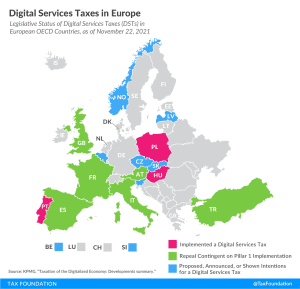

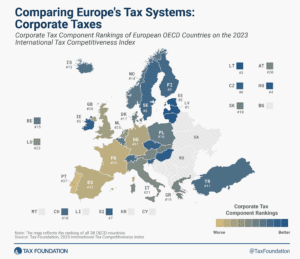

Digital Taxation Around the World

The digitalization of the economy has been a key focus of tax debates in recent years. Our new report reviews digital tax policies around the world with a focus on OECD countries, explores the various flaws and benefits associated with the wide set of proposals, and provides recommendations for lawmakers to consider.

12 min read