All Related Articles

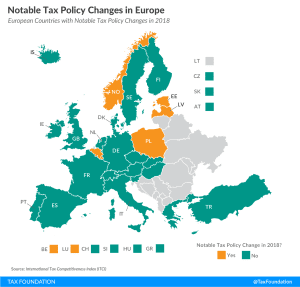

Notable Tax Policy Changes in Europe

2 min read

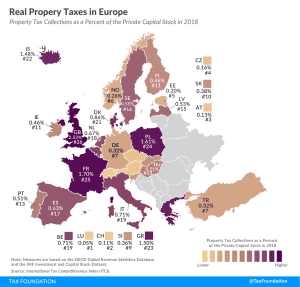

Real Property Taxes in Europe, 2019

3 min read

Capital Cost Recovery across the OECD, 2019

Capital cost recovery, though often overlooked, can have a significant impact on investment decisions—with far-reaching economic consequences.

24 min read

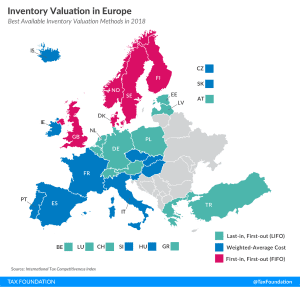

Inventory Valuation in Europe

2 min read

Tax Treatment of Worker Training

15 min read

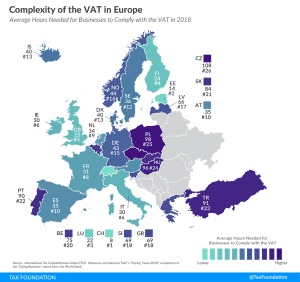

Complexity of the VAT in Europe

2 min read

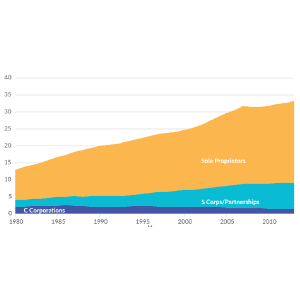

Increasing Individual Income Tax Rates Would Impact a Majority of US Businesses

Since most U.S. businesses are pass-through businesses, such as partnerships, S corporations, LLCs, and sole proprietorships, changes to the individual income tax, especially to top marginal rates, can affect a business’s incentives to invest, hire, and produce.

4 min read

Facts and Figures 2019: How Does Your State Compare?

Our updated 2019 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

Maine’s Water Extraction Tax Proposal Is Poor Tax Policy

Taxing the extraction of water does not make sense as an excise tax and does not make sense as a mechanism to finance rural broadband and public education.

4 min read

Corporate Tax Reform Comes to Arkansas

Arkansas’s Senate Bill 576 would overhaul the state’s corporate income tax code and dramatically increase its competitiveness from 46th to 44th nationally.

3 min read