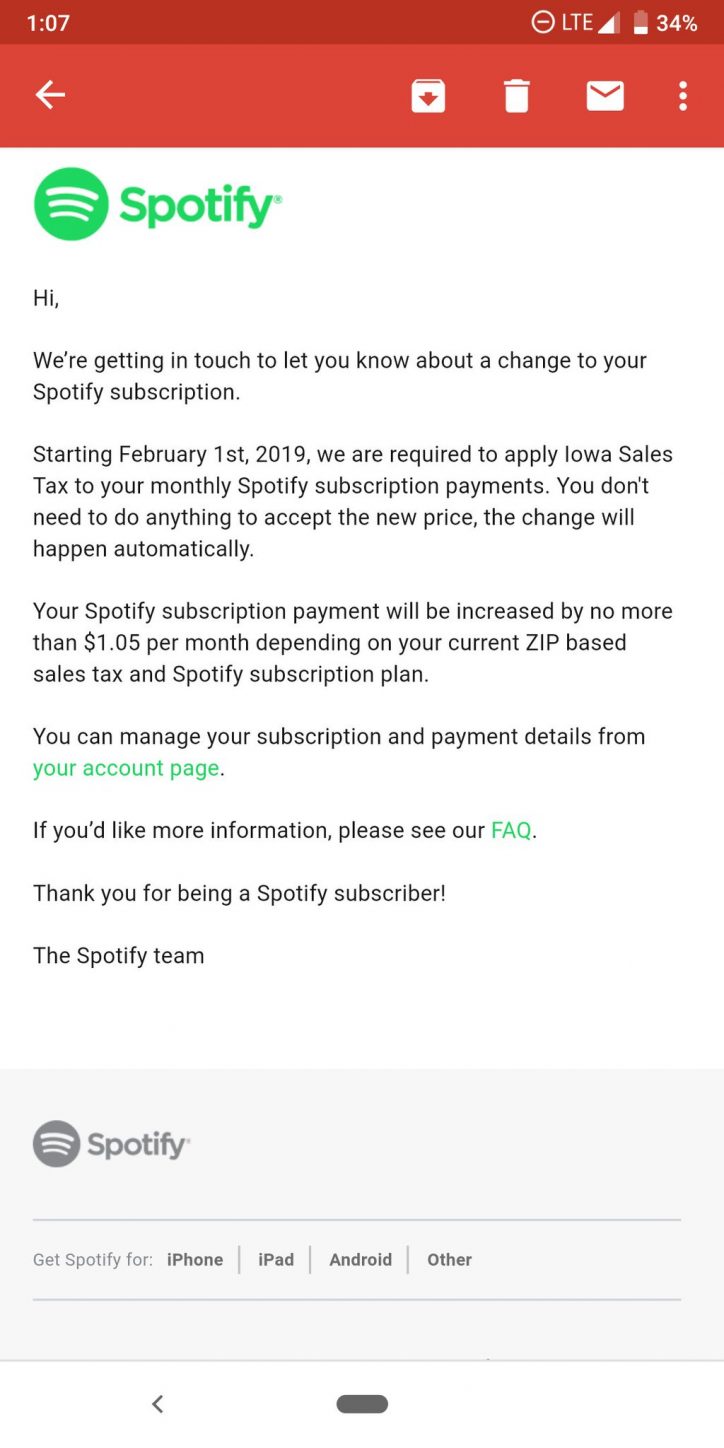

Digital music service Spotify surprised many of its subscribers yesterday, with those in D.C. learning they now had to pay Iowa’s sales tax on their subscription:

Iowa subscribers got a similar message but reversed, informing them they’ll have to pay D.C. sales tax.

Not to worry. Late in the day, Spotify e-mailed again to say it had been “a mix-up on our part” and clarifying that Iowa subscribers will pay Iowa sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. and D.C. subscribers will pay D.C. sales taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. . (Iowa subscribers, however, might have preferred paying D.C.’s 6 percent sales tax instead of their 7 percent sales tax, which is the rate in most cities.)

It does highlight an interesting issue: With Spotify headquartered in New York, a data center in Virginia, and subscribers presumably everywhere, which state properly gets to put its sales tax on Spotify’s sales? The general practice is to tax based on billing address, but that’s not a mandated rule. States can deviate from it, although a state taxing someone with no connection to the state would raise constitutional issues. A bipartisan federal bill to set billing address as the default tax rule for all states, the Digital Goods and Services Tax Fairness Act, remains pending in Congress.

Why Iowa and D.C.? Iowa last year passed a tax overhaul that reduced individual and business tax rates, eliminated tax deductions and credits, and removed exceptions to the sales tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. . Starting this year, their sales tax now applies to digital goods, ridesharing, and subscription services, including Spotify. D.C. passed legislation at the end of 2018 imposing sales tax on online sales above a certain threshold and applying the sales tax to digital goods and services. Before, some were exempt and some (video streaming) were subject to a 10 percent utility gross receipts tax. Now all just pay the 6 percent sales tax.

Share this article