Historical US Federal Corporate Income Tax Rates & Brackets, 1909-2025

How do current federal corporate tax rates and brackets compare historically?

1 min read

How do current federal corporate tax rates and brackets compare historically?

1 min read

The analysis provides key insights into how their models work and the sort of outputs we can expect from their models as part of next year’s tax debate.

8 min read

Thirty-nine states will begin 2025 with notable tax changes, including nine states cutting individual income taxes. Recent years have seen a wave of significant tax reforms, and the changes scheduled for 2025 show that these efforts have not let up.

25 min read

While tariffs are often presented as tools to enhance US competitiveness, a long history of evidence and recent experience shows they lead to increased costs for consumers and unprotected producers and harmful retaliation, which outweighs the benefits afforded to protected industries.

The holiday season is marked by time with friends and family, joy, and gift-giving. But could tax policy make the sticker shock from your shopping list next year tariff-ying?

4 min read

Taxes and their broader impact are generally overlooked in American education. Taxes influence earnings, budgets, voting, and decisions on where to live, but do American taxpayers understand the US tax system?

25 min read

The worldwide average statutory corporate tax rate has consistently decreased since 1980 but has leveled off in recent years. In the US, the 2017 Tax Cuts and Jobs Act brought the country’s statutory corporate income tax rate from the fourth highest in the world closer to the middle of the distribution.

18 min read

What happens to your taxes when the Tax Cuts and Jobs Act expires on January 1, 2026? In this episode, we explore the potential tax hikes facing millions of Americans and the debate over measuring the budgetary impacts of extending tax cuts.

As we prepare for the tax code’s “move,” it’s time to start cleaning out the proverbial attic of our messy system. For the sake of our economy, moves toward growth must win the day.

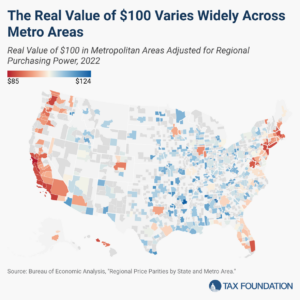

Many policies, such as minimum wage levels, tax brackets, and means-tested public benefit income thresholds, are denominated in nominal dollars, even though a dollar in one region may go much further than a dollar in another. Lawmakers should keep that reality in mind as they make changes to tax and economic policies.

6 min read

Consumers legally wagered more than $100 billion on sporting contests in 2023, creating more than $1.8 billion in state revenue. Sports betting is now legal in 38 states and DC, and the landscape is rapidly evolving.

18 min read

Lawmakers will enter the 2025 fiscal legislative session with an opportunity to build on the successes of the November special session. Efforts should include addressing the outstanding issues within the corporate and sales tax codes that currently hold the state back.

7 min read

If lawmakers are serious about pro-growth policies and fiscal responsibility, they will need to put policies forward that achieve those goals. Simply adjusting the baseline doesn’t reduce actual deficits in the coming years.

7 min read

Recent data suggest that tax competitiveness plays a significant role in residents’ relocation decisions.

3 min read

Tariffs are almost always the main issue connecting the tax reform debate with strategic competition with China. However, some provisions of the 2017 Tax Cuts and Jobs Act (TCJA) should get some of that attention, especially the 100 percent bonus depreciation and the research and development (R&D) amortization.

“Full expensing” may not sound like the most exciting policy, but it’s the strongest tool in our tax code to help our small businesses.

The US government’s $6.8 trillion budget is larger than the GDPs of Germany and Japan. Its roughly $2 trillion annual deficit is larger than the GDP of Mexico. And it has 441 agencies that employ more than 2.8 million civilian employees.

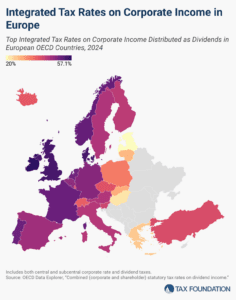

In most European OECD countries, corporate income is taxed twice, once at the entity level and once at the shareholder level.

4 min read

New IRS data shows the US federal income tax system continues to be progressive as high-income taxpayers pay the highest average income tax rates. Average tax rates for all income groups remain lower after the Tax Cuts and Jobs Act (TCJA).

6 min read

Tax reform in Alabama is desirable and very possible. However, the overtime exemption, which complicates the tax code, reduces neutrality, and adds to compliance and reporting costs, is not a good example.

4 min read