Evaluating Wyoming’s Business Tax Competitiveness

Wyoming’s low taxes are highly attractive, but policymakers are still hard at work helping the state achieve broader economic development goals.

13 min read

Wyoming’s low taxes are highly attractive, but policymakers are still hard at work helping the state achieve broader economic development goals.

13 min read

Federal policymakers are debating a legislative package focused on boosting U.S. competitiveness vis-a-vis China; however, it currently contains little to no improvements to the U.S. tax code.

34 min read

Learn more about the FDA’s proposal to ban the sale of menthol cigarettes and flavored cigars. Including its effect on revenue & public health measures.

4 min read

In more than 100 years of state income taxes, only four states have ever moved from a graduated-rate income tax to a flat tax. Another four may adopt flat tax legislation just this year. We discuss what flat taxes are, what they mean for taxpayers, and why so many states are making a push for them this year.

Efforts to improve the taxpayer experience should focus on the IRS’s operations and include structural improvements to the tax code.

4 min read

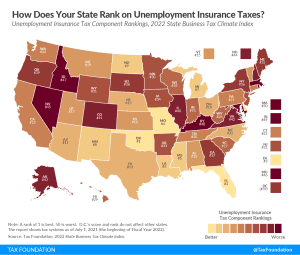

Ranking unemployment insurance tax codes on the 2022 State Business Tax Climate Index. Learn more about state unemployment insurance tax code and systems.

4 min read

The ongoing economic uncertainty from the COVID-19 pandemic, supply chain disruptions, and current inflationary pressures have highlighted the importance of investment.

33 min read

Among the many achievements in the illustrious career of former Sen. Orrin Hatch (R-UT) was his commitment to bipartisan tax reform.

3 min read

Government-set pricing of prescription drugs is not a fix for today’s rampant inflation and further, it would give rise to new problems of its own.

6 min read

Tax reform has become a major focus for state legislatures this session, and Missouri lawmakers are tuned in to the action: after adjusting individual income tax triggers in 2021, the legislature is exploring further tax reform options.

6 min read

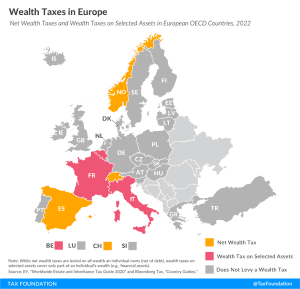

Only three European OECD countries levy a net wealth tax, namely Norway, Spain, and Switzerland.

3 min read

As the deadline for tax filing nears, the IRS faces scrutiny for its backlog of returns, inaccessible taxpayer service, and delays in issuing certain refunds.

5 min read

Learn where and when taxes originated and how they resemble taxes we have today. Understand how the American tax code developed from the beginning of the colonies. Learn about some of the weirder taxes throughout history, designed not just to raise revenue, but influence behavior too.

Total tax collections are currently running 25 percent higher than last year, and if that pattern holds, total federal tax collections will reach over $5 trillion in FY 2022—a new all-time high.

3 min read

In times of inflation, a review of the tax code shows that some provisions are automatically indexed, or adjusted, to match inflation, while others are not. And that creates unfair burdens for taxpayers. But it’s not always as simple as just “adjusting for inflation.”

4 min read

As part of President Biden’s proposed budget for fiscal year 2023, the White House has once again endorsed a major tax increase on accumulated wealth, adding up to a 61 percent tax on wealth of high-earning taxpayers.

4 min read

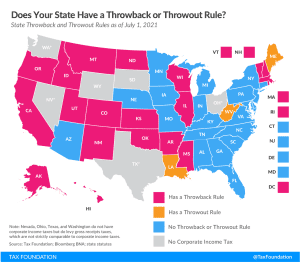

While throwback and throwout rules in states’ corporate tax codes may not be widely understood, they have a notable impact on business location and investment decisions and reduce economic efficiency.

3 min read

Before competing in the UEFA Champions League, football clubs in Europe also compete to lure the best players.

5 min read

Over the course of the last year, it has become clear that Democratic lawmakers want to change U.S. international tax rules. However, as proposals have been debated in recent months, there are clear divides between U.S. proposals and the global minimum tax rules.

5 min read

Tax burdens rose across the country as pandemic-era economic changes caused taxable income, activities, and property values to rise faster than net national product. Tax burdens in 2020, 2021, and 2022 are all higher than in any other year since 1978.

24 min read