Sen. Warren’s Wealth Tax Is Problematic

Sen. Elizabeth Warren recently proposed a wealth tax on high-net-worth individuals, a type of tax that is poorly targeted, difficult to administer, and raises constitutional questions.

4 min read

Sen. Elizabeth Warren recently proposed a wealth tax on high-net-worth individuals, a type of tax that is poorly targeted, difficult to administer, and raises constitutional questions.

4 min read

A new, high tax rate on capital gains income would be a risky move for Washington State even if it didn’t face an enormous constitutional challenge.

5 min read

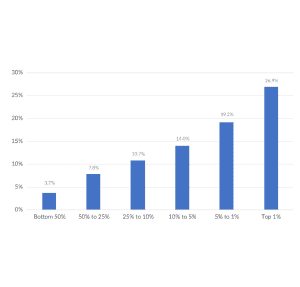

Due to a narrow tax base and a decrease in capital gains realizations, Congresswoman Ocasio-Cortez’s plan to tax income above $10 million would not raise as much revenue as intended. See our 10-year revenue estimates.

9 min read

Recent interest in raising the tax burden on high-income individuals glosses over the fact that the U.S. federal tax code is already progressive.

3 min read

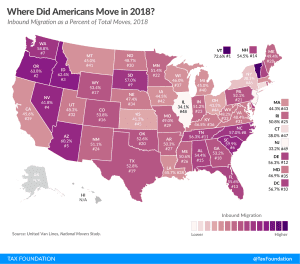

Research suggests place-based incentive programs redistribute rather than generate new economic activity, subsidize investments that would have occurred anyway, and displace low-income residents.

20 min read

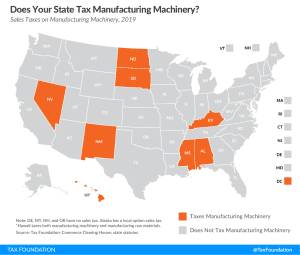

In 2019, key trends in state tax policy include reductions in corporate tax rates, updating sales tax systems to include remote online sales, taxes on marijuana and sports betting, gross receipts taxes, and more. Explore our new 2019 guide!

32 min read