All Related Articles

The Italian DST Remix

6 min read

Tax Reforms in Georgia 2004-2012

9 min read

How Controlled Foreign Corporation Rules Look Around the World: United Kingdom

The UK rules are designed to arrive at the most accurate definition of foreign income that should be taxed in the home country. These rules apply one of the most detailed approaches to solving the issue of taxing the right type and amount of foreign income. The method can be considered more effective, but the compliance implications and derived costs may be higher compared to those that are derived from the application of other methods.

7 min read

The Impacts of Tightening up on Transfer Pricing

As with other anti-base erosion policies, transfer pricing regulations reveal the challenges of designing rules that address problems associated with various strategies businesses use to minimize their tax burdens. While countries may want to target specific abuses, the way the rules are designed can have real economic impacts on cross-border investment.

6 min read

State Tax Changes as of July 1, 2019

15 min read

Five Things to Know about the Pending Tax Treaties in the Senate

The tax treaties pending before the Senate present an opportunity to make the U.S. a more attractive place for companies from our treaty partner countries to invest and hire.

7 min read

How Controlled Foreign Corporation Rules Look Around the World: Netherlands

The Dutch tax system is characterized by its simplicity and the attractiveness to investors. With the incorporation of CFC rules, the Dutch government protected its tax base from erosion and profit shifting. The Netherlands is facing a whole series of adjustments that would create a more complex system adapted to the international standards recommended by the OECD and adopted by the European Union Council. When revising the rules authorities must be mindful about not making the system more complex and to avoid increasing the compliance burden in the country.

5 min read

How Controlled Foreign Corporation Rules Look Around the World: Japan

Japan is a country with a complex multilayer system to calculate the corporate income tax. As a consequence, the CFC income determination has evolved as a complex set of rules to complement the corporate income tax. It would be a great idea for the Japanese authorities to address a simplification of the rules to facilitate the entry of new capital investments into their economy.

7 min read

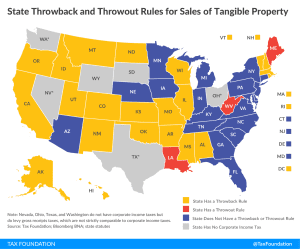

State Throwback and Throwout Rules: A Primer

38 min read