Trump Tariffs: The Economic Impact of the Trump Trade War

The tariffs amount to an average tax increase of nearly $1,300 per US household in 2025.

32 min read

The tariffs amount to an average tax increase of nearly $1,300 per US household in 2025.

32 min read

Pairing permanent TCJA individual tax cuts with new limits on business SALT deductions would shrink the economy, reduce American incomes, and increase the federal budget deficit, undermining the policy goals of TCJA permanence.

3 min read

The Trump administration advocates an “energy dominance” agenda to boost US energy production and lower costs. Its tariff agenda runs directly counter to it.

5 min read

What happens when the country’s most important retirement program runs out of money? Social Security faces a funding crisis by 2035. We unpack how the system works, why it’s in trouble, and what fixes could keep it afloat.

Catastrophic rhetoric about US manufacturing is not justified. The tariffs are extremely counterproductive. Still, all is not well in the US manufacturing sector. What should we do?

7 min read

As Congress debates expensing and other policies impacting business investment, lawmakers should consider the importance of business investment in research and development (R&D) as a driver for economic growth. Recent studies suggest that the economic benefits of R&D spending are even greater than previously understood.

7 min read

The tariff policies already in effect threaten to offset the benefits of the promised tax cuts.

2 min read

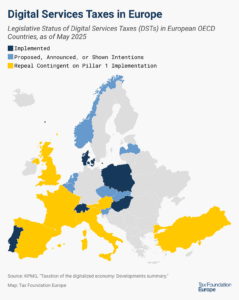

Currently, about half of all European OECD countries have either announced, proposed, or implemented a digital services tax. Because these taxes mainly impact US companies and are thus perceived as discriminatory, the US responded with retaliatory tariff threats.

5 min read

On April 10, the House adopted the Senate’s amended version of the budget resolution, which allows $5.3 trillion in deficit-financed tax cuts.

9 min read

A tax preference originally designed to level the playing field now has the opposite effect, creating preferences for one class of financial institutions even though the distinctions between credit unions and banks are increasingly blurred.

6 min read

Tax Foundation Europe’s Sean Bray had the opportunity to interview Professor of International Taxation at the University of Mannheim Business School, Christoph Spengel, about the future of the EU tax mix.

15 min read

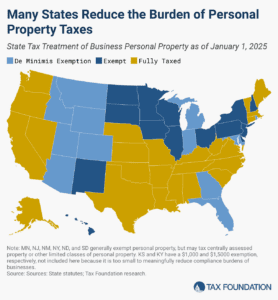

Does your state have a small business exemption for machinery and equipment?

4 min read

President Trump has repeatedly floated the idea of entirely replacing the federal income tax with new tariffs. Recently, he has said that when tariff revenues come in, he will use them to replace or substantially cut income taxes for people making under $200,000.

8 min read

By implementing a more sophisticated and nuanced trigger system for its tax reduction goals, North Carolina can sustain its trajectory toward lower tax rates, reinforce its reputation as a business-friendly state, and ensure long-term fiscal stability in an ever-changing economic landscape.

4 min read

Hemp, intoxicating or otherwise, is a growing market that needs to be addressed with tax policy. A well-designed tax will generate tax revenues for states while improving public health by shifting consumers away from illicit markets.

5 min read

Without aligning fiscal discipline with pro-growth tax policies, Germany and the EU risk high deficits, mounting debt, and sustained inflation.

5 min read

Daniel Bunn had the opportunity to interview the Vice-Minister for Economy and Finance of Italy, Maurizio Leo, about the tax policy priorities of the Italian government. The conversation shows a commitment to reforming rules that create legal uncertainty and support competitiveness.

5 min read

Without businesses as their taxpayers and tax collectors, governments would not have the resources to provide even the most basic services.

5 min read

On average, businesses in the OECD are liable for collecting, paying, and remitting more than 85 percent of the total tax collection.

15 min read

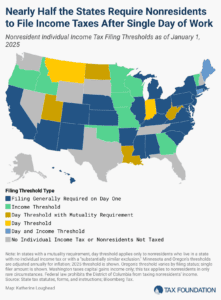

One area of the tax code in which extreme complexity and low compliance go hand-in-hand—and where reform is desperately needed—is in states’ nonresident individual income tax filing and withholding laws.

7 min read