All Related Articles

Revenue Gains in Asian and Pacific Countries Likely Offset by COVID-19

Because of the COVID-19 pandemic and the associated economic crisis, countries in the Asia-Pacific region will see a differentiated impact on their capacity of mobilizing domestic revenue depending on the structure of their economy. According to the OECD report, those economies that rely mostly on natural resources, tourism, and trade taxes are especially vulnerable.

5 min read

New York and New Jersey Consider Financial Transaction Taxes

Seeking new sources of funding, New York and New Jersey—two states at the heart of global financial markets—are considering financial transaction taxes.

5 min read

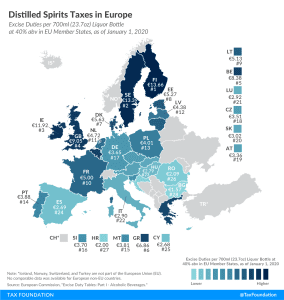

Distilled Spirits Taxes in Europe

2 min read

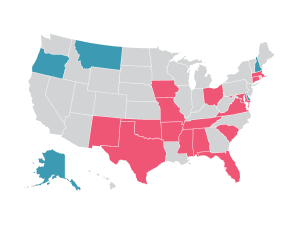

Sales Tax Holidays by State, 2020

In the midst of the coronavirus crisis, some states are hoping that a sales tax holiday might help restart struggling industries by stimulating the economy. However, sales tax holidays can mislead consumers about savings and distract from genuine, permanent tax relief.

41 min read

Tax Options to Promote Short-Term Recovery and Long-Term Economic Growth in Wisconsin

From a revenue standpoint, Wisconsin was better off than many states going into this crisis, but the policy decisions—including tax policy decisions—state policymakers make in the months ahead will have far-reaching implications for how quickly jobs and wages are restored in Wisconsin.

7 min read

Financial Transaction Tax Could Hit Average Spanish

Spain is planning to implement two major taxes during the next few months, a digital services tax and a financial transaction tax, which have the potential to negatively impact capital formation, growth, and economic recovery and start a harmful trade war.

5 min read

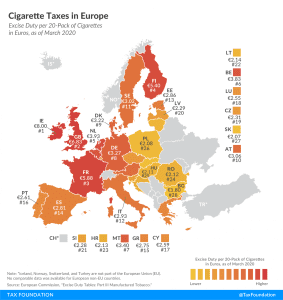

Cigarette Taxes in Europe, 2020

Ireland and the United Kingdom levy the highest excise duties on cigarettes in the European Union (EU), at €8.00 ($8.95) and €6.83 ($7.64) per 20-cigarette pack, respectively. This compares to an EU average of €3.22 ($3.61). Bulgaria (€1.80 or $2.01) and Slovakia (€2.07 or $2.32) levy the lowest excise duties.

3 min read