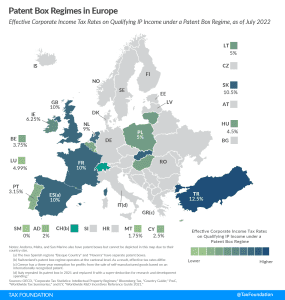

Patent Box Regimes in Europe, 2022

Patent box regimes (also referred to as intellectual property, or IP, regimes) provide lower effective tax rates on income derived from IP. Most commonly, eligible types of IP are patents and software copyrights. Currently, 13 of the 27 EU member states have a patent box regime.

4 min read