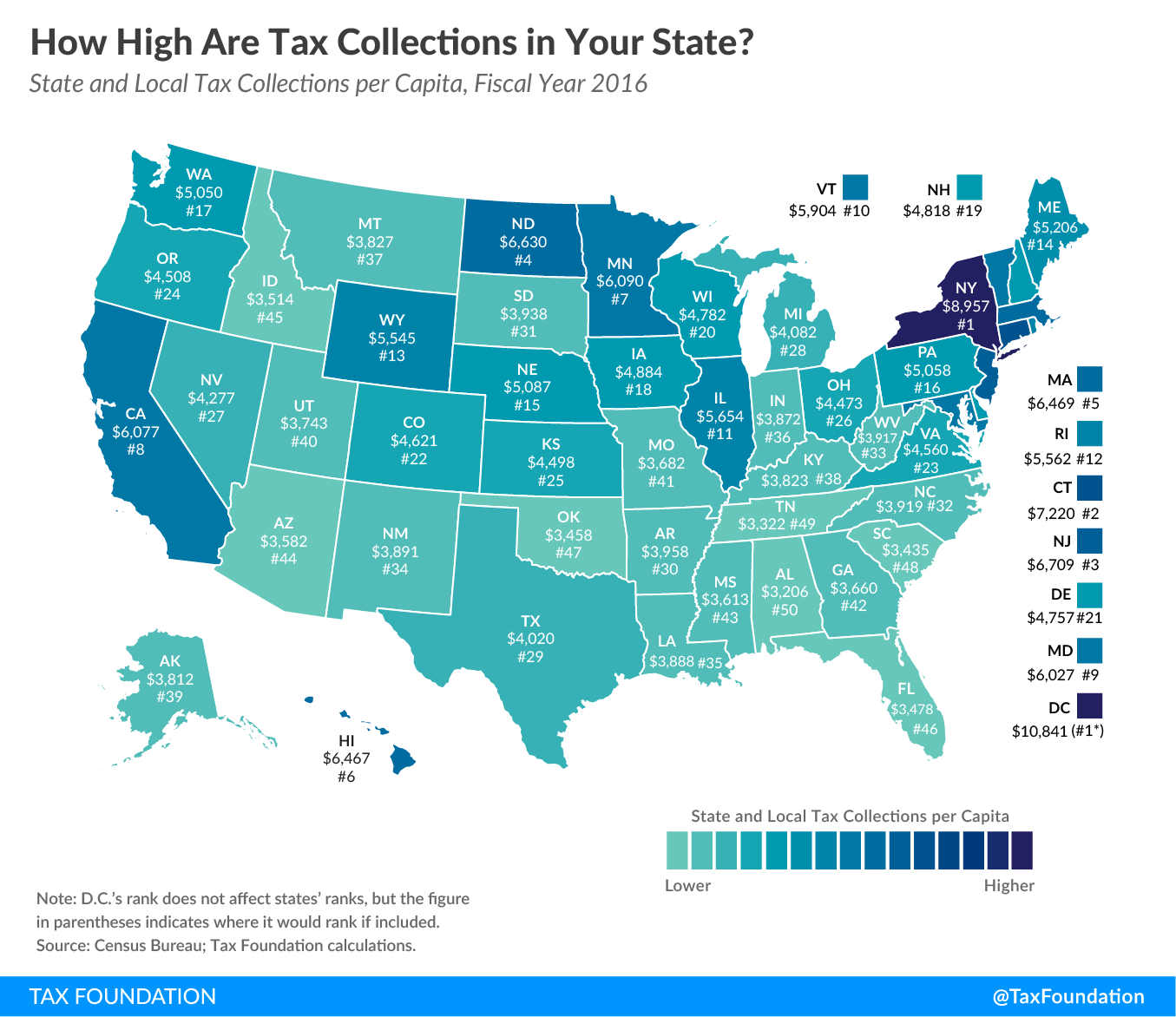

Today’s state tax map shows state and local taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. collections per capita in each of the 50 states and the District of Columbia. D.C.’s tax collections per capita ($10,841) are higher than in any state. The five states with the highest tax collections per capita are New York ($8,957), Connecticut ($7,220), New Jersey ($6,709), North Dakota ($6,630), and Massachusetts ($6,469). The five states with the lowest tax collections per capita are Alabama ($3,206), Tennessee ($3,322), South Carolina ($3,435), Oklahoma ($3,458), and Florida ($3,478).

While some of these results speak for themselves, others are less intuitive. For example, as a resource-rich state, North Dakota generates a substantial share of its tax revenue from severance taxes on oil and natural gas, the burden of which is borne mainly by consumers outside North Dakota. As a result, in terms of tax collections per capita, North Dakota joins the ranks of the high-tax states in the Northeast even though North Dakota’s tax burden is comparatively low.

It is also important to note that severance taxes are far from the only example of “tax exporting” states engage in. Travel taxes—such as hotel, car rental, and meal taxes—also disproportionately impact nonvoting nonresidents who have few means of redress. As a result, states that generate substantial amounts of tax revenue from tourism may also show tax collections per capita that are significantly higher than the actual tax burden that falls on the in-state population. It is important to keep both legal incidence and economic incidence in mind when evaluating the true costs of any tax.

Note: This is part of a map series in which we examine per capita state tax collections

- How Much Does Your State Collect in Corporate Income Taxes Per Capita?

- How Much Does Your State Collect in Sales Taxes Per Capita?

- How Much Does Your State Collect in Individual Income Taxes Per Capita?

- How Much Does Your State Collect in Property Taxes Per Capita?

- How Much Does Your State Collect in Excise Taxes Per Capita?