All Related Articles

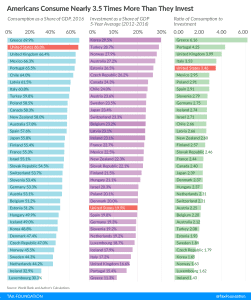

Americans Consume Much More than They Invest

Recent data show that Americans stand out for consuming much more than they invest, and this is due in part to the tax code’s bias against savings.

3 min read

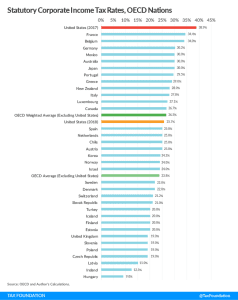

The United States’ Corporate Income Tax Rate is Now More in Line with Those Levied by Other Major Nations

The Tax Cuts and Jobs Act significantly reduced the federal statutory corporate income tax rate. When combined with state and local taxes, it put the U.S.’s corporate tax rate in line with the average among OECD nations.

4 min read

The ‘Grain Glitch’ Needs to Be Fixed

The Tax Cuts and Jobs Act tax preference for farm co-ops would distort agricultural activity and create tax planning opportunities for wealthy taxpayers.

9 min read

State Corporate Income Tax Rates and Brackets, 2018

State corporate income tax rates range from 3 percent in North Carolina to 12 percent in Iowa. Download and compare each state’s 2018 rates and brackets here.

6 min read

The U.S.’s New Ranking on the International Tax Competitiveness Index

The TCJA is projected to improve the United States’ current ranking from 30th among the 35 Organisation for Economic Co-operation and Development (OECD) countries to 25th, an improvement of five places.

4 min read

Pennsylvania’s New Penalties on Investment Could Scare off Amazon, Others

While other states are working to promote growth, Pennsylvania is headed in the opposite direction with a policy that dramatically overtaxes investment.

4 min read

West Virginia Constitutional Amendment Would Roll Back Property Taxes on Machinery and Equipment

Governor Justice’s proposal to roll back West Virginia’s tangible personal property tax, a tax on equipment and machinery, is an opportunity improve the state’s outmoded property tax structure.

4 min read

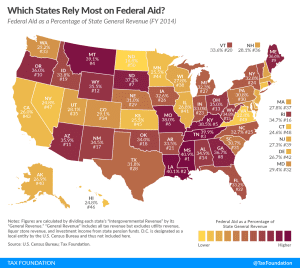

Tax Reform Moves to the States: State Revenue Implications and Reform Opportunities Following Federal Tax Reform

Federal tax reform gives states an opportunity to improve their own tax codes. This study surveys the federal provisions to which states conform, what each state can expect from federal tax changes, and what options are available to them.

58 min read

Reviewing the Credit Union Tax Exemption

2 min read

President Trump Approves Tariffs on Washing Machines and Solar Cells

Tariffs on washing machines and solar cells, though designed to help U.S. manufacturing and protect consumers, will likely raise prices and distort markets.

3 min read

Washington Legislature Considers B&O Tax Surcharge

Legislation introduced in Washington State correctly diagnoses the problem with the state’s B&O tax, but the proposed remedy could use some work.

6 min read

A Look Ahead at Expiring Tax Provisions

5 min read

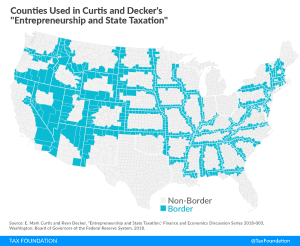

New Federal Reserve Paper: State Corporate Taxes Hurt Entrepreneurship

For every 1 percentage point increase in a state’s corporate tax rate, employment in start-up firms declines 3.7 percent, according to a recent Federal Reserve study.

2 min read