodological changes.

General

Colombia was added to this year’s Index as it became the 37th member of the Organisation for Economic Co-operation and Development (OECD) in 2020.[6]

Due to the COVID-19 pandemic, PwC paused its annual “Paying Taxes” study, which we use for the six variables related to tax compliance. Thus, these variables now have a three-year time lag in the Index (two years in previous editions).

Corporate Tax

Over the last few years, several OECD countries have implemented so-called digital services taxes (DSTs). DSTs are taxes on selected gross revenue streams of large digital companies. To capture this new type of tax in the Index we added a new variable called “Digital Services Taxes” in the subcategory “Tax Incentives and Complexity” in the corporate tax section. This change worsens the rank of countries that levy a DST relative to those countries that do not.

Individual Taxes

In previous editions of the Index, the variable “Top Income Tax Rate” reflected the “top marginal personal income tax rate” calculated by the OECD. However, this top marginal personal income tax rate is measured at the income threshold at which the top statutory personal income tax rate first applies. Particularly for countries with flat income tax systems that provide credits or deductions this can mean that the top marginal rates are very low—simply because of the income levels these rates are measured at, not because these are the marginal tax rates that apply to high-income earners. To better reflect the actual top income tax rates we now use the “top statutory personal income tax rate” calculated by the OECD.

Property Taxes

In prior editions of the Index the variable “Wealth Taxes” was binary; a country could either have a wealth tax or not have a wealth tax. However, while some countries levy a comprehensive tax on net wealth, others limit their wealth taxes to selected assets, such as security accounts, financial assets held abroad, or real estate. To better reflect the difference between these two types of wealth taxes, there are now three categories (from best to worst): 1) “No Wealth Tax;” 2) “Wealth Tax on Selected Assets;” and 3) “Net Wealth Tax.”

Cross-Border Tax Rules

In recent years, many OECD countries implemented or adapted their controlled foreign corporation (CFC) rules. The Index looks at 1) whether a country has CFC rules; 2) whether CFC rules apply only to passive income or to all income; and 3) the breadth of exemptions from the general CFC rules. The scoring of the latter two components was slightly adjusted to reflect that some rules exempt CFCs based on substantial economic activities or the share of active income. This change benefits countries that provide exemptions for CFCs with substantial economic activities or a significant share of active income.

Country Profiles

Australia

Australia ranks 9th overall on the 2021 International Tax Competitiveness Index, the same as in 2020. Learn more about the Australian tax system here.

✔️ Some strengths of the Australian tax system:

- Property taxes in Australia are assessed on the value of the land rather than real estate or other improvements to land.

- Australia’s corporate and individual taxes have an integrated treatment of dividends, alleviating the burden of double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income. on distributed earnings.

- Australia ranks well on consumption taxes due to its low goods and services tax (GST) rate but applies it to a relatively narrow base.

❌ Some weaknesses of the Australian tax system:

- Australia’s treaty network consists of just 45 countries, when the average among OECD countries is 75.

- The corporate tax rate in Australia is 30 percent, above the OECD average (22.9 percent).

- Corporations are limited in their ability to write off investments.

Austria

Austria ranks 18th overall on the 2021 International Tax Competitiveness Index, two places worse than in 2020. Learn more about the Austrian tax system here.

✔️ Some strengths of the Austrian tax system:

- Austria’s international tax system is relatively competitive as it is fully territorial without any country limitations, has a broad tax treaty network of 89 countries, and Controlled Foreign Corporation rules that only apply to subsidiaries that do not have substantial economic activity.

- The VAT in Austria applies to a broad base and has better-than-average complexity for compliance and reporting.

- There are no estate, inheritance, or wealth taxes.

❌ Some weaknesses of the Austrian tax system:

- The headline corporate rate of 25 percent is slightly above the OECD average (22.9 percent).

- Austria implemented a digital services tax (DST) in 2020.

- The tax wedgeA tax wedge is the difference between total labor costs to the employer and the corresponding net take-home pay of the employee. It is also an economic term that refers to the economic inefficiency resulting from taxes. on labor is the 3rd highest among OECD countries.

Belgium

Belgium ranks 23rd overall on the 2021 International Tax Competitiveness Index, four spots worse than in 2020. Learn more about the Belgium tax system here.

✔️ Some strengths of the Belgium tax system:

- Belgium has a broad tax treaty network, with 95 countries, and a territorial tax system as it fully exempts foreign-sourced dividends and capital gains without any country limitations.

- Capital gains resulting from normal management of private wealth are exempt from tax.

- Belgium provides an allowance for corporate equity (ACE) to address the debt bias that is inherent to the standard corporate income tax.

❌ Some weaknesses of the Belgium tax system:

- The corporate rate of 25 percent is slightly above average among OECD countries (22.9 percent).

- Belgium levies an estate taxAn estate tax is imposed on the net value of an individual’s taxable estate, after any exclusions or credits, at the time of death. The tax is paid by the estate itself before assets are distributed to heirs. and a financial transaction tax and introduced a new annual tax on securities accounts.

- The Belgian tax wedge on labor is the highest among the OECD countries, with the average single worker facing a tax burden of 51.5 percent.

Canada

Canada ranks 20th overall on the 2021 International Tax Competitiveness Index, two spots worse than in 2020. Learn more about the Canadian tax system here.

✔️ Some strengths of the Canadian tax system:

- Consumption taxes are low, and the associated compliance burden is near the average for OECD countries.

- Canada allows businesses to immediately write off investments in machinery.

- Canada does not levy wealth, estate, or inheritance taxes.

❌ Some weaknesses of the Canadian tax system:

- The personal tax on dividends is 39.3 percent, well above the OECD average of 24.1 percent.

- Canada taxes capital gains at a rate of 26.75 percent, while the OECD average is 19.1 percent.

- The corporate rate of 26.2 percent is above average among OECD countries (22.9 percent).

Chile

Chile ranks 27th overall on the 2021 International Tax Competitiveness Index, five spots better than in 2020. Learn more about the Chilean tax system here.

✔️ Some strengths of the Chilean tax system:

- As a response to the COVID-19 pandemic, Chile temporarily allows businesses to immediately write off investments in buildings and machinery and to immediately amortize intangibles.

- Chile temporarily reduced its corporate income tax rate to 10 percent for most of its businesses.

- Chile has the second lowest tax wedge on labor among OECD countries, at 7 percent, compared to the OECD average of 34.6 percent.

❌ Some weaknesses of the Chilean tax system:

- Labor and consumption taxes are complex, creating a serious compliance burden.

- The tax rate on capital gains was recently increased to 40 percent, well above the OECD average of 19.1 percent.

- Chile has a worldwide tax systemA worldwide tax system for corporations, as opposed to a territorial tax system, includes foreign-earned income in the domestic tax base. As part of the 2017 Tax Cuts and Jobs Act (TCJA), the United States shifted from worldwide taxation towards territorial taxation. , while most OECD countries have territorial provisions.

Colombia

Colombia ranks 31st overall on the 2021 International Tax Competitiveness Index, the same as in 2020. Learn more about the Colombian tax system here.

✔️ Some strengths of the Colombian tax system:

- A worker earning the nation’s average wage faces the lowest tax burden in the OECD.

- Colombia taxes dividends and capital gains at very low rates.

- While capital gains resulting from inheritance and gifts received are subject to a 10 percent tax, there is no comprehensive estate or inheritance tax.

❌ Some weaknesses of the Colombian tax system:

- The VAT base is very narrow, covering less than 40 percent of Colombian consumption.

- Colombia levies a net wealth tax and a financial transactions tax.

- At 31 percent, Colombia’s corporate income tax rate is significantly above the OECD average (22.9 percent).

Czech Republic

The Czech Republic ranks 7th overall on the 2021 International Tax Competitiveness Index, the same as in 2020. Learn more about the Czech tax system here.

✔️ Some strengths of the Czech tax system:

- The corporate rate of 19 percent is below the OECD average (22.9 percent), with above-average cost recoveryCost recovery is the ability of businesses to recover (deduct) the costs of their investments. It plays an important role in defining a business’ tax base and can impact investment decisions. When businesses cannot fully deduct capital expenditures, they spend less on capital, which reduces worker’s productivity and wages. provisions.

- Taxes on labor are minimally distortive.

- The Czech Republic has a territorial tax system, exempting both foreign dividend and capital gains income from other European countries, combined with a broad tax treaty network.

❌ Some weaknesses of the Czech tax system:

- Consumption taxes have a high compliance burden.

- Net operating losses can only be carried forward for five years (they can, however, also be carried back for two years).

- The Czech Republic’s thin capitalization rules are among the stricter ones in the OECD.

Denmark

Denmark ranks 28th overall on the 2021 International Tax Competitiveness Index, the same as in 2020. Learn more about the Danish tax system here.

✔️ Some strengths of the Danish tax system:

- Compliance times associated with corporate, consumption, and individual taxes are all below the OECD averages.

- Denmark has a territorial tax system, exempting both foreign dividend and capital gains income for its treaty partners and other European countries.

- Property taxes are modest, and Denmark allows property taxes to be deducted against corporate income tax.

❌ Some weaknesses of the Danish tax system:

- In addition to a top statutory personal income tax rate of 55.9 percent, the personal income tax rates on dividends and capital gains are both at 42 percent, well above the OECD averages of 24.1 percent and 19.1 percent, respectively.

- Net operating losses can be carried forward indefinitely but are limited to 60 percent of taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. if they exceed a certain amount.

- Denmark uses First-In-First-Out for assessing the cost of inventory for tax purposes.

Estonia

Estonia ranks 1st overall on the 2021 International Tax Competitiveness Index, the same as in 2020, and for the eighth consecutive year. Learn more about the Estonian tax system here.

✔️ Some strengths of the Estonian tax system:

- Estonia’s corporate income tax system only taxes distributed earnings, allowing companies to reinvest their profits tax-free.

- The VAT applies to a broad base and has a low compliance burden.

- Property taxes only apply to the value of land.

❌ Some weaknesses of the Estonian tax system:

- Estonia has tax treaties with just 58 countries, below the OECD average (75 countries).

- Estonia’s territorial tax system is limited to European countries.

- Estonia’s thin capitalization rules are among the more stringent ones in the OECD.

Finland

Finland ranks 15th overall on the 2021 International Tax Competitiveness Index, two places better higher than in 2020. Learn more about the Finnish tax system here.

✔️ Some strengths of the Finnish tax system:

- Finland has a relatively low corporate tax rate of 20 percent.

- The compliance burdens of corporate, consumption, and labor taxes are all below the OECD averages.

- Finland has a territorial tax system and a broad tax treaty network with 76 countries.

❌ Some weaknesses of the Finnish tax system:

- Finland levies both an estate and a financial transactions tax.

- Companies are limited in their ability to carry forward net operating losses and are restricted to using First-In-First-Out as the cost accounting method for inventory.

- Finland’s top statutory rate on personal income is relatively high at 51.2 percent (the OECD average is 42.7 percent).

France

France ranks 35th overall on the 2021 International Tax Competitiveness Index, the same as in 2020. Learn more about the French tax system here.

✔️ Some strengths of the French tax system:

- France has above-average cost recovery provisions for investments in machinery, buildings, and intangibles.

- Corporate and consumption taxes have a relatively low compliance burden.

- France has a broad tax treaty network, with 122 countries.

❌ Some weaknesses of the French tax system:

- France has multiple distortionary property taxes with separate levies on estates, bank assets, financial transactions, and a wealth tax on real estate.

- The tax burden on labor of 46.6 percent is among the highest for OECD countries.

- A reduced 10 percent tax rate applies to income derived from IP rights through a so-called patent boxA patent box—also referred to as intellectual property (IP) regime—taxes business income earned from IP at a rate below the statutory corporate income tax rate, aiming to encourage local research and development. Many patent boxes around the world have undergone substantial reforms due to profit shifting concerns. .

Germany

Germany ranks 16th overall on the 2021 International Tax Competitiveness Index, one place worse than in 2020. Learn more about the German tax system here.

✔️ Some strengths of the German tax system:

- The VAT rate of 19 percent is near the OECD average (19.2 percent) and the VAT compliance burden is relatively low.

- Germany has a broad tax treaty network, with 96 countries.

- Inventory can receive Last-In-First-Out treatment, the most neutral treatment of inventory costs.

❌ Some weaknesses of the German tax system:

- Germany has the fifth highest corporate income tax rate among OECD countries, at 29.9 percent.

- The personal income tax is complex with an associated compliance burden of 134 hours—the third highest among OECD countries.

- Companies are limited in the amount of net operating losses they can use to offset income on future or previous tax returns.

Greece

Greece ranks 29th overall on the 2021 International Tax Competitiveness Index, the same as in 2020. Learn more about the Greek tax system here.

✔️ Some strengths of the Greek tax system:

- The net personal tax rate of 5 percent on dividends is significantly below the OECD average of 24.1 percent.

- Labor tax complexity is below the OECD average.

- Controlled Foreign Corporation rules in Greece are modest and only apply to passive income.

❌ Some weaknesses of the Greek tax system:

- Companies are severely limited in the amount of net operating losses they can use to offset future profits, and companies cannot use losses to reduce past taxable income.

- Greece has a relatively narrow tax treaty network (57 treaties compared to an OECD average of 75 treaties).

- At 24 percent, Greece has one of the highest VAT rates in the OECD on one of the narrowest bases.

Hungary

Hungary ranks 13th overall on the 2021 International Tax Competitiveness Index, the same as in 2020. Learn more about the Hungarian tax system here.

✔️ Some strengths of the Hungarian tax system:

- Hungary has the lowest corporate tax rate in the OECD, at 9 percent.

- Hungary has a flat personal income tax system.

- Controlled Foreign Corporation rules are better-than-average.

❌ Some weaknesses of the Hungarian tax system:

- Companies are severely limited in the amount of net operating losses they can use to offset future profits, and companies cannot use losses to reduce past taxable income.

- Hungary has the highest VAT rate among OECD countries, at 27 percent.

- Hungary levies taxes on estates, real estate transfers, and bank assets.

Iceland

Iceland ranks 32nd overall on the 2021 International Tax Competitiveness Index, two spots worse than in 2020. Learn more about the Icelandic tax system here.

✔️ Some strengths of the Icelandic tax system:

- Iceland’s corporate tax rate of 20 percent is below the OECD average of 22.9 percent, and the tax treatment of investments is one of the best in the OECD.

- Corporate, consumption, and labor taxes are less complex than they are on average in the OECD.

- Iceland has a territorial tax system that fully exempts foreign dividends and capital gains with no country limitations.

❌ Some weaknesses of the Icelandic tax system:

- Companies are limited in the amount of net operating losses they can use to offset future profits, and companies cannot use losses to reduce past taxable income.

- The VAT of 24 percent applies to a relatively narrow tax base.

- Iceland’s Controlled Foreign Corporation rules apply to both passive and active income.

Ireland

Ireland ranks 19th overall on the 2021 International Tax Competitiveness Index, one spot better than in 2020. Learn more about the Irish tax system here.

✔️ Some strengths of the Irish tax system:

- Ireland has a low corporate tax rate of 12.5 percent.

- Net operating losses can be carried back one year and carried forward indefinitely, allowing companies to be taxed on their average profitability.

- Ireland has no formal thin capitalization rules.

❌ Some weaknesses of the Irish tax system:

- Ireland’s personal tax rate on dividend income of 51 percent is the highest among OECD countries.

- The VAT rate of 23 percent is one of the highest in the OECD and applies to a relatively narrow tax base.

- Corporations are limited in their ability to write off investments.

Israel

Israel ranks 14th overall on the 2021 International Tax Competitiveness Index, 13 spots better than in 2020, making the most improvement. Learn more about the Israeli tax system here.

✔️ Some strengths of the Israeli tax system:

- Net operating losses can be carried forward indefinitely.

- The VAT rate is relatively low at 17 percent and applies to a relatively broad base.

- Israel does not levy wealth or estate taxes.

❌ Some weaknesses of the Israeli tax system:

- On average, compliance with the corporate code takes 110 hours (compared to an OECD average of 42 hours).

- The steep progressivity of Israel’s taxes on labor leads to efficiency costs.

- Israel has a relatively narrow tax treaty network, with 58 countries (the OECD average is 75).

Italy

Italy ranks 37th overall on the 2021 International Tax Competitiveness Index, the same as in 2020. Learn more about the Italian tax system here.

✔️ Some strengths of the Italian tax system:

- Italy has above-average cost recovery provisions for investments in intangibles, as well as an allowance for corporate equity (ACE).

- Last-In-First-Out treatment of the cost of inventory is allowed.

- Italy has a broad tax treaty network, with 100 countries.

❌ Some weaknesses of the Italian tax system:

- Italy has multiple distortionary property taxes with separate levies on real estate transfers, estates, and financial transactions, as well as a wealth tax on selected assets.

- The VAT rate of 22 percent applies to the fourth narrowest consumption tax base in the OECD (tied with Colombia).

- Compliance with the personal income tax system takes 169 hours on average, highest by far in the OECD (the OECD average is 66 hours).

Japan

Japan ranks 24th overall on the 2021 International Tax Competitiveness Index, one place worse than in 2020. Learn more about the Japanese tax system here.

✔️ Some strengths of the Japanese tax system:

- Japan has a low VAT rate of 10 percent applied to a broad base.

- Corporate and consumption taxes are less complex than they are on average in the OECD.

- Japan’s personal income tax rate on dividends is 20.3 percent, below the OECD average of 24.1 percent.

❌ Some weaknesses of the Japanese tax system:

- Japan has poor cost recovery provisions for business investments in machinery and buildings.

- Japan has a hybrid international tax system with a 95 percent exemption for foreign dividends and no exemption for foreign capital gains, while many OECD countries have moved to a fully territorial system.

- Companies are severely limited in the amount of net operating losses they can use to offset future profits.

Korea

Korea ranks 26th overall on the 2021 International Tax Competitiveness Index, one spot worse than in 2020. Learn more about the Korean tax system here.

✔️ Some strengths of the Korean tax system:

- Korea has a low VAT of 10 percent that is applied to a relatively broad base.

- Korea has a broad tax treaty network, with 93 countries.

- Business investments in machinery receive better-than-average treatment for corporate write-offs.

❌ Some weaknesses of the Korean tax system:

- Korea has multiple distortionary property taxes with separate levies on real estate transfers, estates, and financial transactions.

- The personal income tax rate on dividends is 44.0 percent (compared to an OECD average of 24.1 percent).

- Korea is one of the few OECD countries that operates a worldwide corporate tax system (rather than a territorial system).

Latvia

Latvia ranks 2nd overall on the 2021 International Tax Competitiveness Index, the same as in 2020. Learn more about the Latvian tax system here.

✔️ Some strengths of the Latvian tax system:

- Latvia’s corporate income tax system only taxes distributed earnings, allowing companies to reinvest their profits tax-free.

- Corporations can deduct property taxes when calculating taxable income.

- Taxes on labor are relatively flat, allowing the government to raise revenue from taxes on workers with very few distortions.

❌ Some weaknesses of the Latvian tax system:

- Latvia’s network of tax treaties includes 62 countries, a relatively low number.

- Latvia’s thin-capitalization rules are among the stricter ones in the OECD.

- The threshold at which the VAT applies is significantly higher than the average VAT threshold for OECD countries.

Lithuania

Lithuania ranks 6th overall on the 2021 International Tax Competitiveness Index, the same as in 2020. Learn more about the Lithuanian tax system here.

✔️ Some strengths of the Lithuanian tax system:

- Business investments in machinery, buildings, and intangibles receive better-than-average tax treatment.

- Lithuania’s corporate tax rate is 15 percent, well below the OECD average of 22.9 percent.

- Lithuania’s taxes on labor are relatively flatter than average, allowing the government to raise revenue from taxes on workers with very few distortions.

❌ Some weaknesses of the Lithuanian tax system:

- Lithuania has tax treaties with just 54 countries, below the OECD average (75 countries).

- Lithuania has both a patent box and a super deduction for Research and Development expenditures.

- Multinational businesses face strict thin capitalization rules.

Luxembourg

Luxembourg ranks 5th overall on the 2021 International Tax Competitiveness Index, the same as in 2020. Learn more about the Luxembourg tax system here.

✔️ Some strengths of the Luxembourg tax system:

- Business investments in machinery and intangibles receive better-than-average tax treatment.

- Luxembourg applies its relatively low VAT rate of 17 percent on almost all final consumption.

- Capital gains are tax-exempt if a movable asset such as shares was held for at least six months, encouraging long-term savings.

❌ Some weaknesses of the Luxembourg tax system:

- Companies are limited in the time period in which they can use net operating losses to offset future profits and are unable to use losses to offset past taxable income.

- Luxembourg has several distortionary property taxes with separate levies on real estate transfers, estates, and corporate net assets.

- The income tax is relatively progressive with a combined top statutory rate on personal income of 45.8 percent.

Mexico

Mexico ranks 33rd overall on the 2021 International Tax Competitiveness Index, the same as in 2020. Learn more about the Mexican tax system here.

✔️ Some strengths of the Mexican tax system:

- The personal income tax rate on dividends is 17.1 percent, below the OECD average of 24.1 percent.

- Corporations can deduct property taxes when calculating taxable income.

- Mexico allows for Last-In-First-Out treatment of the cost of inventory.

❌ Some weaknesses of the Mexican tax system:

- Average compliance time associated with corporate and consumption taxes is estimated to be around 100 hours for each tax annually.

- The VAT base is the narrowest in the OECD, with only one third of final consumption being taxed.

- Mexico has a higher-than-average corporate tax rate of 30 percent (the OECD average is 22.9 percent).

Netherlands

The Netherlands ranks 12th overall on the 2021 International Tax Competitiveness Index, the same as in 2020. Learn more about the Dutch tax system here.

✔️ Some strengths of the Dutch tax system:

- The Netherlands allows net operating losses to be carried back one year, and the Last-In-First-Out treatment of the cost of inventory is allowed.

- The Netherlands has a territorial tax system exempting both foreign dividends and capital gains and a broad tax treaty network, with 96 countries.

- Corporations can deduct property taxes when calculating taxable income.

❌ Some weaknesses of the Dutch tax system:

- The Netherlands has a progressive taxA progressive tax is one where the average tax burden increases with income. High-income families pay a disproportionate share of the tax burden, while low- and middle-income taxpayers shoulder a relatively small tax burden. system with a combined top rate on personal income of 49.5 percent.

- The VAT of 21 percent applies to approximately half of the potential consumption tax base.

- Companies are severely limited in the time period in which they can use net operating losses to offset future profits.

New Zealand

New Zealand ranks 3rd overall on the 2021 International Tax Competitiveness Index, the same as in 2020. Learn more about the New Zealand tax system here.

✔️ Some strengths of the New Zealand tax system:

- New Zealand allows corporate losses to be carried forward indefinitely and has introduced a temporary one-year carryback provision, allowing businesses to be taxed on their average profitability.

- The VAT of 15 percent applies to nearly the entire potential consumption tax base.

- New Zealand property taxes apply just to the value of land rather than real estate or other improvements to the land.

❌ Some weaknesses of the New Zealand tax system:

- New Zealand has an above-average corporate tax rate of 28 percent (the OECD average is 22.9 percent) and relatively poor cost recovery provisions for business investments.

- New Zealand has a narrow tax treaty network, with 40 countries.

- The cost of inventory can be accounted for using First-In-First-Out method or the average cost method (Last-In-First-Out is not permitted).

Norway

Norway ranks 10th overall on the 2021 International Tax Competitiveness Index, one place better than in 2020. Learn more about the Norwegian tax system here.

✔️ Some strengths of the Norwegian tax system:

- Norway allows corporate losses to be carried forward indefinitely and its corporate income tax rate of 22 percent is close to the OECD average (22.9 percent).

- Compliance time associated with corporate and individual taxes is below average.

- Norway has a territorial tax system, with a network of 87 tax treaties.

❌ Some weaknesses of the Norwegian tax system:

- Corporations are limited in their ability to write off investments.

- Norway is one of the few OECD countries that levies a net wealth tax.

- Controlled Foreign Corporation rules are applied to both passive and active income.

Poland

Poland ranks 36th overall on the 2021 International Tax Competitiveness Index, the same as in 2020. Learn more about the Polish tax system here.

✔️ Some strengths of the Polish tax system:

- Poland has a below-average corporate tax rate of 19 percent (OECD average is 22.9 percent).

- Poland’s taxes on labor are generally flat, allowing the government to raise revenue from taxes on workers with relative low efficiency costs.

- Poland has a broad tax treaty network including 85 countries.

❌ Some weaknesses of the Polish tax system:

- Poland has multiple distortionary property taxes with separate levies on real estate transfers, estates, bank assets, and financial transactions.

- Companies are severely limited in the amount of net operating losses they can use to offset future profits and are unable to use losses to reduce past taxable income.

- Companies can only write off 33.8 percent of the cost of industrial buildings in real terms (the OECD average is 50.1 percent).

Portugal

Portugal ranks 34th overall on the 2021 International Tax Competitiveness Index, the same as in 2020. Learn more about the Portuguese tax system here.

✔️ Some strengths of the Portuguese tax system:

- Corporations can deduct their property taxes from their taxable income, and there is an allowance for corporate equity (ACE).

- Portugal has a territorial tax system, exempting foreign dividend and capital gains income for most countries.

- Portugal provides above-average capital cost write-offs for investments in machinery.

❌ Some weaknesses of the Portuguese tax system:

- Portugal has a high corporate tax rate of 31.5 percent (the OECD average is 22.9 percent).

- Companies are severely limited in the amount of net operating losses they can use to offset future profits and are unable to use losses to reduce past taxable income.

- The VAT at a rate of 23 percent applies to just half of the potential consumption tax base.

Slovak Republic

The Slovak Republic ranks 11th overall on the 2021 International Tax Competitiveness Index, three spots better than in 2020. Learn more about the Slovakian tax system here.

✔️ Some strengths of the Slovakian tax system:

- The personal income rate on dividends is very low at 7 percent (compared to an OECD average of 24.1 percent).

- The Slovak Republic has better-than-average tax treatment of business investment in machinery, buildings, and intangibles.

- Corporations can deduct property taxes when calculating taxable income.

❌ Some weaknesses of the Slovakian tax system:

- Companies are severely limited in the amount of net operating losses they can use to offset future profits and are unable to use losses to reduce past taxable income.

- The VAT of 20 percent applies to approximately half of the potential consumption tax base.

- The Slovak Republic has both a patent box and a super deduction for Research and Development expenditures.

Slovenia

Slovenia ranks 25th overall on the 2021 International Tax Competitiveness Index, one place worse than in 2020. Learn more about the Slovenian tax system here.

✔️ Some strengths of the Slovenian tax system:

- Slovenia has a 19 percent corporate tax rate, below the OECD average (22.9 percent).

- Slovenia’s 22 percent VAT applies to a relatively broad base.

- Capital gains taxes are reduced the longer assets are held (a zero percent rate applies after holding an asset for at least 20 years), encouraging long-term savings.

❌ Some weaknesses of the Slovenian tax system:

- Slovenia’s tax treatment of investments in buildings and intangibles is below the OECD average.

- Slovenia has a relatively narrow tax treaty network, with 59 countries, and only a partial territorial tax system.

- Slovenia has multiple distortionary property taxes with separate levies on real estate transfers, estates, and bank assets.

Spain

Spain ranks 30th overall on the 2021 International Tax Competitiveness Index, four places worse than in 2020. Learn more about the Spain tax system here.

✔️ Some strengths of the Spanish tax system:

- Spain has a territorial tax system that exempts both foreign dividends and capital gains income from taxation.

- The Spanish tax treaty network is made up of 93 countries.

- Property taxes can be deducted against corporate income taxes.

❌ Some weaknesses of the Spanish tax system:

- The VAT of 21 percent applies to less than half of the potential consumption tax base.

- Spain has multiple distortionary property taxes with separate levies on real estate transfers, net wealth, estates, and financial transactions.

- Spain has both a patent box and a credit for Research and Development.

Sweden

Sweden ranks 8th overall on the 2021 International Tax Competitiveness Index, the same as in 2020. Learn more about the Swedish tax system here.

✔️ Some strengths of the Swedish tax system:

- Sweden provides for net operating losses to be carried forward indefinitely, allowing for corporations to be taxed on their average profitability.

- Sweden has a territorial tax system that exempts both foreign dividends and capital gains income from taxation without any country limitations.

- Sweden has a broad tax treaty network, with 81 countries.

❌ Some weaknesses of the Swedish tax system:

- Sweden’s personal dividend tax rate and capital gains tax rate are both 30 percent, above the OECD average (24.1 percent for dividends and 19.1 percent for capital gains).

- Sweden has a top statutory personal income tax rate of 52.3 percent, which is above the OECD average (42.7 percent).

- Sweden has Controlled Foreign Corporation rules that apply to both passive and active income.

Switzerland

Switzerland ranks 4th overall on the 2021 International Tax Competitiveness Index, the same as in 2020. Learn more about the Swiss tax system here.

✔️ Some strengths of the Swiss tax system:

- Switzerland has above-average cost recovery provisions for investments in buildings and intangibles.

- Switzerland has a broad tax treaty network, with 93 countries.

- The Swiss VAT of 7.7 percent applies to a broad base and has very low compliance costs.

❌ Some weaknesses of the Swiss tax system:

- Switzerland has multiple distortionary property taxes with separate levies on real estate transfers, net wealth, estates, assets, and financial transactions.

- Companies are limited in the time period in which they can use net operating losses to offset future profits and are unable to use losses to reduce past taxable income.

- The VAT exemption threshold is almost twice as high as the OECD average.

Turkey

Turkey ranks 17th overall on the 2021 International Tax Competitiveness Index, seven places worse than in 2020. Learn more about the Turkish tax system here.

✔️ Some strengths of the Turkish tax system:

- Turkey has a territorial tax system exempting foreign dividends and capital gains income without any country limitations.

- The personal income tax on dividends is 20 percent, below the OECD average (24.1 percent).

- Turkey provides an allowance for equity (ACE), addressing the debt bias inherent to the standard corporate income tax.

❌ Some weaknesses of the Turkish tax system:

- Companies are severely limited in the time period in which they can use net operating losses to offset future profits and are unable to use losses to reduce past taxable income.

- Turkey’s VAT rate of 18 percent applies to just a third of the potential tax base.

- Turkey has multiple distortionary property taxes with separate levies on real estate transfers, estates, and financial transactions.

United Kingdom

The United Kingdom ranks 22nd overall on the 2021 International Tax Competitiveness Index, the same as in 2020. Learn more about the UK tax system here.

✔️ Some strengths of the UK tax system:

- The corporate income tax rate is 19 percent, below the OECD average (22.9 percent).

- The UK has a territorial tax system exempting both foreign dividend and capital gains income without any country limitations.

- The UK tax treaty network with 130 countries is the broadest in the OECD.

❌ Some weaknesses of the UK tax system:

- The top personal income tax rate on dividends is 38.1 percent, well above the OECD average (24.1 percent).

- The real property tax burden is among the highest in the OECD.

- The VAT at a rate of 20 percent applies to less than half of the potential consumption tax base.

United States

The United States ranks 21st overall on the 2021 International Tax Competitiveness Index, the same as in 2020. Learn more about the U.S. tax system here.

✔️ Some strengths of the U.S. tax system:

- The U.S. provides full expensing for business investments in machinery.

- The U.S. allows for Last-In-First-Out treatment of the cost of inventory.

- Corporations can deduct property taxes when calculating taxable income.

❌ Some weaknesses of the U.S. tax system:

- U.S. states’ sales taxes apply on average only to a third of the potential tax base.

- The U.S. has a partial territorial system and does not exempt foreign capital gains income.

- The real property tax burden is among the highest in the OECD.

Note: Each year we review and improve the methodology of the Index. For that reason, prior editions are not comparable to the results in this 2020 edition. All data and methodological notes are accessible in our GitHub repository.

[1] Cristina Enache, “Sources of Government Revenue in the OECD,” Tax Foundation, Feb. 11, 2021, https://www.taxfoundation.org/publications/sources-of-government-revenue-in-the-oecd/.

[2] Organisation for Economic Co-operation and Development (OECD), “Tax and Economic Growth,” Economics Department Working Paper No. 620, July 11, 2008.

[3] Costa Rica joined the OECD in May 2021, becoming its 38th member. Due to data availability Costa Rica is not included in this edition of the Index but will be included starting next year.

[4] Last year’s scores published in this report can differ from previously published rankings due to both methodological changes and corrections made to previous years’ data.

[5] Tax Foundation, “International Tax Competitiveness Index,” https://github.com/TaxFoundation/international-tax-competitiveness-index.

[6] Costa Rica joined the OECD in 2021 and will be included in next year’s edition of the International Tax Competitiveness Index.

Share