All Related Articles

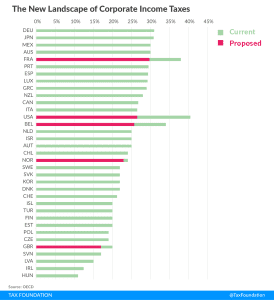

Tax Cuts and Jobs Act Puts the U.S. with its International Peers

If enacted, the Tax Cuts and Jobs Act would put the U.S. corporate tax rate more in line with its international peers at 13th highest of 35 OECD countries.

2 min read

Trends in State Tax Policy, 2018

In 2018, trends to watch in state tax policy will include reductions in corporate tax rates, the spread of gross receipts taxes, new and lower taxes on marijuana, estate tax repeal, a wait-and-see approach on federal tax reform, and more.

16 min read

The Tax Foundation’s 80th Anniversary

2 min read

Important Differences Between the House and Senate Tax Reform Bills Heading into Conference

The House and Senate have both passed legislation that would overhaul the federal tax code. Learn about the key differences between the two bills.

7 min read

Key Changes in Senate Tax Reform Bill Heading into the Vote-a-Rama

A brief summary of the most notable provisions of the Senate Tax Cuts and Jobs Act in the form in which it enters the “vote-a-rama.”

3 min read

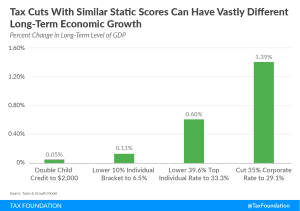

JCT’s Dynamic Score is Positive But Underestimates Economic Benefits

The Joint Committee on Taxation (JCT) dynamic scoring estimate of the Senate’s Tax Cuts and Jobs Act confirms that tax changes impact economic growth. While JCT’s estimates are positive, there is reason to believe that the tax plan would produce even greater dynamic effects than its analysis shows.

3 min read

International Provisions in the Senate Tax Cuts and Jobs Act

The Senate’s version of the Tax Cuts and Jobs Act (TCJA) includes several important changes to the taxation of multinational corporations.

5 min read

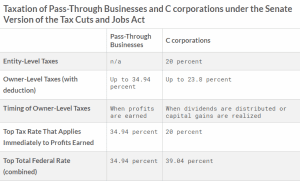

Are Pass-Through Businesses Treated Fairly Under the Senate Version of the Tax Cuts and Jobs Act?

A more careful look shows that the Senate Tax Cuts and Jobs Act doesn’t put pass-through businesses at a disadvantage compared to C corporations.

4 min read

The House Takes a Big Step Forward on Tax Reform

The House of Representatives passed the Tax Cuts and Jobs Act by a vote of 227-205. Here is a summary of the major provisions in the final package.

2 min read

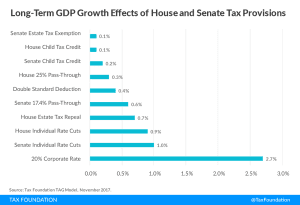

The Economics of Permanent Corporate Rate Cuts Must Outweigh the Optics of Sunsetting Individual Tax Cuts

The Senate Tax Cuts and Jobs Act is right to make the most pro-growth policies permanent and sunset the ones that will do less economic harm.

6 min read

Overview of the Senate’s Amendment to the Tax Cuts and Jobs Act

The Chairman’s Mark of the Senate’s Tax Cuts and Jobs Act includes a number of important changes. Here’s a quick overview of those that matter most.

3 min read