Tax Literacy Belongs in Every Classroom

Though high schools will continue to teach the next generation about civics, English, and math, one critical topic remains missing from many classrooms: taxes.

Though high schools will continue to teach the next generation about civics, English, and math, one critical topic remains missing from many classrooms: taxes.

As US businesses and consumers face higher costs of goods due to the Trump tariffs, Senator Hawley (R-MO) has introduced legislation to rebate tariff revenue to provide financial relief. The proposal takes a similar approach to the stimulus checks issued during the COVID-19 pandemic.

4 min read

The One Big Beautiful Bill Act (OBBBA) significantly alters the Inflation Reduction Act (IRA) green energy subsidies.

6 min read

For Congress, work on the One Big Beautiful Bill Act is done. But in state capitols, the work has not yet begun. Many of the tax changes in the federal reconciliation act flow through to state tax codes—automatically in some states, and subject to an update in states’ Internal Revenue Code conformity date in others.

39 min read

The Trump tariffs amount to an average tax increase of nearly $1,300 per US household in 2025 and over $1,600 per US household in 2026.

39 min read

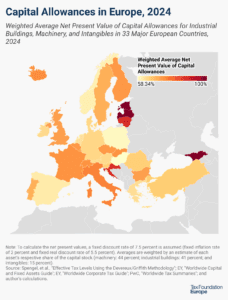

Although sometimes overlooked in discussions about corporate taxation, capital allowances play an important role in a country’s corporate tax base and can impact investment decisions—with far-reaching economic consequences.

6 min read

The Trump tariffs will likely raise the cost of food for Americans, particularly for liqueurs and spirits, baked goods, coffee, fish, and beer.

4 min read

Even when international relations are frayed, there is value in finding ways to combat corporate profit shifting while also fostering a healthy commercial atmosphere and positive trade relations.

7 min read

Rather than adopt temporary policies that phase out and expire, policymakers should focus their efforts on long-term reforms to support investment.

7 min read

Our experts explain how this major tax legislation may affect you and how policymakers can better improve the tax code.

24 min read

This past spring, DC taxpayers were sidelined when the Washington Commanders announced that city aid would help fund a new stadium on the site of the vacant RFK Stadium. The $4 billion deal will be offset by a staggering $1.15 billion in public revenue.

However states choose to respond to other tax provisions of the One Big Beautiful Bill Act, they should conform to the pro-growth provisions, which represent a marked improvement in the corporate tax code.

12 min read

The administration has a strong desire to boost manufacturing investment and there are many provisions in the new tax bill that support this aim. But the administration’s erratic trade policy is driving up the costs of key inputs that manufacturers rely on to build things in the US.

Several major new tax breaks are scheduled to expire at the end of 2028, setting the stage for another tax fight to either extend them or allow them to expire.

5 min read

Oklahoma can continue to enhance its competitiveness by pursuing a variety of reforms to the corporate and individual income tax, but it should avoid policies that would negatively impact the economy, like enacting a wholesale elimination of the property tax.

6 min read

The European Commission proposed new budget options for 2028 to 2034. It is worth zooming in on one new proposal for revenues that would support EU-level spending. The “Corporate Resource for Europe,” or CORE, provides a good opportunity to think through how best to raise revenue for the EU budget.

5 min read

Our analysis finds that the Trump tariffs threaten to offset much of the economic benefits of the new tax cuts, while falling short of paying for them.

3 min read

The One Big Beautiful Bill is now law—but what does it actually do? In this episode, we break down the new tax law’s key provisions, including who benefits, who doesn’t, and what it means for the economy, tax certainty, and the federal deficit.

Sean Bray interviews Dr. Michele Chang, Director of the Masters in Transatlantic Affairs and Professor of European Political Governance at the College of Europe, about the future of the EU tax mix.

12 min read

The aim of patent boxes is generally to encourage and attract local research and development (R&D) and to incentivize businesses to locate IP in the country. However, patent boxes can introduce another level of complexity to a tax system, and some recent research questions whether patent boxes are actually effective in driving innovation.

4 min read