All Related Articles

The First Filing Season under the TCJA

3 min read

Recapping the 2019 Arkansas Tax Reform

3 min read

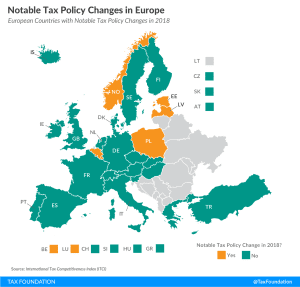

Notable Tax Policy Changes in Europe

2 min read

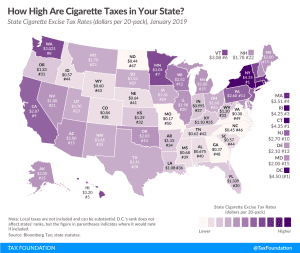

How High Are Cigarette Taxes in Your State?

Cigarette taxes around the country are levied on top of the federal rate of $1.0066 per 20-pack of cigarettes. As of 2016, taxes accounted for almost half of the retail cost of a pack of cigarettes.

2 min read

A Tradition Unlike Any Other: The Masters Tax Exemption

Augusta National Golf Club is famous for more than green jackets and pimento cheese sandwiches—legend has it that it’s the impetus for one of the tax code’s many exemptions.

3 min read

The Alternative Minimum Tax Still Burdens Taxpayers with Compliance Costs

Although Congress intended the AMT to be a tax on wealthy taxpayers, for much of its history it has subjected middle-income taxpayers in high-tax states to heavy compliance burdens. TCJA reforms that have increased the AMT’s exemption and exemption phaseout threshold will shield some taxpayers from the AMT through 2025, but the number of taxpayers impacted will increase in 2026 when the TCJA’s individual income tax reforms expire.

14 min read

Tax Policy and Entrepreneurship: A Framework for Analysis

A key element of America’s dynamism problem is a drop in entrepreneurship. Removing tax barriers for entrepreneurs would improve America’s dynamism while making America’s tax code more neutral, efficient, and simple for all taxpayers.

25 min read

Putting A Face On America’s Tax Returns: Summary

Who really bears the burden of federal taxes? How progressive is our current tax system and what role do taxes play in the debate over income inequality?

5 min read

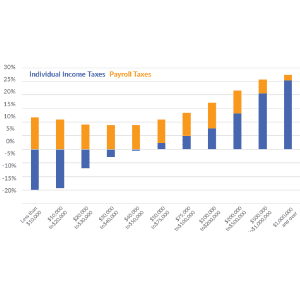

New Report Shows the Burdens of Payroll and Income Taxes

The tax burden for most Americans in 2019 –67.8 percent—will come primarily from payroll taxes, not income taxes. While the income tax is progressive, with average rates rising with income, the payroll tax is regressive, with the highest average rate falling on Americans with the lowest incomes.

4 min read