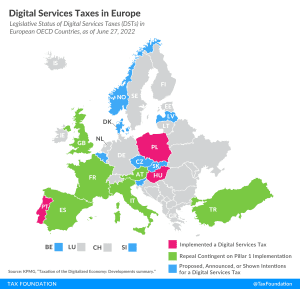

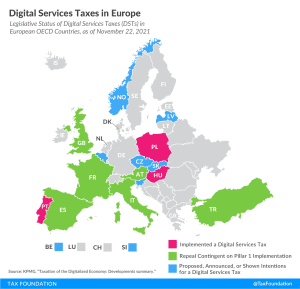

Digital Services Taxes in Europe, 2022

About half of all European OECD countries have either announced, proposed, or implemented a digital services tax.

7 min readElke Asen was a Policy Analyst with the Tax Foundation’s Center for Global Tax Policy, focusing on international tax issues and tax policy in Europe. Prior to joining the Tax Foundation, Elke interned with the EU Delegation in Washington, D.C., the German Development Agency, and a social startup in Munich, Germany. She holds a BS in Economics from Ludwig Maximilian University of Munich.

Elke was born and raised in a small town of 500 people outside of Salzburg, Austria, and loves to travel. Road tripping and backpacking are her favorites.

About half of all European OECD countries have either announced, proposed, or implemented a digital services tax.

7 min read

Despite ongoing multilateral negotiations in the OECD, about half of all European OECD countries have either announced, proposed, or implemented their own unilateral digital services tax.

7 min read

A well-structured tax code (that’s both competitive and neutral) is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

40 min read

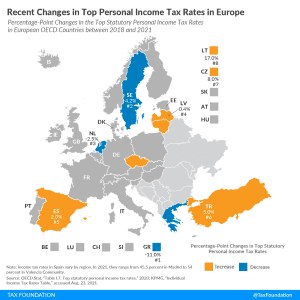

In the past three years, eight European OECD countries changed their top personal income tax rate, of which four of them cut their top personal income tax rates.

3 min read

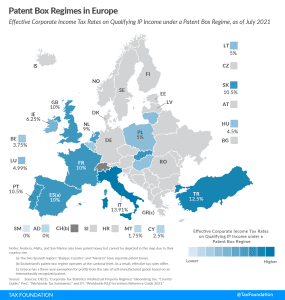

Patent box regimes (also referred to as intellectual property, or IP, regimes) provide lower effective tax rates on income derived from IP. Most commonly, eligible types of IP are patents and software copyrights. Currently, 14 of the 27 EU member states have a patent box regime.

4 min read

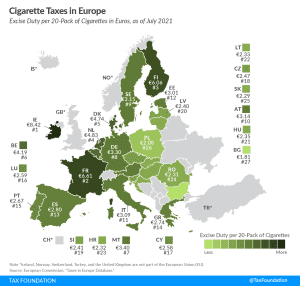

Ireland and France levy the highest excise duties on cigarettes in the EU, at €8.42 ($9.60) and €6.61 ($7.53) per 20-cigarette pack, respectively. This compares to an EU average of €3.34 ($3.80). Bulgaria (€1.81 or $2.06) and Poland (€2.08 or $2.37) levy the lowest excise duties.

3 min read

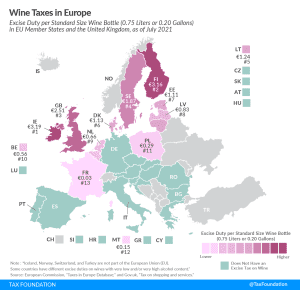

As one might expect, southern European countries that are well-known for their wines—such as France, Greece, Portugal, and Spain—either don’t tax it or do so at a very low rate. But travel north and you’ll see countries that tend to levy taxes on wine—and often hefty taxes.

3 min read

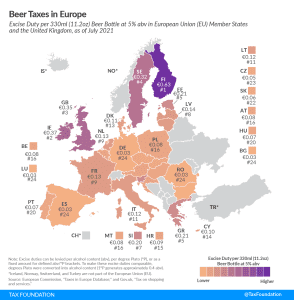

Finland has the highest excise tax on beer in Europe, followed by Ireland and the United Kingdom. Compare beer taxes in Europe this International Beer Day

3 min read

New data clearly points to an increase in tax complexity for multinationals in the OECD as well as globally. The OECD’s ongoing efforts to reform the international tax system will likely further add complexity to the international tax environment.

3 min read

The United Nations (UN) recently released its annual “World Investment Report,” which shows the dramatic fall in global foreign direct investment (FDI) caused by the COVID-19 crisis.

3 min read

During the COVID-19 pandemic, several OECD countries temporarily expanded their NOL carrybacks and carryforwards to provide relief to illiquid but otherwise solvent businesses. These policies should be made permanent and, where necessary, expanded.

21 min read

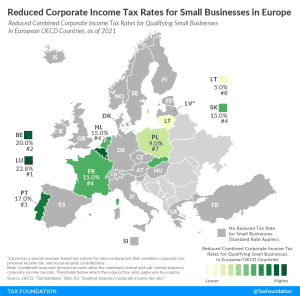

Corporate income taxes are commonly levied as a flat rate on business profits. However, some countries provide reduced corporate income tax rates for small businesses. Out of 27 European OECD countries covered in today’s map, eight levy a reduced corporate tax rate on businesses that have revenues or profits below a certain threshold.

3 min read

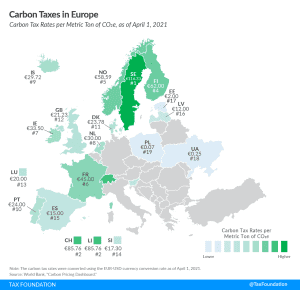

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems (ETS), and carbon taxes.

3 min read

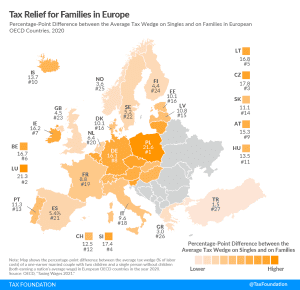

Most countries provide tax relief to families with children—typically through targeted tax breaks that lower income taxes. While all European OECD countries provide tax relief for families, its extent varies substantially across countries.

2 min readTo encourage private retirement savings, OECD countries commonly provide tax-preferred retirement accounts. However, in many countries, including the United States, the system of tax-preferred retirement accounts is complex, which may deter savers from using such accounts—and potentially lower overall savings.

21 min read

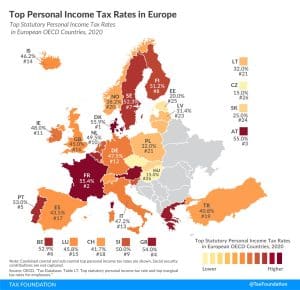

Most countries’ personal income taxes have a progressive structure, meaning that the tax rate paid by individuals increases as they earn higher wages. The highest tax rate individuals pay differs significantly across Europe, with Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) having the highest top statutory personal income tax rates among European OECD countries.

3 min read

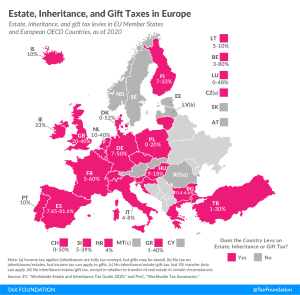

Estate tax is levied on the property of the deceased and is paid by the estate itself. Inheritance taxes, in contrast, are only levied on the value of assets transferred and are paid by the heirs. Gift taxes are levied when property is transferred by a living individual. The majority of European countries covered in today’s map currently levy estate, inheritance, or gift taxes.

3 min read

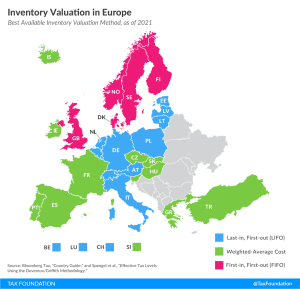

The method by which a country allows businesses to account for inventories can significantly impact a business’s taxable income. When prices are rising, as is usually the case due to factors like inflation, LIFO is the preferred method because it allows inventory costs to be closer to true costs at the time of sale.

2 min read