How Controlled Foreign Corporation Rules Look Around the World: Spain

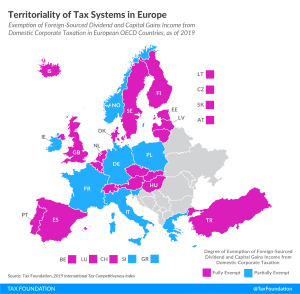

The CFC legislation in Spain is not as complicated as it is in some other countries, and it is aligned with the standards recommended by the OECD. The Spanish rules have evolved in a way that the rules are designed to comply with the EU principles not to interrupt the functioning of the Union and its single market.

4 min read