All Related Articles

State Tax Ballot Measures to Watch on Election Day 2022

From income tax changes to cannabis legalization and taxation, here’s what voters decided on Election Day.

6 min read

Should We Tax University Endowments?

Taxing university endowments has gained popularity recently, partly in response to the Biden administration’s forgiveness of student loan debt. Some view it as a means of holding universities accountable for the product they’re selling. Others view it as a tool to tamp down tuition rates or punish ideological opponents. But do these arguments hold water and is an endowment tax sound policy?

7 min read

2023 Tax Brackets

The IRS recently released the new inflation adjusted 2023 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, Alternative Minimum Tax (AMT), Earned Income Tax Credit (EITC), Child Tax Credit (CTC), capital gains brackets, qualified business income deduction (199A), and the annual exclusion for gifts.

4 min read

The UK’s Tax Battles, Part One: How We Got Here

This episode of The Deduction is part one in our ongoing coverage of the UK’s tax battles. Jesse chats with Tom Clougherty, research director and head of tax at the Centre for Policy Studies in London about what went down in the UK this fall: from the leadership elections to the countless U-turns the new prime minister has made to try and reform the country’s tax code.

International Tax Competitiveness Index 2022

While there are many factors that affect a country’s economic performance, taxes play an important role. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

41 min read

California Can’t Give Up Tax Increases

California is no stranger to high taxes, and the state has enough going for it that its economy can withstand higher tax burdens than would be viable in other parts of the country. But there’s always a tipping point.

6 min read

Inflation Is Surging, So Are Federal Tax Collections

Federal tax collections are approaching the highest levels in U.S. history set during World War II and again during the dot-com bubble in 2000. Meanwhile, federal spending in FY 2022 was over 25 percent of GDP—a level only exceeded during the height of the pandemic in 2020 and 2021, and during World War II.

4 min read

What the EU Gets Wrong About “Tax Fairness” and How Principled Tax Policy Can Help

A more principled EU tax system will increase economic growth across the economy and provide the government with stable finances for spending priorities.

7 min read

West Virginia Voters Will Determine the Scope of Potential State Tax Reform

West Virginia Amendment 2 would not directly reduce tangible personal property taxes—on cars, inventory, or machinery and equipment. It would, however, empower the legislature to consider such reforms.

4 min read

Understanding the Tax Treatment of Inventory: The Role of LIFO

Repealing LIFO, as some policymakers have proposed, is not sound policy. LIFO helps firms avoid the penalty on inventory investment created by FIFO and is neither a targeted tax break nor a subsidy (as some opponents suggest).

17 min read

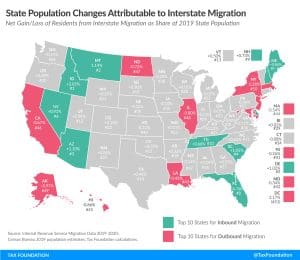

Taxes and Interstate Migration: 2022 Update

IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

12 min read

2022 Spanish Regional Tax Competitiveness Index

The 2022 Spanish Regional Tax Competitiveness Index allows policymakers and taxpayers to evaluate and measure how their regions’ tax systems compare.

8 min read

Tax Hike Proposals Live on Despite Being Dropped in the Inflation Reduction Act

President Biden proposed a 7-point hike in the corporate tax rate to 28 percent, a new minimum book tax on corporate profits, and higher taxes on international activity. We estimated these proposals would reduce the size of the economy (GDP) by 1.6 percent over the long run and eliminate 542,000 jobs.

6 min read

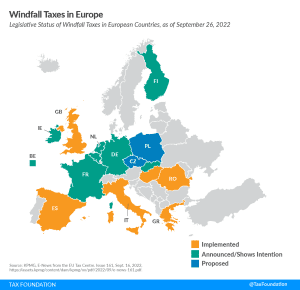

Windfall Profit Taxes in Europe, 2022

It’s unlikely these implemented and proposed windfall taxes will achieve their goals of addressing high gas and energy prices and raising additional revenues. They would more likely raise prices, penalize domestic production, and punitively target certain industries without a sound tax base.

9 min read

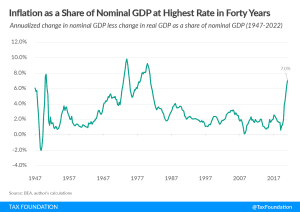

The “Inflation Tax” Is Regressive

A new CBO report reveals that lower- and middle-income households are disproportionately shouldering the burden of this current inflation wave. And historical analysis suggests there is much more to come.

5 min read

Impact of Italian Elections on National Tax Policy and EU Fiscal Policy

In the EU, Italy plays an important role in economic policy. If the EU wants to further develop own resources, it will need the backing of the Italian government—which seems unlikely at the moment.

4 min read

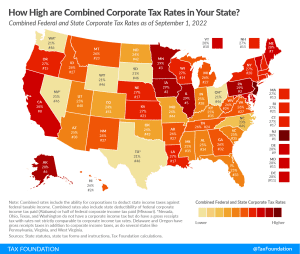

Combined Federal and State Corporate Income Tax Rates in 2022

When examining tax burdens on businesses, it is important to consider both federal and state corporate taxes. Corporate taxes are one of the most economically damaging ways to raise revenue and are a promising area of reform for states to increase competitiveness and promote economic growth, benefiting both companies and workers.

3 min read