Doing Tax Policy at the Ballot Is Not for the Faint of Heart

Some tax ballot initiatives will be straightforward, some will be complex, and—let’s be honest—some will be a drafting nightmare.

5 min read

Some tax ballot initiatives will be straightforward, some will be complex, and—let’s be honest—some will be a drafting nightmare.

5 min read

The Inflation Reduction Act primarily uses carrots, not sticks, to incentivize reductions in carbon emissions. It creates or expands tax credits for various low- or no-emission technologies, rather than imposing a generalized penalty for emissions, such as a carbon tax.

5 min read

For many years, the UK has adopted a strikingly ungenerous approach to capital cost recovery – the ability of firms to write off investment against tax. This has coincided with consistently low levels of business investment. The super-deduction, which has temporarily made the UK tax system much more supportive of capital investment in plant and machinery is set to expire.

34 min read

The Section 232 tariffs on imports of steel and aluminum raised the cost of production for manufacturers, reducing employment in those industries, raising prices for consumers, and hurting exports.

14 min read

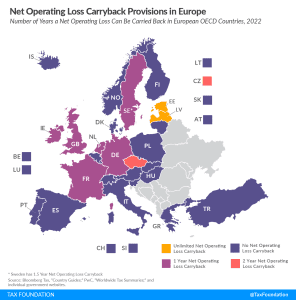

Carryover tax provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

4 min read

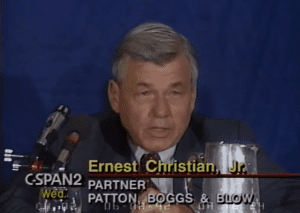

Ernest S. Christian, Jr., (1937-2022) was one of the tax policy community’s most distinguished and influential experts, showing us how effective sound tax policy can be. He passed away on September 13th, leaving behind a legacy of tax reform.

4 min read

Maine has blueberry taxes. Alabama has mosquito taxes. Each state and county has its tax quirks. But when state and local governments want to raise revenues, there are four key taxes they turn to.

The Inflation Reduction Act created numerous tax subsidy programs intended to accelerate the transition to a greener economy.

8 min read

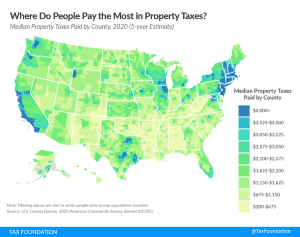

Property taxes are the primary tool for financing local government and generating state-level revenue in some states as well.

5 min read

Massachusetts’ competitive tax advantage in New England is driven primarily by its competitive individual income tax rate and its sales and use tax structure. If the Commonwealth changes its tax code in ways that narrow the base or increase the rate, it cedes greater tax competitiveness to other states, regionally and nationally.

34 min read

If ever there was a paycheck protection program, defending people from bracket creep may be the most important one ever designed.

6 min read

In an already-challenging economic environment, new UK Prime Minister Liz Truss must get tax rates correct to avoid over-burdening a population and business sector facing immense uncertainty. Focusing only on rates while ignoring the base misses an opportunity for real, pro-growth reform.

4 min read

Every change to a state’s tax system makes its business tax climate more or less competitive compared to other states and makes the state more or less attractive to business.

7 min read

The Inflation Reduction Act includes a book minimum tax, which is raising the eyebrows of accountants everywhere. Scott Dyreng, a professor of accounting at Duke University, and Daniel Bunn join Jesse to discuss how these minimum taxes work and how companies aim to comply with all these new complex rules and tax increases.

The phaseout of 100 percent bonus depreciation, scheduled to take place after the end of 2022, will increase the after-tax cost of investment in the U.S. Permanently extending it would increase long-run economic output by 0.4 percent and increase employment by 73,000 FTE jobs.

20 min read

The Inflation Reduction Act focused more on enforcement and hiring more auditors rather than programs that make it easier for taxpayers to comply with the code and the IRS to administer it.

6 min read

The mix of tax sources states choose can have important implications for both revenue stability and economic growth, and the many variations across states are indicative of the different ways states weigh competing policy goals.

29 min read

In a pattern that has become all too common in recent decades, the newly enacted Inflation Reduction Act (IRA) added yet another layer of complexity to an already complex and burdensome federal tax code.

9 min read

In response to high oil prices, Sen. Wyden has proposed raising taxes on oil and gas companies in three ways. His “Taxing Big Oil Profiteers Act” would create an additional 21 percent tax on so-called excess profits earned over 10 percent of revenues of oil companies with annual revenues over $1 billion; levy a tax on stock buybacks; and remove last-in, first-out (LIFO) tax treatment of inventory accounting.

7 min read