A capital allowance is the amount of capital investment costs, or money directed towards a company’s long-term growth, a business can deduct each year from its revenue via depreciation. These are also sometimes referred to as depreciation allowances.

Capital Allowances and Cost Recovery

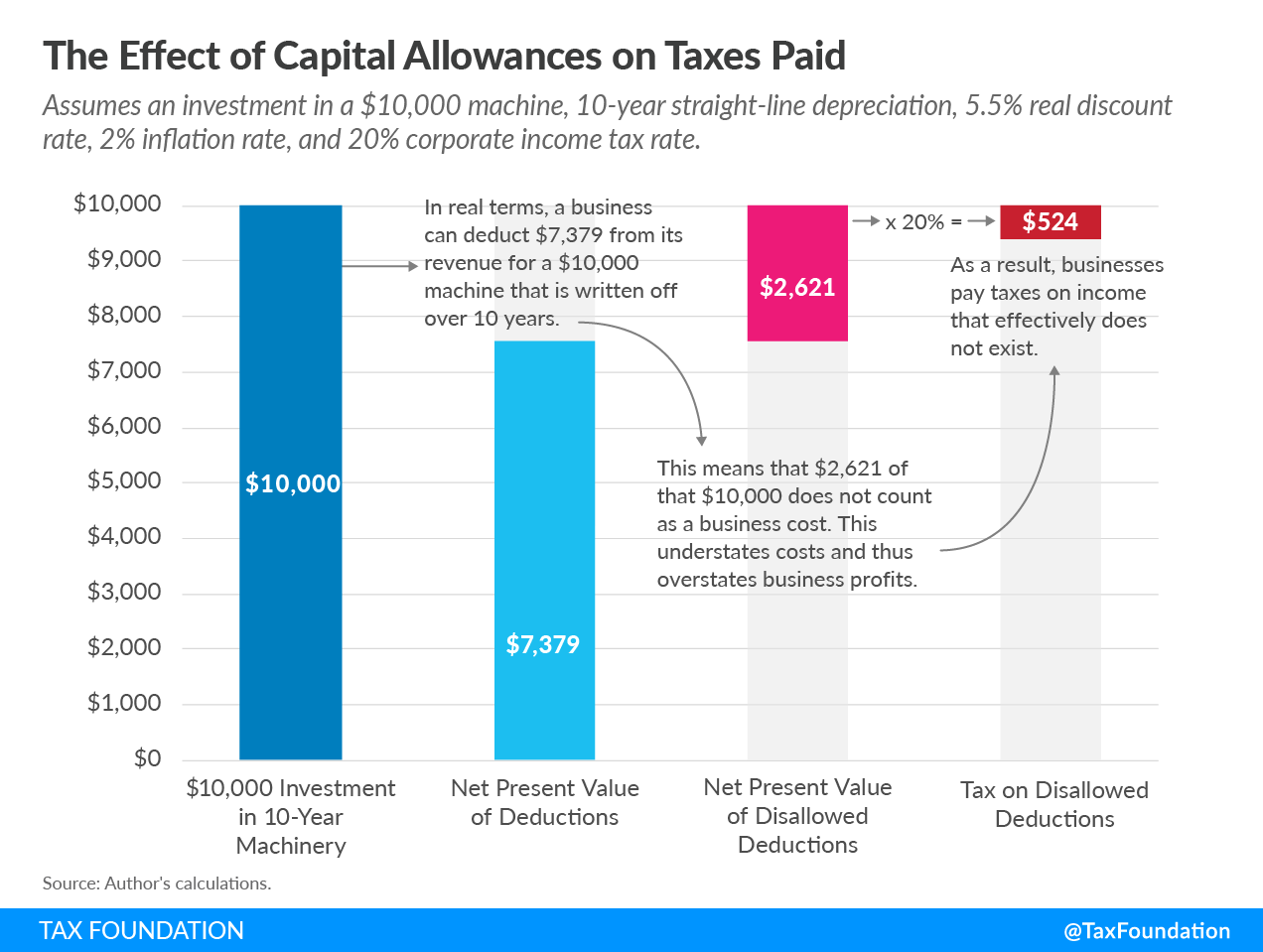

Governments set depreciation schedules to define when businesses can deduct their capital investment costs from their revenues. The amount of investment costs a business can deduct in a year is called a capital allowance. This is a form of cost recovery, or the ability of businesses to recover (deduct) the costs of their investments.

Capital cost recovery plays an important role in defining a business’s corporate tax base and directly impacts investment decisions. When businesses are not allowed to fully deduct capital expenditures in real terms, they make fewer capital investments, which can reduce worker productivity and wages.

Capital Allowances and Economic Growth

Depending on their structure, capital allowances can have important economic impacts by either boosting or slowing investment which, in turn, impacts economic growth.

Lower capital allowances increase the cost of capital, which leads to less investment and reduces productivity, employment, and wages. For example, a government could lengthen the time frame (depreciation schedule) for the deduction of machinery, which would increase short-term costs and slow or reduce investment in machinery, harming the manufacturing industry.

Conversely, if the depreciation schedule were shortened, or if businesses were allowed to fully expense machinery, businesses would be more inclined or able to invest in machinery and boost production, employment, wages, and spur economic growth.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe