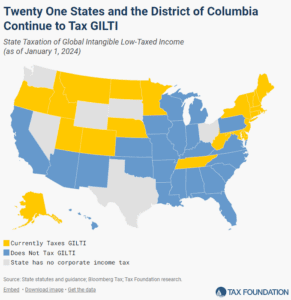

GILTI Tax Treatment by State, 2024

States that tax GILTI increase filing complexity, drive up the cost of tax compliance, and introduce unnecessary economic uncertainty and legal risk. 21 states and DC continue to tax GILTI despite these challenges.

6 min read