Legislation Introduced to Cancel R&D Amortization

Canceling the amortization of research and development costs would reduce federal revenue, but policymakers have a variety of options to offset the costs.

3 min read

Canceling the amortization of research and development costs would reduce federal revenue, but policymakers have a variety of options to offset the costs.

3 min read

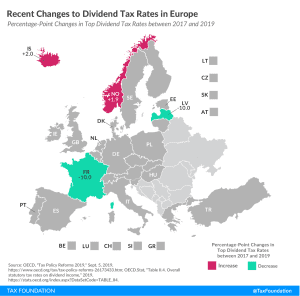

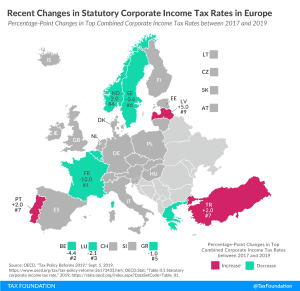

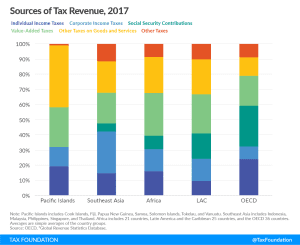

Our International Index compares OECD countries on over 40 variables that measure how well each country’s tax system promotes sustainable economic growth and investment.

11 min read

Countries around the world often design their tax policies to become attractive targets for foreign investment. These policies can be anything from a system with special preferences for certain industries to a well-designed tax system based on principles of sound tax policy. Systems that are rife with special preferences and complexities can create distortions in local jurisdictions and across the global economy.

3 min read

Facing an $838 million budget shortfall, a looming pension crisis, and an aggressive spending wish list, some Chicago policymakers and activists are expressing interest in a laundry list of new and higher taxes that could, collectively, raise as much as an additional $4.5 billion a year.

6 min read

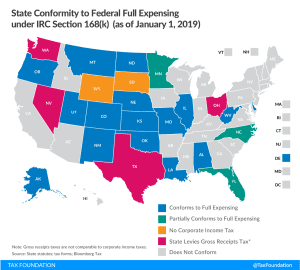

Additional evidence on the economic benefits of full expensing of investment was recently published in the American Economic Journal: Economic Policy.

4 min read

France’s new 3 percent digital tax may be targeted at Amazon and other large digital firms, but Amazon’s French vendors will bear the burden of the tax.

3 min read

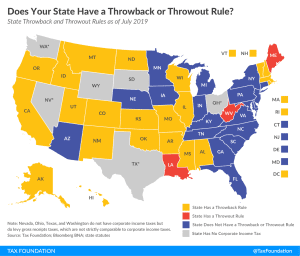

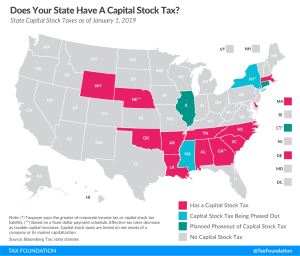

Tangible personal property taxes increase the complexity of state and local tax codes, discriminate against taxpayers based on their capital structure, and change economic behavior by incentivizing taxpayers to modify their property ownership to avoid the tax.

32 min read

The expenditures offered to small businesses are not created equal. We review the tax expenditures small businesses rely on most.

3 min read