All Related Articles

Testimony: U.S. International Tax Policies That Support Investment and Innovation

Even in the face of a global minimum tax, Congress still has a chance to develop a strategic approach in support of U.S. investment and innovation.

How America’s Debt Problem Compares to Other Countries—and Why It Matters

According to the International Monetary Fund (IMF), the U.S. federal government is among the most indebted governments in the world.

6 min read

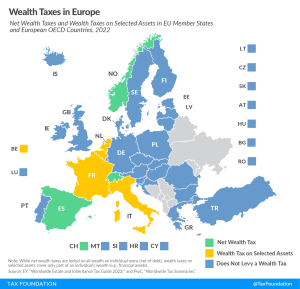

Wealth Taxes in Europe, 2023

Instead of reforming and hiking the wealth tax, perhaps policymakers should consider whether the tax is serving its intended objectives, and, if not, consider repealing the tax altogether.

4 min read

Does the Optimal Tax System Exist?

While research on optimal taxation often focuses on the pure economic implications, it rarely considers cultural and societal differences that can lead to very different outcomes when trying to implement an optimal tax system.

4 min read

Testimony: Considerations for Improving Wisconsin’s Tax Structure and Competitiveness

If Wisconsin policymakers return some of the projected continued revenue growth to taxpayers in a structurally sound and pro-growth manner, those tax cuts will benefit businesses and individuals throughout the state, leading to more innovation, more job and wage growth, more economic opportunities, and more vibrant communities.

The Faulty Revenue Estimate Behind Minnesota’s Consideration of Worldwide Combined Reporting

As Minnesota lawmakers consider making theirs the first state to mandate worldwide combined reporting, they are relying on a revenue estimate that is—this may not be the technical term—completely bogus.

7 min read

The Role of Pro-Growth Tax Policy and Private Investment in the European Union’s Green Transition

Permanent full expensing is an efficient and neutral tax policy that will allow markets to allocate private investment effectively while moving the economy towards the climate goals of the EU.

33 min read

New Jersey Should Take Opportunity to Make Corporate Taxes More Competitive

By letting the corporate surtax expire, eliminating taxes on GILTI, and embracing full expensing, New Jersey would take important steps toward creating a more welcoming and competitive tax environment.

6 min read

Fast Approaching Debt Limit Deadline and Growing Debt Demand Action

As policymakers look to tackle America’s debt and deficit crisis, they should consider international experiences on successful fiscal consolidations.

6 min read

Do Consumption Taxes Do a Better Job of Taxing Criminals?

One of the arguments in favor of the FairTax is that it would do a better job of taxing the underground economy than the income tax it is intended to replace.

6 min read

Carbon Taxes in Theory and Practice

In our latest report, we consider several theoretical arguments for carbon taxes and the evidence from carbon taxes implemented around the world related to emissions, economic growth, distribution and revenue recycling options, other environmental taxes, green subsidies, and environmental regulations.

49 min read

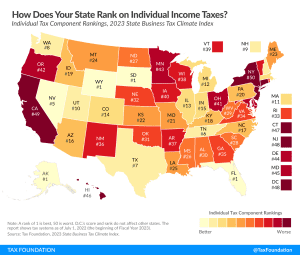

Ranking Individual Income Taxes on the 2023 State Business Tax Climate Index

Individual income tax rates can influence location decision-making, especially in an era of enhanced mobility, where it is easier for individuals to move without jeopardizing their current job, or without limiting the scope of their search for a new one.

5 min read

Why the Estonian Tax System Would Remain Competitive after Tax Reform

When a country has a broad base with a simple and transparent tax code, small rate changes have little influence. Therefore, policymakers shouldn’t only focus on rate changes when it comes to increasing tax competitiveness.

4 min read

Minnesota’s Omnibus Tax Bill Would Undermine the State Economy

As policymakers in St. Paul finalize this year’s tax bill, they should avoid policies that incentivize the diversion or relocation of capital. Importantly, states do not institute tax policy in a vacuum. The evidence from states’ experiences and the academic literature supports the conclusion that tax competitiveness matters not just to businesses but to human flourishing.

15 min read

Reforming EU Own Resources: Competitiveness versus Raising Revenue

When it comes to EU-level tax policy ideas, competitiveness seems to be less of a priority than raising revenue or pursuing social objectives.

4 min read

What the EU’s Carbon Border Adjustment Mechanism Means for Europe and the United States

The Carbon Border Adjustment Mechanism (CBAM) is a key aspect of the EU’s broader Fit for 55 package which aims to cut 55 percent of net greenhouse gas (GHG) emissions in the EU by 2030. The growing number of competing climate policies between the EU and U.S., such as tax provisions in the Inflation Reduction Act, could present policymakers on both sides of the Atlantic an opportunity to work together.

5 min read

Inflation Reduction Act’s Price Controls Are Deterring New Drug Development

As predicted, the Inflation Reduction Act’s misguided price-setting policy is already discouraging drug development. Rather than double down on it, as President Biden proposes doing in his budget, lawmakers ought to restore incentives to invest in the United States.

5 min read

Tax Policy and Economic Downturns in Europe

While some temporary policies can help in a crisis, policymakers should focus their efforts on sustainable policies that support growth and the resilience of businesses (and government coffers) over the long term.

6 min read

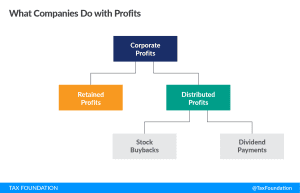

A Better Way to Tax Stock Buybacks

The distributed profits tax is a sounder approach to concerns about investment and stock buybacks than the existing policy approach.

6 min read