Zoom Calls Not a Taxing Matter

Zoom Video Communications announced that, come November, the company will start collecting and remitting local utility and communications taxes in California, New York, Maryland, and Virginia.

5 min read

Zoom Video Communications announced that, come November, the company will start collecting and remitting local utility and communications taxes in California, New York, Maryland, and Virginia.

5 min read

The IRS recently released the new 2021 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, Alternative Minimum Tax (AMT), Earned Income Tax Credit (EITC), Child Tax Credit (CTC), capital gains brackets, qualified business income deduction (199A), and the annual exclusion for gifts.

6 min read

They may not draw as much attention as elections for office, but Election Day 2020 will also feature a number of important votes on tax-related ballot initiatives in states around the country. What are the ballot measures taxpayers should be paying attention to this year and what could they mean for the future of state tax policy? Tax Foundation Vice President of State Projects Jared Walczak and Senior Policy Analyst Katherine Loughead break down measures ranging from recreational marijuana legalization in New Jersey and Montana to income tax increases in Illinois and Arizona.

Our new guide identifies key areas for improvement in UK tax policy and provides recommendations that would support long-term growth without putting a dent in government revenues.

24 min read

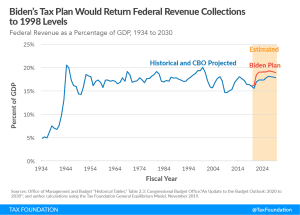

If we consider Biden’s tax plan over the entire budget window (2021 to 2030) as a percentage of GDP—1.30 percent—it would rank as the 6th largest tax increase since the 1940s and and one of the largest tax increases not associated with wartime funding.

6 min read

What has President Joe Biden proposed in terms of tax policy changes? Our experts provide the details and analyze the potential economic, revenue, and distributional impacts.

23 min read

If we look at both the legal incidence of the Biden-Harris policy proposals and their economic incidence, we find both direct and indirect tax increases on many taxpayers who earn less than $400,000.

2 min read

President Joe Biden’s tax plan would yield combined top marginal state and local rates in excess of 60 percent in three states: California, Hawaii, and New Jersey (also New York City).

4 min read

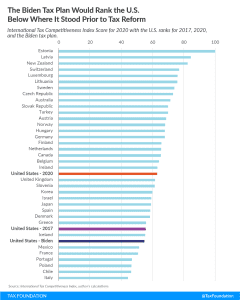

While the Biden campaign is certainly focused on increasing taxes on U.S. businesses and high-income earners, it is important that policymakers also understand what that reversal might do to U.S. competitiveness, and the competitive global environment in which U.S. companies and U.S. workers operate.

3 min read

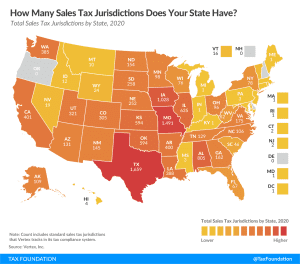

Following the Wayfair decision, states’ move to tax online sales has increased the importance of simplicity in sales tax systems, as sellers now have to deal with differing regulations in multiple states. There are over 11,000 standard sales tax jurisdictions in the United States in 2020

2 min read

Significantly raising the income tax through Proposition 208 will only serve to make Arizona less competitive, especially at a time when individuals and small businesses are already struggling. If Arizona is looking for a long-term way to increase education funding, it would do well to avoid overburdening struggling taxpayers and look toward more broad-based, stable sources of revenue.

5 min read

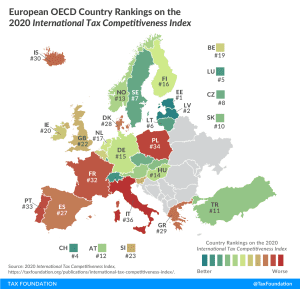

Our International Index compares OECD countries on over 40 variables that measure how well each country’s tax system promotes sustainable economic growth and investment.

13 min read

A competitive tax code has never been more important, and these tax policy improvements can both strengthen the short-term economic recovery and promote long-term economic growth in Nebraska.

26 min read

What can the U.S. do to raise the revenue needed for infrastructure upkeep and accurately internalize the costs associated with road usage?

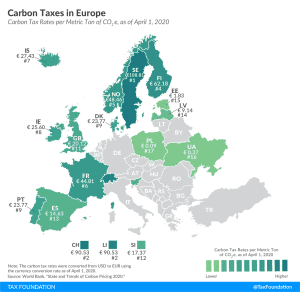

17 European countries have implemented a carbon tax, ranging from less than €1 per metric ton of carbon emissions in Ukraine and Poland to over €100 in Sweden.

3 min read

Spain’s upper house passed two major tax bills today: the financial transaction tax (FTT) and the digital service tax (DST). Both taxes will go into effect in January 2021.

3 min read

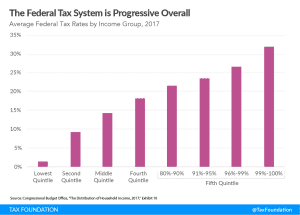

Contrary to the perceptions of some, new data indicate that (1) income earned after taxes and transfers has increased over the past several decades for all income groups; (2) the federal tax system is increasingly progressive; and (3) that system relies heavily on higher earners to raise revenue for government services and means-tested transfers.

3 min read

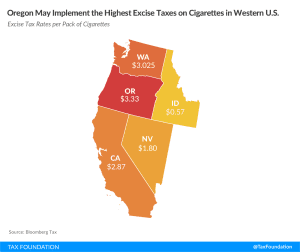

Oregon’s Measure 108 introduces a risk of increased tax avoidance and evasion activity as consumers of the products often procure cigarettes from lower tax jurisdictions. At $3.33 per pack, Oregon would have the highest excise tax on cigarettes in the region.

5 min read