The Inflation Reduction Act (IRA) may be smaller than the proposed Build Back Better legislation from 2021, but both sets of legislation propose a reintroduced corporate alternative minimum tax (AMT). The 30-year experience with a corporate AMT shows it is not a good solution: if taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. breaks are poor policy, they should be repealed directly; if they are sound policy, all eligible taxpayers should be able to take full advantage of them.

The corporate alternative minimum tax was first introduced in the Tax Reform Act of 1986 (TRA86) in response to arguments that are echoed by some today: publicity around a phenomenon in which very large firms with significant accounting earnings were paying little or no tax. The AMT was thus designed to prevent specific companies from using enough tax breaks to face zero tax liability in a given year while reporting an accounting profit. It was ultimately repealed in 2017 after the corporate AMT underwent numerous tweaks and reforms.

Instead of taking that direct approach, the AMT required corporations to calculate their income tax liability twice, once using the tax code and once using an alternative calculation for tentative AMT, and pay whichever was largest. The AMT created economic inefficiencies, increased tax burdens and complexity, and saw declining tax revenues over time.

Furthermore, the AMT originally included a third level of tax calculation, known as the Business Unreported Reported Profits (or BURP) adjustment, where companies had to then add half of the difference between a firm’s book incomeBook income is the amount of income corporations publicly report on their financial statements to shareholders. This measure is useful for assessing the financial health of a business but often does not reflect economic reality and can result in a firm appearing profitable while paying little or no income tax. , reported on financial filings, to their new alternative minimum income taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. . As Gordon Gray explained for the American Action Forum last year:

For example, a firm that earned $100 million as calculated under the AMT rules but reported $200 million in book income in its Security and Exchange Commission (SEC) form 10-K would have to plus-up its alternative minimum taxable income by 50 percent – or $50 million in this example – to $150 million against which the firm would pay tax.

Companies that paid AMT in one year received a credit that could be used to offset future liability under the regular tax code (but not below their tentative AMT liability), which meant that for most firms, the primary effect of the alternative minimum tax was to shift tax liability over time.

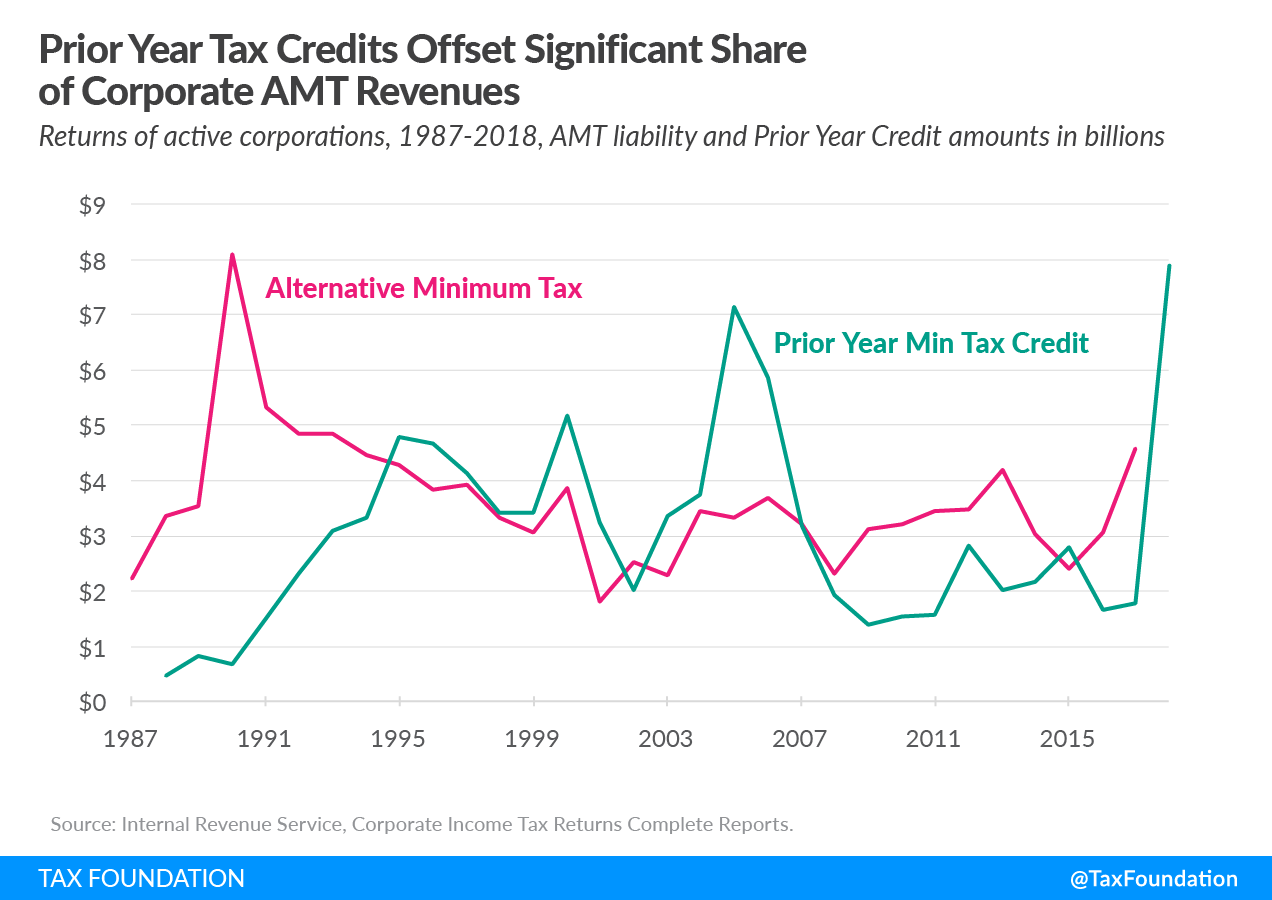

As illustrated in the accompanying chart, corporate AMT liabilities peaked in 1990 at just over $8 billion, falling to a low of $1.8 billion in 2001. As firms built up and used tax credits for prior year AMT to offset their regular tax liability, the net revenue raised from the AMT system fell: From 1995 through 2001, credits for prior year AMT exceeded current year AMT liability, meaning the AMT system lost revenue on net in those years.

Because firms moved in and out of the old alternative tax system, they could take advantage of credits for prior year AMT to offset portions of their regular tax liability, significantly reducing the net revenue raised. A similar, but perhaps smaller, effect could emerge under the new proposal, as it also includes a credit for prior year AMT. A firm’s ability to use its credits may be limited, however, if the new proposal is more likely to keep firms in the AMT system. If firms remain paying AMT liability year after year, they would be unable to use their credits, limiting the offsetting effects of the credits.

Another relevant problem with the AMT, particularly the original TRA86 version that incorporated book income, is how it treated depreciation deductions. For tax purposes, it makes sense for firms to deduct the cost of physical investments when the investments are made. For accounting purposes, however, spreading deductions over several years often makes more sense. The AMT partially disallowed accelerated depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. deductions that let companies take deductions for investments faster under the regular tax code.

As a result, it disproportionately affected firms in industries that rely heavily on physical capital investment, like manufacturing. As a 2005 Treasury Department report noted, mining, warehousing and transportation, and manufacturing firms faced the largest AMT burdens.

Our analysis of the recent Biden administration tax proposals shows a similar set of industries would be disproportionately penalized. The disparate treatment of firms in different industries, and of different sizes, created economic inefficiencies. The same Treasury report noted that “a more efficient tax system would treat all firms equally, leaving investment and other business decisions to be undertaken based on their economic fundamentals rather than based on their tax consequences.”

The AMT underwent significant reforms that made it less economically distortionary. The BURP adjustment ended after 1989. A few years later, the Omnibus Budget Reconciliation Act of 1993 repealed the Adjusted Current Earnings provision of the AMT, which had also limited depreciation deductions. After these improvements, however, the AMT raised significantly less revenue.

Ultimately, the corporate alternative minimum tax has either ended up as a heavy burden on investment or as an ineffective revenue raiser. If politicians want to deal with the problem of targeted, non-neutral tax breaks as a way to raise revenue, they should adjust those policies directly, rather than use a complex policy like the alternative minimum tax that also punishes productive activity in the process.