All Related Articles

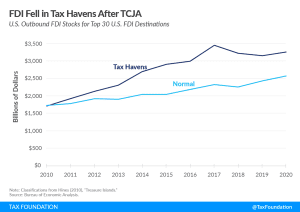

Trends in FDI Before and After the Tax Cuts and Jobs Act

Overall, the data shows outbound FDI shifted from low-tax to other jurisdictions, while inbound FDI remained largely unchanged.

3 min read

Oklahoma Becomes First State in Nation to Make Full Expensing Permanent

Gov. Stitt signed into law a pro-growth bill that will set the state apart from its peers. Other states should look to follow Oklahoma’s example and make full expensing permanent to maintain their competitiveness in an increasingly mobile economy.

3 min read

Efforts to Improve Tax Treatment of Saving Gain Traction on Hill

The proposals share a common goal of improving incentives for households to save during a time when inflation is impacting their finances.

3 min read

An International Tax Agenda for Congress on the Anniversary of the Global Tax Deal

Congress should prioritize evaluation of recent international tax trends and the model rules and adjust U.S. rules in a way that supports investment and innovation and moves towards simplicity.

25 min read

How FDI Adds Value to Supply Chains

Although the dispersion of our supply chains throughout the world has been scrutinized in recent years, both inbound and outbound foreign direct investment are critical to sustaining supply chain resiliency and reducing economic risks for both firms and investors.

5 min read

State Tax Changes Taking Effect July 1, 2022

Although the majority of state tax changes take effect at the start of the calendar year, some are implemented at the beginning of the fiscal year. Fourteen states have notable tax changes taking effect on July 1.

7 min read

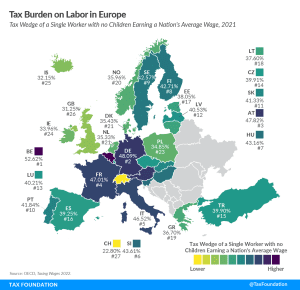

Tax Burden on Labor in Europe, 2022

To make the taxation of labor more efficient, policymakers should understand the inputs into the tax wedge, and taxpayers should understand how their tax burden funds government services.

4 min read

Windfall Profits Taxes?

Oil prices have skyrocketed, posing a new risk to the post-pandemic recovery. Feeling the pressure to respond, policymakers have proposed everything from gas tax holidays, tapping into strategic reserves, and even rebate cards. One idea that has crawled back from the dead: “Windfall Profits Taxes.” This idea is seemingly simple: legislation targeted at the “excess” profits of oil companies. However, as with anything in tax policy, the reality is much more complicated.

Carbon Taxes in the Global Market: Changes on the Way?

As policymakers on both sides of the Atlantic debate the way forward on carbon border adjustment mechanisms, it is important to keep principles of good tax policy in mind.

7 min read

Impact of Elections on French Tax Policy and EU Own Resources

The French election results are paralyzing for French pro-growth tax reforms, pessimistic for EU own resources, and dire for overall economic certainty.

5 min read

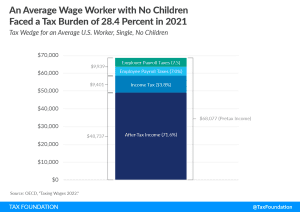

The U.S. Tax Burden on Labor, 2022

Although the U.S. has a progressive tax system and a relatively low tax burden compared to the OECD average, average-wage workers still pay nearly 30 percent of their wages in taxes.

4 min read

Carbon Taxes and the Future of Green Tax Reform

Our new analysis reviews the basic structure of carbon taxes, how they compare to the existing set of climate policies, and how they could fit into various pro-growth tax reform packages.

26 min read

4 Things to Know About the Global Tax Debate

The Biden administration has been supportive of the negotiations, but the changes should be reviewed in the context of recent policy changes in the U.S. and elsewhere, the general landscape of business taxation in the U.S., and potential challenges and risks arising from the global tax deal.

3 min read

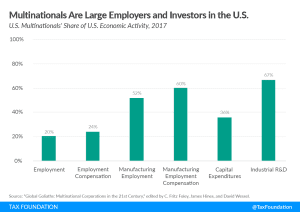

Why FDI Matters for U.S. Employment, Wages, and Productivity

Contrary to the Biden administration’s claims, raising taxes on cross-border investment would hurt U.S. economic growth and jobs. Research shows that FDI creates jobs in the U.S. and raises workers’ wages and productivity.

5 min read

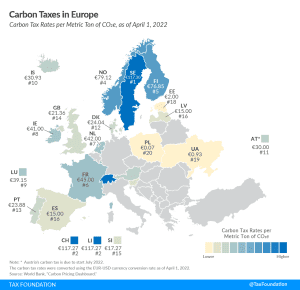

Carbon Taxes in Europe, 2022

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems, and carbon taxes. In 1990, Finland was the world’s first country to introduce a carbon tax.

3 min read