Proposed Estate Tax Changes in Oregon: A Long-Overdue Reform?

While evaluating new estate tax bills this legislative session, Oregon legislators should consider the state’s competitive tax landscape and interstate migration patterns.

4 min read

While evaluating new estate tax bills this legislative session, Oregon legislators should consider the state’s competitive tax landscape and interstate migration patterns.

4 min read

The agreement represents a major change for tax competition, and many countries will be rethinking their tax policies for multinationals. If there is no agreement on changes to Pillar Two or digital services taxes, retaliatory American tariffs could be on the horizon.

8 min read

While LIFO is rarely the main focus of the overall tax policy debate, it is a sound structural piece of the tax code. LIFO comes close to matching the economic ideal while still remaining true to the accounting principle.

15 min read

Permanently extending the Tax Cuts and Jobs Act would boost long-run economic output by 1.1 percent, the capital stock by 0.7 percent, wages by 0.5 percent, and hours worked by 847,000 full-time equivalent jobs.

6 min read

The Tax Foundation models tax policy using our proprietary Taxes and Growth model, illustrating the economic, revenue, and distributional impacts of different changes to the federal tax code. We’ve recently implemented improvements to the model that have been underway for the past several years, and we will be detailing them further in our forthcoming model methodology update.

4 min read

The next government needs to prioritize measures to improve Germany’s competitiveness as an investment location.

7 min read

The variety of approaches to taxation among European countries creates a need to evaluate these systems relative to each other. For that purpose, we have developed the European Tax Policy Scorecard—a relative comparison of European countries’ tax systems.

55 min read

Compromising on the timing and availability of expensing—or offsetting the revenue losses by worsening other parts of the tax code—would squander an opportunity to craft a fiscally responsible, pro-growth tax reform.

Ahead of Germany’s federal election, the country’s economy remains stuck in a prolonged recession, with GDP stagnating for the past two years and failing to surpass its pre-pandemic level.

6 min read

Rather than hurting foreign exporters, the economic evidence shows American firms and consumers were hardest hit by tariffs imposed during President Trump’s first-term.

5 min read

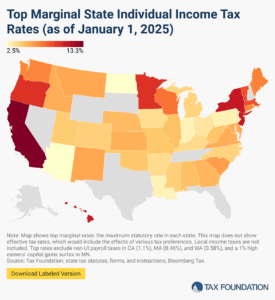

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

12 min read

If Republicans want a successful year for tax reform, they must put aside the extensive demands for niche provisions and, instead, approach this debate with a principles-first mindset.

The House Budget Committee has released a budget resolution that specifies large reductions in both taxes and spending over the next decade, paving the way to extend the expiring provisions of the Tax Cuts and Jobs Act (TCJA) and potentially cut other taxes.

6 min read

The Trump administration appears to be moving in a “reciprocal” policy direction despite the significant negative economic consequences for American consumers of across-the-board tariffs on goods coming into the US. However, the EU’s VAT system should not be used as a justification for retaliatory tariffs.

6 min read

As Kansas policymakers consider ways to provide long-term property tax relief, a well-structured, exemption-free levy limit would be a structurally sound and effective reform to consider.

8 min read

In this episode, Adam Hoffer, Director of Excise Tax Policy at the Tax Foundation, joins Kyle Hulehan to unpack the intricacies of sports betting tax policy during one of the biggest betting events of the year—Super Bowl 59.

As Republicans look for ways to offset the budgetary cost of extending the expiring provisions of the Tax Cuts and Jobs Act (TCJA) and potentially enacting other tax cuts, the latest estimates indicate several trillion dollars could be raised by reducing tax credits and other preferences in the tax code.

5 min read

Are tariffs making everything more expensive? With Trump’s new tariff plans hitting $1.1 trillion in imports—far more than his first term—prices could rise for businesses and consumers alike.

A recent poll from the Tax Foundation found that most American taxpayers—regardless of age, education, or income level—do not understand basic income tax filing concepts.

In a recent survey regarding companies’ barriers to conducting business in the EU single market, VAT ranked first. Policymakers should invest in reforming VAT systems to close both compliance and policy gaps in ways that improve the overall efficiency of their tax systems.

7 min read