All Related Articles

2017 GDP and Employment by Industry

In the U.S. economy, there are tens of millions of businesses, including more than 30 million pass-through businesses and more than a million C corporations. Most output and employment come from firms that provide services to consumers—such as education, health care, and social assistance services—though a large share of output and employment still comes from firms in production industries, particularly manufacturing.

2 min read

New Study Finds that High Tax Rates Lower the Chance of Business Survival

America’s tax code distorts the economic decision-making of firms, such as the favorable treatment of debt financing over equity. This study adds to this argument while providing motivation for policymakers to focus on how reforms to tax policy can increase American entrepreneurship.

2 min read

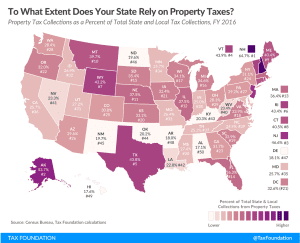

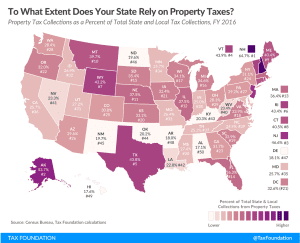

Iowa Adopts a “Soft” Property Tax Cap

3 min read

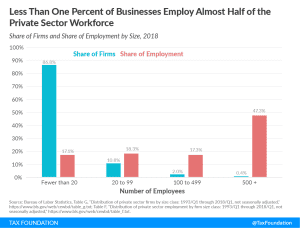

Firm Variation by Employment and Taxes

Less than one percent of businesses employ almost half of the private sector workforce. Large companies pay 89% of corporate income taxes in the United States.

2 min read

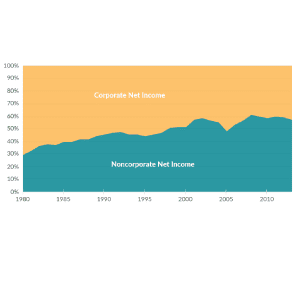

Corporate and Pass-through Business Income and Returns Since 1980

More business income is reported on individual tax returns than corporate returns. The U.S. now has fewer corporations and more individually owned businesses. Corporations make up less than 5 percent of businesses but earn 60 percent of revenues.

3 min read

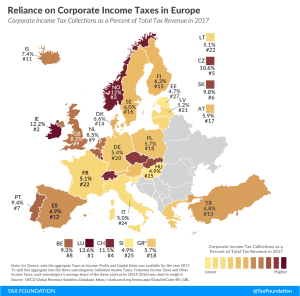

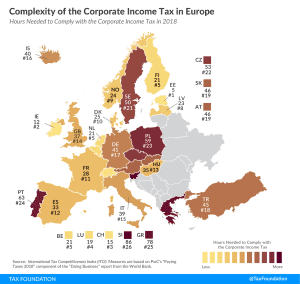

Sources of Government Revenue in the OECD, 2019 Update

OECD countries have on average become more reliant on consumption taxes and less reliant on individual income taxes. These policy changes matter, considering that consumption-based taxes raise revenue with less economic damage and distortionary effects than taxes on income.

10 min read

Germany Proposes First R&D Tax Break

2 min read

Tax Treaty Network of European Countries

1 min read

An Analysis of Senator Warren’s ‘Real Corporate Profits Tax’

Sen. Elizabeth Warren introduced a 7 percent surtax on corporate profits called the “Real Corporate Profits Tax.” We estimate that this tax would reduce the incentive to invest in the United States, and result in a 1.9 percent smaller economy, a 3.3 percent smaller capital stock, and 1.5 percent lower wages. The surtax would raise $872 billion between 2020 and 2029 on a conventional basis and $476 billion on a dynamic basis. The tax would make the tax code more progressive, but it would fall on taxpayers in every income group.

9 min read

An Overview of Capital Gains Taxes

Capital gains taxes create a burden on saving because they are an additional layer of taxes on a given dollar of income. The capital gains tax rate cannot be directly compared to individual income tax rates, because the additional layers of tax that apply to capital gains income must also be part of the discussion.

14 min read