Key Findings

- At the end of 2025, most individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. provisions of the TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Cuts and Jobs Act (TCJA) will expire, increasing taxes on individuals.

- Making these provisions permanent is estimated to reduce federal tax revenues by $176 billion annually (in 2021 dollars).

- While making these provisions permanent would increase the long-run size of the economy by 1.4 percent, many lawmakers may worry about the potential increase in the federal deficit from the reduced tax revenues and may look for offsetting sources of revenues.

- One such option is a carbon tax. Introducing a carbon taxA carbon tax is levied on the carbon content of fossil fuels. The term can also refer to taxing other types of greenhouse gas emissions, such as methane. A carbon tax puts a price on those emissions to encourage consumers, businesses, and governments to produce less of them. in 2021 at a rate of $60 per metric ton of carbon dioxide equivalent, growing at 5 percent annually, would raise sufficient federal tax revenues to cover the cost of making the individual provisions permanent. A carbon tax would reduce long-run economic growth by 0.4 percent.

- In addition to being revenue-neutral, combining these policies would increase the long-run size of the economy by 1 percent, making it a sustainable pro-growth option.

- However, this trade would put a disproportionate burden on lower-income taxpayers. Expanding refundable tax credits or providing carbon dividends could address this distributional concern.

Introduction

In December 2017, the United States passed the Tax Cuts and Jobs Act (TCJA)—a major overhaul of the U.S. corporate and individual income tax system. On the individual income tax side, the TCJA featured broad tax rate cuts, the curbing or elimination of several tax deductions, and the expansion of some tax credits. Some of the most prominent changes are as follows:

- Individual income tax rates were reduced from 10 percent, 15 percent, 25 percent, 28 percent, 33 percent, 35 percent, and 39.6 percent to 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent, respectively.

- The widths of individual income tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. were adjusted.

- The standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. Taxpayers who take the standard deduction cannot also itemize their deductions; it serves as an alternative. was doubled to $12,700, $25,400 for married taxpayers.

- The personal exemption was eliminated.

- The Child Tax CreditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. (CTC) was doubled to $2,000 per child.

- Both the state and local tax deductionA tax deduction allows taxpayers to subtract certain deductible expenses and other items to reduce how much of their income is taxed, which reduces how much tax they owe. For individuals, some deductions are available to all taxpayers, while others are reserved only for taxpayers who itemize. For businesses, most business expenses are fully and immediately deductible in the year they occur, but others, particularly for capital investment and research and development (R&D), must be deducted over time. (SALT) and the home mortgage interest deductionThe mortgage interest deduction is an itemized deduction for interest paid on home mortgages. It reduces households’ taxable incomes and, consequently, their total taxes paid. The Tax Cuts and Jobs Act (TCJA) reduced the amount of principal and limited the types of loans that qualify for the deduction. were capped.

On net, these changes reduced taxes for low-, middle-, and upper-income households. Additionally, they resulted in lower tax rates on labor, increasing the long-run size of the economy.[1]

However, most of the individual provisions are scheduled to expire at the end of 2025. The only significant individual income tax change that will remain is the use of chained-CPI to adjust tax parameters for inflation. Lawmakers may want to extend the individual tax cuts. However, doing so would reduce federal revenue significantly. Some lawmakers may worry about the impact of the reduced revenues on the federal deficit and will want to look for offsetting sources of revenue.

One such option for generating revenue offsets is a carbon tax. This paper shows that revenue from a newly introduced federal carbon tax could offset the cost of making the TCJA’s individual provisions permanent.[2] According to the Tax Foundation’s model, making the individual provisions permanent would reduce federal tax receipts by $256 billion in 2030 ($176 billion in a 2021 economy) and increase the long-run size of the economy by 1.4 percent.

A carbon tax introduced in 2021 at $60 per metric ton of carbon dioxide equivalent, growing at 5 percent annually to $93 by 2030, would increase federal revenues by $2.33 trillion between 2021 and 2030, and by $257 billion in 2030 ($177 billion in a 2021 economy). Thus, the revenue raised through a carbon tax could finance the individual provisions in 2030.[3] The Tax Foundation model shows that a carbon tax would reduce GDP by 0.4 percent in the long run.

Using the carbon tax revenue to offset the revenue reduction from making TCJA’s individual provisions permanent would put a disproportionate tax burden on lower-income taxpayers. There are several options to address this distributional concern, including the expansion of refundable tax credits and a carbon dividend.

Making the Individual Income Tax Provisions of the TCJA Permanent

The TCJA, enacted in December 2017, made several significant changes to the federal income tax.[4] The bill reduced tax rates for both corporations and individuals, limited major deductions, and created a new set of rules for companies that earn income overseas.

However, at the end of 2025, nearly all of the individual provisions of the TCJA are set to expire, increasing taxes for most U.S. households the following year. To avoid this tax increase, policymakers can decide to make these provisions permanent. While this would boost long-term economic growth, it would also reduce federal tax revenues in the long run.

Overview of the Individual Income Tax Provisions in the TCJA

The individual income tax provisions in the TCJA reduced tax rates, altered tax brackets, and created, adjusted, and repealed several deductions, credits, and exemptions, which will be outlined below.[5]

Adjustment of Tax Brackets and Tax Rates

Prior to the TCJA, the federal individual income tax was levied at seven rates, ranging from 10 percent to 39.6 percent. The new rate schedule created by the TCJA preserved the same number of brackets but lowered several of the rates substantially. Individual income tax rates were reduced from 10 percent, 15 percent, 25 percent, 28 percent, 33 percent, 35 percent, and 39.6 percent to 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent, respectively.

The bill also reconfigured the thresholds and widths of several of the brackets, with the effect of reducing the size of marriage penalties arising from the tax bracket structure.

After December 31, 2025, the individual income tax rate schedule is set to revert to the pre-TCJA brackets and rates. Should this occur, many households would see their taxes increase significantly in 2026.

| Current Law, 2021 | ||

|---|---|---|

| Tax Rate | Single | Joint |

| 10% | $0-$10,075 | $0-$20,150 |

| 12% | $10,075-$41,000 | $20,150-$82,000 |

| 22% | $41,000-$87,425 | $82,000-$174,850 |

| 24% | $87,425-$166,900 | $174,850-$333,800 |

| 32% | $166,900-$211,925 | $333,800-$423,850 |

| 35% | $211,925-$529,850 | $423,850-$635,800 |

| 37% | $529,850+ | $635,800+ |

| Source: Congressional Budget Office, “Budget and Economic Data: Tax Parameters and Effective Marginal Tax Rates,” January 2020, https://www.cbo.gov/data/budget-economic-data#10. Dollar amounts represent 2020 tax parameters. | ||

Expansion of the Standard Deduction

Under the TCJA, the standard deduction was increased from $6,350 to $12,700 for singles and from $12,700 to $25,400 for married joint filers.[6] This change is set to expire after December 31, 2025.

| Current Law, 2021 | |

|---|---|

| Single | $12,700 |

| Joint | $25,400 |

| Source: Congressional Budget Office, “Budget and Economic Data: Tax Parameters and Effective Marginal Tax Rates,” January 2020, https://www.cbo.gov/data/budget-economic-data#10. Dollar amounts represent 2020 tax parameters. | |

Repeal of the Personal Exemption

The TCJA eliminated the personal exemption, which had previously allowed households to reduce their taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. Taxable income differs from—and is less than—gross income. by $4,050 for each filer and dependent. As this provision is also set to expire, the personal exemption would be reinstated in 2026.[7]

Introduction of a 20 Percent Deduction for Pass-Through Business Income (Section 199A)

Most businesses in the United States are “pass-through businesses”: they are not subject to the corporate income tax, but instead have their income taxed on their owners’ individual income tax returns. One major change in the TCJA was the creation of a new temporary deduction (section 199A) for households that receive income from pass-through businesses.

Previously, income from pass-through businesses had been subject to the same rate schedule as other personal income, such as wages and salaries. For instance, prior to the enactment of the TCJA, a household earning $100,000 of self-employment income would pay the same amount of income tax as a household earning $100,000 of wages and salaries.

Under the section 199A deduction, income from pass-through businesses is now generally subject to tax rates that are effectively 20 percent lower than the rates that apply to other income. For instance, instead of being taxed at a top rate of 37 percent like wages and salaries, the section 199A deduction effectively allows qualifying pass-through businessA pass-through business is a sole proprietorship, partnership, or S corporation that is not subject to the corporate income tax; instead, this business reports its income on the individual income tax returns of the owners and is taxed at individual income tax rates. income to be taxed at a top rate of 29.6 percent.

That said, the deduction is subject to several complex limitations which restrict the benefit of the provision for high-income households. After December 31, 2025, households with pass-through business income would no longer be able to claim the section 199A deduction.

Modification of the Child Tax Credit

As part of the TCJA, the maximum CTC was increased from $1,000 to $2,000, with the maximum refundable portion increased from $1,000 to $1,400.[8] The refundability threshold was lowered from $3,000 to $2,500, and income phaseout thresholds were increased from $75,000 to $200,000 for single filers and from $110,000 to $400,000 for married couples filing jointly. (Maximum credit amount is phased out at a rate of 5 percent once taxable income reaches these thresholds.)

The TCJA also created a nonrefundable $500 credit for certain dependents who do not meet the CTC eligibility guidelines. This new credit is for children ages 17 to 18, dependents between ages 19 to 24 in school at least five months of the year, and some older dependents. It is subject to the same phaseout as the CTC.

After December 31, 2025, these provisions are scheduled to revert to prior law.

Introduction of a $10,000 SALT Cap, Limiting the Value of the Home Mortgage Interest Deduction, Repeal of the “Pease” Limitation, and Expansion of the Medical Expense Deduction

Prior to the TCJA, individuals who itemized their deductions could deduct the amount of state and local taxes (SALT) against their federal taxable income. The taxes individuals could deduct included state and local individual income taxes (or sales taxes), real estate taxes, and personal property taxes. The amount that individuals could deduct was unlimited. The TCJA introduced a cap on state and local tax deductions of $10,000 per household.

Prior to the TCJA, the home mortgage interest deduction was limited to interest paid on $1 million of home acquisition debt and $100,000 of home equity debt. The TCJA limited the mortgage interest deduction to interest paid on $750,000 of home acquisition debt, and interest on home equity debt is no longer deductible.

The TCJA repealed the “Pease” limitation on itemized deductions. The provision reduced the value of a taxpayer’s itemized deductions by 3 percent for every dollar of taxable income above a certain threshold (in 2017, these thresholds were $261,500 for single filers and $313,800 for joint filers). This reduction continued until the “Pease” limitation had phased out 80 percent of the value of itemized deductions.

The TCJA expanded the medical expense deduction by lowering the expense threshold from 10 percent of adjusted gross incomeFor individuals, gross income is the total of all income received from any source before taxes or deductions. It includes wages, salaries, tips, interest, dividends, capital gains, rental income, alimony, pensions, and other forms of income. For businesses, gross income (or gross profit) is the sum of total receipts or sales minus the cost of goods sold (COGS)—the direct costs of producing goods, including inventory and certain labor costs. to 7.5 percent for tax years 2017 and 2018; previously, a temporary reduction of the threshold had been available to taxpayers over 65 years of age, or with a spouse over 65. The 7.5 percent floor for all taxpayers has been extended through 2020.[9] Under current law, it is set to expire in 2021.

The SALT cap, the limit on the home mortgage interest deduction, and the repeal of the “Pease” limitation are scheduled to expire after December 31, 2025. The expansion of the medical expense deduction will expire after December 31, 2020.

Increase in AMT Exemption Amount and Phaseout Threshold

The alternative minimum tax (AMT) is a provision that requires some upper-income households to calculate their taxes twice, under two sets of rules, and to pay whichever amount is higher. The intent of the provision is to prevent households from receiving excessive benefits from tax preferences.

Under the TCJA, the AMT exemption amount was increased significantly, from $54,300 for singles and $84,500 for married couples filing jointly in 2017 to $70,300 for singles and $109,400 for married couples filing jointly in 2018. The thresholds for the phaseout of the AMT exemption were also increased, from $120,700 in alternative minimum tax income (AMTI) for single filers and $160,900 for married taxpayers filing jointly in 2017 to $500,000 in AMTI for single filers and $1 million for married taxpayers filing jointly in 2018.

This change has led to vastly fewer households being subject to the AMT. However, this change is set to expire after December 31, 2025.

Revenue Estimate of Making the TCJA’s Individual Provisions Permanent by Major Provision

While some of the TCJA’s individual provisions would lower federal tax revenues if made permanent, others would increase them. On net, in 2030, federal revenue would be $256 billion lower ($176 billion lower in a 2021 economy) compared to current law.

More specifically, the permanent repeal of the personal exemption and a permanent SALT cap, the limited home mortgage interest deduction, and other changes to itemized deductions would all increase federal tax revenues. The lower income tax rates and adjusted income tax brackets, the higher standard deduction, the pass-through deduction, and the adjusted CTC and AMT would lower federal revenues.

| Provision | In a 2021 Economy* |

|---|---|

| Income tax brackets and rates | -$156 |

| Double the standard deduction | -$105 |

| Repeal the deduction for personal exemption | $164 |

| 20% deduction for pass-through business income | -$29 |

| Modified Child Tax Credit (CTC) | -$73 |

| SALT cap; home mortgage interest deduction; “Pease” limitation; medical expense deduction; and all other itemized deduction changes | $103 |

| AMT exemption amount and phaseout thresholds | -$81 |

| Total | -$176 |

|

Note: *CBO’s GDP projections were used to put the 2030 estimates of this paper in terms of a “2021 economy.” For example, making the individual provisions permanent reduces federal revenue by $256 billion in 2030. In a 2021 economy, this would translate to $176 billion ($256 billion / 31.022 trillion in GDP in 2030 x 21.313 trillion in GDP in 2021). Because the TCJA individual provisions would not be extended until after 2025, there would be no effect in 2021. These estimates of the 2030 impact of permanently extending the individual provisions are put in terms of a “2021 economy” to make the results more intuitive for today’s policy debate. Source: Tax Foundation General Equilibrium Model, August 2020. |

|

Economic and Distributional Effect of Making the Individual Provisions Permanent

According to the Tax Foundation General Equilibrium Model, making the TCJA’s individual provisions permanent would increase the economy’s size by 1.4 percent in the long run.

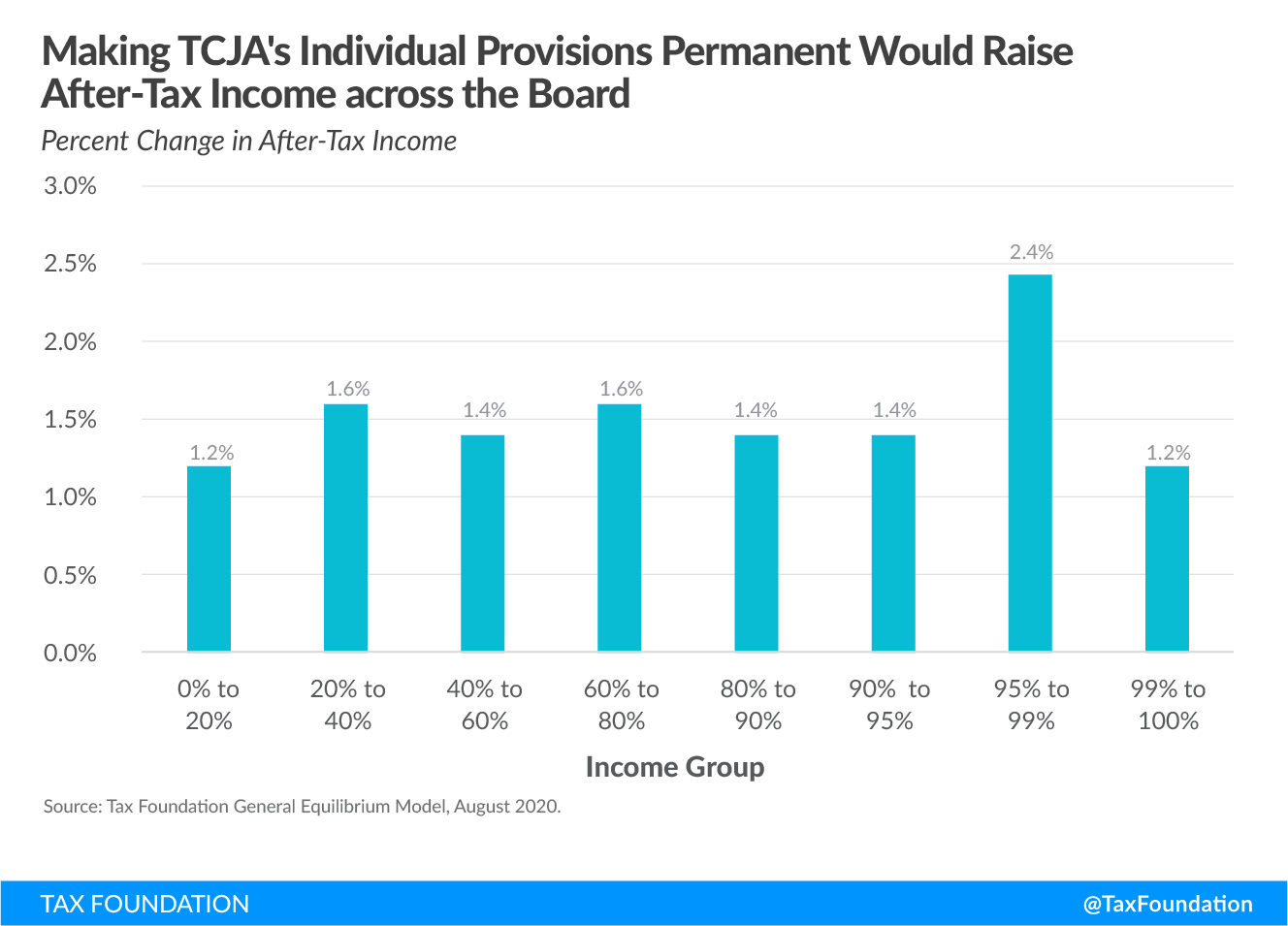

On a conventional basis, making the TCJA’s individual provisions permanent would increase the after-tax income of all income groups. Taxpayers in the 95th to 99th percentiles would see the largest increase in after-tax incomeAfter-tax income is the net amount of income available to invest, save, or consume after federal, state, and withholding taxes have been applied—your disposable income. Companies and, to a lesser extent, individuals, make economic decisions in light of how they can best maximize their earnings. , at 2.4 percent. Lower income groups and the top 1 percent would also see an increase in after-tax income, ranging between 1.2 percent and 1.6 percent. Total after-tax income would increase by 1.6 percent.

Introducing a Carbon Tax

To illustrate the revenue impact of a carbon tax, a sample carbon tax enacted by the federal government is modeled in this paper.[10] This proposal would enact a carbon tax in 2021 equal to $60 per metric ton of carbon dioxide equivalent, growing at 5 percent annually to $93 by 2030. The carbon tax would apply to a broad tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. , covering all energy-related carbon emissions in the United States, and would be border-adjusted.[11] Finally, the tax would exempt international bunker fuels used for international aviation and maritime transport.[12]

Carbon Tax Base

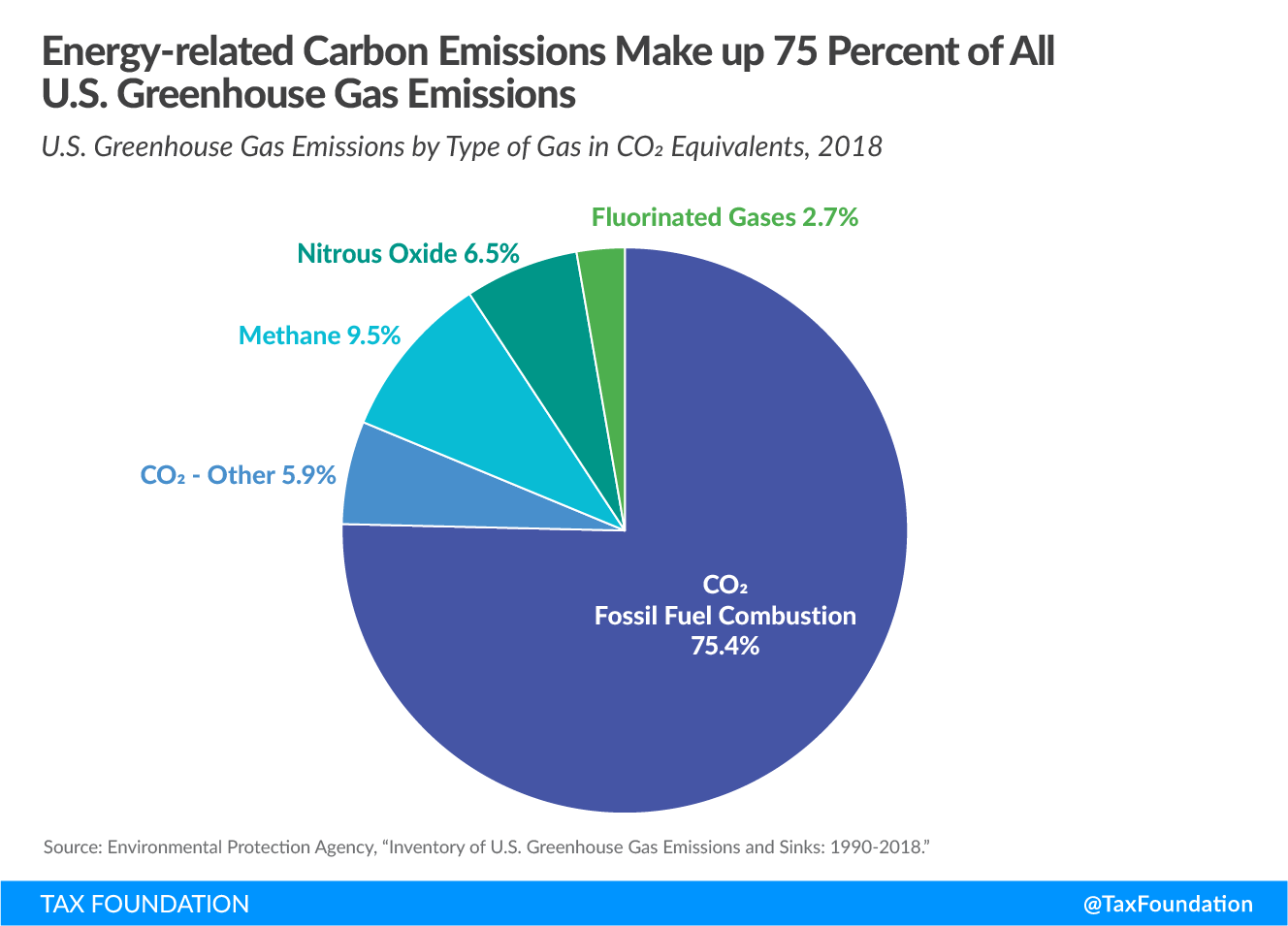

Carbon taxes can be levied on carbon emissions and on other types of greenhouse gases, such as methane, nitrous oxide, and fluorinated gases. According to the Environmental Protection Agency (EPA), carbon emissions from fossil fuel combustion—or so-called energy-related carbon emissions—constitute around three-fourths of all greenhouse gases, making them the main target of a carbon tax. This carbon tax analysis will be solely based on these energy-related carbon emissions.[13]

Carbon emissions from industrial processes (other than fossil fuel combustion) made up 5.9 percent of all greenhouse gas emissions in 2018; methane emissions from energy production, agriculture, and landfills 9.5 percent; nitrous oxide from agriculture 6.5 percent; and fluorinated gases (HFCs, PFCs, SF6, and NF3, man-made industrial gases mainly used as refrigerants) the remaining 2.7 percent.[14]

According to the U.S. Energy Information Agency (EIA), energy-related carbon emissions are estimated to amount to 4,993 million metric tons in 2020. Under current policies, these emissions are expected to decline slightly and total 4,733 million metric tons in 2025 and 4,674 million metric tons in 2030. Extrapolating these projections, energy-related carbon emissions are estimated to total 47,786 million metric tons over the next decade (2021-2030).[15]

There is a degree of uncertainty in predicting the behavioral response to a carbon tax, the speed of technological change, changes in the energy mix, and consumer demand of carbon-intensive goods under current law and under a carbon tax. It is assumed in this paper that carbon emissions would decrease incrementally to 80 percent of the baseline in the first five years of a carbon tax, and to 75 percent in the following five years.

| Year | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2021-2030 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Tax Rate | |||||||||||

|

Tax Rate ($/mt CO2-e) |

$60.00 | $63.00 | $66.15 | $69.46 | $72.93 | $76.58 | $80.41 | $84.43 | $88.65 | $93.08 | |

| Tax Base | |||||||||||

| Total Emissions (all energy-related carbon emissions, mmt CO2-e) | 4,957 | 4,909 | 4,837 | 4,796 | 4,733 | 4,755 | 4,724 | 4,708 | 4,694 | 4,674 | 47,786 |

| Taxable Emissions (after behavioral response, border adjustment, and bunker fuels, mmt CO2-e) | 4,865 | 4,611 | 4,340 | 4,103 | 3,850 | 3,816 | 3,739 | 3,674 | 3,611 | 3,544 | 40,152 |

| Source: U.S. Energy Information Administration, “Annual Energy Outlook 2020: Energy-Related Carbon Dioxide Emissions by Sector and Source”; author’s calculations. | |||||||||||

Revenue Estimate of a Carbon Tax

The estimates show that a carbon tax of $60 per metric ton of carbon dioxide equivalent, growing at 5 percent annually to $93 in 2030, would raise federal revenue by $2.33 trillion between 2021 and 2030. The carbon tax itself would collect $2.99 trillion in receipts over the 10-year budget window. However, imposing a carbon tax would reduce income and payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. revenue—the so-called “excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. offset”[16]—by approximately $660 billion over 10 years.

In 2030—the year this analysis focuses on—this carbon tax proposal would raise $257 billion ($177 billion in a 2021 economy).

| 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2021-2030 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Gross Revenue | $292 | $290 | $287 | $285 | $281 | $292 | $301 | $310 | $320 | $330 | $2,988 |

| Net Revenue (After Excise Tax Offset) | $228 | $227 | $224 | $222 | $219 | $228 | $234 | $242 | $250 | $257 | $2,331 |

| Source: Tax Foundation General Equilibrium Model, August 2020. | |||||||||||

Economic and Distributional Effect of a Carbon Tax

According to the Tax Foundation General Equilibrium Model, introducing a $60 carbon tax in 2021 that increases at 5 percent annually to $93 in 2030 reduces the economy’s size by 0.4 percent in the long run.

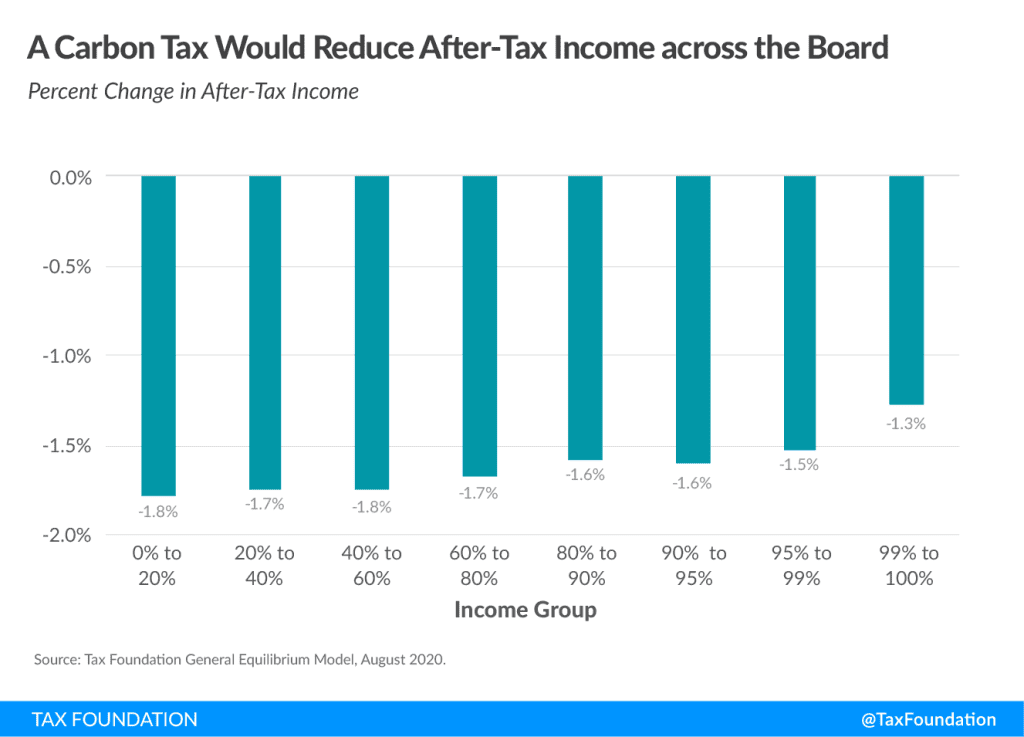

On a conventional basis, introducing a carbon tax would reduce after-tax incomes for all income groups. Taxpayers in the lowest income quintile would see the largest decrease in after-tax income, at 1.8 percent, while the top 1 percent would see the smallest decrease, at 1.3 percent. All income groups in between would also see a decrease, ranging from 1.5 percent to 1.8 percent. Total after-tax income would decrease by 1.6 percent.

Carbon Tax Revenue Recycling: Making the Individual Provisions Permanent

Looking at the year 2030, a carbon tax can raise sufficient revenue to cover the TCJA’s individual provisions that are currently set to expire in 2026.

Making the individual provisions permanent would reduce federal tax revenues by $256 billion in 2030 ($176 billion in a 2021 economy). At the same time, a carbon tax—enacted in 2021 at $60 per metric ton and escalating at 5 percent annually to $93 by 2030—would raise $257 billion in 2030 ($177 billion in a 2021 economy), covering the cost of the individual provisions.

A package that is revenue-neutral over the 10-year budget window (2021-2030)—rather than specifically in the year 2030 as modeled in this paper—would require a carbon tax rate of $29 per metric ton of carbon in 2021, escalating at 5 percent annually to $45 in 2030. However, designing a carbon tax with just the 10-year budget window in mind would ignore the annual costs of permanently extending the individual income tax cuts. Instead of relying on the 10-year budget window to calibrate the offset, this paper estimates a carbon tax that would offset the revenue costs of permanently extending TCJA’s individual income tax provisions on an annual basis, specifically in the year 2030.

The positive economic effects of making the individual provisions permanent (+1.4 percent in GDP) exceed the negative economic effects of the carbon tax (-0.4 percent in GDP), resulting in a net positive effect of 1.0 percent on the long-run size of the economy.

| Change in Long-Run GDP | |

|---|---|

| Permanent Individual Provisions | +1.4% |

| Carbon Tax | -0.4% |

| Net Effect | +1.0% |

| Source: Tax Foundation General Equilibrium Model, August 2020. | |

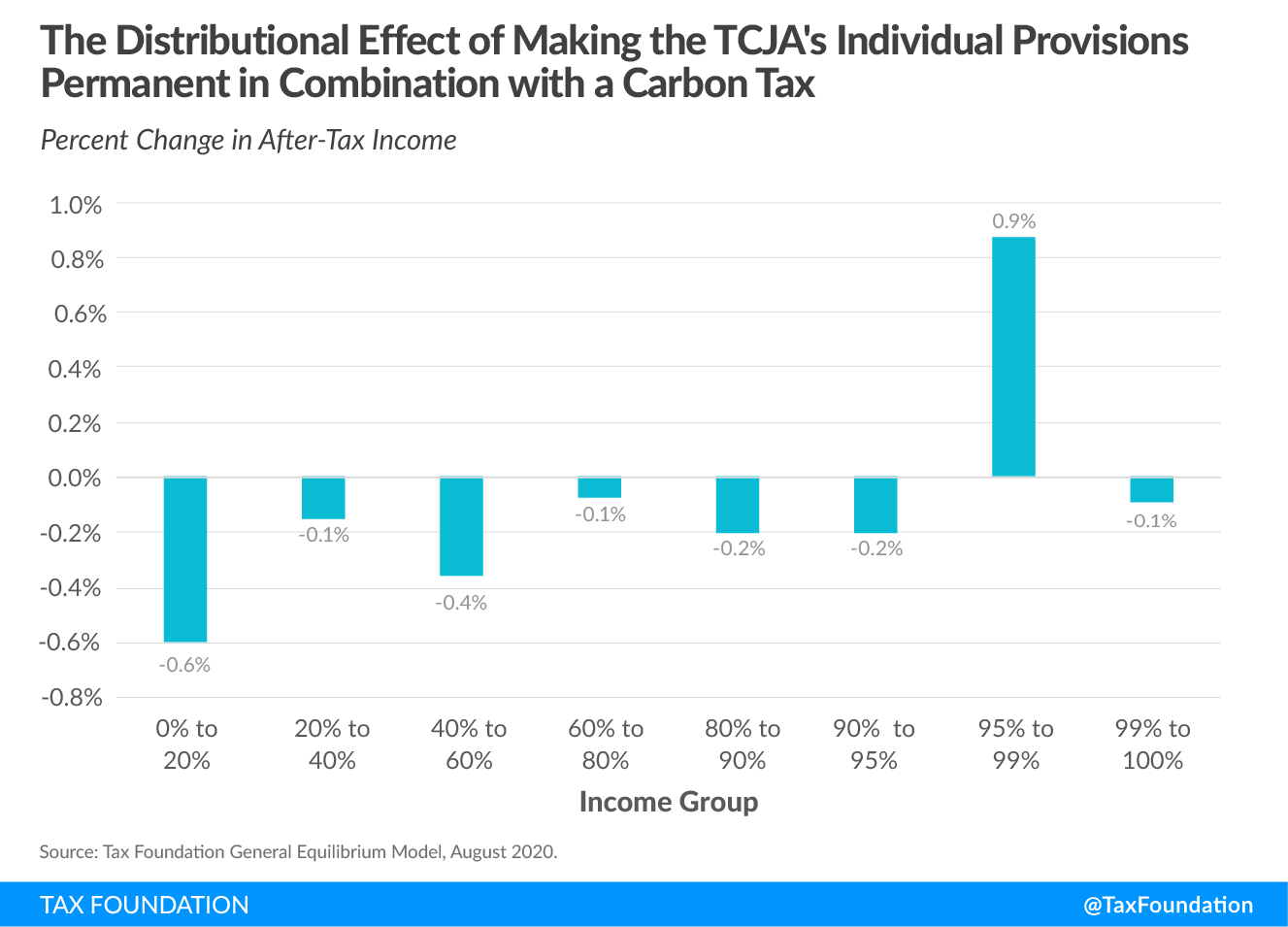

However, the two changes combined would reduce after-tax income for almost all income groups, as the tax increase resulting from the carbon tax would exceed the benefit to those groups of making the individual provisions permanent. Taxpayers in the lowest income quintile would see the largest net tax increase, as their after-tax income would decline by 0.6 percent. The other income groups with net tax increases (all income groups except the 95th to 99th percentiles) would see their after-tax incomes decline by between 0.1 percent and 0.4 percent. Taxpayers in the 95th to 99th percentiles would see a tax cut, as after-tax income would increase by 0.9 percent.

To alleviate the additional tax burden on lower-income taxpayers, refundable tax credits—such as the Earned Income Tax Credit (EITC) or the CTC—could be expanded at the same time. This would, however, reduce federal revenues, and thus take away the revenue-neutrality of the package. For example, the Tax Foundation model estimates that doubling the EITC for childless filers and making the entire CTC refundable would reduce revenues by $39 billion in 2030 ($27 billion in a 2021 economy).[17] These additional costs would need to be covered either by a higher carbon tax rate or other tax increases, or be deficit-funded.

Another option to address the disproportionate tax burden on lower-income taxpayers would be to implement a carbon dividend—a policy Canada and Switzerland have adopted.[18] A carbon dividend would rebate some or all of the carbon tax revenue back to taxpayers.[19] This option, however, would also require additional revenue if the package is intended to remain revenue-neutral.

Conclusion

The TCJA’s individual provisions are scheduled to expire at the end of 2025. Policymakers will need to decide whether these provisions should be extended—partially or fully—or made permanent. Making them permanent would increase the long-run size of the economy by 1.4 percent. However, it would also permanently decrease federal tax revenues. In 2030, federal revenues would be $256 billion lower ($176 billion lower in a 2021 economy) than under current law.

Out of concern over the impact of these reduced revenues on the federal deficit, some lawmakers may look for offsetting sources of revenues. A carbon tax could be introduced to cover the tax revenue loss of making the individual provisions permanent. The estimates in this paper show that a $60 carbon tax enacted in 2021, rising at 5 percent annually to $93 by 2030, would raise $257 billion in 2030 ($177 billion in a 2021 economy), offsetting the $256 billion needed to make the individual provisions permanent. A carbon tax would reduce the long-run size of the economy by 0.4 percent.

Hence, permanent individual provisions combined with a carbon tax can be a revenue-neutral trade and increase the long-run size of the economy by 1 percent, making it a sustainable pro-growth option.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe[1] Huaqun Li and Kyle Pomerleau, “The Distributional Impact of the Tax Cuts and Jobs Act over the Next Decade,” Tax Foundation, June 28, 2018, https://taxfoundation.org/the-distributional-impact-of-the-tax-cuts-and-jobs-act-over-the-next-decade/.

[2] Importantly, there is a timing effect: The individual provisions do not expire until the end of 2025, while this report models a carbon tax that would be implemented in 2021. To circumvent this timing effect and to show the longer-term feasibility of these policy changes, this paper does not provide estimates for the full 10-year budget window. Instead, it provides a snapshot for the year 2030—the last year of the current budget window. To make the results more intuitive for today, they are presented in terms of a “2021 economy” by using CBO’s GDP projections. See Congressional Budget Office, “Budget and Economic Data: 10-Year Economic Projections,” July 2020, https://www.cbo.gov/data/budget-economic-data#4. The CBO projects an economy in nominal terms of $21.313 trillion in 2021 and $31.022 trillion in 2030. For example, the carbon tax raises $257 billion in 2030. In a 2021 economy, this would translate to $177 billion ($257 billion / 31.022 trillion x 21.313 trillion).

[3] To achieve a package that is revenue-neutral over the 10-year budget window (2021-2030), the carbon tax rate would need to be $29 per metric ton of carbon in 2021, escalating at 5 percent annually to $45 in 2030.

[4] “Public Law 115 – 97 – An act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018,” Dec. 22, 2017, https://www.govinfo.gov/app/details/PLAW-115publ97/summary.

[5] Ibid.

[6] Dollar amounts represent 2020 tax parameters.

[7] Congressional Budget Office, “Budget and Economic Data: Tax Parameters and Effective Marginal Tax Rates,” January 2020, https://www.cbo.gov/data/budget-economic-data#10. Dollar amounts represent 2020 tax parameters.

[8] For more details on the Child Tax Credit, see Taylor LaJoie, “The Child Tax Credit: Primer,” Tax Foundation, Apr. 14, 2020, https://taxfoundation.org/child-tax-credit/.

[9] Congressional Research Service, “Individual Tax Provisions (“Tax Extenders”) Expiring in 2020: In Brief,” May 20, 2020, https://crsreports.congress.gov/product/pdf/R/R46243.

[10] Kyle Pomerleau and Elke Asen, “Carbon Tax and Revenue Recycling: Revenue, Economic, and Distributional Implications,” Tax Foundation, Nov. 6, 2019, https://taxfoundation.org/carbon-tax/ provides a more detailed discussion of a similar carbon tax proposal.

[11] A border tax adjustment effectively broadens the base of the carbon tax to include carbon-intensive products consumed in the U.S. but produced elsewhere, and exempts carbon-intensive exports from the tax. The United States consumed 7.9 percent more CO2 than it produced in 2017 (most recent data), making the United States a net importer of CO2. See Integrated Carbon Observation System, “Global Carbon Budget 2019,” https://www.icos-cp.eu/global-carbon-budget-2019. In our paper it is assumed that a border-adjustment would on average capture 5 percent of these net imports and thus increase the tax base by 5 percent.

[12] U.S. emissions from international bunker fuels increased from 100 million metric tons in 2013 to 122.1 million metric tons in 2018, an annual increase of approximately 5 million metric tons. See Environmental Protection Agency, “Inventory of U.S. Greenhouse Gas Emissions and Sinks: 1990-2018,” Apr. 13, 2020, https://www.epa.gov/ghgemissions/inventory-us-greenhouse-gas-emissions-and-sinks-1990-2018. There are no projections for international bunker fuels for the period 2021-2030. To project these numbers, it is assumed that this trend will continue and thus increase the amount of international bunker fuel emissions subtracted from the tax base by 5 million metric tons annually.

[13] Taxing greenhouse gases other than energy-related carbon emissions can be administratively more challenging because their source is not limited to fossil fuels. See John Horowitz, Julie-Anne Cronin, Hannah Hawkins, Laura Konda, and Alex Yuskavage, “Methodology for Analyzing a Carbon Tax,” Office of Tax Analysis, The Department of the Treasury, January 2017, https://www.treasury.gov/resource-center/tax-policy/tax-analysis/Documents/WP-115.pdf. However, some non-carbon emissions are easier to abate than carbon emissions, making their marginal abatement costs relatively lower. See Environmental Protection Agency, “Global Non-CO2 Greenhouse Gas Emission Projections & Mitigation, 2015-2050,” September 2019, https://www.epa.gov/global-mitigation-non-co2-greenhouse-gases. Thus, broadening the tax base to greenhouse gases other than carbon emissions can minimize overall abatement costs.

[14] Environmental Protection Agency, “Inventory of U.S. Greenhouse Gas Emissions and Sinks: 1990-2018.”

[15] U.S. Energy Information Administration, “Annual Energy Outlook 2020/Table 18: Energy-Related Carbon Dioxide Emissions by Sector and Source,” Jan. 29, 2020, https://www.eia.gov/outlooks/aeo/data/browser/#/?id=17-AEO2020&cases=ref2020&sourcekey=0. EPA and EIA data differ slightly due to differences in methodology. For example, the EIA includes international bunker fuels, while the EPA does not.

[16] The income and payroll tax offset can occur for one of two reasons, or a combination of

both. If the excise tax is passed back to the factors of production and borne entirely by the producer,

the tax reduces some combination of business profits and labor compensation. Alternatively, the tax

could be passed forward in the form of higher prices. Higher prices reduce the amount of income

available to consumers for purchasing other goods and services. The industries affected by the

decline in consumption see lower revenue, resulting in lower profits and labor compensation. The Tax Foundation model assumes an income and payroll tax offset of 22 percent.

[17] More specifically, the model estimated the doubling of the EITC for childless filers (this would increase both the phase-in and phaseout rate for these taxpayers from 7.65 percent to 15.3 percent) and the expansion of the refundability of the CTC and an inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. adjustment for the CTC (this would reduce the earned income threshold to 0 and make the entire CTC ($2,000) refundable).

[18] Switzerland’s dividend comes in the form of a rebate on health insurance, which is compulsory.

[19] Pomerleau and Asen, “Carbon Tax and Revenue Recycling: Revenue, Economic, and Distributional Implications” models the economic and distributional effects of a $50 carbon tax paired with a dividend.

Share this article